Across asset classes, the perceived opportunity for value creation correlates to an extent with the speed of execution, liquidity and time horizon of investments. Equities and hedge funds are at the forefront of the perceived opportunity for value creation, with infrastructure and real estate at the other end of the spectrum. At sector level, managers’ views on the opportunity set differ widely, demonstrating both the structural nature of AI’s impact and the broad dispersion of opportunity for AI-driven alpha generation across asset classes, according to Artificial Intelligence Integration in Investment report.

Challenges in agreeing to a definition of AI reinforce the complexity of determining exactly how managers are using and integrating capabilities. According to Mercer’s AI integration survey, there is clear consensus among managers about what constitutes AI, with what might be termed the “core capabilities” being generative AI (gen AI), large language models (LLS), natural language processing (NLP) and machine learning (ML) models.

38% cite regime analysis — enabling dynamic risk positioning relative to the nuances of the current market environment — in terms of risk, data coherence and weighted probabilities of future regimes as the key methodology for developing their models.

Even among AI-integrated investment teams, the role of AI in reaching final investment decisions varies widely.

Hedge funds have long embraced technology and tools in an effort to maintain an edge relative to the competition, and in pursuit of persistent alpha (see how Generative AI Changes the Cyber Insurance Landscape?). Quantitative- and systematic-based hedge funds have a 20-year head start as pioneers in the areas of machine learning, advanced risk-management systems and process automation.

Investment opportunities and AI technology

More than half of AI-integrated investment teams (56%) report that AI analysis informs rather than determines final investment decisions. A fifth of these teams (20%) report that AI proposes investment decisions, which investment teams can override.

For a minority (10%) — likely to correspond with quantitative or systematic managers and/or strategies — AI executes decisions based on models that are periodically evaluated by investment teams.

Nearly three-quarters of managers (72%) currently using AI expect the integration of gen AI to improve their investment decision-making processes, whereas a fifth (19%) expect it to improve their processes significantly.

This trend is echoed among managers that plan to implement AI in the future. Two-thirds (65%) expect gen AI to improve their decision-making processes, with nearly one in 10 (9%) expecting significant improvements.

In terms of alpha generation, managers view use of AI as a driver of improvement — rather than replacement — across a range of existing processes. More than half of managers (52%) believe that AI could have a significant or very significant impact on alpha generation by enhancing monitoring of existing and/or potential investments.

The value-creation potential of AI in investment opportunities varies across asset classes and is influenced by factors such as speed of execution, liquidity and time horizon

Ursula Niederberger, Strategic Investment Research, Mercer

In the short term, AI can provide advantages in terms of speed and execution, particularly in high-frequency trading. It can quickly analyze data and take advantage of market inefficiencies.

Value creation opportunities brought about by AI

Liquidity is also a consideration, as AI can identify liquid assets for efficient buying and selling. However, in illiquid markets like real estate, AI may have limited value-creation potential in the short term, according to Generative AI — Emerging Risks & Insurance Market Trends.

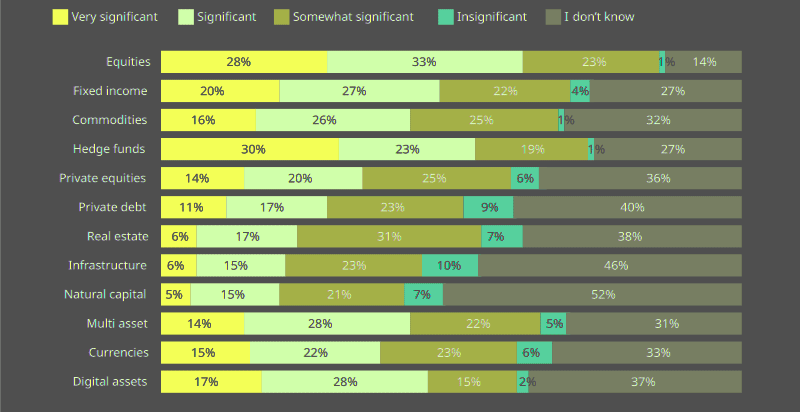

How significant do companies perceive the value creation opportunities brought about by AI to be in the following asset classes?

AI-driven opportunities for value creation at the asset-class level

At the asset-class level, managers’ expectations around the potential impacts of AI on value creation vary widely.

Among those already using AI, there is a clear consensus on the opportunity set in equities, with 61% of managers seeing very significant or significant prospects for value creation.

This is followed by hedge funds at 53% and digital assets at 45%. Additionally, nearly half of managers (47%) see a significant or very significant prospective value-creation opportunity in fixed income.

In the fixed income arena, AI may be used to support ‘bottom up’ credit analysis of corporate-bond issuers, similar to how it would be deployed to support and expand equity analysis

Noel Collins, Senior Director Fixed Income Investment Research, Mercer

From a top down perspective, AI may be used to improve macro and geopolitical analysis and therefore help with portfolio positioning and risk assessments. Although AI capabilities are not yet the norm for fixed income managers, we are incorporating this focus to an increasing extent in our own research.

AI-driven opportunities for value creation at the sector level

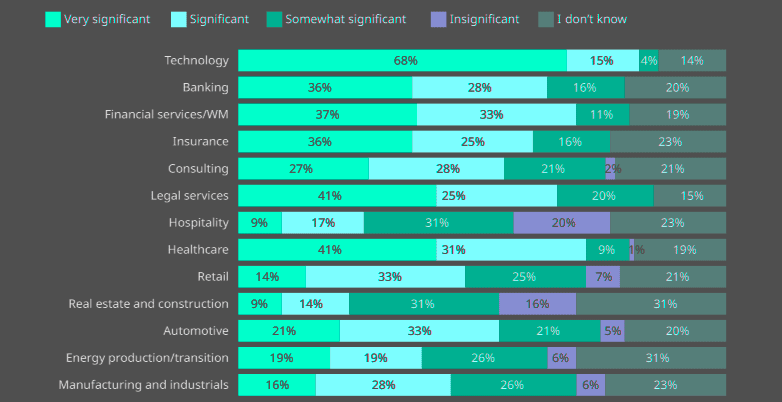

Managers see significant or very significant value-creation opportunities through the integration of AI across a range of sectors/business lines, but the perceived opportunity in different industries differs significantly, indicating the potential for alpha generation.

Among those already using AI, the technology sector naturally emerges as the most prominent opportunity, viewed as significant or very significant by 83% of managers.

Healthcare (72%); financial services and wealth management (70%); legal services (66%); banking (64%); and insurance (61%) are the next-most-cited significant or very significant areas of opportunity for value creation.

Big picture, the application of AI across investment processes in public and private market contexts looks very different. So far, the use of AI investment processes and broader applications of gen AI are yet to become truly impactful in the private markets space.

From an underlying investment perspective, managers across the venture arena are inherently focused on innovation, be it new software, products or applications.

Venture capital investment managers are coming up against companies claiming to be developing AI that are simply database-analysis tools with no autonomous component

Erik Sebusch, Global Strategy Leader for Venture Capital & Growth Equity at Mercer

At sector level, we are seeing a lot of VC interest in AI applications to legal and computational analysis, visual analysis in the healthcare space, and learning and predictive technology developments more broadly. Biotech and gaming are two areas in which we see gen AI applications really taking off.

Given VCs’ focus on innovation, we might expect managers to be a bit further along in terms of using AI for sourcing opportunities. When it comes to seed and early-stage investments, data points for finding companies are few and far between, often existing as merely an idea and concept among key individuals.

How significant do companies perceive the value creation opportunities brought about by AI to be in the following business lines?

From an AI-analysis perspective, managers have screen-scraped LinkedIn and other platform sources for many years — to aggregate and sift data on prior companies, and schools, thereby elevating more interesting companies and entrepreneurial talent to speak. These approaches are not generative AI applications, but LLMs.

Beyond their investment approach and process, managers are using machine learning and database analysis to help drive efficiencies and manage their workload.

It is still very early days for VCs to be using AI for risk management and the operational efficiency of their entity.

Although challenges around an agreed definition of AI reinforce the complexity of determining exactly how managers are using and integrating its capabilities, managers are clear cut in determining “what counts” as AI.

Managers’ integration of AI has ramped up over the past year, but for many, AI integration has been a more-than-three-year journey.

ML, NLP and gen AI are the priority areas for operational investment, though investment in predictive AI also plays out strongly in our findings. Productivity is the name of the game for many managers, but the jury is still out on AI’s commercial impacts on both AUM and revenues. On a five-year view, managers expect AI to have a limited impact on headcount, though firms do intend to hire more specific skillsets during this period.

………………..

AUTHORS: Ursula Niederberger – Strategic Investment Research at Mercer Investment Consulting, Noel Collins – Senior Director Fixed Income Investment Research at Mercer, Erik Sebusch – Global Strategy Leader for Venture Capital & Growth Equity at Mercer