In the new future of mobility, insurers will be able to simplify, streamline, and automate the claims journey through connectivity and telematics technology such as cameras and sensors that provide real-time, accurate data.

Usage-based insurance with telematics is gaining popularity, many motor insurers are beginning to offer it as an option to customers. Over the past decade, insurers have transitioned from discussion and experimentation to market introduction of insurance telematics. We’d like to introduce you to telematics and give you some vocabulary to help you stay abreast of the growing trend.

The approximately $260 billion US auto insurance market is on notice. The conventional US insurance market, currently dominated by internal-combustion-engine (ICE) vehicles, will likely stop growing by the middle of this decade. Conventional ICE vehicles will be steadily displaced by EVs.

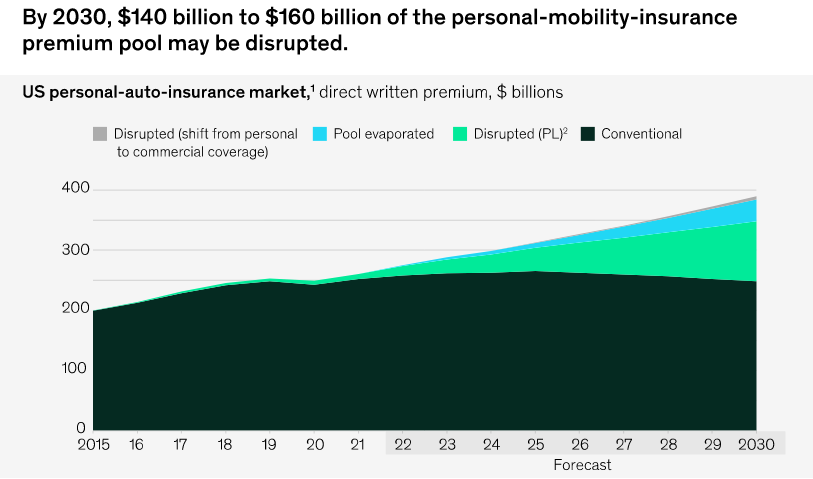

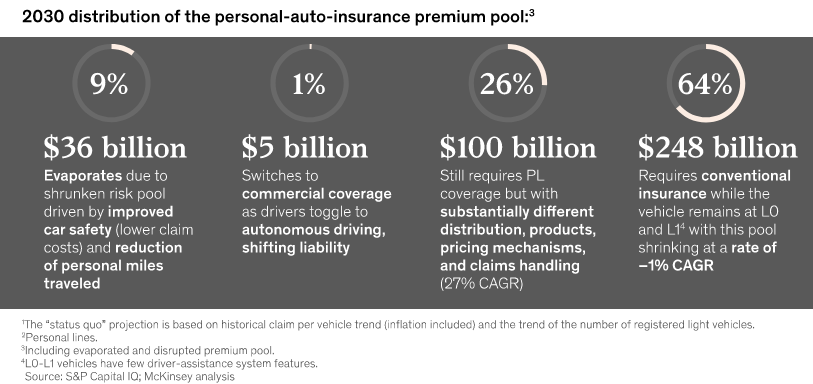

If current conditions remain, the value of direct written premiums in the market will reach about $390 billion by 2030, compared with $260 billion in 2021.

But with connected technology accelerating, the size and composition of the insurance risk pool may change significantly.

By 2030, two-thirds of the auto insurance market will be L0 or L1 vehicles requiring “status quo” insurance products. The rest of the market will be disrupted in three ways

Loss of Auto Insurance market size

The proliferation of safety technology as a result of the greater adoption of connected EVs will reduce accidents, but it will also exert downward pressure on premiums. At the same time, distance traveled is expected to decrease as the availability and cost-effectiveness of shared mobility take a larger share of mileage. Together, these shifts will lead to up to 10% ($26 billion) in lost premiums that will completely leave the insurance market.

New personal-lines insurance products will be required

About 25% ($100 billion) of overall premiums will still require personal-lines coverage, but they will have substantially different approaches to distribution, product and pricing, and claims. OEMs have the potential to be a major influence in this area because they will have the ability to unlock access to customers and demand an “OEM-certified” repair process as a prerequisite for maintaining product warranties and in relation to where liability would fall in the case of a malfunction.

Some liability will shift to commercial-lines products

About 1% ($5 billion) in annual premiums will shift to commercial insurance as conditionally autonomous L3 vehicles penetrate the US fleet of personal passenger vehicles. As the autonomous-driving system takes on more responsibility with an increasing number of L3 vehicles in the fleet, liability will partially shift from human drivers to OEMs and autonomous-vehicle software providers.

Traditional auto insurance pricing factors are also still generally built into your rate, such as your driving record, credit, vehicle type and location.

The US Auto Insurance Study is based on responses from 36,935 auto insurance customers and was conducted between January and April 2022. The survey aims to examine customer satisfaction in five key areas: billing process and policy information, claims, interaction, policy offerings, and price.

According to Verisk, in the taxonomy of the Internet of Things, a phrase coined by Kevin Ashton in 1999 that has gained currency in the past few years, telematics is in the topic family of machine-to-machine (M2M) communication mechanisms.

The enabling technologies stem from telecommunication advances that have reduced the cost of connecting associated but remote endpoints: everything from smartphones to temperature sensors. The word telematics implies a bidirectional exchange between endpoints for sensing or measuring feedback or control (see How will Technology Impact Insurance? 16 New Technology Trend Evolution).

Furthermore, the new generation of young people is used to pay for usage, like data contracts for phones or car sharing. But what does this change mean, how do telematics and usage-based products reshape the traditional motor insurance industry and how can insurers use it for their benefits?

The type of data that devices can collect from or about a vehicle varies by implementation, typically drives cost, and is constrained by regulation and customers’ willingness to share. Programs in place use sensors to determine factors as simple as distance (vehicle-miles traveled) and as sophisticated as camera-based recording. Devices transmit and store the resultant collection for immediate or deferred analysis, meaningful interpretation, and/or visualization.

Understanding your customer helps you to sort them more effectively and allows you to offer personalized motor insurance products that fit the customer’s needs perfectly.

To provide outstanding customer experiences and engagement, the products you offer have to be individualized. Personalized products require a holistic overview of the customer, which can be created through the use of data analysis.

In addition to that, telematics solutions often lead to constant customer engagement with the carrier through an app or other devices, to check their usage. Gamification features such as rewards or point-scoring grab attention and paves the way to discourage dangerous driving. Customers with high engagement are more likely to be satisfied with the service and willing to pay more.

……………………

AUTHORS: Tanguy Catlin – Senior Partner McKinsey; Russell Hensley – Partner in McKinsey’s Detroit office; Philipp Kampshoff – Senior Partner in McKinsey’s Houston office; Doug McElhaney – Partner in McKinsey’s Washington, DC, office