The cyber insurance market is anticipated to maintain favorable premium growth and underwriting results through 2023; however, pricing will likely moderate further this year in response to recent profits and competitive factors.

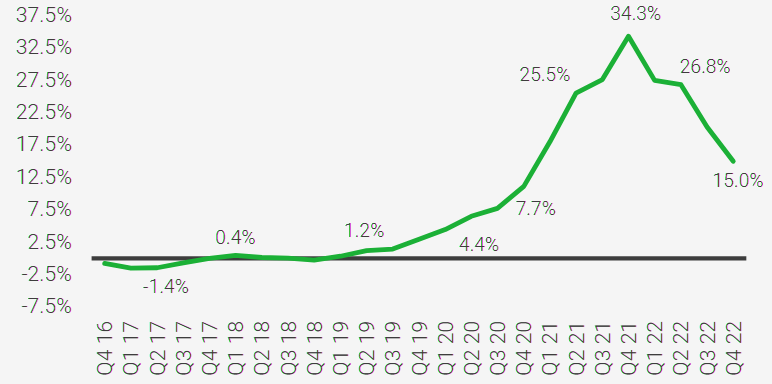

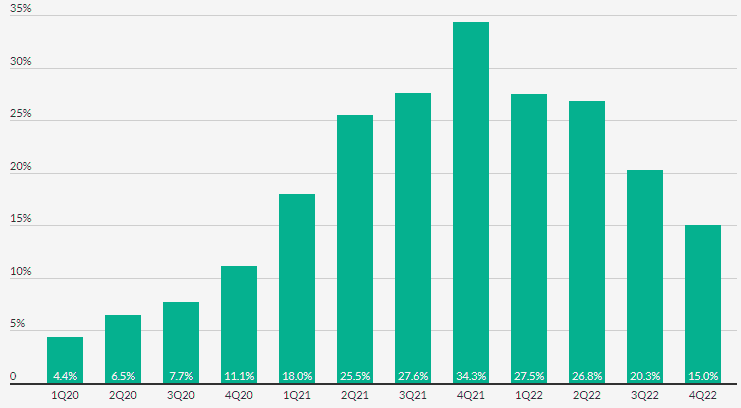

According to The Council of Insurance Agents & Brokers’ Commercial P&C Market Survey, for the first time in six quarters, the average increase in premiums for cyber fell below 20%, coming in at 15% in Q4 2022.

While still high, this increase was noticeably down from the line’s peak of 34.3% at the end of 2021, suggesting the line may have begun to stabilize in Q4 or even Q3, when some respondents first commented on the possibility of some premium pricing relief (see Cyber Security Top Trends & Cyber Attack Threats).

Premium Change for Cyber Insurance

One possible factor behind the recent smaller increases is reduced cyber claims activity. According to survey results, the number of respondents reporting an increase in cyber claims has fallen almost 20% from the previous quarter, and nearly 30% from the beginning of the year.

Cyber premium pricing relief may also be related to the historical underpricing of this line, discussed in particular in the Q4 2021 survey.

Then, respondents pointed out that despite the rapidly increasing frequency and severity of cyber claims, carriers were still generally offering cyber coverages at low to moderate prices, and may not have been pricing properly for the cyber risk faced by many businesses.

It could be that after several quarters of sharp increases, premiums may have reached or may be about to reach a more appropriate level for the potential losses, which can be sizable.

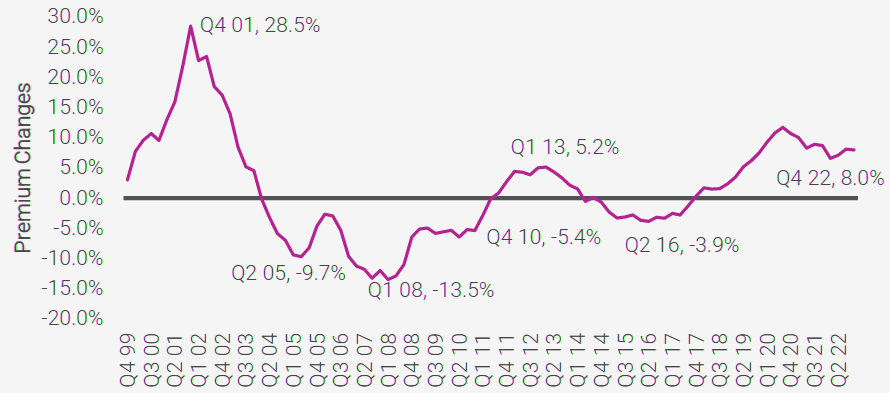

Cyber insurance renewal premium rate increases

According to Fitch Ratings, average cyber renewal insurance premium rate increases have decelerated, with a 15% sequential-quarter increase in 4Q22 down considerably from a record 34% increase in 4Q21.

Industry statutory direct written premiums for cyber coverage in standalone and package policies increased by over 50% in 2022 to $7.2 bn, following 73% premium growth in the prior year.

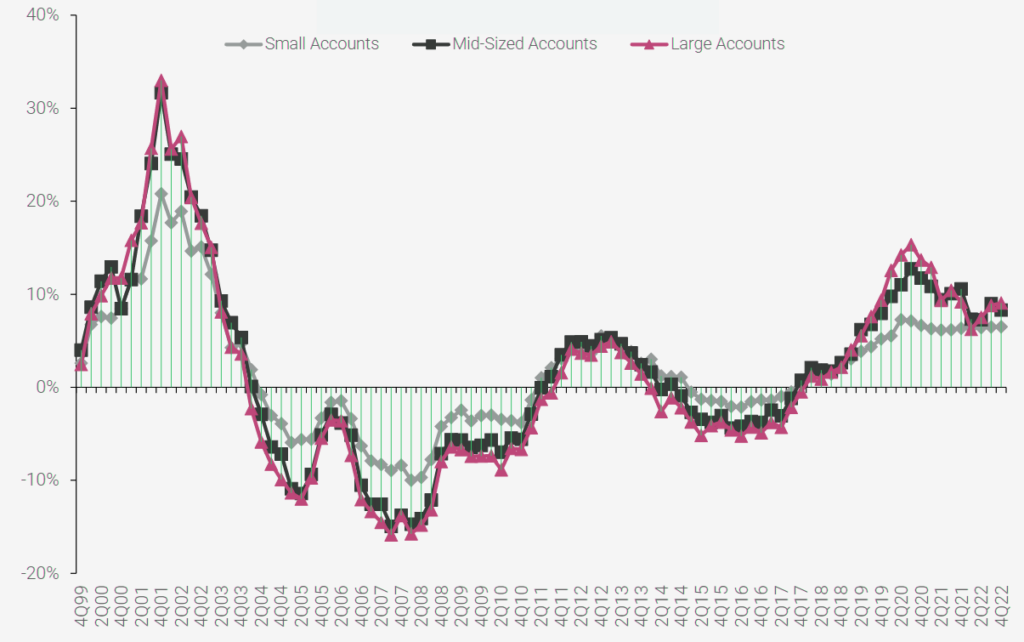

- Premiums increased for the 21st consecutive quarter in Q4, with respondents reporting an average premium increase across all account sizes of 8%.

- Premium increases continued to stabilize across most lines. Most recorded a lower average premium increase in Q4. Workers compensation premiums once again decreased at an average of -1.1%.

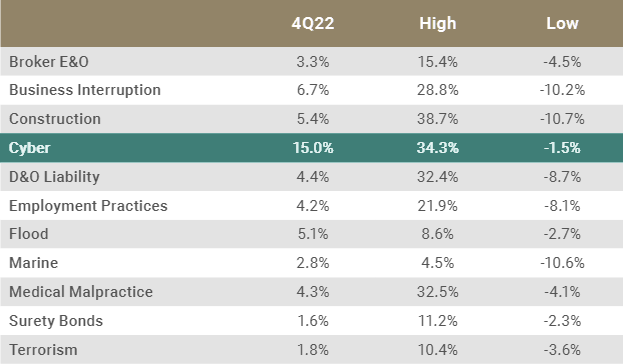

- ➢ Umbrella premiums increased an average of 9.6% in Q4, ending a 12-consecutive-quarter streak of double-digit increases. The rate at which cyber premiums increased continued to moderate this quarter, with an average premium increase of 15%, down from 20% in Q3, 26.8% in Q2, and 27.5% in Q1.

- Despite these signs of relief, 85% of respondents reported that the top client concern in Q4 was “future premium increase”; 67% of them said “high current premium” was top of mind for their clients.

- One line that did not experience pricing increase moderation was commercial property. Premiums in this line increased sharply in Q4 at an average of 16%, compared to 11.2% in Q3 and 8.3% in Q2. This was the first time in 7 quarters that a line of business other than cyber experienced the highest average increase.

- Inflation’s effects on property valuations and building replacement costs, as well as increased claims due to natural catastrophes were the primary drivers for commercial property’s difficulties, according to respondents. These factors in turn led to further difficulties with underwriting, including significant restrictions on capacity—89% of respondents reported a reduction of commercial property capacity.

- Brokers were focused on enhancing the customer experience this quarter, with 45% of respondents identifying it as a top priority. Typical responses included bringing in technology to help clients easily access the information they need, simplifying the insurance process as much as possible, and implementing additional services to add value, such as assistance with loss control or compliance.

Q4 results showed similar trends to Q3—while there were signs of premium pricing moderation, premiums nevertheless continued to climb.

Some brokers also reported seeing tighter terms and increased scrutiny, with carriers requesting additional data when reviewing applications.

Average Premium Changes

Insurance rate changes by lines

Average Rate Changes by Account Size

Insurance claimes

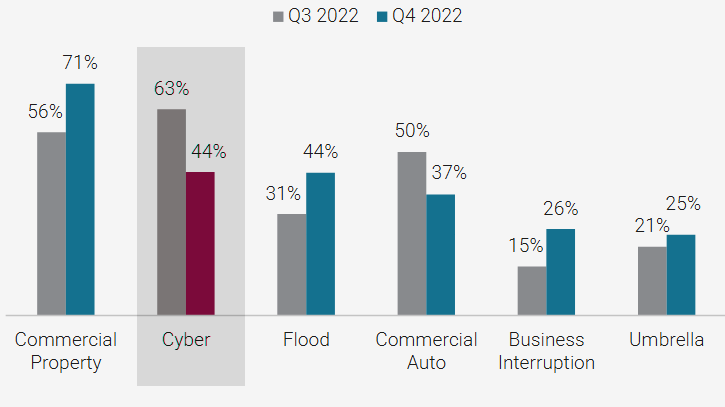

Claims data from this quarter was linked with natural catastrophe. Reports of commercial property and flood claims both increased again this quarter.

Commercial property stood out, with 71% of respondents reporting an increase in claims, up from 29% at the beginning of 2022.

Respondents reporting an increase in claims

Multiple respondents attributed this increase in commercial property claims to Hurricane Ian. One respondent said the increased flood claims stemmed from “CAT events in SE,” which may possibly be Ian or the final hurricane of the season, Nicole.

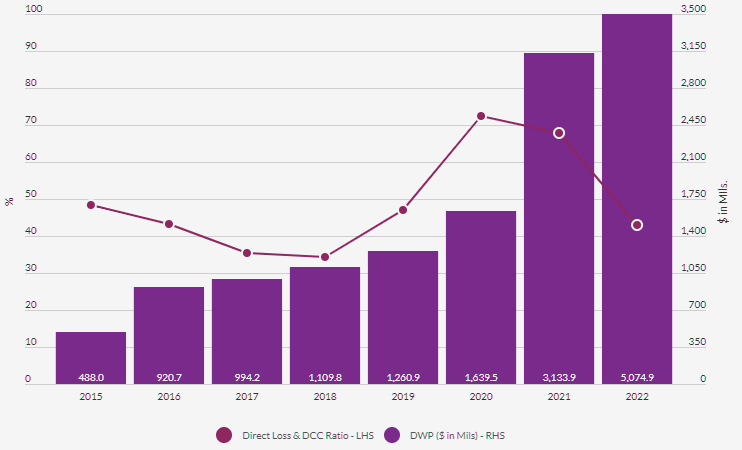

Standalone Cyber Risk Direct Loss & DCC Ratios

Stand-alone cyber coverage, which represents approximately 70% of industry premiums, increased by 62% in 2022 (see US P&C Insurance Market Underwriting Results in 2023).

The Combined Ratio Improved 25 Percentage Points in 2022 Amid a 62% Increase in Premiums

Rising policyholder awareness of the multi-faceted cyber threat continues to boost demand for coverage.

Rapid recent premium growth and a reduction in claims experience in 2022 led to a strong recovery in results for the US Cyber insurance line following two consecutive years of more elevated loss ratios.

Insurers saw an acceleration in market premiums relative to already strong growth according to data compiled from cyber insurance supplemental filings in statutory financial statements (see Cyber Security, Insurance & Cyber Business Intelligence Review).

For standalone cyber coverage, the direct incurred loss and defense and cost containment (DCC) expenses ratio improved significantly to 43% in 2022 from 68% a year earlier.

Cyber Insurance Renewal Premium Rates QoQ Change

Renewal Rate Increases Decelerated

Sharp growth in earned premiums and slower expansion of reported claims and incurred losses drove improvement in results. This was due in part from a moderation of ransomware incidents, an elevated level of awareness of cyber risk at executive levels, and more stringent enforcement of cyber hygiene standards by insurance companies.

The costs of defending and settling cyber claims is becoming more burdensome, with defense costs and containment (DCC) costs rising significantly.

The improvement in direct cyber results also reflects a more cautious approach by insurers to underwriting and risk selection, resulting in sharply higher premium rates in the last two years.

Insurers serve a role in promoting effective cyber risk management practices for policyholders, and have become more insistent that insureds demonstrate practices that include use of dual factor authentication, diligent system updates and patches, and frequent employee cyber training as part of the application process.

However, statutory cyber financial data does not provide a full picture of segment profitability, as direct results do not include all underwriting and adjusting expenses.

Effects on premiums and losses from ceded reinsurance also are not considered and cyber is typically a product for which primary carriers buy considerable reinsurance protection.

The claims environment remains more uncertain relative to other property/casualty products, in part due to the rapid pace of technological change and potential for new types of cyber incidents. Underwriters and modeling experts are active in developing tools to measure and manage risk aggregations and large loss exposures, but the nature and probability of loss of various potential cyber catastrophes remains highly difficult to project.

………………………

AUTHORS: James Auden – Managing Director, Insurance at Fitch Ratings, Christopher Grimes – Director at Fitch Ratings, Laura Kaster – Senior Director of North and South American Financial Institutions at Fitch Ratings

Edited & Reviewed by Oleg Parashchak — CEO & Editor-in-Chief Beinsure / Finance Media