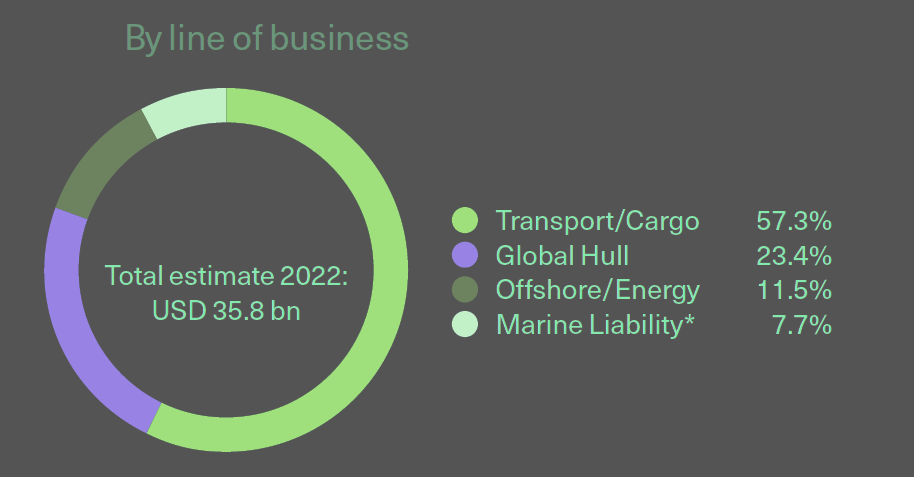

Global marine insurance premiums totalled USD35.8 bn an 8.3%. The post-pandemic rebound in trade, increased asset values, reduced market capacity and an adjustment in premiums were all likely to have exerted an influence, according to The International Union of Marine Insurance Stats Report. Beinsure analysts selected the most important insights from the report for you.

European markets continued to enjoy growth whilst some Asian markets had slowed due to a range of economic factors.

This annual research reports on the health of the marine insurance sector within the framework of the global economy, trade and shipping.

Data is gathered from a number of agencies including IUMI’s own sources and is analysed and presented with some additional commentary (see Shipping Safety & Key Risks for Marine Insurance).

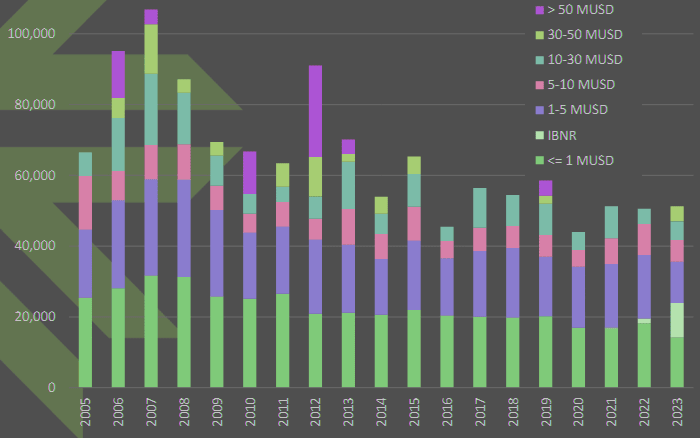

The report also provides an update on IUMI’s Major Claims Database. Cargo claims are now being published for the fourth consecutive year based on 13 data fields. Major losses are analysed with respect to loss severity, frequency, location and cause.

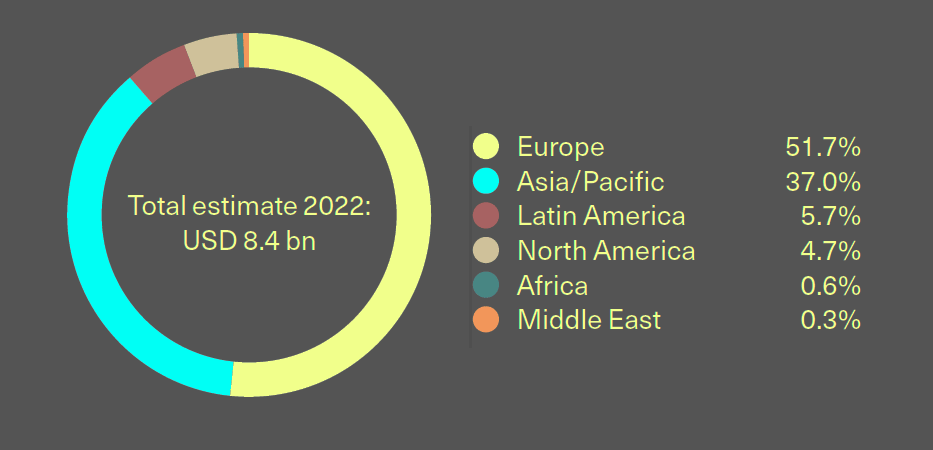

- Ocean hull premiums were reported at USD8.4 billion, up by 5.7% on the previous year. More activity, more vessels, rising values and reduced market capacity were responsible. Claims continued to be low resulting in positive loss ratios for nearly all regions.

- Premiums for cargo insurance reached USD20.5 billion representing an 8.3% uptick on last year and continuing the trend for market development in this sector. This was on the back of a post-pandemic rebound in global trade. Loss ratios had returned to more normal levels, had started at their lowest point since 2015.

- The offshore energy sector continued its three-year run of premium base growth reporting USD4.1 billion, an increase of 7.3%. The uptick in oil prices was largely responsible, translating into increased offshore activity and a rise in average day rates. Losses had remained relatively low and recent years’ loss ratios were currently positive.

Year-on-year growth for the ocean carriage of cars

According to Global Marine P&I Sector report, year-on-year growth for the ocean carriage of cars has jumped by a massive 23% whereas the container trades appear to have shrunk by almost 4%. This is largely due to high inflationary pressures affecting consumer confidence. A 10.5% increase in coal trades is concerning in terms of global ESG ambitions.

According to Marine and Cargo Insurance Market AGCS report, Chinese related trade accounts for around 50% of global seaborne activity and there are some reports of that economy slowing. Although the headline numbers are weaker than they have been, depreciation of the Chinese currency is likely to be a significant factor.

Total container capacity calling at Chinese ports shows no signs of slowing; and the China-USA trade, whilst down from the Covid peak, remains strong.

Similarly, exports of electric vehicles from China are at record numbers but probably not fully counted. With freight rates for car carriers at sky-high levels, many vehicles are now being moved by container which might explain observations of a reduction of total car carrier capacity calling at China recently, despite rising car exports.

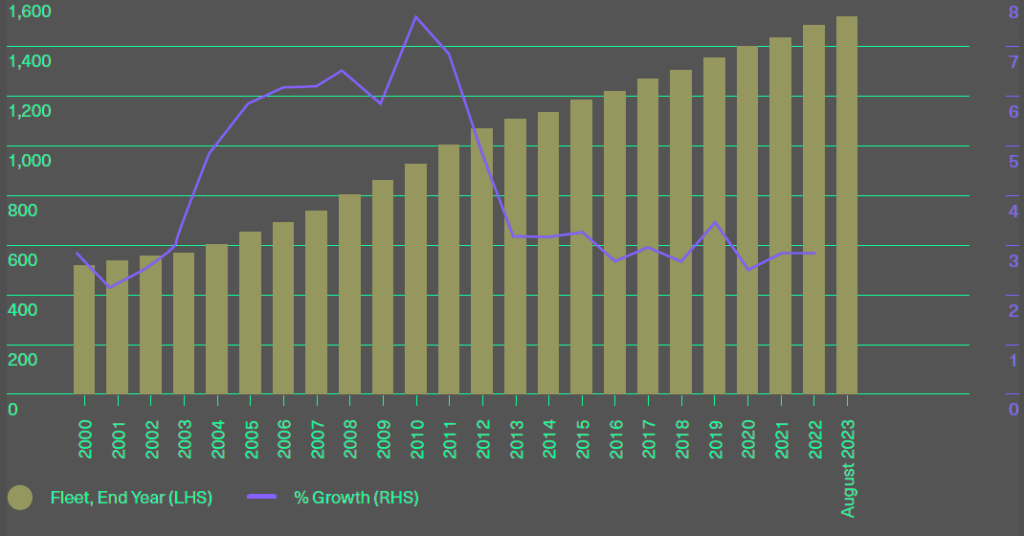

Development of the global fleet

The slowdown in global fleet growth has stabilised and is reported to be at 2.1% (gross tonnage) currently. New deliveries are down but so is scrap-ping activity.

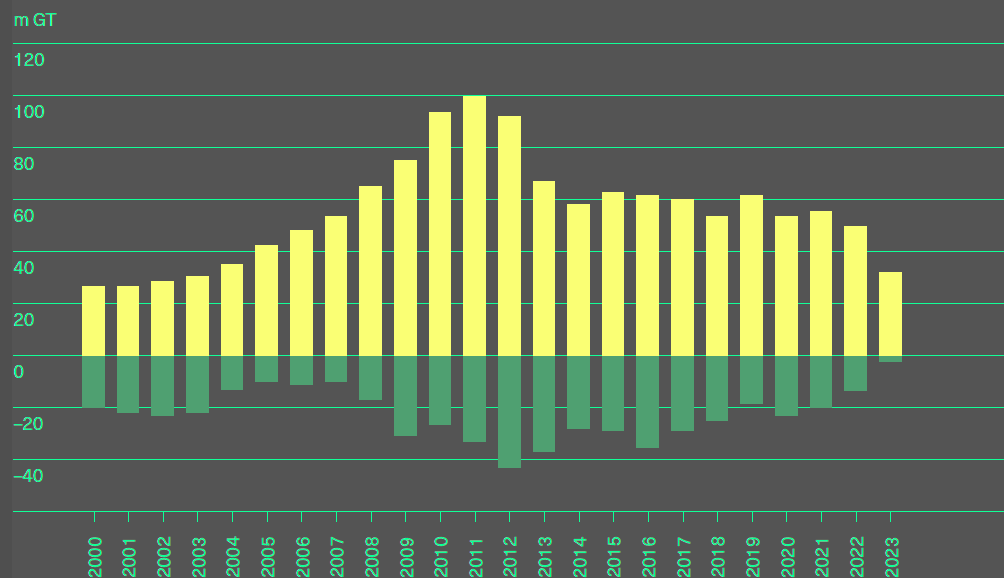

Deliveries and scrapping of global fleet

Fleet ownership continues to develop with many Japanese owned vessels making way for the growth of the Chinese owned fleet as sale and lease-back arrangements are put in place. In August of this year – and for the first time – the Chinese fleet was reported to just overtake the Greek fleet in terms of gross tonnage.

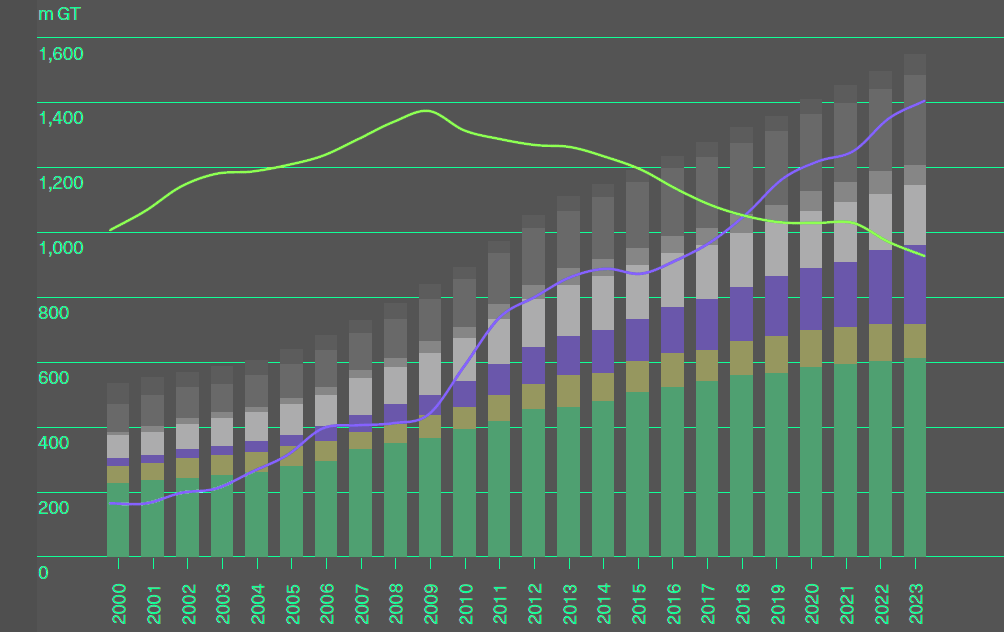

Long term regional development

Of concern is the continuing increase in the age of the world fleet which, in 2023, stood at 22.43 years. With the possible exception of gas carriers, all vessel types are getting older. This has the potential to impact the future claims environment.

It should be noted that the global offshore wind market continues to grow in importance. The upward trend is positive following a slight slowdown during Covid. Forecasts for capacity, investment and contracting all remain strong.

Environmental, Social, Governance (ESG) matters

IUMI’s Facts & Figures Committee began tracking three ESG issues related to the UN’s sustainable development goals – illegal, unreported, unregulated (IUU) fishing activities; ship recycling; and greenhouse gas emissions.

The most significant development has been IMO’s strengthening of its GHG reduction ambitions. The new strategy calls for shipping to achieve net-zero GHG emissions around 2050 with at least a 20% reduction by 2030 and at least a 70% reduction by 2040

This is welcomed and fully supported by IUMI. Insurers will play a pivotal role as new tech-nologies will give rise to new risks that must be understood and insured. Work on creating a safety roadmap is already underway at IMO and elsewhere and will identify the challenges and discuss potential solutions.

IUMI co-sponsored this IMO initiative – which was spearheaded by the International Association of Classification Societies (IACS) – and will be involved in its continuing development. Guidelines for the safe use of ammonia and hydrogen as propulsion technologies have already been published and most class societies have issued a range of relevant notations.

However, it will be important for holistic regulations to be in place which must also put a heavy emphasis on crew safety.

Global Marine insurance

The global marine insurance premium base reached a total of USD35.8 billion. The reasons are complex but likely to include a post-pandemic rebound in global trade coupled with reduced market capacity, particularly for hull.

By line of business, cargo continued to command the largest share with 57.3%, followed by hull (23.4%), offshore energy (11.5%) and marine liability (excluding P&I) at 7.7%

Increased vessel values, more activity offshore and an upward adjustment in premiums were also responsible.

Marine insurance premiums by line of business

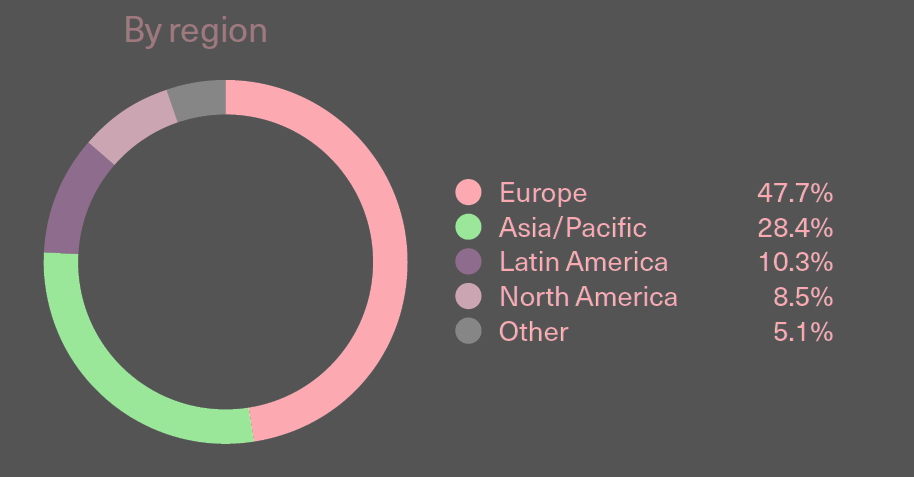

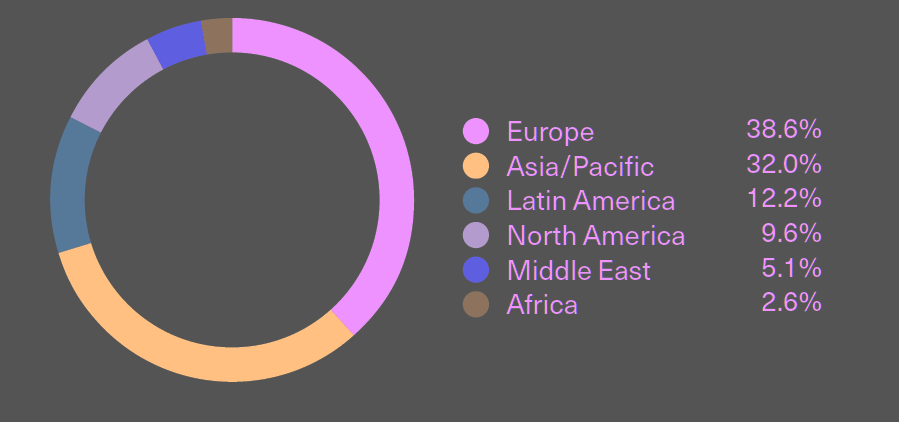

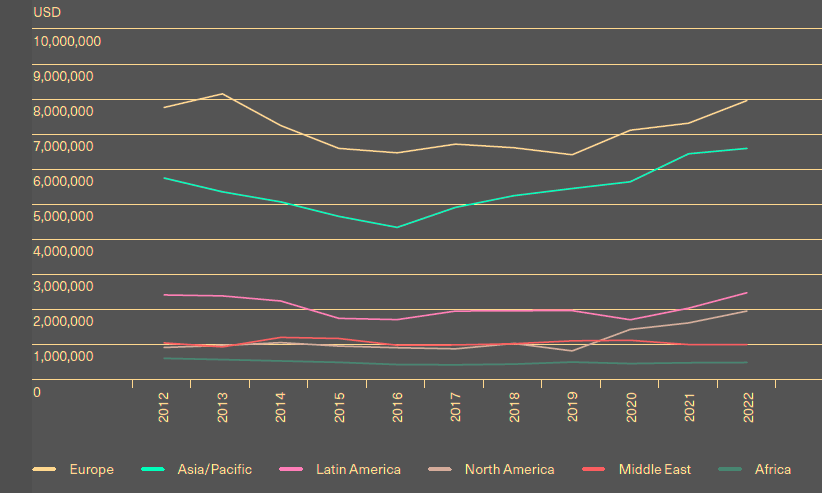

By region, there was not much change on the previous year. The European markets were continuing their upward trend having bottomed-out in 2019 and the Asia/Pacific market had experienced slower growth probably as a result of economic factors plus the fact that the Japanese and Chinese currencies were weaker when paired with the US dollar.

Marine insurance premiums by region

Overall, the general trend for global premiums was upwards. However, care should be taken as exchange rates impact all markets, particularly cargo where business tends to be written in local currencies.

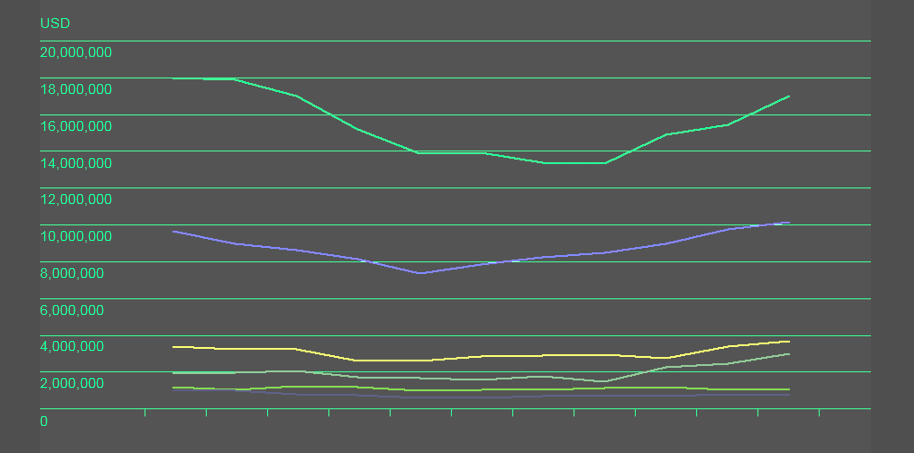

Marine premium

To accurately track performance, claims trends should be monitored, being coupled with vessel activity, value accumulation, nat-cat impact, the use of new technology and inflation impact on repair costs. Fires, in particular, continued to be a concern in 2022 and also into 2023.

Global marine hull insurance

Global marine hull insurance premiums achieved a total of USD8.4 billion – an increase of 5.7%. This was largely due to a combination of growing activity, an increased number of vessels and their rising values, and reduced market capacity.

Distribution across regions and markets remained stable with Europe dominating at 51.7% followed by Asia/Pacific at 37%.

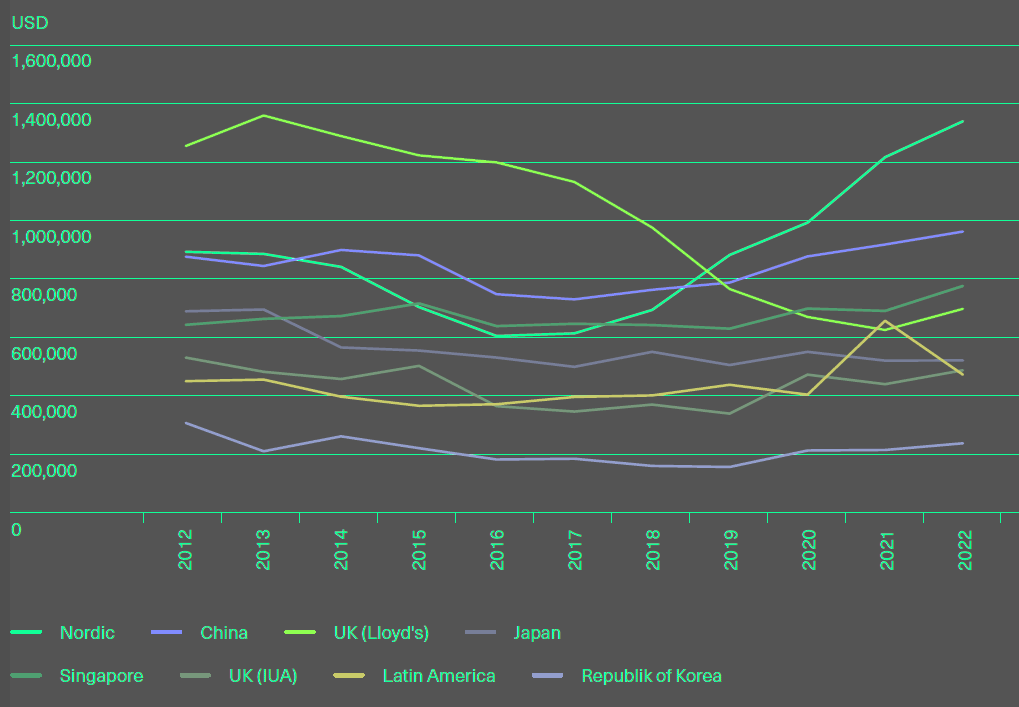

In terms of performance, all markets except for Latin America continued to improve with the Nordic countries enjoying the steepest growth. The UK’s Lloyd’s market also enjoyed growth after many years of decline.

Hull insurance premiums by region

Premium growth is generated by a combination of several factors: these include the post-pandemic growth in trade and shipping activity, rate corrections after years of negative hull insurance results, increases in vessel values in certain segments, changes in insurance market capacity and – to the degree this is captured by these figures – the recent increase in the demand for war coverage.

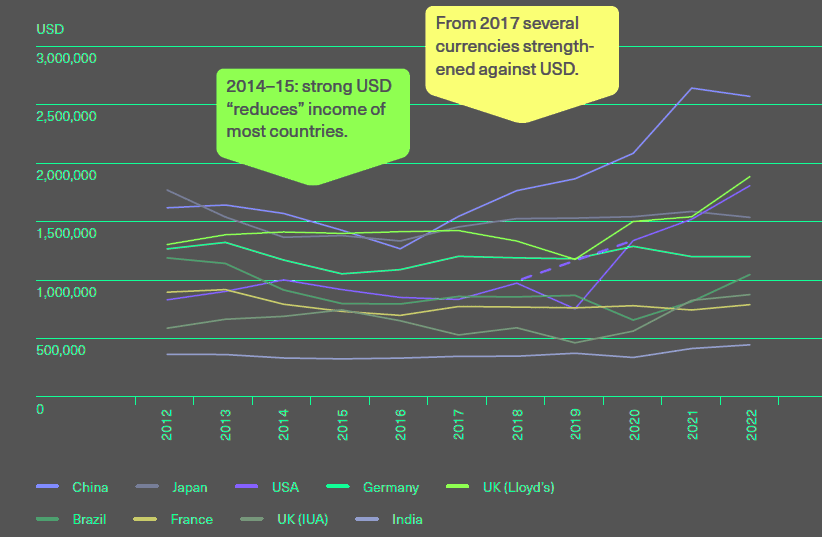

Hull premium trends by major markets

The gap between total gross tonnage/number of vessels and global premiums – which opened markedly from 2011–2018 – has closed slightly since 2020 and now appears to be relatively stable, following a market correction.

Global Marine insurance claims

On the whole, the global fleet is ageing and this is likely to reduce the average value of a vessel going forward. The 2023 half-year hull trend report issued by the Nordic Association of Marine Insurers (Cefor) shows that the change in insured values on renewal varies by sector and was particularly marked for containerships.

Following huge demand for these vessels immediately post-pandemic which drove vessel values upwards, demand now appears to have normalised leading to reverse value adjustments.

The upward adjustment for tankers in 2022, with a further clear increase in 2023, is related to the Ukraine war and a resulting change in trade patterns.

Supply/offshore vessels have, after a number of dire years, started to experience some improvement in value development due to the oil price rise driving an increase in offshore activity.

Claims trends back to pre-pandemic levels

The Cefor report further shows that claims frequency has enjoyed a long-term downward trend. In 2020, there was an extraordinary dip as a result of Covid-induced reduced activity in some vessel segments.

Post-Covid, claims frequency has returned to a more normal level but remains low. Total loss frequency continues its long-term positive trend and now appears to oscillate around historically low levels.

Claims costs per vessel have returned to more normal levels following Covid and average repair costs have seen some upward trend probably due to the impact of inflation.

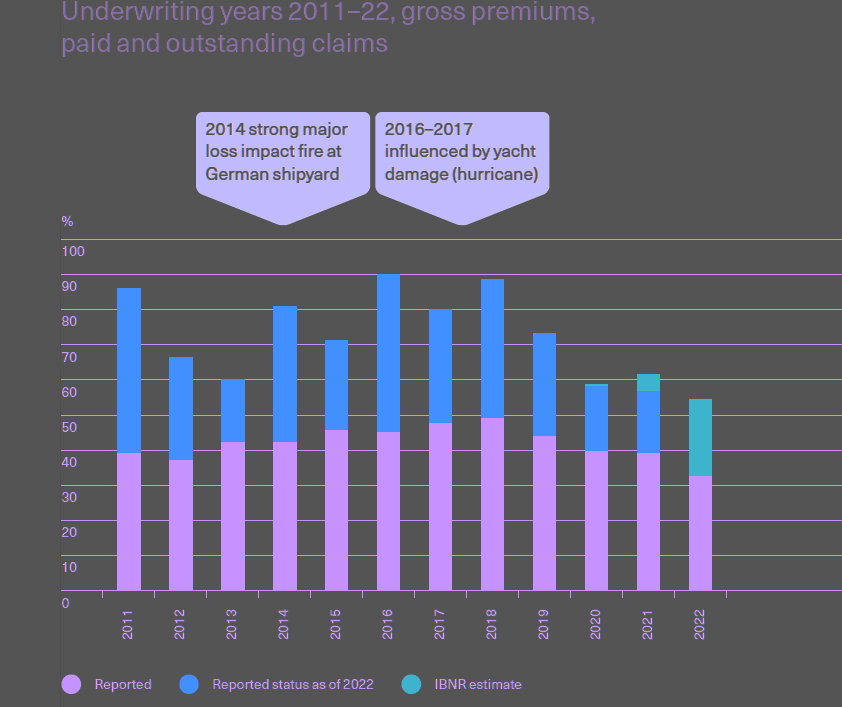

Ultimate insurance loss ratios – Europe

Major losses have been moderate in recent years with the exception of onboard fires. 2023 has seen an uptick in major losses which is likely to continue particularly with regard to the high-value containership and cruise ship sectors having resumed full activity.

Hull insurance loss ratios – Asia

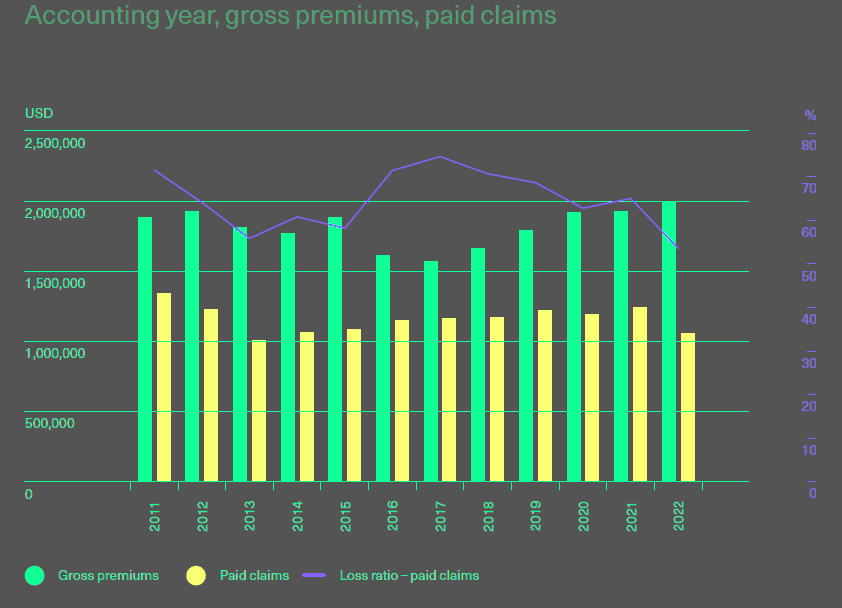

Loss ratios in nearly all regions experienced a downward trend in 2023 and have done so for the past three years. Having suffered many years of negative results, this is welcome.

Insurance claim cost per vessel

Loss ratios for 2022 have started from their lowest point since 2015 which is very positive for hull underwriters. For Europe, where loss ratios are presented as underwriting year and not accounting year (as they are for other regions), claims covered under the youngest underwriting years will still develop.

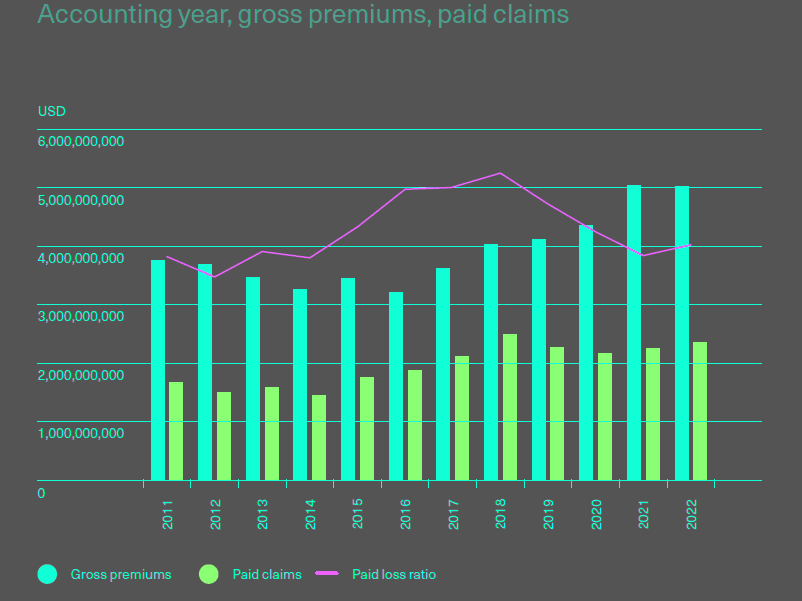

Global marine cargo insurance

The global premium base for the cargo market in 2022 was reported at USD20.5 billion representing an increase on 8.3% on 2021. This demonstrates continuing market development over a number of consecutive years.

Premium distribution across regions has remained relatively unchanged from previous years with Europe and Asia/Pacific commanding the top and second slots respectively

With the exception of the African and Middle Eastern regions, all others have continued to enjoy growth. In terms of major markets, the UK (Lloyd’s), US and Brazilian markets grew strongly in 2022 but Japan and China turned downward.

The lacklustre performance of these two markets is partly due to a depreciation of those countries’ currencies against the US dollar.

Cargo insurance premiums by region

The performance of the cargo market tends to reflect the value of goods transported and global trade volumes which have both rebounded strongly post pandemic.

Cargo insurance premium

Further growth is projected but forecasts differ and so it is not possible to predict with any certainty. Other factors impacting this market included premium rate adjustments, general market conditions and exchange rate effects.

Cargo premium trends by major markets

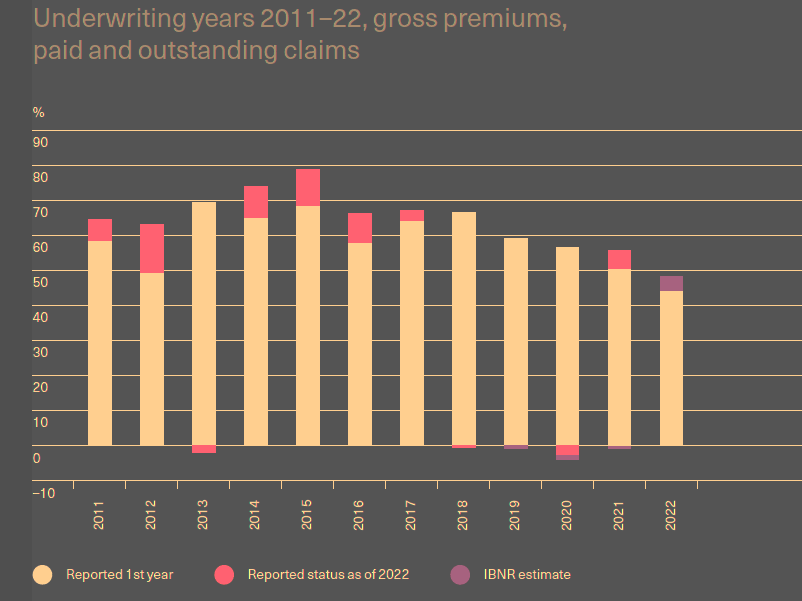

For the European markets, recent underwriting years have seen loss ratios return to a more normal – flatter – pattern following a few years of extraordinary upwards claims adjustments.

2023 started at the lowest level since 2015 which is extremely positive for cargo underwriters and potentially heralds a period of sustainability.

Ultimate cargo insurance loss ratios – Europe

Cargo insurance loss ratios – Asia

It should be noted that this market is reported by underwriting year and so the ratios will develop over the coming few years. In other regions, loss ratios are reported by accounting year and, in the main, have improved to show a more positive and sustainable global market.

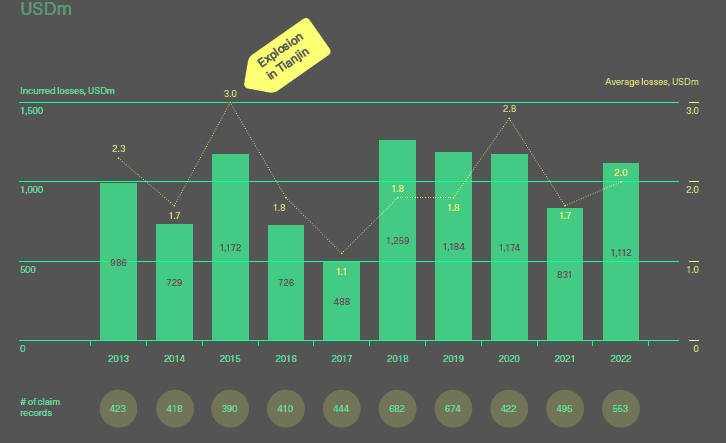

Cargo – Incurred losses and average losses

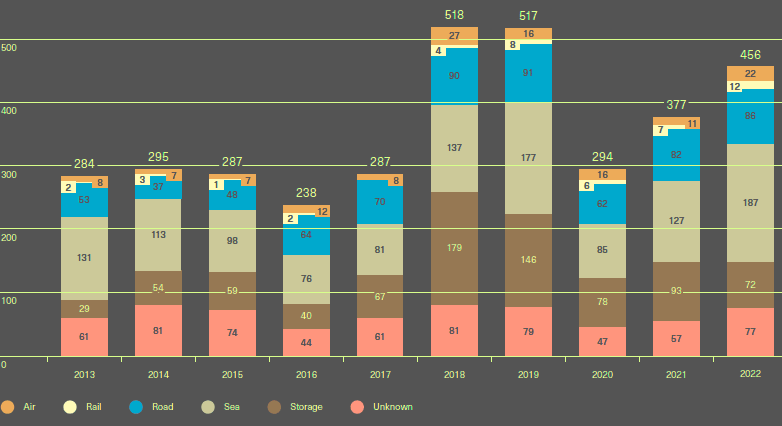

Number of cargo losses by mode of transport

Closer to home, cargo underwriters are grappling with a number of specific issues. Inflation has a direct impact on the value of goods transported and, consequently, the value of associated claims. Accumulation of risk in single shore-side facilities or on-board ever-larger vessels continues to generate problems.

Global offshore energy insurance

The upward trend in the offshore energy premium base continued into 2022 resulting in USD4.1 billion for the year, up by 7.3% on last year.

The uptick was largely reflective of the oil price and a corresponding uplift in offshore activity, particularly jack ups and deep-water vessels. Inflation and its impact on asset values was also a factor.

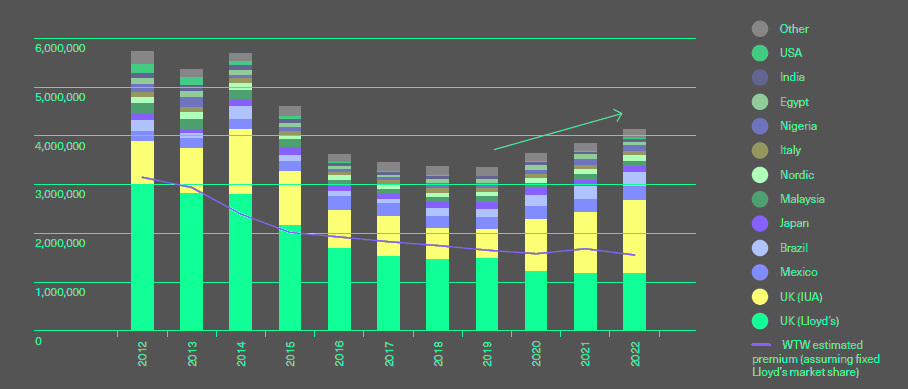

The two major markets in this sector are both in the UK (Lloyd’s and IUA) with the IUA continuing to grow its share. Other markets have remained relatively stable. The global premium base which bottomed-out in 2019 and has risen year-on-year since then.

Offshore energy insurance premium

The premium base tends to mirror the oil price which has been relatively strong since late 2020 and more so in 2022. Prices began to fall in 2023 which is likely to herald weaker returns for insurers in 2023 and 2024, although a recent OPEC agreement might arrest the anticipated decline.

Increases in the oil price will drive an uplift in offshore activity, generally after an 18-month lag and this will impact average day rates and the overall premium base as a result.

There is generally a long back-log in claims reporting which makes loss ratios challenging to analyse and predict.

The youngest underwriting years will continue to develop, often over a number of years, and claims impact on results can differ substantially from year to year.

Reported outstanding losses for 2020 increased substantially since last year’s reporting but on the whole, losses in this sector remain low and relatively stable. A fragile balance remains, however, with reduced premiums (but now rising) and a modest claims impact. Risks and claims resulting from unit activation have the potential to disrupt the balance.

…………………

AUTHORS / The International Union of Marine Insurance Facts & Figures Committee: Jun Lin – Chair of IUMI’s (Gard), Astrid Seltmann – Vice Chair of IUMI’s Facts & Figures Committee (Cefor), Mathieu Daubin – Vice Chair of IUMI’s Committee – Chief Underwriting Officer AXA XL, David Matcham – Chief Executive at International Underwriting Association of London, Mariella Dauphinee – Executive Committee Liaison (Marine Claims Manager at Intact Insurance Company)