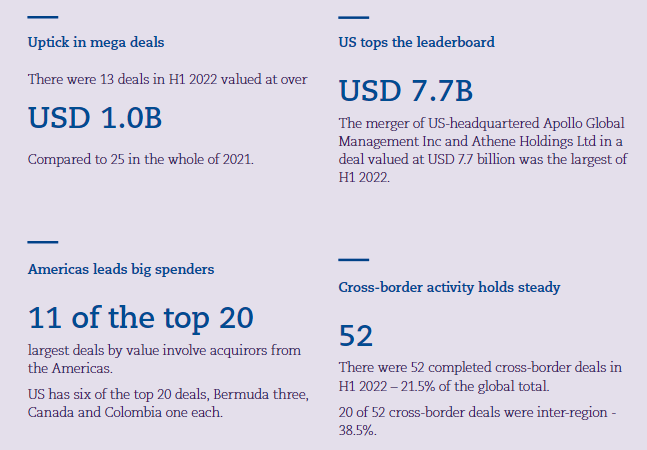

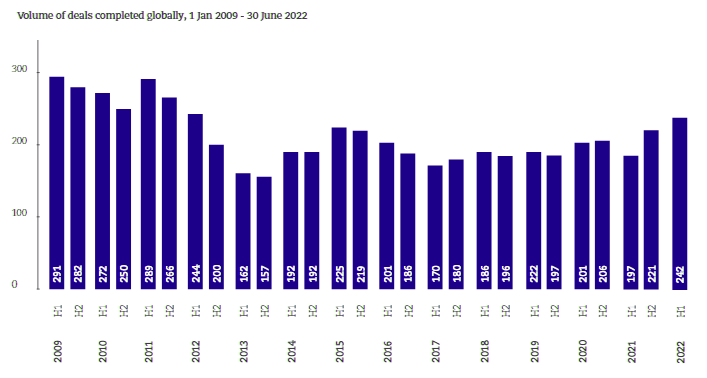

In the face of stark economic pressures – inflation, rising energy costs, and looming recession – insurers remain focused on growth opportunities. The volume of mergers and acquisitions (M&A) in the global insurance industry reached its highest rate of growth for ten years, up 9.5% in 2023.

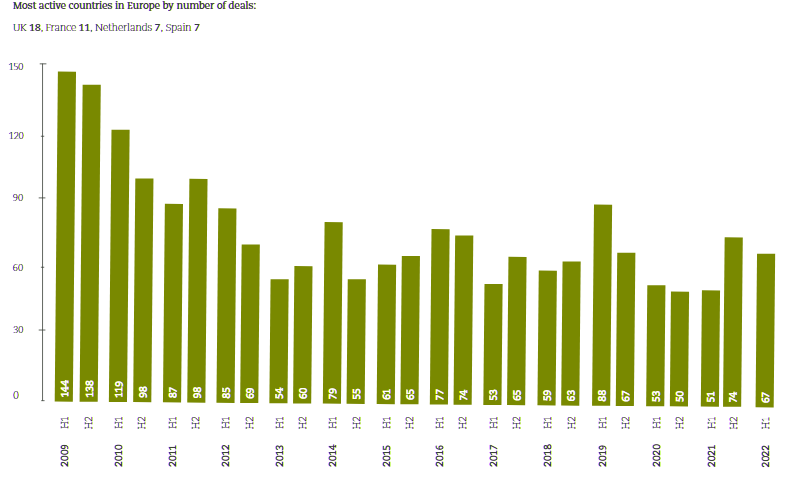

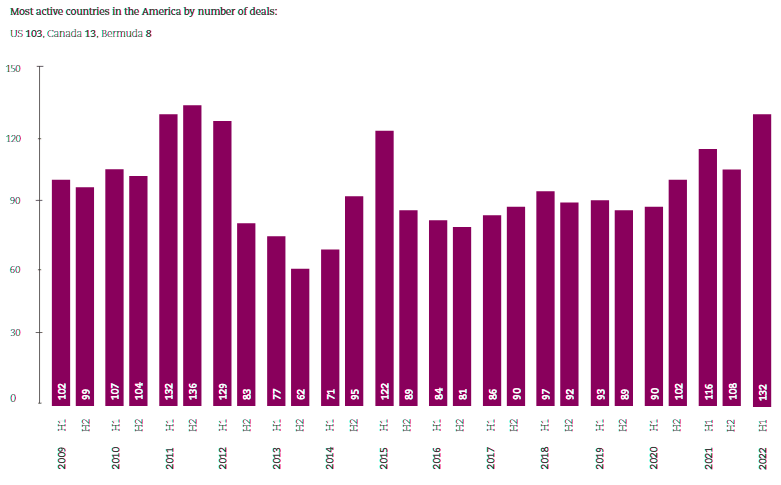

According to Clyde&Co Report, while the Middle East & Africa (MEA) region has seen significant growth, the global trend has largely been driven by the much larger US market, which has seen a 22% increase in transactions. Activity has dropped back slightly in Europe but held steady in Asia-Pacific.

A number of factors are driving deals. Private equity (PE) firms and asset managers are still keen to explore either entry into the insurance market or expansion of existing footprints.

Flagging insurtech valuations mean acquisitions are increasingly attractive to both PE investors and traditional carriers seeking to increase technological capabilities.

And rising interest rates promise better investment returns for long duration businesses, while helping insurers to rebalance portfolios (see 11 Types of Merger & Acquisition).

Five growth factors to watch

- Market sentiment remains positive. Against a testing political and economic backdrop for the insurance industry, carrier sentiment around growth varies across territories and industry sectors.

- No shortage of capital to deploy. Private equity interest in the insurance industry remains buoyant, especially with respect to the broker space. Funds are awash with capital and keen to deploy it in a sector they increasingly view as giving attractive and reliable returns.

- Run-off and divestments remain popular. One area which has seen a significant increase in transactions in the first half of 2022 has been the divestment of non-core assets by carriers, with non-life divestments involving a mixture of spinning off divisions/subsidiaries for sale to third parties, sales of renewals rights, portfolio transfers, and run-off.

- Insurtechs facing bumps in the road. Investment into the insurtech sector has soared in recent years, reaching a record level last year, but a decline in the valuation of tech companies which have recently gone public began late last year.

- Cyber remains an opportunity and a threat. Cyber has seen a boom in both insurance capacity and the creation of specialised brokers and carriers in recent years, but the risk is becoming something of a double-edged sword.

While this survey focuses on the carrier space, it is worth noting that there is also significant M&A activity in insurance distribution, with PE interest driving an increase in broker consolidation and expansion, across the US, Europe, MEA and Australia (see 4 stages of M&A deals).

Activity up in all regions except Europe

| Region | H1’2022 | H1’2023 | Change |

| Global | 221 | 242 | 9.5% |

| Americas | 108 | 132 | 22.2% |

| Europe | 74 | 67 | -9.5% |

| APAC | 24 | 27 | 12.5% |

| MEA | 12 | 16 | 33.3% |

1. Market sentiment remains positive

Against a testing political and economic backdrop for the insurance industry, carrier sentiment around growth varies across territories and industry sectors. Inflation is driving up expense ratios, while companies face strong competition for both talent and clients.

On the upside, the hardening of rates across multiple business classes continues, albeit at a slower pace. However, a nagging fear remains that some struggling insureds may forgo purchasing cover altogether.

This is contributing to a more cautious investment approach by carriers, particularly with respect to expanding international business operations.

But while cost pressures have driven branch office closures by many carriers in recent years, there remains strong appetite for acquisitions of other businesses, particularly among P&C carriers who are in a good position to increase premium income at upcoming renewals.

The big question for carriers is whether demand could falter with the threat of recession and a contraction in global trade, putting a brake on expansion plans (see important points of Mergers & Acquisitions).

M&A activity jumps

2. No shortage of capital to deploy

Private equity (PE) interest in the insurance industry remains buoyant, especially with respect to the broker space. Funds are awash with capital and keen to deploy it in a sector that they increasingly view as giving attractive and reliable returns.

While it is perhaps too early to assess the impact that insurers’ ESG credentials could have on their attractiveness as investment vehicles and acquisition targets, scrutiny from potential acquirors and investors in the sustainability of target companies is likely to increase in the near future.

Although PE investment has been particularly strong in the global broker market, it has also focused on the carrier space in selected territories, including investments into Lloyd’s. Investors in Asia have adopted a more considered approach due to the high cost of capital and a tough investment environment.

3. Run-off and divestments remain popular

One area which has seen a significant increase in transactions has been the divestment of non-core assets by carriers, with non-life divestments involving a mixture of spinning off divisions/subsidiaries for sale to third parties, sales of renewals rights, portfolio transfers, and run-off.

Europe in particular has witnessed an increase in run-off transactions compared with last year, as insurers seek to make their businesses more attractive to prospective buyers or investors.

Some companies have also exited from underwriting in non-core jurisdictions, through a combination of traditional M&A and sale of selected renewal rights, and then repatriation and run-off of remaining business.

As life insurers still struggle to grow against a backdrop of inflation and rising interest rates, there will continue to be deals to send non-core business to run-off so companies can focus on being pure risk carriers.

Investment into the insurtech sector has soared in recent years, reaching a record level last year with $15.5bn of capital funding across 566 deals according to CB Insights, with much of this growth occurring in the US market.

However, a decline in the valuation of tech companies which have recently gone public began late last year, with insurtech valuations continuing to worsen in 2023.

The current economic climate appears to present a heightened risk to insurtech companies, with one firm forced to lay off 330 employees earlier this year due to continuing losses.

Elsewhere, growth in the sector remains modest, with limited numbers of insurtechs in the Asian market, where up-front capital requirements remain a significant barrier (see InsurTech Sector Overview). Likewise, insurtech investment in Europe has seen limited activity, with partnerships between insurtechs and traditional carriers a more likely route to growth in both markets.

4. Cyber remains an opportunity and a threat

Cyber has seen a boom in both insurance capacity and the creation of specialised brokers and carriers in recent years, but the risk is becoming something of a double-edged sword.

In the US, a recent Government Accountability Office report warned that insurers are increasingly pulling back coverage, partly due to the alarming rate of increase for cyber incidents, with activity expected to cost around $2.6 billion.

As lesser players retreat from the class, the threat of major losses from large and systemic risks is also persuading bigger cyber insurers to sublimit coverage and introduce more exclusions.

Volume of M&A deals in Europe

Volume of M&A deals in the Americas

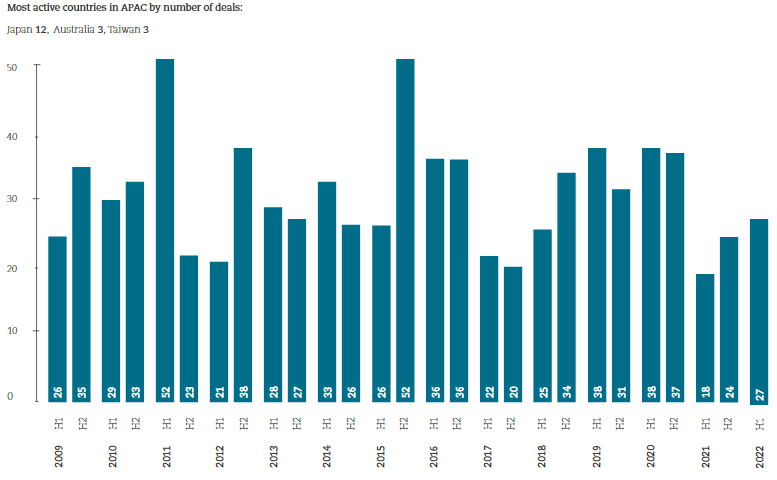

Volume of M&A deals in APAC

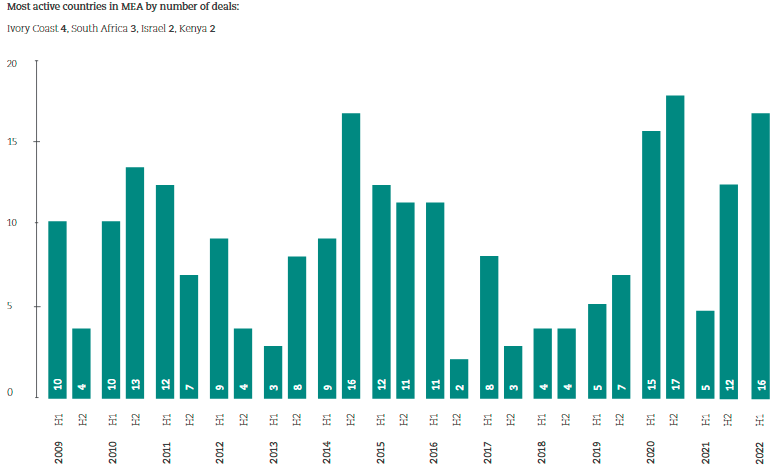

Volume of M&A deals in MEA

At the same time, cyber insurers are themselves increasingly targets for hackers, due to the significant quantity of sensitive data about insureds in their possession, and many traditional carriers are also prone to attacks due to their vulnerable legacy systems.

That said, cyber coverage is still greatly in demand and attracting high premiums, while investment in specialized cyber brokers remains highly attractive to private equity. While the biggest changes to cyber coverage are around terms and conditions, there is some concern that even with current robust demand, the upwards momentum of rates may persuade some insureds to stop buying cover.

……………………….

AUTHORS: Eva-Maria Barbosa – Partner, Ivor Edwards – Partner, Joyce Chan – Partner, Peter Hodgins – Partner, Marc Voses – Partner Clyde & Co