Ratings of U.S. life insurers are not currently at risk from commercial real estate (CRE) exposure, given stable investment portfolios comprised of high-quality, diversified exposures, conservative underwriting, strong liquidity and effective asset-liability management (ALM).

Fitch Ratings expect any CRE losses to remain within ratings sensitivities, given the strength of diversified portfolios, despite our expectation for monetary policy to lead to a mild recession in 1H2024.

U.S. life insurers’ CRE exposure is largely comprised of commercial mortgages, with commercial mortgage backed securities (CMBS) representing less than 5% of cash and invested assets and non-meaningful allocation to equity real estate.

Mortgage loans comprised 13% of U.S. life insurers’ portfolios, or 1.6x capital, at YE2022, above historic levels of 8%-12%, but stable yoy.

Approximately 85% were commercial mortgage loans (CML), with 90% of CMLs rated CM1 or CM2 on an NAIC basis, along with de minimis troubled mortgages and an average loan-to-value ratio of 54% at YE2022.

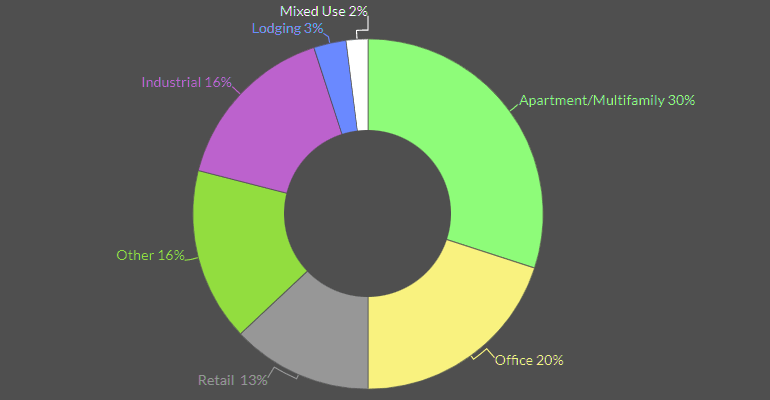

U.S. Life Insurer Commercial Mortgages by Type

CRE charge-offs in 2Q2023 jumped fourfold yoy to $1.17 billion across the U.S. banking industry, according to S&P Global data. Life insurer debt service coverage ratios are starting to deteriorate and material unrealized losses are emerging, portending higher losses, but are expected to remain within ratings sensitivities.

Largest Exposures Include Multifamily, Office and Industrial

Office properties in particular are under pressure in urban areas due to enduring remote work trends. However, overall loan losses remain near historical averages. Office property valuations are being pressured from low occupancy, rising rates and lower rent, increasing the potential for defaults.

Fitch expects a majority of near-term maturing office loans to be extended rather than paid off. Office mortgages will continue to deteriorate into 2024.

Hotel and retail segments are performing relatively better, as hotels benefitted from resurgence of summer travel, while retail has had little to no additional construction the last decade, though brick-and-mortar retail has been stressed by the movement toward e-commerce.

U.S. life insurers’ commercial real estate (CRE) exposure is predominantly via commercial mortgage loans, with more modest exposure to commercial mortgage backed securities (CMBS) at less than 5% of cash and invested assets, with equity real estate not a meaningful allocation.

US Life Insurer Investment Allocation

Though materially stronger than office, some weakness in multifamily is starting to emerge, as a small percentage of properties have negative cashflow as higher rates and outsized supply pressure valuations.

Insurance costs are rising dramatically in some areas due to increased frequency and severity of losses, amid more volatile weather-induced flooding and fires, with rising costs in the sunbelt due to climate-driven risks.

More than $1 trillion of multifamily debt has been underwritten with floating rates since 2020, according to S&P Global.

Approximately 12% of multifamily properties have a floating rate 150-200bps higher than origination; however, a majority of floating rate loans have cap rates and hedges in place to limit losses. Fitch has seen an increase in delinquencies in multi-family, but they currently remain at manageable levels.

Life insurers’ significant capital and short-term liquidity make them unlikely to be forced sellers of real estate assets at distressed valuations. Most insurers that invest directly in real estate have a long holding period.

Surrenders have remained at or below pricing expectations, given robust surrender charge protection and strong ALM mitigating risks. Rising rates are also expected to continue to reduce investment maintenance reserve (IMR) balances for U.S. life insurers, but strong liquidity and effective ALM will mitigate the negative effects on statutory capital and cash flows.

………………………….

AUTHORS: Jamie Tucker – CPA, CFA, Senior Director, Life Insurance Fitch Ratings, Laura Kaster – CFA, Senior Director, Fitch Wire (North and South American Financial Institutions)