The War in Ukraine has once again demonstrated the devastating toll that a systemic event can have on the global risk landscape. As quickly as the conflict began, our economic assumptions have been challenged; our energy mixes thrown into question; and our geopolitical relationships redefined.

The knock-on effects of the crisis will last a lifetime, and it is clear the damage already caused has left the world in a dramatically altered state. Business and insurers must work to understand and navigate the world it leaves behind.

The latest Lloyd’s report, Ukraine: A conflict that changed the world, created in partnership with Aon, aims to provide insights on the medium to long term impacts of the Ukraine crisis on the risk landscape.

The analysis is based on in-depth interviews with 75 sector experts and practitioners across Aon and Lloyd’s, each providing real-life, practical insights on the challenges that companies are facing today and how they are adjusting their risk management approaches in response.

Understanding the War`s Impacts

Based on in-depth interviews with sector experts and practitioners, this research highlights four ‘macro themes’ shaping the risk environment today as a result of the crisis. The impact of these themes on businesses are summarised below.

Geopolitics

This crisis has exposed the vulnerabilities associated with globalisation in an international system in which a powerful state asserts self- interest and breaches international norms and laws. In this new dawn for globalisation, many organisations are likely to adopt hedging strategies to protect their global interests and assets as more protectionist trade policies are introduced. Countries and businesses are pivoting towards reshoring supply chains as a means to achieve self-sufficiency and more control on access to priority goods and services. This reversal of decades of trade and specialisation will inevitably make goods and services more expensive in the long term.

Inflation

Despite higher energy and commodity prices increasing profit margins in some sectors, supply side costs have increased across the economy. Most of these increased costs get passed on to the end consumer, further exacerbating price inflation, whilst businesses seeking to absorb them may face a struggle to stay afloat. Many businesses are likely to adjust their budgets for risk management solutions and reduce discretionary spend to account for inflationary pressures from supply shocks.

Economic impact

Owing to its position as a leading energy and commodity exporter in global supply chains across various industries, Russia’s exclusion from international trade will have significant economic ramifications – particularly for businesses in Europe and in goods-producing industries like food and energy. Whilst the rouble has recovered from an initial shock, any persisting depreciation of the rouble would negatively affect Russia’s ability to boost investment and productivity, damaging global agriculture and manufacturing and creating further risks to food and energy security. Meanwhile, the disruption to critical exports from Ukraine, such as grain, presents a significant and immediate threat to global food security.

Social transformation

As widely reported, this conflict has brought with it the fastest refugee flow in Europe since World War Two, surpassing the flow of asylum seekers at the height of the Syrian refugee crisis. Around three million people fled Ukraine in the first three weeks of the crisis and this will continue to grow as the conflict continues. The resulting displacement will contribute to labour shortages and require organisations to reconfigure their labour pools, especially in transport and logistics, to meet the rising demand on products and services.

The potential impacts are therefore far-reaching. The prominent theme throughout our analysis is that these risks are incredibly interrelated. As with COVID-19, first-order impacts have the potential to trigger second- and third-order impacts in different risk categories.

As one example, take the heightened supply chain risks could increase inflationary pressures. It is therefore critical for businesses to take a broad, informed approach to assessing, mitigating and managing risk within their organisations – while building resilience through activities such as supply chain simplification, workforce upskilling and implementing a robust cyber security framework.

The ripple effects of Russia’s War in Ukraine are changing the world

Far from Russia’s war in Ukraine, stores are running out of cooking oil, people are paying more at the gas pump, farmers are scrambling to buy fertilizer and nations are rethinking alliances.

Russia’s invasion of Ukraine has triggered seismic repercussions: a fast-moving refugee crisis, unprecedented sanctions against a major economy and a shakeup of global relationships, including a reinvigorated NATO.

Below, we zoom in on some of the ways the world has changed since the war began on Feb. 24.

- Ukraine and Russia are key exporters of wheat, barley, corn and cooking oil, particularly for African and Middle Eastern countries. Russia is also a major producer of fertilizer and petroleum.

- More than 5.8 million people have fled Ukraine in one of the fastest-growing refugee crises in recent history. Humanitarian groups, with resources already strained by crises elsewhere, have sprung into action. The U.N. refugee agency has projected that some 8.3 million people might leave Ukraine and called for more financial support for refugees and host countries as both face challenges with access to food, housing, transportation, education and money.

- A 21st century war in Europe — led by a nuclear power — is pushing the world toward a potentially profound realignment. It has rattled prominent global players such as the European Union and the United Nations and forced countries to take sides in new ways that have led to escalating tensions and momentous diplomatic shifts.

- Russia is the second-largest producer of natural gas and the third-largest producer of oil. The European Union has particularly depended on Russian energy; it is now preparing to phase in an oil embargo. A historic restructuring is sweeping the global petroleum and gas trade as countries ban or cut Russian energy imports, sanction Russian companies, face Russia’s demands for payments in rubles and search for alternative sources.

- Russia has more nuclear weapons than any other country in the world. Its military attack on Ukraine has notably reenergized NATO, a military and political alliance of the United States and European countries. Urgently, countries around the world have escalated military spending or have begun a consequential reevaluation of their defenses.

Within Ukraine, public-health researchers are concerned not only about the immediate loss of life and the health crises caused by the war, but also prolonged trauma.

“A lot of people’s homes have been reduced to rubble,” says Margaret Harris, spokesperson for the World Health Organization’s Ukraine team. “There will be an enormous rise in the need for strong psychological care.”

Now that Russia has largely withdrawn to the east of the country, life — and research — is resuming in some areas, including Lviv, Kyiv, Dnipro and Vinnytsia. But much of the country still has air-raid alerts every night, and bombs fall indiscriminately. Many people are worried that winter will bring a renewed military offensive by Russia.

Researchers in Russia, meanwhile, say that the reaction to the invasion is cutting their country off from international research and that many people have already left for better prospects elsewhere. European and US organizations have cut ties with Russian science, including cancelling joint projects.

Defining the scenarios: five potential outcomes for the Ukraine conflict

Russia’s invasion of Ukraine has affected economies and livelihoods well outside the conflict zone.

Given a lack of clarity for the world as to how the conflict will develop, in the graphic to the right we consider five potential future scenarios, based on commentators’ analysis and the most recent events at the time of writing this report. The varying outcomes of each scenario will have differing consequences on the business landscape.

1. Defensive push-back

Ukraine military successes force a Russian withdrawal

Bolstered by international assistance, Ukraine’s military and civilian resistance grind Moscow’s advance to a halt, preventing the Russian regime from toppling Kyiv’s government and establishing a puppet regime. Russian policy towards the conflict changes and its troops are withdrawn.

Commentators have speculated on varying outcomes of this level of Ukrainian resistance:

Strategic: The conflict ends entirely on Ukraine’s terms, meaning the full reclamation of Ukrainian sovereignty, including Crimea and the parts of the Donbas occupied by Russia in the years before it fully invaded in February.

Tactical: Ukraine expels Russia from the western side of the Dnieper River, establishes perimeters of defence around the areas Russia controls in Ukraine’s East and South and secures its access to the Black Sea.

Ukraine remains a sovereign democracy, Europe is faced with an improved security situation, as Russia is isolated, and Ukraine grows ever closer to the West.

2. Protracted conflict

Support for Ukraine from an alliance of states leads to a protracted conflict

Russian troops take over Kyiv and install a new administration. A western-backed Ukrainian government-in-exile is formed and based outside the country.

This results in a humanitarian disaster in Ukraine, large-scale emigration and prompts a united and stronger sanctions response by the US, the EU and the UK.

There is a strong sense of unity amongst the NATO alliance, which leads to a rapid build-up of NATO troops in the region in a bid to deter further Russian invasions.

The Ukrainian insurgency takes a significant, sustained human and financial toll on Russia – which is forced to devote far more of its resources over a much longer period of time than it had anticipated.

3. Annexation

Russia controls parts of Eastern and Southern Ukraine in a now divided state

Through a negotiated settlement, Ukraine could accept a loss of territory and let Russia annex or control two allegedly pro -Russian regions of the Donbas (a coal- mining region of Ukraine that borders Russia and that Russia has occupied since 2014) as part of a compromise that prevents a full-scale Russian invasion of Ukraine.

Despite the settlement, Russia maintains aspirations to capture both Eastern and Western regions of Ukraine (from Odesa to Kharkiv), gain control of much of the defence industry (including intercontinental missile production), and deprive access to the Black Sea.

An international alliance may provide “significant military assistance” to the Western Ukrainian state to support insurgency in Eastern Ukraine.

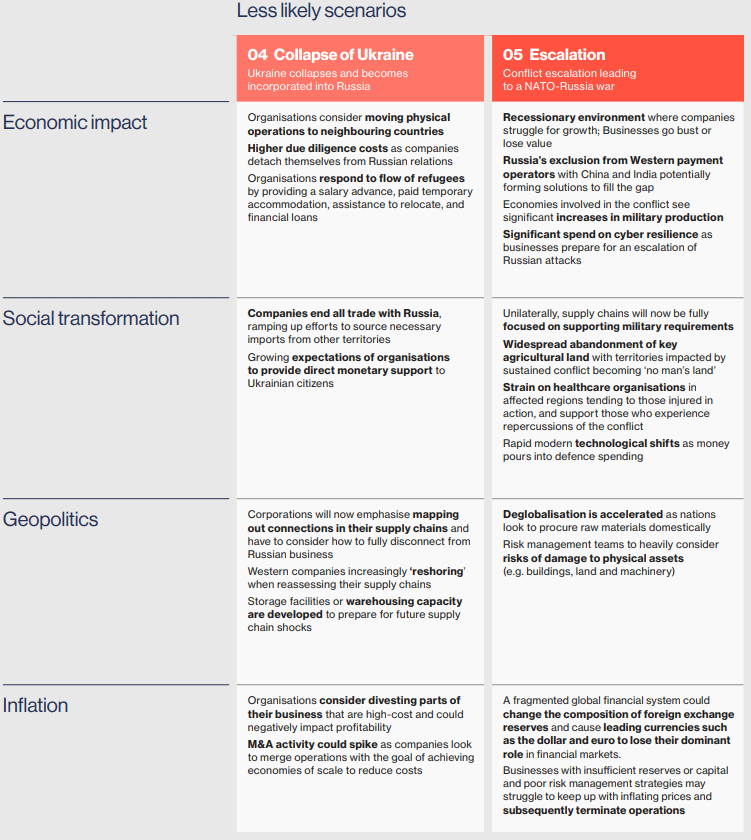

4. Collapse of Ukraine

Ukraine collapses and becomes incorporated into Russia

Russia takes control of Ukraine and the Ukrainian government is ousted. Russia employs cyber attacks and disinformation, backed by threats of force, to cripple the country and induce regime change.

The threat of an escalation into military conflict is ever-present and a significant increase in defence spending across Europe contributes to growing inflation, exacerbated by continued energy price rises.

China may look to strengthen its relationship with a newly emboldened Russia, for example by providing aid to help Russia circumvent Western sanctions.

Depending on China’s response, this could lead to a fragmentation of existing trade partnerships and risk the decoupling of Chinese-Western trading relationships. China is also likely to pay close attention to the outcome of the crisis to assess its geopolitical options in the years ahead.

5. Escalation

Conflict escalation leading to a NATO-Russia war

Russia launches attacks on Western supply lines to Ukraine in NATO members’ territories. This move triggers Article 5 of the NATO charter, which is a collective-defence clause – an attack on one is an attack on all. The NATO member state invokes Article 5 and NATO states begin to mobilise and respond, including the US, UK and France which possess nuclear weapons.

The growing geopolitical tensions lead to a sudden and dramatic reduction in oil and gas supplies to Europe.

This, along with food production and export restrictions, contributes to an extremely high inflation environment.

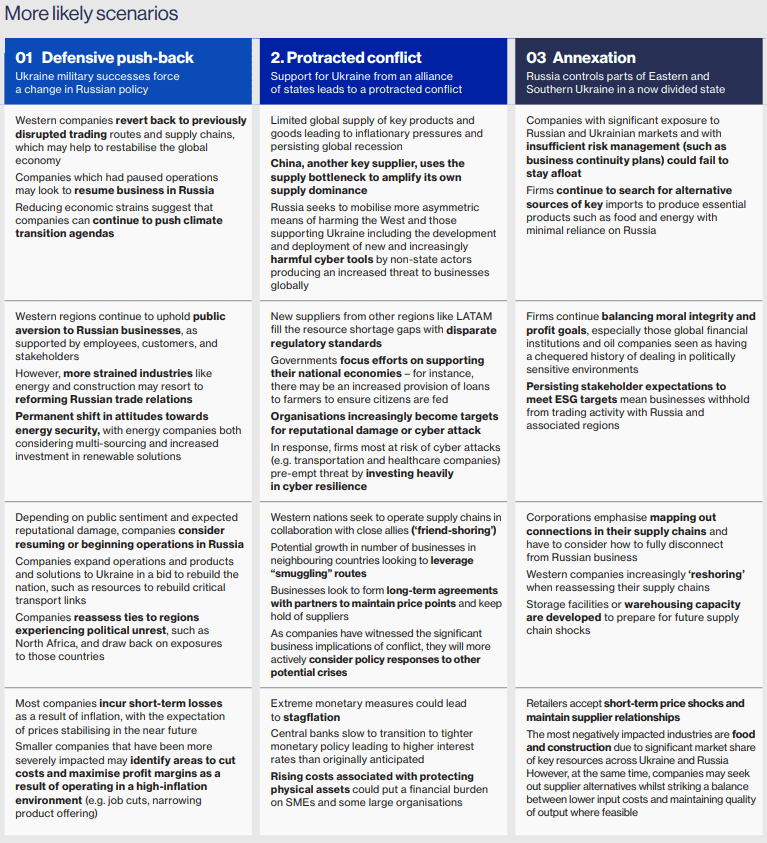

How businesses may react in each eventuality?

The matrix below seeks to assess how businesses may react in each eventuality, with impacts to businesses split across our four macro themes.

- Economic impact

- Social transformation

- Geopolitics

- Inflation

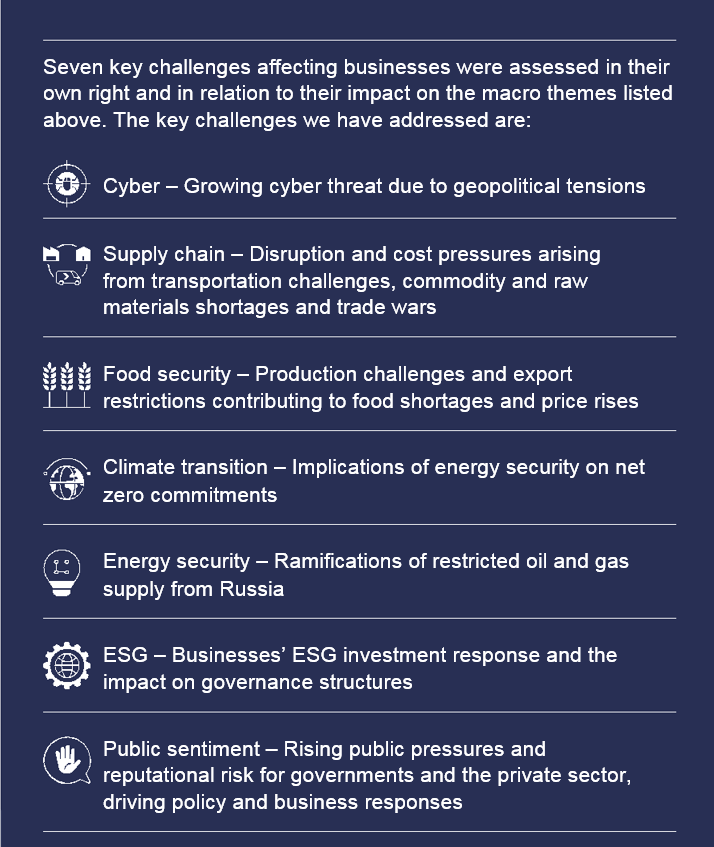

Key market forces influencing the risk landscape

With the overarching macro themes impacting all businesses globally, the following section highlights the business implications of specific challenges for the global economy, namely:

- cyber

- supply chain

- food security

- climate transition

- energy security

- ESG

- public sentiment

Each of these market forces has been analysed against thepotential effects of the five scenarios and overarching macro themes.

Cyber-attacks against Ukraine

In January 2022, multiple cyber-attacks against Ukraine’s government websites were recorded, with another wave disabling multiple government and bank services in the following month. From the outset of the conflict, there has been a global increase in cyber-attacks, but early indications of the number of attacks may rise as Russia continues to plan and execute cyberattacks (see Largest Ransomware pay-outs by Cyber Insurers Outlook). It takes time to plan and execute these attacks, which is why it’s possible that there is a delayed growth in frequency.

As a result, businesses should expect a need to increase their cyber resilience to minimise the peripheral impacts of state-sponsored attacks and opportunistic threat actors in the wake of the crisis. This will likely lead to businesses being more well-versed in financing their risk transfer solutions while improving their appetite for more comprehensive risk management.

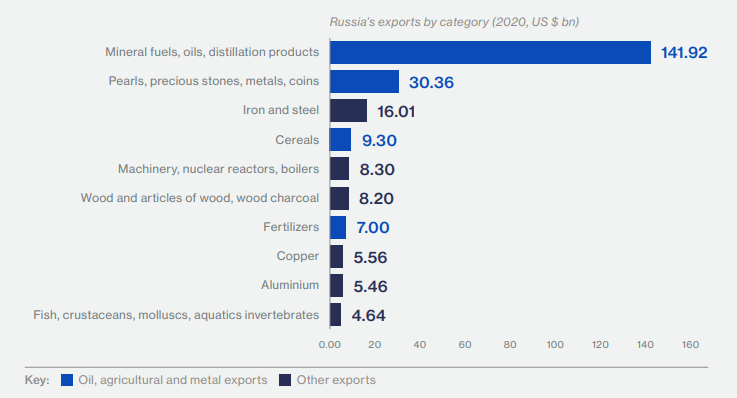

Supply chain

Supply chain constraints have been worsened by the war – with Russian oil, agricultural and metal exports constituting over $190bn in 2020, sanctions against Russia could have significant ramifications across the global energy and commodity supply markets.

Companies with international exposure or operations in Russia are also facing potential losses – they are now unable to access spare parts, insure their facilities and export their goods. Multinational corporates will assess fragilities in their global business, with decisions made on stopping, scaling-back or continuing operations in exposed regions.

Food security

Ukraine and Russia’s position as major exporters of wheat (combined output accounts for 30 percent of global supply) and sunflower oil (combined output at 55% of global supply) has led to severe disruptions to food supplies as a consequence of the crisis.

Many nations are targeting food independence -– as early as 2023. We may see farmers start to use new crop technologies that offer biologics that provide improved plant health and soil fertility benefits, leading to an increase in the yield of crops. However, as this will take time to have a real impact, to fill the short-term shortage, companies in regions such as Latin America are being encouraged to increase supply but will likely need to meet varying and demanding regulations from Western states.

Climate transition

Accelerated decarbonisation of energy and increased reliance on imported energy left Europe vulnerable to energy supply disruptions and economic shocks resulting from extraordinarily high energy prices. Almost 40% of natural gas consumed in the European Union originates in Russia making gas a particular vulnerability, especially for Germany and Italy which have a greater proportion of gas coming from Russia relative to their overall dependence on gas as an energy source.

With the entire value chain around LNG (and non-Russian natural gas) likely to experience accelerated demand, organisations will look to implement agile and lean technology advancements that can cut costs and improve extraction efficiency to increase margins while recalculating their budget for risk transfer solutions to account for inflationary pressures from supply shock.

Energy security

The desire for greater independence from fossil fuels is exacerbated by the war and will further accelerate decarbonisation initiatives. The EU has woken up to the dangers of over-reliance on energy provision from unreliable partners and is responding by accelerating its transition to renewables More than 90 percent of global emissions are now covered by Net Zero pledges which will support the renewable energy industry, suggesting this crisis could lead to an acceleration of geopolitical tailwinds for renewables (see Cybersecurity & Insurance sits at the Top of the agenda for business). However, this cannot be achieved quickly, increasing the EU’s reliance on hydrocarbons for its energy needs, even re-opening coal fired power stations and burning more coal.

There will be winners and losers in the accelerated climate transition pathway. In the short term, construction and energy giants emerge as the clear winners from the inflated demand of renewable projects while the long-term downside of a disrupted transition has potential detrimental spill over effects to communities and biodiversity.

ESG

From an ESG perspective, company performance is still being measured in returns delivered over decades and not days. As such, the immediate actions necessary to mitigate losses from catastrophic events, including the war in Ukraine, should be distinguished from the steps that are necessary to preserve a company’s long-term value (see ESG Strategy & Implementation).

Organisations face heightened expectations from employees, customers, and shareholders to see how they will align with societal expectations especially with global financial institutions. Companies will have to reassess their partnerships and step up their due diligence checks on suppliers and third-party vendors to identify and remove potential ties with Russia to mitigate that risk.

Public sentiment

Global sentiment towards the conflict in Ukraine has largely been heavily pro-Ukrainian, with some countries traditionally considered part of the “Russian sphere” such as Slovakia and Hungary showing allegiance and support towards Ukraine. However, if the conflict continues into the future allegiances on both sides will be tested by politically and commercial imperatives.

Most corporations are proactively exiting Russia or terminating Russian partnerships, while a handful are remaining to either provide essential goods to Russian civilians or seeking healthy profit margins, potentially risking reputational damage. In the future, Russia will have to adapt to the ‘new normal’ by trading via smuggling rings in neighbouring countries and importing ‘knock-off’ goods from China and India.

Impact on businesses

Transportation and logistics:

Organisations closely intertwined with key supply chain networks are at high risk of targeted cyber-attacks, due to the potential magnitude of disruption, coupled with relatively weaker cyber resilience compared to industries such as financial institutions. Firms should work closely with third -party cyber solution providers and allocate a sufficient portion of their budget to developing cyber protection.

Public sector and healthcare:

As evidenced by the severity of the WannaCry attacks on NHS systems in 2017, healthcare providers and other public sector entities are also vulnerable to cyber threats. They are at high-risk of being targeted, largely as a statement of intent from Russia and their allies. As with transport companies, the government should invest heavily in ensuring sufficient cyber security exists in these sectors.

Technology:

Technology sector companies are experiencing growing demand for cyber security solutions. However, there is a watchful eye on the technology industry, with companies having to pay stringent attention to data protection, chip manufacturing and other solutions potentially exposed to the conflict.

Russia exports sizeable quantities of oil, metal, and agricultural commodities

Due to insufficient business continuity planning, several companies are experiencing bottlenecks in production – firms should invest and develop risk management processes to plan for various supply chain shocks that may emerge from the crisis. Risk practitioners recommend that organisations start to prioritise geopolitical factors on the risk agenda, especially given the close link between geopolitics and energy security.

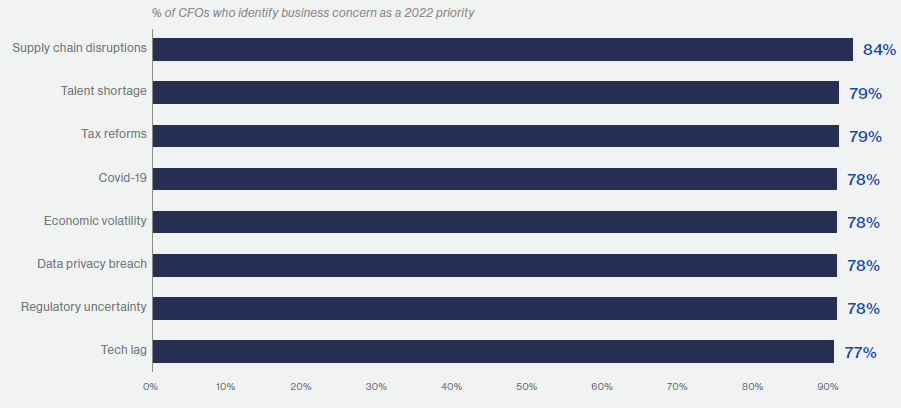

Supply chain disruptions pose greatest risk to business finance leaders

Trade blockages imposed by Russia on Ukrainian seafarers could have significant economic repercussions – experts at Allianz Trade predict that supply chain shocks and declining confidence could result in a loss of c.$480 billion in exports to Russia and EU countries in 2022.

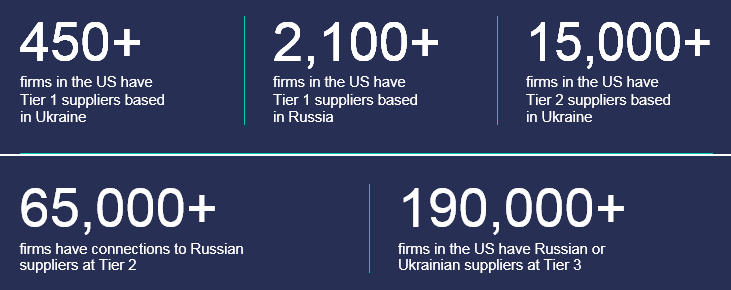

Exposures to Russian and Ukrainian suppliers

Voluntary suspension of shipments further amplifies the challenges. Cargo ships in the region have been halted, putting pressure on cargo capacity, and raising concerns about further supply chain disruptions. Shipping conglomerate Maersk have suspended all shipments to and from Russia except for food and medicine. Other organisations such as Ocean Network Express and Mediterranean Shipping Company (MSC) have implemented similar suspensions.

The mounting costs are impacting specific industries, especially construction and manufacturing. Construction projects already underway will not be as impacted as those in their infancy, with live projects benefiting from long-term agreements that protect against price shocks, while cost levels accelerate for newer projects.

As part of their risk management strategies, companies are looking to proactively drive down costs to reflect changes in commodity prices, while working closely with suppliers to ensure they are well positioned for a range of future outcomes.

Part of this risk analysis will include the need to regularly revisit customer pricing to ensure they remain competitive while maximizing margins. High inflation has forced central banks to tighten monetary policy while entering an economic slowdown, which carries further risks of recession.

Countries are accelerating renewable energy take-up and seeking to better manage domestic energy supplies, while Europe is reconsidering its nuclear and coal phase out by reversing its plans to move away from nuclear power and coal solutions. Green technologies, however, require large quantities of mineral resources, many of which largely originate from Russia and its non-Western allies. Trade tensions could exacerbate the impact of supply dominance by these countries creating a bottleneck for the supply of key metal input for low-carbon technology. This may very well threaten Europe’s ability to deliver its green transformation.

Implications for businesses

Inflationary pressures associated with supply chain issues, such as costs of materials, labour and logistics are mounting, with companies considering a number of solutions to maintain revenue and profitability. For instance, oil and gas producers and food manufacturers will be the most impacted by inflation, largely due to Russia and Ukraine having dominant positions as major exporters of key raw materials across these industries.

Other industries may need to change business models as a result of subtle changes in trading behaviours.

As each nation becomes more focused on developing domestic production to avoid geopolitical risks, transportation and logistics companies will likely need to evolve to accommodate a lower demand for international trade but growing interest in national logistics solutions.

With ESG becoming an increasingly prominent topic on corporates’ risk agendas, significant resources are being allocated to dedicated ESG teams across multinational corporations to develop risk management strategies. With increased awareness and potential scrutiny from employees, customers and stakeholders, businesses could incur significant costs to adhere to ESG standards.

Responding to the new risk landscape

As new risks continue to emerge, businesses will need to develop risk management strategies to increase their resilience and prepare for the different potential outcomes. Following conversations with market experts who work closely with multinational corporations, this section addresses the immediate actions and long-term plans that companies should consider to best prepare for any potential business interruption.

………………………..

by Oleg Parashchak – CEO Finance Media Holding