Artificial Intelligence in Insurance

Artificial Intelligence in Insurance – AI-assisted risk assessment can help insurers better customize plans so that customers pay only for what they actually need. It can also minimize human error in the application process, so customers are more likely to receive plans that properly fit their needs.

AI can facilitate the swift processing of insurance-policy claims and automate benefits transactions. It can also regulate a policy’s specifics to further streamline the handling of claims without any human intervention.

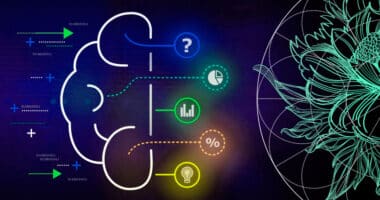

AI and ML are employed in various applications in the insurance industry, including fraud detection and prevention, risk assessment and underwriting, customer service and engagement, claims processing and management, as well as predictive analytics and risk management.

In this section, we have collected the most current articles and reviews on the topic of the Artificial Intelligence in Insurance.