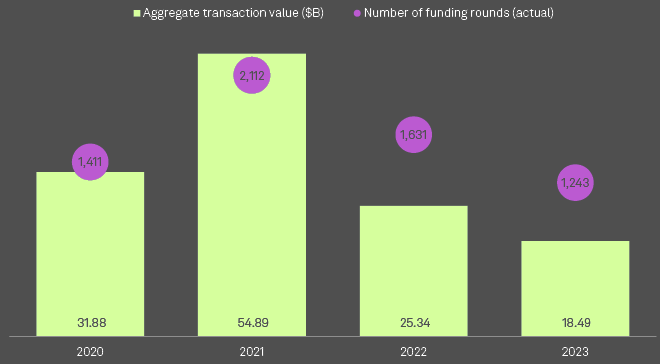

The value of venture capital funding rounds worldwide dropped 27% year over year to $18.49 billion in October while the volume declined 23.8% to 1,243.

The investment value and volume were the lowest October totals since at least 2020, according to S&P Global Market Intelligence.

For the year to Oct. 31, the total value was $216.13 billion, less than half of the $435.19 billion raised during full year 2022.

The value of funding rounds appears to be on track for a steep annual decrease.

Global PE/VC investment: value and number of rounds

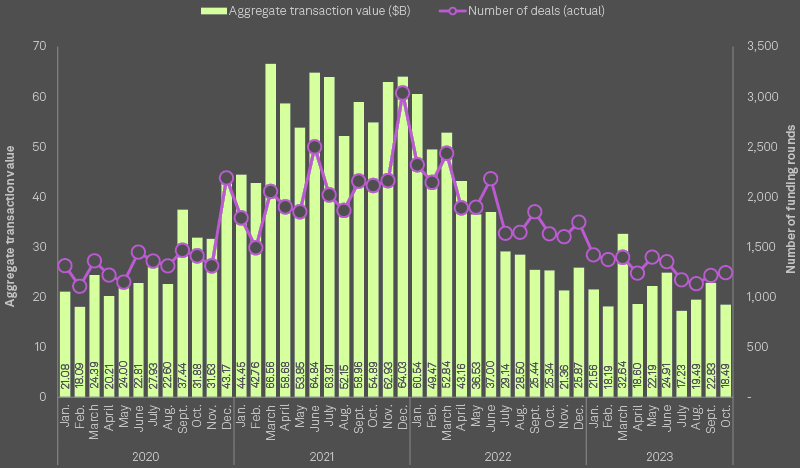

Global PE/VC investment: values and number of deals

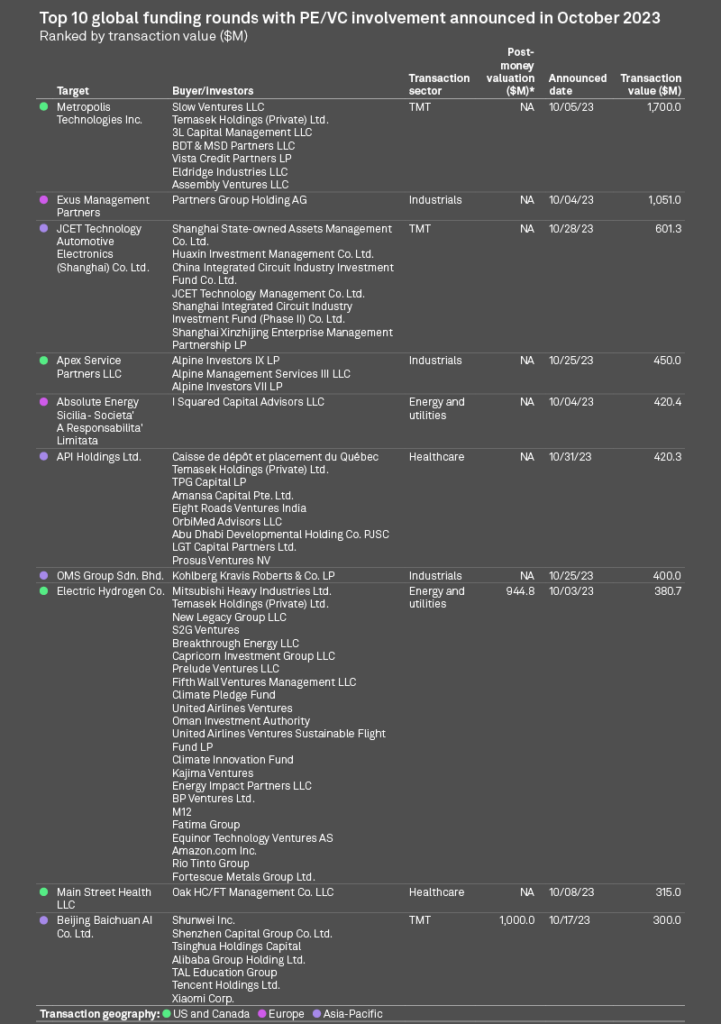

Largest Venture Capital funding rounds

Four of the 10 largest funding rounds were for companies in the US and Canada.

Santa Monica, Calif.-based Metropolis Technologies Inc., which developed an AI platform for spot-tracking garage space, raised $1.70 billion in series C financing, the largest funding round globally in October. The round comprised $1.05 billion in series C preferred stock and $650 million in debt financing.

Investors in the round included 3L Capital Management LLC, Assembly Ventures LLC, BDT & MSD Partners LLC, Eldridge Industries LLC, Slow Ventures LLC, Temasek Holdings (Pvt.) Ltd. and Vista Credit Partners LP.

Spanish research and consulting firm for renewable energy investment Exus Management Partners was set to raise $1.05 billion in the second-largest funding round announced for October. Swiss private equity firm Partners Group Holding AG was the sole investor in Exus’ funding round.

Global PE/VC investment: founding per sector

Investments by sector

The technology, media and telecom industry dominated global venture capital investments in October, attracting 40.4% of the total. It was followed by the industrial and healthcare sectors, each accounting for 18.1% of the total fundraising.

The value of global private equity deals with sovereign wealth fund investment fell by nearly half. Transactions with sovereign wealth fund investment totaled $39 billion across 11 deals in 2022, compared to $74.36 billion across 10 deals a year earlier.

Private equity and venture capital investment in financial technology and payments companies in Europe has been dwarfed by the $10 billion put into US companies in the first five months of the year.

Fintech has moved from the fringes of European finance to its core, but performance varies widely. If all countries could match the best in region, the economic benefits would be considerable (see Biggest FinTech Unicorns in the World).

…………………..

AUTHORS: Muhammad Hammad Asif and Annie Sabater – S&P Global Market Intelligence analytics