To build an AI-driven organization for the future, it will require a combination of technical and business skills that many finance teams do not have today.

Gartner analysts discussed the new AI-focused roles and skill sets finance leaders will need to incorporate into their teams, the importance of keeping people in the loop when using AI-based solutions, and other AI best practices.

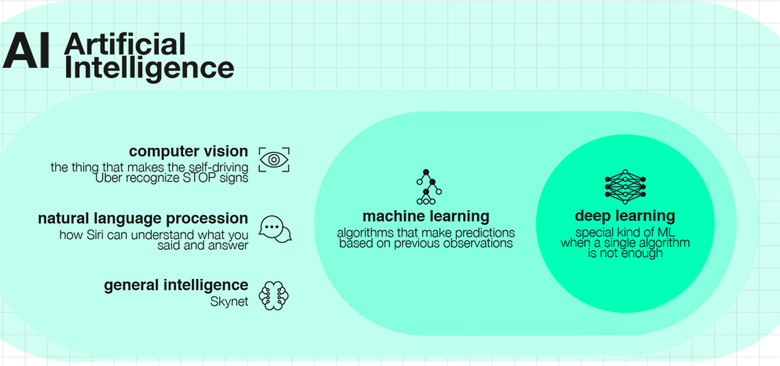

Artificial Intelligence is the broadest term which denotes the whole field in computer science which deals with solving problems traditionally associated with intelligent “learning” or “problem solving”.

Under the big umbrella of Artificial Intelligence, Machine Learning is the study of algorithms which (with proper training) can learn to solve new tasks without being explicitly programmed to do so (see 9 New Technology Trends by Insurance Sector: Big Data, AI & Machine learning).

The term Deep Learning covers a subset of Machine Learning methods which combine different “standard” ML techniques to effectively adapt to and make decisions from vast amounts of data.

On the same hierarchical level as ML are the subfields of Natural Language Processing or Computer Vision. Although in articles fintech problems are almost exclusively associated with ML, typical fintech use-cases like the automation of Customer Service or introducing Digital Assistants rely heavily on other areas of AI, like NLP.

Artificial Intelligence can replace Human Financial Analysts

The debate on whether Artificial Intelligence can replace Human Financial Analysts in the future has been an ongoing conversation (see How AI Technology Can Help Insurers Enhance the Customer Experience?).

With the rise of advances in technology and the introduction of Machine Learning and Autonomous Machines, the concept of replacing a human in the financial field as Financial Analysts is something that has sparked both optimistic and pessimistic views.

On one hand, AI has the potential to be used in sophisticated and advanced ways when analyzing trends in the financial market. AI can analyze data, spot patterns and make quick actionable decisions.

It can recognize changes in the market and can autonomously detect proceedings by sifting through multiple markets using machine-learning algorithms and big data processing, understanding the cause and effect of financial markets with far superior accuracy than humans (see How Artificial Intelligence Can Help Insurers Reduce the Inflation Impact?).

AI can monitor businesses, financial metrics, and corporate performance in real-time. It could even help in forecasting stock prices and model scenarios that humans wouldn’t necessarily consider.

Leading finance teams will learn to position AI-driven tools and solutions as co-workers that help them do their jobs better. Using AI as a co-worker instead of a replacement also ensures that finance leaders avoid delegating responsibility to machines that should be owned by a person.

We’re seeing a profound shift in how finance teams work based on the accelerating use of AI to help them handle the increased complexity of their daily activities and become more productive

Mark D. McDonald, senior director analyst in the Gartner Finance Practice

Just like any disruptive technology throughout history, AI will inevitably displace and replace some roles and skills, but new roles, skills, and opportunities will also emerge.

High-Priority Roles for Effectively Leveraging AI

In the future, Gartner analysts expect finance and accounting teams to look more like software development organizations, and finance leaders should begin introducing aspects of this paradigm shift into their teams.

3 roles that will play an integral role in finance teams in the future

- Citizen Data Scientists – These are current finance and accounting staff that will learn basic data science skills to help them automate tasks and make better decisions. Citizen data scientists will not have the expertise to build complex solutions that extend beyond their immediate scope of work. They will need help building a professional-grade solutions.

- Center of Excellence – These are roles new to an organization and are comprised of technical professionals who can build and maintain technically-solid AI solutions. These include professional data scientists, software engineers, data engineers, statisticians, and other non-traditional finance roles. A center of excellence often starts with a single professional data scientist and grows with demand.

- Company Leadership – Building teams of the future requires leaders to balance the challenges of introducing new skills and processes while making sure that the organization continues to support daily business operations.

Can AI replace Human Financial Analysts?

What’s more, with the constant advancements in technology, developments in AI, and its potential cost savings to businesses and organizations, many people are optimistic about its potential use in financial markets.

Companies may use AI to understand the sentiment of stock holders by observing digital footprints and online discussions.

Indicators like sentiment analysis may help companies to monitor and optimize strategies in real-time and to stay ahead of their competitors in the market. In the banking industry, AI could perform tasks such as fraud detection, market analysis, and risk assessment, which would give analysts more time to focus on the big picture.

On the other hand, skeptics of the idea of AI replacing Human Financial Analysts in the future feel that AI may be a great tool for technical work, but that it could not replace humans and their emotional intelligence, problem solving, and intuition.

AI may have extensive knowledge and analytical capabilities, but emotions are something that cannot be taught to a machine.

Humans have the ability to think critically and innovatively and make decisions based on what is in the best interests of their clients. AI also has its limitations and cannot be perfect. AI could make mistakes and may not always be able to interpret data in the right way.

Overall, Artificial Intelligence will certainly play a role in transforming the roles and tasks of Financial Analysts. However, both AI and Human Financial Analysts have their unique strengths and limitations and they cannot be perfectly interchangeable. AI will certainly be a valuable tool to assist humans in the financial industry, but it will never be able to completely replace them.

Benefits of Artificial Intelligence in Finance

The benefits of implementing AI in finance—for task automation, fraud detection, and delivering personalized recommendations—are monumental.

AI use cases in the front and middle office can transform the finance industry by:

- Enabling frictionless, 24/7 customer interactions

- Reducing the need for repetitive work

- Lowering false positives and human error

- Saving money

Automating middle-office tasks with AI has the potential to save North American banks $70 bn by 2025. Further, the aggregate potential cost savings for banks from AI applications is estimated at $447 bn by 2023, with the front and middle office accounting for $416 bn of that total.

The Human-Machine Learning Loop

By taking advantage of the complementary strengths of people and AI technology, finance teams can build a collaborative partnership in a human-machine learning loop where each relies on the other.

This loop establishes a new pattern of working that taps into AI’s power without removing people from the equation.

The loop formalizes what each is responsible for so that leaders don’t over-rely on machines or delegate human responsibilities to machines. The loop ensures human feedback and judgement remains front and center

Leverage AI for what it does best – automating manual tasks. Be cautious about allowing machines to take actions based on their own advice. By leveraging the strengths of both people and their new machine counterparts, organizations can reach new levels of productivity and value without big risks.

Applications of AI in Financial Services

According to Insider Intelligence, with key business benefits and pressure from tech savvy consumers top of mind, AI algorithms are being implemented by FIs across every financial service—here’s how:

AI in Personal Finance

Consumers are hungry for financial independence, and providing the ability to manage one’s financial health is the driving force behind adoption of AI in personal finance. Whether offering 24/7 financial guidance via chatbots powered by natural language processing or personalizing insights for wealth management solutions, AI is a necessity for any financial institution looking to be a top player in the industry.

AI in Consumer Finance

One of the most significant business cases for AI in finance is its ability to prevent fraud and cyberattacks. Consumers look for banks and other financial services that provide secure accounts, especially with online payment fraud losses expected to jump to $48 billion per year by 2023, according to Insider Intelligence. AI has the ability to analyze and single-out irregularities in patterns that would otherwise go unnoticed by humans.

AI in Corporate Finance

AI is particularly helpful in corporate finance as it can better predict and assess loan risks. For companies looking to increase their value, AI technologies such as machine learning can help improve loan underwriting and reduce financial risk. AI can also lessen financial crime through advanced fraud detection and spot anomalous activity as company accountants, analysts, treasurers, and investors work toward long-term growth.

……………….

Edited by