Total assets of euro area insurance corporations increased to €8,267 bn in 2023, according to European Central Bank data.

Debt securities accounted for 34.2% of the sector’s total assets in 2023. The second largest category of holdings was investment fund shares (30.6%), followed by equity (14.3%) and loans (6.9%).

According to Insurance Europe, every year, European insurers pay out an impressive amount of over €1,000 bn in claims, which translates to approximately €2.8 bn per day.

They also play a significant role in the job market, as they employ over 920,000 people.

EU Insurance holdings of debt securities

Insurance holdings of debt securities increased to €2,829 bn at the end of the quarter of 2023 from €2,827 bn at the end of the previous quarter.

Net purchases of debt securities amounted to €7 bn in 2023; price and other changes amounted to -€6 bn. The year-on-year growth rate of debt securities held was -1.8%.

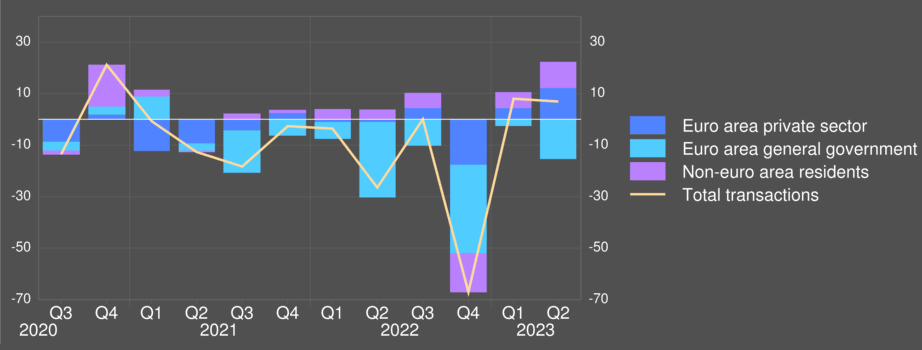

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was -4.7% in 2023, with net sales in the quarter amounting to €15 bn.

Insurance corporations’ holdings of debt securities by issuing sector

As regards debt securities issued by the private sector, the annual growth rate was 0.3%, and quarterly net purchases amounted to €12 bn. For debt securities issued by non-euro area residents, the annual growth rate was 1%, with quarterly net purchases of €10 bn.

Turning to insurance corporations’ holdings of investment fund shares, these increased to €2,526 bn in 2023, from €2,493 bn in the previous quarter, with net purchases of €4 bn and price and other changes of €29 bn.

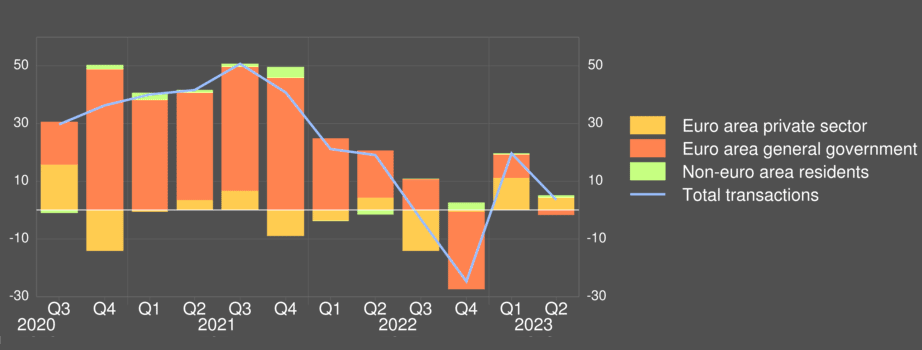

The year-on-year growth rate in the second quarter of 2023 was -0.2%. The annual growth rate of euro area money market fund shares held by insurance corporations was 0.7% in 2023, with net purchases in the quarter amounting to €4 bn.

Insurance corporations’ holdings of investment fund shares by issuing sector

As regards holdings of euro area non-money market fund shares, the annual growth rate was -0.4%, with quarterly net sales amounting to €2 bn.

For investment fund shares issued by non-euro area residents, the annual growth rate was 4.8%, with quarterly net purchases of €1 bn.

Assets and liabilities of euro area insurance corporations

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €5,934 bn in 2023, up from €5,907 bn in the first quarter of 2023.

Life insurance technical reserves accounted for 88.1% of total insurance technical reserves in the second quarter of 2023.

Unit-linked products amounted to €1,548 bn, accounting for 29.6% of total life insurance technical reserves.

Insurance corporations’ holdings assets and liabilities

| Total assets/liabilities | 8,267 |

| Assets | |

| Currency and deposits | 352 |

| Loans | 571 |

| Debt securities | 2,829 |

| Issued by euro area residents | 2,191 |

| General government | 1,247 |

| Domestic general government | 776 |

| Other euro area general government | 471 |

| Private sector | 945 |

| Issued by non-euro area residents | 637 |

| Equity | 1,185 |

| of which: Listed shares | 239 |

| Issued by euro area residents | 155 |

| Issued by non-euro area residents | 85 |

| Investment fund shares | 2,526 |

| Issued by euro area residents | 2,45 |

| Money market funds | 145 |

| Non-money market funds | 2,304 |

| Issued by non-euro area residents | 76 |

| Insurance technical reserves and related claims | 320 |

| Financial derivatives | 41 |

| Non-financial assets | 127 |

| Remaining assets | 315 |

| Liabilities | |

| Loans | 290 |

| Debt securities issued | 161 |

| Equity | 1,395 |

| Insurance technical reserves | 5,934 |

| Life insurance technical reserves | 5,228 |

| Unit-linked insurance technical reserves | 1,548 |

| Non-unit-linked insurance technical reserves | 3,68 |

| Non-life insurance technical reserves | 706 |

| Financial derivatives | 60 |

| Remaining liabilities | 427 |

- “Other assets” includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- “Private sector” refers to euro area excluding general government.

- “Investment funds” includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions.

Figures shown in the annex table are a snapshot of the data as at the time of the current release.

TOP 20 Largest Insurance Companies in Europe 2023

The European insurance industry is dominated by a few large multinational companies, such as Allianz, AXA, Generali, but there are also many smaller regional or niche insurers operating in the market. The largest insurance markets in Europe are Germany, the United Kingdom, France, Italy, and Switzerland.

Largest European Insurers ranked by gross premiums written ($ thousands).

| № | Insurers / Group | Gross Premiums Written | Capital |

| 1 | AXA | 115,365,186 | 80,000,778 |

| 2 | Allianz | 101,940,002 | 99,281,745 |

| 3 | Assicurazioni Generali | 82,829,784 | 36,887,624 |

| 4 | Munich Re | 67,426,876 | 36,723,018 |

| 5 | Zurich | 50,556,000 | 38,278,000 |

| 6 | HDI | 49,401,334 | 12,549,334 |

| 7 | Lloyd’s | 48,159,991 | 45,009,616 |

| 8 | Swiss Re | 42,951,000 | 27,135,000 |

| 9 | Chubb | 41,261,000 | 59,441,000 |

| 10 | Credit Agricole Assurances | 36,162,868 | 19,968,870 |

| 11 | CNP Assurances | 33,310,400 | 25,403,435 |

| 12 | BNP Paribas Cardif | 25,485,615 | 7,068,214 |

| 13 | Aviva | 25,243,733 | 26,552,768 |

| 14 | MAPFRE | 25,160,334 | 10,485,622 |

| 15 | Achmea | 24,782,970 | 12,962,077 |

| 16 | Prudential | 23,495,000 | 20,878,000 |

| 17 | R+V Versicherung | 23,280,637 | 9,983,207 |

| 18 | Poste Italiane | 20,755,046 | 14,129,057 |

| 19 | Societe de Groupe d’Assurance Mut Covea | 20,350,167 | 21,308,727 |

| 20 | SCOR SE | 20,106,451 | 7,560,802 |

There were more than 9,000 insurance companies operating in Europe. In terms of domestic companies, only around 300 companies were operating inside Europe.

Insurance companies in Europe are increasingly using digital technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) to improve their products, services, and operations.

The European insurance industry is focused on integrating ESG factors into its operations and investment decisions aimed towards expansion.

In contrast, life insurance sectors that have significant holdings of traditional life policies supported by assets with shorter durations compared to their liabilities would benefit from rising interest rates. This is particularly true for the French and German life sectors. Despite the negative short-term impacts of high investment volatility, rising lapse rates, and lower new business volumes, Fitch anticipates that the positive effects on capital and medium-term earnings will outweigh the negative factors.

……………..

Reviewed by Oleg Parashchak — CEO & Owner Finance Media Holding