A new, higher interest rate era is emerging from the economic stresses of the inflation shock and war in Ukraine. Though economic growth has been relatively resilient this year, we expect global GDP to grow by just 1.7% in real terms in 2023 as inflationary recessions approach major economies such as the US and Europe.

We continue to view inflation as the number one macro risk, and we expect it to stay sticky, even if headline inflation declines rapidly next year. It brings downside risks to growth from higher central bank interest rates.

In advanced markets we forecast real GDP growth of just 0.4% in 2023, the lowest since the 1980s outside of the global financial and COVID-19 crises. In emerging markets, we anticipate substantially lower growth rates than pre-pandemic that will likely feel akin to recession.

Real GDP growth, inflation and interest rates in select regions

For the insurance industry, we expect the macro environment of higher interest rates, insurance market rate hardening and scarce capital to be a very positive catalyst over 2023-2024; these drivers should strengthen medium-term investment results and profitability.

In our view, the global economy will cool down noticeably under the weight of inflation and interest rate shocks. The repricing of risk in the real economy and financial markets is actually healthy and a long-term positive.

Jerome Jean Haegeli, Group Chief Economist, Swiss Re

In today’s challenging times – and for the economic recovery ahead – the insurance industry can show its value as it provides financial resilience.

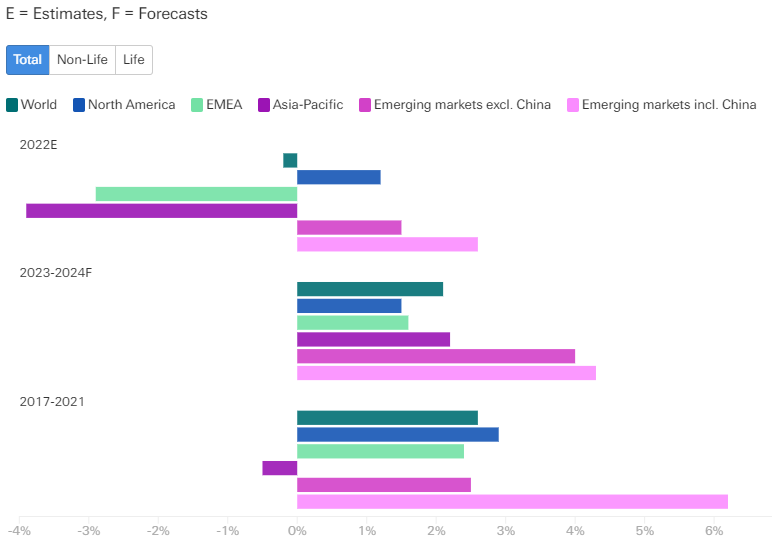

We anticipate significant rate hardening in 2023 and potentially some years after in response to high inflation and natural catastrophe and financial market losses this year. Global premium growth is forecast at 2.1% in real terms annually on average over 2023 and 2024. We continue to expect total (nominal) premium volumes to exceed USD 7 trillion for the first time this year.

Financial stability and debt sustainability risks

This year we add debt and its related risks, as a fourth dimension to the “3D” set of long-term economic drivers we identified last year. As central banks unwind unconventional monetary policies, it is exposing financial vulnerabilities that have built up over the past decade.

Debt, and specifically whether governments can sustain public spending commitments in the face of higher interest rates, is a key concern. We see a risk that market shocks accumulate and fuse into financial instability.

Central banks face competing priorities of price stability, financial stability and enabling governments to pursue looser fiscal policy. This creates a risk of real interest rates being repressed in the longer term, either through higher inflation or eventually lower nominal interest rates, to manage debt sustainability or financial stability concerns.

If so, we see inflation likely being higher and more volatile. Addressing demand-side drivers of inflation with supply-side or productivity-enhancing policies and investments would help ease this tension.

Inflation still a concern, but higher interest rates a tailwind for insurers

Inflation remains the number one industry concern. We forecast high inflation in cost components relevant for insurers, such as construction and healthcare that suggests insurers’ claims and costs could rise markedly in 2022 and 2023, even without considering changes in claims frequency and natural catastrophe activity.

However, higher interest rates should be a silver lining as inflation pressure abates in 2023 and 2024.

Insurance premium forecasts, global regions

In non-life insurance, slowing global growth and inflation will likely cut real premium growth to below 1% this year, with a recovery as inflation eases and the hard market goes on.

Global non-life insurance return on equity (ROE) is expected to be lower in 2023 as underwriting performance and investment results are weaker, but rebound to a 10-year high in 2024 as the interest rate tailwind and potential rate hardening take effect.

In life insurance, we forecast a 1.9% contraction in global premiums in real terms in 2023 as consumers face cost-of-living pressure, but a return to trend growth in 2023 and 2024, carried by emerging markets. Life profitability is improving due to rising interest rates and normalising COVID-19 mortality claims.

……………………..

AUTHORS: Fernando Casanova Aizpun – Senior Economist Swiss Re Institute, Li Xing – Head Insurance Market Analysis Swiss Re Institute, Roman Lechner – P&C Economic Research Lead Swiss Re Institute, Rajeev Sharan – Senior Economist Swiss Re Institute, James Finucane – Senior Economist of the Swiss Re Institute for the Americas