Belgian and Dutch insurers’ conservative investment portfolios should be resilient to rising credit risks amid weakening economic conditions and tightening monetary policy, according to Fitch Ratings.

The strong average credit quality of bond portfolios and the conservative approach to loan investments significantly limit the risk of credit losses and continue to support the insurers’ ratings.

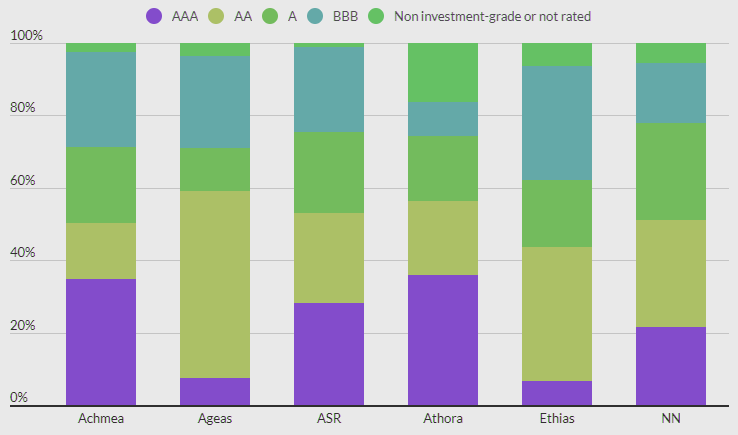

About 80% of the insurers’ investments are fixed-income. The average credit quality of bond portfolios is typically in the low ‘AA’ or high ‘A’ category.

Credit quality has weakened slightly in recent years as insurers took more risk in search of higher yields but Fitch does not expect this to continue now that yields in general have increased.

Investment and asset risk is an important rating consideration for Belgian and Dutch insurers

Most insurers in the peer group achieve ‘Very Strong’ to ‘Strong’ scores for this credit factor supported by conservative well-diversified investment portfolios and low risky-asset exposures.

Dutch insurers maintain higher-quality bond portfolios and have less exposure to equity-type assets than Belgian insurers and therefore mostly score higher for investment and asset risk.

The credit factor has a ‘Moderate’ weight in the overall rating assessment of each insurer in the group, reflecting the moderate sensitivity of their ratings to changes in this credit factor score (see Global Insurer’s Structured Securities Investments Outlook).

However, when an insurer’s investment risk profile materially changes this may increase the importance of this credit factor in overall rating assessments. Manageable Investment Risks Insurers are exposed to market and credit risks through their investment portfolios (see How High Reinsurance Costs Will Impact for Insurers Margins?).

Credit Quality of Bond Portfolios

Dutch insurers, in contrast to Belgian insurers, have built up substantial residential mortgage loan exposure in recent years, in line with an expanding mortgage market.

Mortgage loans accounted for about a quarter of the Dutch insurance sector’s investments at end-2021.

High inflation and rising interest rates will put pressure on borrowers in 2023 but strict mortgage loan underwriting in recent years, together with strong household savings and tight labour markets, mean that most mortgage borrowers are well placed to service their debt.

TOP 15 leading insurance companies in Belgium

| Rank | Insurer | Market Share, % |

| 1 | AG Insurance | 22.3% |

| 2 | AXA | 12% |

| 3 | KBC | 9.5% |

| 4 | Ethias | 9.2% |

| 5 | Baloise | 6.4% |

| 6 | Belfius | 6.2% |

| 7 | P&V | 6.1% |

| 8 | Allianz | 5.5% |

| 9 | NN | 3.9% |

| 10 | ERGO – DKV – DAS | 3.4% |

| 11 | Athora | 2.1% |

| 12 | Federale | 1.8% |

| 13 | Argenta | 1.8% |

| 14 | Credimo | 1% |

| 15 | Cigna | 0.6% |

TOP 15 leading insurance companies in Netherlands

| Rank | Insurer | Market Share, % |

| 1 | Zilveren Kruis Achmea Zorg | 10,5 |

| 2 | CZ Zorg | 7,8 |

| 3 | VGZ | 7,6 |

| 4 | Menzis Zorg | 5,6 |

| 5 | Nationale Nederlanden Leven | 3,5 |

| 6 | Achmea Schade | 3,2 |

| 7 | Univé Zorg | 2,7 |

| 8 | Nationale Nederlanden Schade | 2,5 |

| 9 | ASR Schade | 2,0 |

| 10 | ASR Leven | 1,8 |

| 11 | OHRA Ziektekosten | 1,8 |

| 12 | SRLEV | 1,7 |

| 13 | DSW | 1,7 |

| 14 | AEGON Leven | 1,6 |

| 15 | De Friesland Zorg | 1,5 |

Digitalisation is one obvious route to achieve this objective in areas such as distribution (the biggest non-claims cost block), marketing and customer service.

The main underwriting response is to reprice insurance risks that exhibit elevated claims costs. The need and scope for doing so depend on the competitive environment in the relevant insurance markets, insurers’ assumptions concerning central banks’ ability to tame inflation within a reasonable period of time and the degree of public policy and regulatory constraints and interventions (see How P&C Insurers in the US Can Increase Inflation Resilience?).

Rising interest rates are generally positive for insurers, and the associated falls in bond values do not pose a significant economic risk for Belgian or Dutch insurers as they can typically hold bonds until maturity.

The insurers also tend to match the duration of their assets to their liabilities or use hedging to limit their capital sensitivity to interest rate movements.

The immediate impact of inflation on non-life (property & casualty and health) insurers’ earnings is negative, primarily through rising future claims costs on current insurance policies, the need to bolster loss reserves and, in case of stag-flation, reduced demand.

The insurers’ diverse business mixes and strong capital positions limit the risk of capital pressure due to increased ‘mass-lapse’ assumptions under Solvency II.

The effect on life insurers’ earnings is more neutral. As opposed to non-life insurance, most life insurance products, e.g. mortality, wealth accumulation and longevity protection, offer benefits that are nominally fixed. Having said this, inflation tends to erode the value proposi-tion of life insurance with fixed benefit payouts, weighing on new business and leading to higher lapses.

Lower equity markets, rising interest rates and widening credit spreads adversely affect insurers’ balance sheets through mark-to-market valuation losses. On the other hand, higher interest rates, i.e. discount rates, have a favourable effect on the net present value of future liabilities.

There is a wide range of management actions insurers can take to respond to the new macroeconomic environment. In terms of product design, with customers typically suffering a reduction in real income, insurers could offer more affordable, low-cost products with an increased focus on risk and loss prevention.

……………….

AUTHORS: Andras Sasdi – Director, Insurance Credit Ratings (EMEA) at Fitch Ratings – a branch of Fitch Ratings Ireland, Willem Loots – Senior Director, Insurance at Fitch Ratings, David Prowse – Senior Director, Fitch Wire