Space insurance is roughly divided into four types of coverage. They reflect the phases of most satellite projects – preparing and launching the satellite, then positioning and operating it in orbit.

Welcome to the commercial space age, where private firms build and operate rockets, host myriads of satellites and take people up to space for fun. With ever-more crowded orbits and debris in largely unregulated spheres, outer space hosts plenty of risks, opportunities and unknowns for insurers.

Space insurance solutions are tailored to each policyholder’s needs. They may cover loss of income as well as material damage.

According to Swiss Re Insitute Report, the insurance of satellites with complex and new types of payload is where the know-how and experience of our aerospace experts really pays off. The deployment of previously untried satellites always raises questions about their insurability.

A lot of hard work and dedication is required during all phases. Manufacturer’s technical specifications and presentations, discussions with the manufacturer, operator and broker all need to be analysed before the pieces of the puzzle can be assembled into a well-designed coverage concept.

At the end of last year, China informed the UN office for Outer Space Affairs that for a second time, its space station had to conduct evasive manoeuvres to avoid collisions with Starlink satellites.

The incident highlights that private companies like SpaceX – which launched Starlink – run space programmes and have joined national players in the space race. With dense satellite coverage, Starlink and competitors aim to provide high-speed broadband to even the remotest places on Earth.

National space organisations (eg, NASA) are eager to partner with new commercial players, and bodies like the European Commission advocate “space for everyone”. This underlines the opportunities offered by space exploration, both commercial and public-sector sponsored.

Ample space for growth

It is estimated that the commercial space industry will be worth USD 1 trillion by 2040, up from USD 350 billion currently.

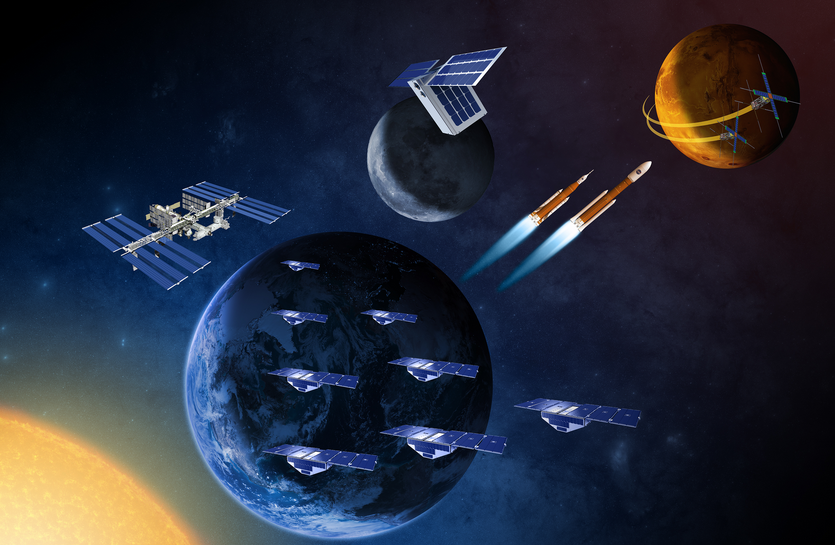

Activities that will emerge and intensify range from the private launch of rockets for tourism and commercial payloads, to space stations and space mining.

Most importantly, commercial interest is focused on satellite systems enabling ever more data services on Earth. This includes broader internet access and data services, such as navigation and climate change and weather monitoring.

Effective regulation is a balancing act

Increasingly, innovative technologies are born of private commercial activities, in addition to those from traditional government-funded missions. But for innovation to happen effectively, and to safeguard the economic benefits from space, there needs to be effective national and international regulation.

International collaborative efforts are needed to mitigate increasing orbital debris, encourage active debris removal and the timely disposal of end-ofmission spacecraft, and to find methods and technologies to removing defunct spacecraft.

With more parties and objects roaming the orbit, the risk of collision of space infrastructure and debris increases, and this in a largely unregulated sector.

Binding international regulations to steer or restrict space traffic, that would oblige originators of debris to “clean up” or be held liable for damage, do not yet exist.

Insurers to step up?

Traditionally, insurers have offered third-party liability insurance to commercial space operators for damage to satellites, rockets and unmanned spaceflights. So far, appetite to offer liability cover for private space passengers is minimal.

That could change. Soon, there could be new policies that insure for bodily injury for space travellers, flight delay, and directors and officers’ (D&O) covers for the management of space operating companies.

Such policies will need to be available on the market before space travel can transform into a fully-functioning tourism offering. Internationally-binding regulations to order space traffic, rights and duties could boost the currently limited appetite of insurers to provide L&H, liability or D&O covers in the context of space tourism and other space activity.

Space Insurance Pricing and Risk

However, despite a large loss to the space insurance market, pricing trends are settling for good risk profiles.

A period of increased pricing since July 2019 for space insurance started to settle in 2023 for certain risk profiles. While a significant loss — US$225 million — reported in 2022, has had a limited impact so far, it could affect the pricing trend going forward, especially if other large losses are experienced in the near term.

There is still significant differentiation in pricing for technically challenging risks or those with high insurance limits.

The previous reduction in geostationary communication satellite orders will impact premium income. However, a resurgence of satellite orders in the past 12 months should help minimize long-term impacts.

Insurers are more focused on technical aspects of space risks, increasing the differentiation in respect of pricing and coverage between risk profiles, especially for large, complex placements.

The technological challenges of flexible payloads and new launch vehicles — several of which are scheduled for flight — may lead to difficulties in terms of capacity and premium rates for some space programs, particularly those involving untested technology.

The COVID-19 pandemic led to some delays in satellite launches and manufacturing — due in part to restrictions on travel and on-site labor — resulting in some delays of premium income to insurers. There has yet to be any observable negative impacts on underwriting terms and conditions offered by insurers.

The impact of COVID-19 on the aviation insurance industry has been more severe. This may have future implications for space underwriters where the space and aviation premium and losses are combined internally. Furthermore, if overall business interruption claims due to COVID-19 run high, many classes of insurance would be affected, including space.

Underwriters focus on the following areas when considering a risk:

- Heritage and in-orbit reliability of satellite hardware selection.

- Flight history of launch vehicle for launch risks.

- Design redundancies and margins.

- Amount of insurance.

- Insured’s approach to risk management and manufacturer technical oversight.

Space placements offer both high exposure and significant premium opportunity for insurers. The catastrophe potential is high, and new technologies require additional levels of due diligence from insurers. Each policy is tailored to individual risk profiles in what is a specialized insurance sector.

Insurers must therefore anticipate these developments in order to be able to assess the associated risks.

For example, they will need to learn how to assess the risks specific to mega-constellations of satellites, particularly those related to increased congestion, the intensification of launches, the development of multiple launchers and the complexity of the tests to which these super-satellite networks must be subjected.

Currently a niche market at the frontier of human technology, space insurance may soon enter a whole new dimension with the intensification of economic activity in outer space.

4 Steps to a Successful Space Insurance Placement

Prepare and start early

Underwriters are becoming more selective, particularly when newer technologies are involved, and are asking for detailed risk information. It’s important to understand the key information that insurers will require, and to allow adequate time for negotiation.

Understand your priorities

In a challenging market, it’s important to know your priorities to ensure an optimum balance of breadth of coverage, insured value, and the overall premium spend. Having a clear strategy in place before commencing negotiations with insurers will be helpful.

Respect long-term relationships, but challenge the status quo

Strong, long-term relationships with the lead insurers can help bring beneficial results at placement. Still, it is important to understand the context of your quotes and ensure that they represent good value propositions. Try to build relationships with a number of lead markets to ensure enough support is available if/when placements become more challenging (for example, on-orbit anomalies/component failures).

Differentiate through risk management

Share with underwriters the details of risk management policies and procedures you have in place, with specific reference to how they mitigate exposures. Space insurers are particularly interested in the technical oversight and are cautious when new technologies are being rolled out. In general, the more information and transparency that can be provided to the insurers, the more comfortable they will become.

Insurance History of Supporting Satellite Missions

While the successful SpaceX mission has created new enthusiasm for space exploration, companies like Global Aerospace have been providing insurance for space initiatives from the time the first commercial satellites and launch vehicles required financial support to cover their risk.

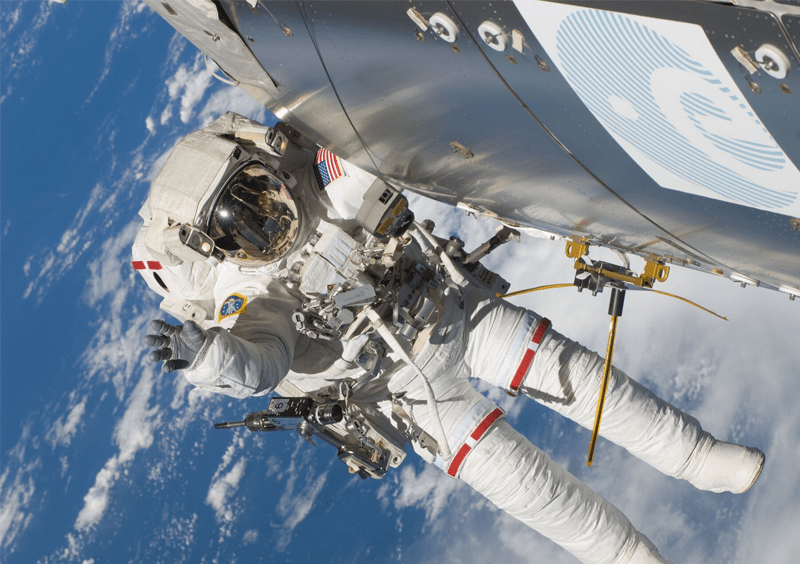

The insurance coverage includes third party liability arising from launch activities as well as covering the value of property launched to space.

The traditional space insurance market insures the value of satellites launched into orbit around the earth.

While governmental and military satellites are usually self-insured, the financial backers of commercially owned satellites often require insurance to be in place. Commercial satellites have been used for communications and television transmissions around the world (SkyTV, Direct TV) and have expanded to include satellite radio (SiriusXM), imaging satellites and soon 5G networks.

The types of satellites can range from large geostationary satellites with values up to $400 million that can operate for 15 years to small low earth orbit satellites (LEO) with values below $1 million that operate for only two or three years. New concepts and technologies such as large constellations of satellites have distinctive risk profiles requiring unique coverages where each risk needs to be underwritten on its own merit.

Like satellites, the launch vehicle industry has gone through a metamorphosis with what is estimated to be 100 new companies involved in the development of new launch vehicles.

The third party liability insurance requirements are set by the launching state, country of origin, and are well understood. However the landscape is changing as these companies look to launch the hundreds of satellites involved in LEO constellations. Rather than a launch sending a single satellite to orbit it now may involve 50 or 100. Third party liability policies can also be provided on satellites in orbit for damage to third party satellites.

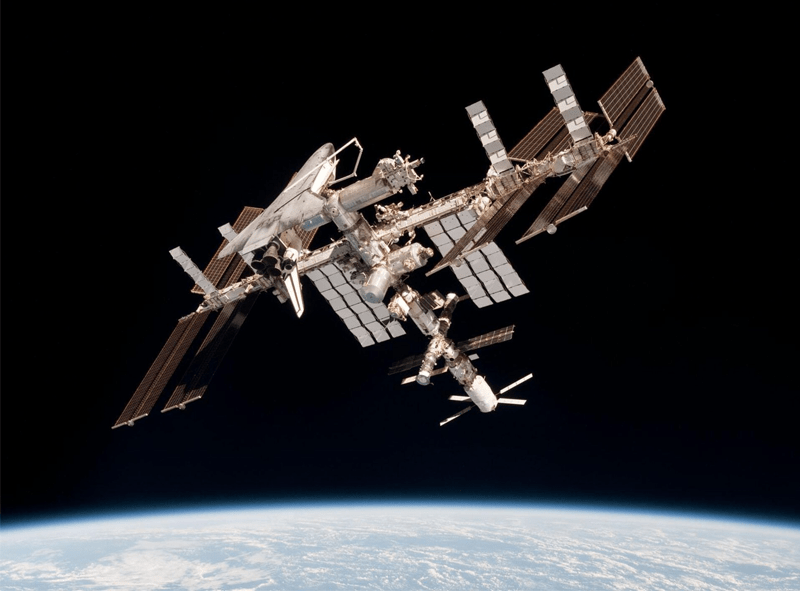

The International Space Station brought together space agencies from the United States, Russia, Japan and Canada and the European Union and a liability regime generally built on cross waivers amongst them. As a NASA project using Space Shuttle it fell into the governmental self-insured arena.

After the shuttle was retired, NASA created commercial contracts to deliver cargo to the ISS which were fulfilled by SpaceX Dragon and Northrop Grumman Cygnus spacecraft. Due to involvement of the private sector commercial contract, insurance was required for launch and re-entry liability as well as cargo, and we have been proud to be a participant.

The Future Space Ecosystem

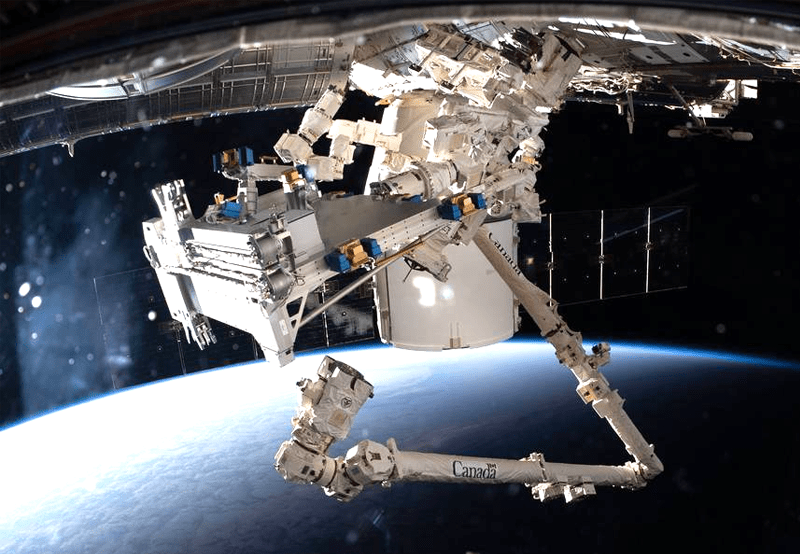

Space robotics, automation and AI combined with standardization, modularisation and digitalisation have been identified worldwide and specifically by European actors as strategic elements for improving aspects such as flexibility, cost-efficiency and protection of the in-space ecosystem as their applications in on-orbit satellite services: an enabler for the green deal in space.

The direct positive effect to develop this line of solutions is the improvement of European competitiveness in key space areas.

Upcoming services in orbit will globally reduce the launch mass and life-cycle costs for satellite missions, promoting the development of new space infrastructures, more sophisticated and flexible, while being cheaper.

Relevant R&I actions aim at the introduction of a sustainable, highly automated, flexible and economical viable space infrastructure in a holistic approach, prepared to maximise commercial opportunities in space and on earth: the future space ecosystem.

Edited & Fact checked by