According to the latest Allianz Global Insurance Report, 2023 was expected to be another bumper year for the insurance industry, but the invasion of Ukraine has dashed those hopes.

Premium income is likely to grow by roughly 1pp slower than originally assumed as the war takes its toll on economic activity and confidence, even as inflation supports the top line.

Global premium income

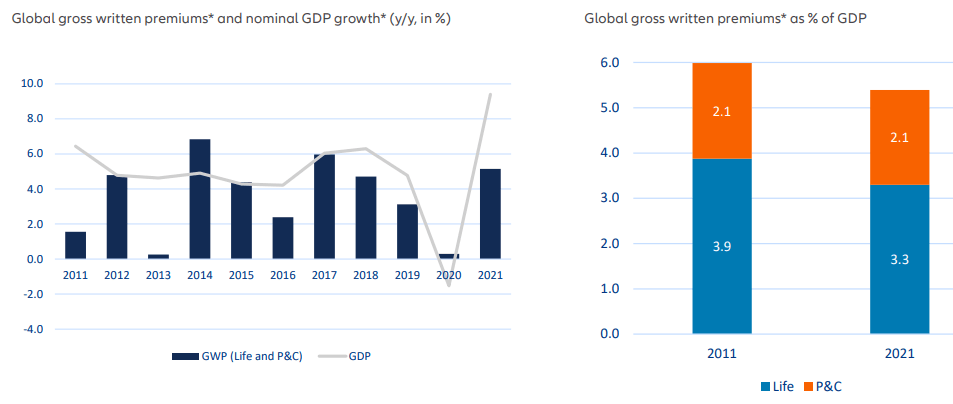

Global premium income to grow by +4.7% in 2023, with life and p&c developing almost in step (+4.9% and +4.6% respectively). This figure must be considered against the backdrop of a global inflation rate of 6.2% this year.

Despite the great uncertainties today, we are not too pessimistic about the more distant future. After all, these uncertainties are precisely the breeding ground for rising risk awareness; they reinforce the impact of the two megatrends of climate and demographic change, which will continue to be the main drivers of demand for risk protection.

Overall, we expect annual growth of +4.8% over the next 10 years (life: +4.9%; p&c: +4.6%). This corresponds to an increase in premium income by +67% or EUR2.8trn by 2032, of which just under EUR1.8trn will be generated by the life segment (+69%) and just over EUR1trn by the p&c segment (+63%).

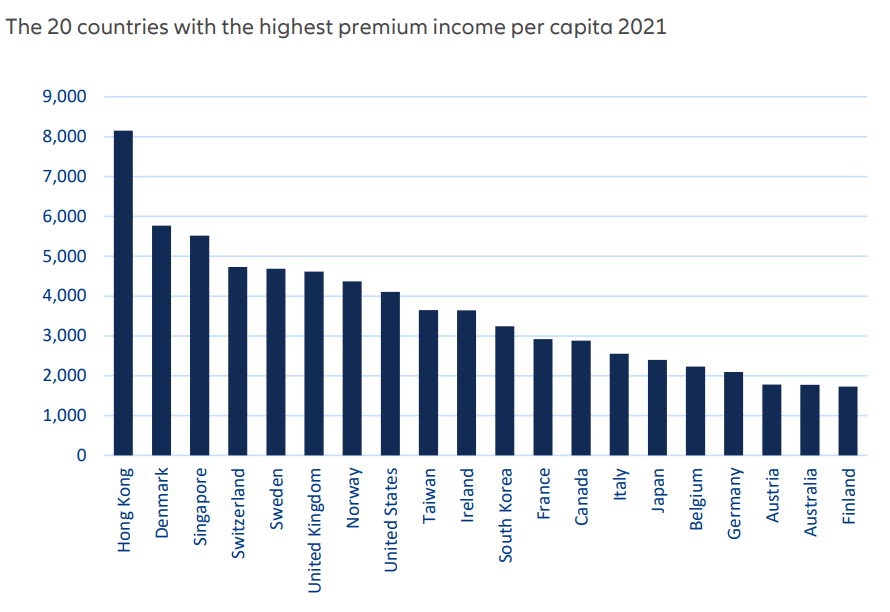

Countries with highest premium income per capita

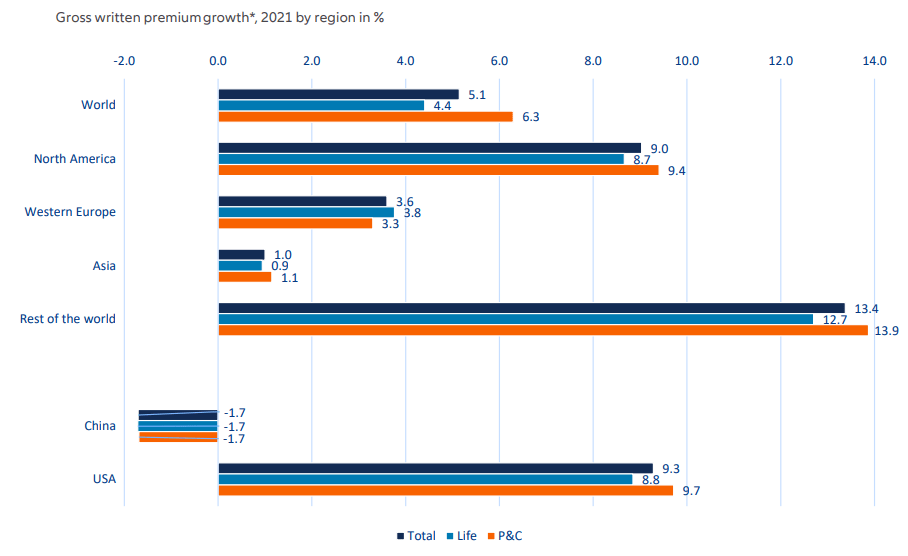

Global premiums grew by 5.1% in 2023 (life: +4.4%; p&c: +6.3%), thanks to strong economic tailwinds, rising risk awareness and record-high savings buoyed by booming markets.

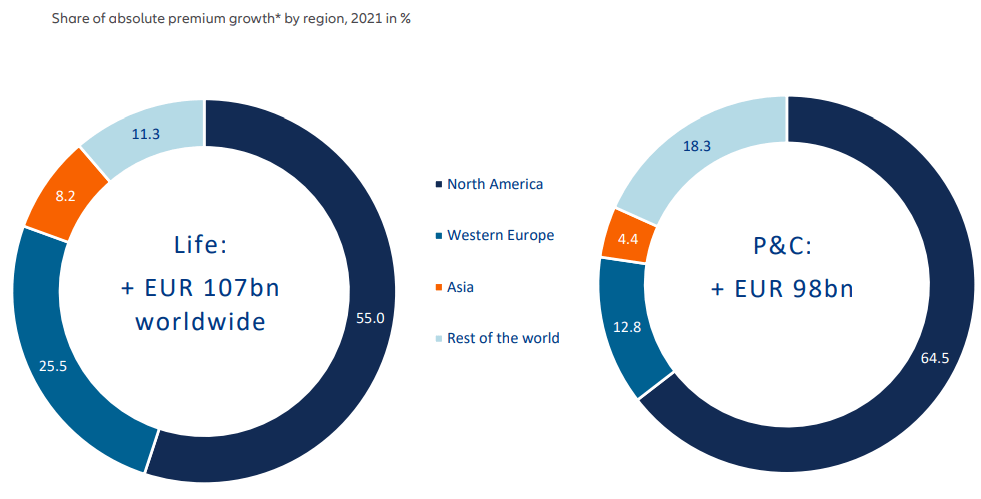

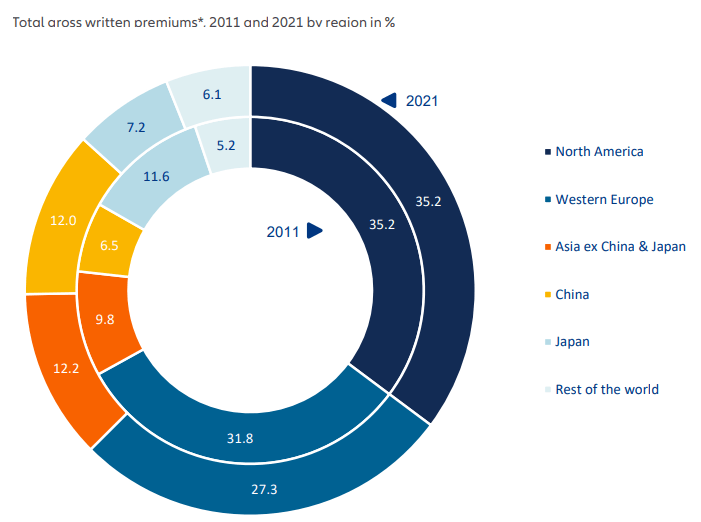

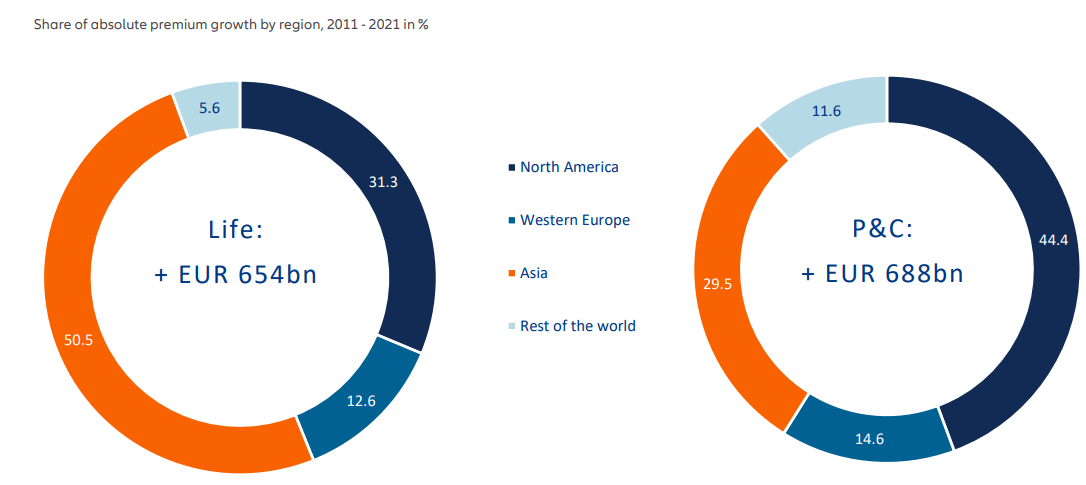

Total premium income reached EUR 4.2trn (life: EUR 2.5trn and p&c: EUR 1.7trn). But what made 2023 really remarkable is the composition of premium growth: More than two-thirds were generated in Western Europe and North America, with the US market alone accounting for half of the increase.

Thus, 2023 represents an unusual end to the past decade in which growth was much lower (+3.6% per year on average) and driven by Asia, which accounted for 40% of all additional premiums, more than half of them written in China. As a consequence, China’s global market share doubled to 12%.

The pandemic and the war in Ukraine are wake-up calls for better risk management, and even more demand for protection (see How War in Ukraine is Changing the World and Insurance?). The industry must succeed in maintaining its economic and social relevance, offering innovative solutions for new and rising risks.

The questions of insurability and affordability are likely to become increasingly urgent in the coming years. This requires a level of creativity and collaboration with all stakeholders, customers, carriers, and policy makers even beyond previous efforts.

Western Europe recorded an increase of 3.6% in total premium income in 2022 (life: 3.8%, P&C: 3.3%); total premium income exceeded EUR 1,1trn. Reflecting the impact of the Ukraine war, growth is likely to decline to 2.9% in 2023 (life: 2.8%, p&c 3.1%).

After that, however, an acceleration is also expected in Europe, with average growth over the next ten years expected to settle at 3.3% (life: 3.3%, non-life: 3.3%), well above the level of the last decade (1.6%), which was marred not only by Corona but also by the euro crisis.

Both lines of insurance business might indirectly benefit from the recent crises

In the life business, increased risk awareness in the wake of the Covid 19 crisis and the inflation-triggered end of zero interest rates should make many savings and pension products more attractive again.

In the p&c business, climate-mitigation efforts will intensify, first and foremost the decarbonization of energy supply. The quest for energy independence makes this even more important now. This requires major investments from both the private and public sectors and creates a high need for risk protection as new risks will emerge with this radical transformation of our economy.

In 2023, the German insurance market grew by a meagre 0.3%. While the p&c segment clocked solid growth of 2.4%, the life segment declined by 1.4%. For 2023, growth of 2.0% (life: 1.8%, p&c: 2.3%) is expected. Over the entire next decade, Germany is expected to achieve average growth of 2.5% per year with both segments moving in sync.

That would be slightly above the previous decade’s level (+1.9%), as the life business should become again a little stronger in the coming years. It would, however, be almost one percentage point below the pace of the rest of Europe.

In the life business, demographic change is likely to be the decisive growth driver. This applies for both advanced and emerging markets: Unrelenting aging and social change combined with rising public debt and often inadequate social security systems speak loudly for the need to increase individual provisions.

This development is likely to benefit from two crisis-related developments in the coming years: increased risk awareness in the wake of the Covid 19 crisis, and the inflationtriggered end of zero interest rates, which should make many savings and pension products more attractive again.

P&C insurance business

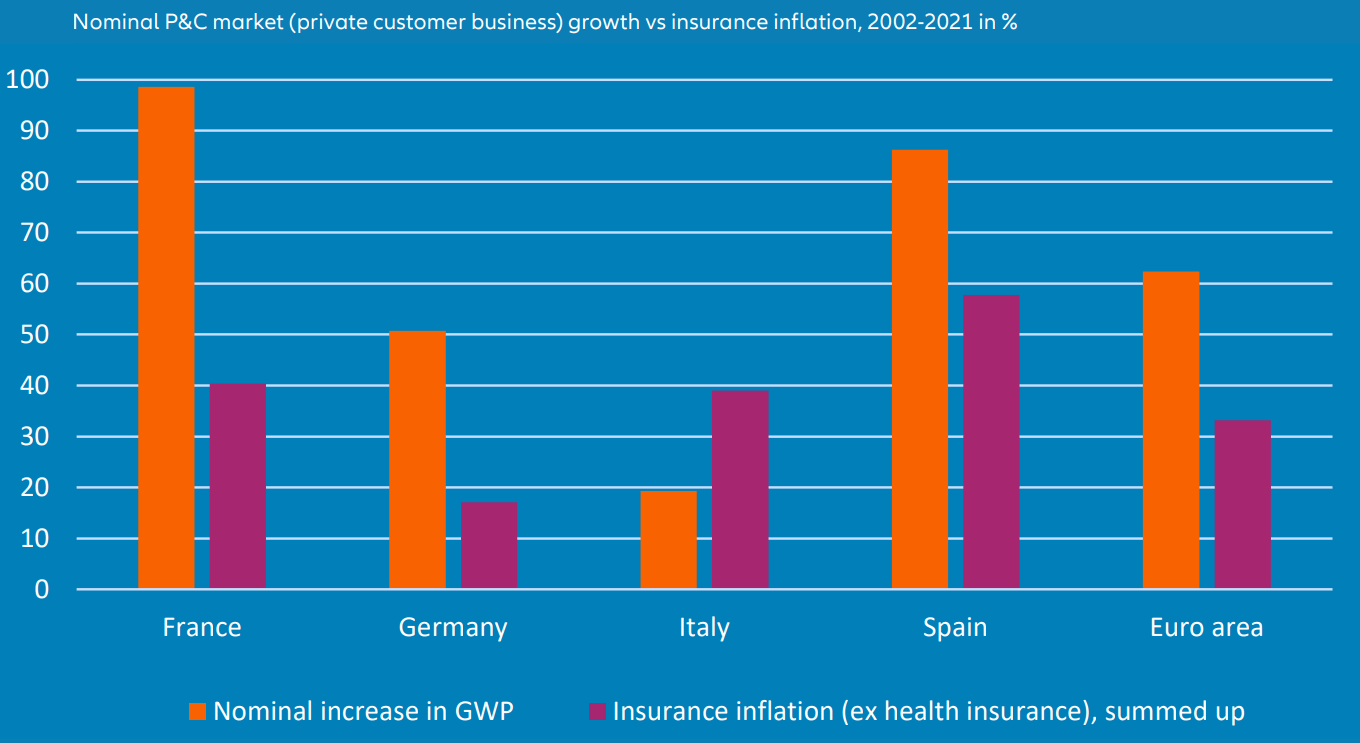

In the P&C insurance business, climate change is the main topic in two respects. First, extreme weather events will increase in the coming years, driving claims and premiums higher.

On the other hand, climate-mitigation efforts will intensify, first and foremost the decarbonization of energy supply, even more important now amid the Ukraine war and the resulting quest for energy independence.

This requires major investments from both the private and public sectors and creates a high need for risk protection as new risks will emerge with this radical transformation of our economy.

Although the growth gaps between emerging and advanced markets will narrow – reflecting the moderate recovery of life markets in Western Europe and Japan as well as diminished growth prospects in China – the global insurance market will continue to shift in favor of the former.

China’s share will increase from 12% to 15%, while the rest of Asia (excluding Japan) is expected to reach a share of just under 17% (2022: 12.2%).

Around 42% of new premiums will be written in Asia (excluding Japan), half of which is likely to come from China alone.

As a result, anyone looking for growth in the 2020s will still have to turn to Asia.

All in all, does this mean good prospects lie ahead for the insurance industry?

Yes, but with one important caveat: only if it succeeds in maintaining its economic and social relevance. The upcoming upheavals will give birth to new risks, for instance risks related to data protection, new green technologies or AI and climate liability. So there will hardly be a lack of demand for protection and prevention.

However, the industry is called upon to offer solutions for these risks so that they do not remain uninsurable or have to be assumed willy-nilly by the state.

The question of insurability – and closely related: affordability – is likely to become increasingly urgent in the coming years, not least with regard to natural hazards. This requires a level of creativity and collaboration with customers and governments that goes beyond previous efforts.

The insurance industry is facing radical transformation. To paraphrase Giuseppe Tomasi di Lampedusa: The industry has to change if it wants to stay relevant. For this, the industry must move beyond pricing and transferring risk to changing outcomes. It needs to actively reduce risk in the system by impact underwriting and investing, and thus leading the pivot to sustainability.

The crisis year 2020 left a clear dent in the development of global premium income (p&c and life).

The year on year growth was a meagre +0.3%, but despite all the adversities associated with Covid-19, it was still in positive territory, thanks to the non-life business.

While the life segment declined by -1.3%, the p&c segment still managed to clock moderate growth of +2.8%.

Life insurance business was driven by all regions

In 2023, the global insurance industry emerged from the second year of the pandemic with a strong recovery: insurers worldwide collected almost EUR4.2trn in premiums, 5.1% more than the year before. In 50 of the 61 countries surveyed, the total premium volume at the end of last year was already above the level of 2019; at the global level, the growth adds up to +5.5%.

The upswing in the life insurance business was driven by all regions, even if significant differences became apparent.

The largest contribution to growth came from North America, or more precisely the US alone: In the US, where just under 27% of global life insurance premiums were written, our projections suggest a strong increase of almost +9%.

The markets of Western Europe, which together generated almost 30% of the global premium volume, also grew by a +3.8%. Within the region, however, the development was anything but homogeneous.

For instance, while double-digit growth rates were observed in Italy (+12.5%), Greece (+13.8%) and Portugal (68.5%), the life insurance market in France (-0.5%) shrank for the second year in a row.

Germany also reported a decline of -1.4% after only meagre growth +0.4% in the previous year.

All other insurance markets (rest of the world, global market share of 4.2%) recorded growth of +12.7% in the life segment. This was mainly driven by strong increases in Latin America (+13.9%) and the Middle East & Africa (+18.9%), which account for around 29% and 42%, respectively, of this group of countries.

In the property insurance business, too, all regions made a positive contribution to global premium growth in 2022.

As in the life segment, the US is at the top of the list: With almost EUR685bn, more than two-fifths of global premiums were written there alone in 2022, an estimated increase of almost +10% over the previous year.

According to our projections, insurers in Western Europe enjoyed positive growth rates in all countries. Overall, the industry wrote 3.3% more business in the region than in the previous year.

The development in Greece (+5.7%) and Austria (+4.7%), for example, was clearly above average, while larger markets such as Germany (+2.4%), Italy (+2.6%) and Spain (+2.7%) were below the regional average. Western Europe accounted for just under 24% of global premium volume at the end of 2022.