The General Insurance OmbudService (GIO) is an independent dispute resolution service that provides free help for consumers of home, auto, business insurance. OmbudService will be recognized as the destination of choice for complaint resolution for the Insurance Industry, its customers, and Governments, by being a Centre of Excellence.

GIO’s services provide consumers with an alternative solution to the courts. The primary objective is to resolve disputes efficiently and equitably.

If you wish to pursue the matter further, you may contact the GIO, which helps resolve disputes between insurance companies and their customers, for home, automobile and business insurance issues in Canada (including Quebec).

It is hope that this process will also increase the confidence and satisfaction of insurance consumers by encouraging them to participate in the dispute resolution process with their insurance company.

Finding a mutually agreeable solution in a confidential, non-confrontational, and cost-effective manner benefits all participants.

General Insurance OmbudService Mission

The GIO mission is to provide consumers of car, home and business insurance in Canada with a cost-free, independent and impartial process to resolve their complaints.

To achieve the mission, GIO is committed to:

- Making insurance consumers aware of the service we provide;

- Applying best practices and standards in addressing complaints;

- Providing access for consumers by toll-free telephone, mail, e-mail, online forms and facsimile;

- Maintaining a knowledgeable and courteous consumer service staff; and

- Ensuring that all cases are treated in a confidential, balanced and fair manner.

How the Dispute Resolution Process Works?

Disputes between consumers and their insurance companies can often be quickly and easily resolved. Problems sometimes arise over a simple misunderstanding.

GIO will help consumers work out issues they are having with their insurance companies before they become protracted or difficult to address.

Who can use GIO services and when?

Any home, car or business insurance policy holder who has a concern, problem or dispute with a GIO member company can use our service. The types of consumer complaints that GIO generally deals with include claims, interpretation of insurance policy coverage, policy processing and handling.

GIO Consumer Service Officers can only review a case once the policy holder has received a final position letter from their insurance company.

Some matters are beyond the scope of GIO services. These include:

- The cost of insurance and rates (In Alberta only, GIO assists policyholders in resolving complaints about auto premiums in accordance with provincial legislation)

- Availability of insurance

- Dispute settlement procedures as required by law or designated regulatory authorities

- Matters that have been, or are, before the courts

GIO’s experienced Consumer Service Officers will review a matter to determine if it falls within our mandate. For complaints outside of our mandate, our CSOs will review other options available to the consumer.

GIO Commitment To Consumers

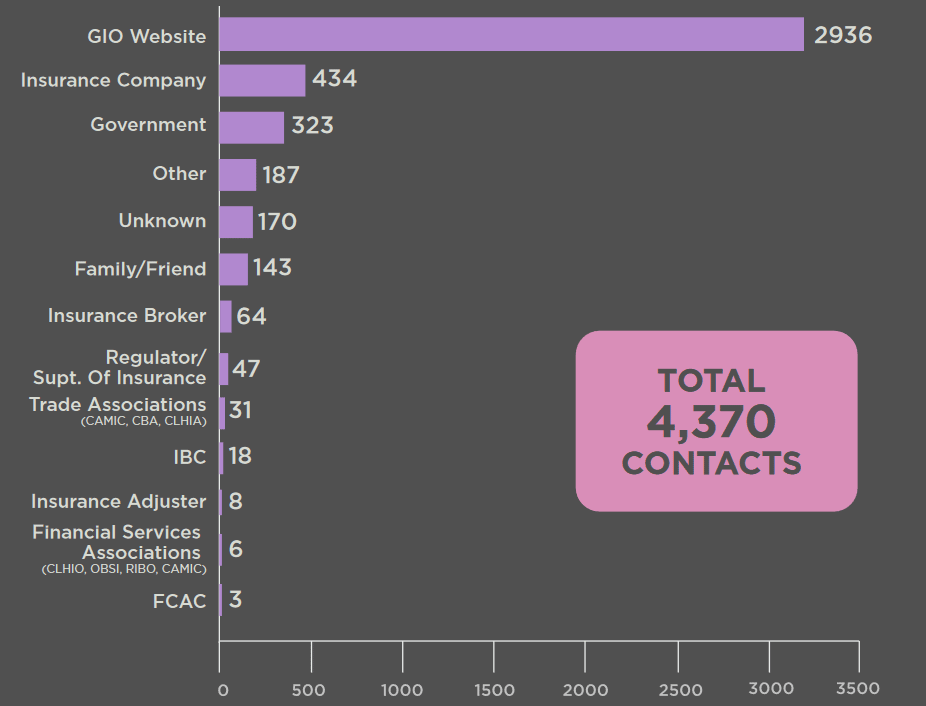

How Consumers Found General Insurance OmbudService?

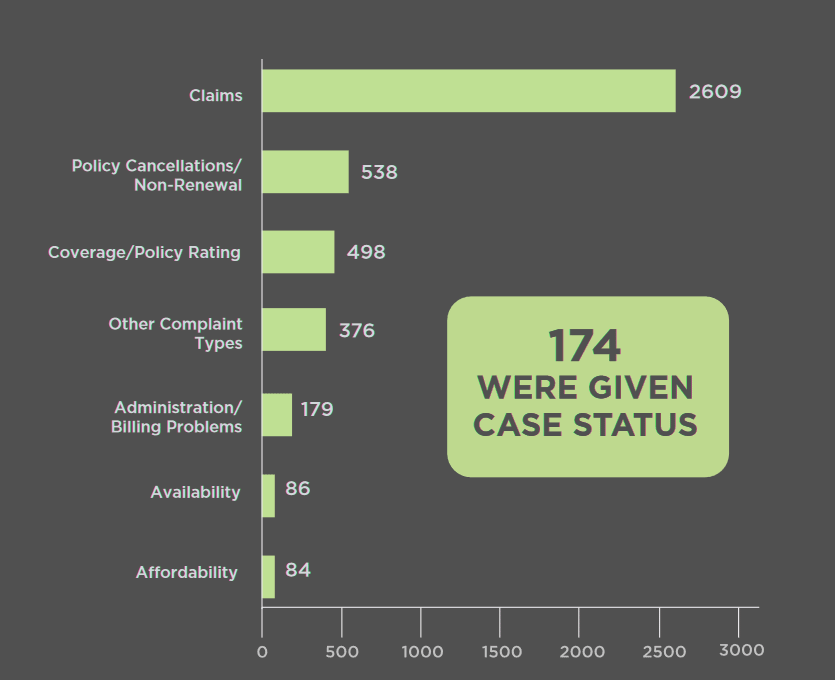

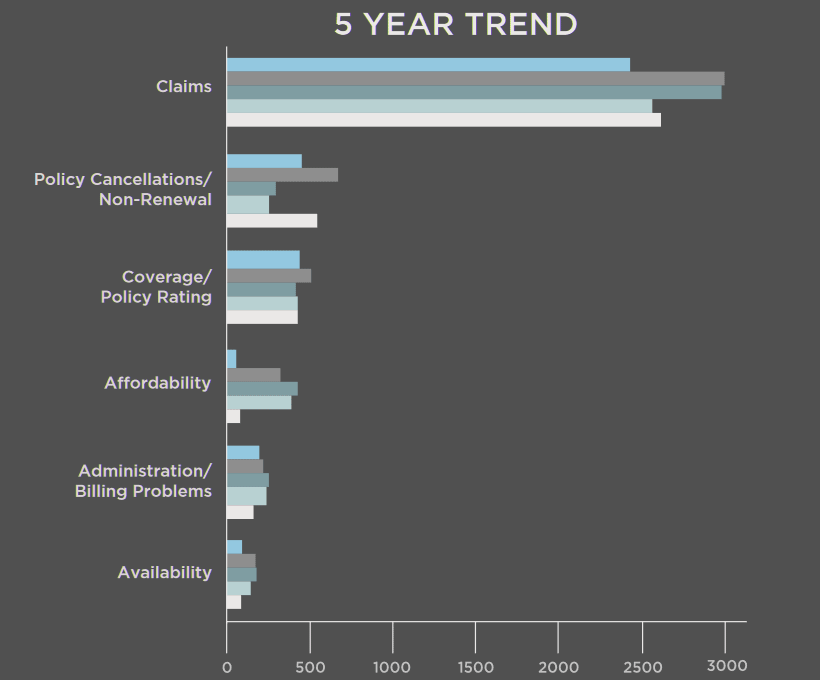

What Insurance Consumers Ask About?

General Insurance Ombudsman urged to boost governance, accessibility

Third-party evaluators have urged the GIO to make further enhancements to its governance, provide more support for consumers with special needs, and continue to gather feedback on customer interactions.

An independent review found GIO to be compliant with all seven of its prescribed guidelines:

- Independence

- Accessibility

- Scope of services

- Fairness

- Methods and remedies

- Accountability and transparency

- Third party evaluation

GIO recommendations for improvement

The review noted improvements on the GIO’s enterprise risk management (ERM) framework, in response to recommendations made during the 2017 evaluation. It praised the GIO for expanding its assessment of significant risks as well as incorporating appropriate risk mitigation strategies.

It recommended that GIO continuously improve the ERM framework given the ongoing evolution of best-in-class practices.

In terms of accessibility, evaluators said that GIO should provider wider support for consumers with special needs and those whose first language was neither English nor French.

It also urged the ombudsman to work closely with regulatory bodies on its data sharing policy and continuously gather feedback on consumer interactions.

GIO has said it would comply with these recommendations. It recently fully redesigned its website, launched a new natural disaster portal, and introduced a quarterly newsletter to keep consumers updated regularly.

Impartial ombudservice

GIO was established in 2002 to provide independent dispute resolution services for consumers. Its services are free of charge and available in English and French. It deals with issues involving claims, interpretation of policy coverage, and policy processing and handling.

Every five years, its board of directors appoints an independent third-party evaluator to conduct a review of its governance and operations. This year marks GIO’s fourth independent evaluation.

GIO Complaint’s Officer will work with the GIO and all applicable provincial and federal regulators in order to resolve the issue as effectively as possible. The GIO may make non-binding recommendations to resolve your dispute.

With the increase in unpredictable and extreme weather events and complex insurance claims, the availability of an independent and impartial ombudservice in the home, auto, and business insurance space continues to be a vital service for Canadians, according to GIO.

by

by