Compounding global crises have made the world a riskier place. Long-standing grievances tied to inequality and the rising cost of living have been inflamed by the (health and economic) effects of COVID-19, and, more recently, Russia’s war in Ukraine. Resulting commodity shocks and more ingrained price pressures have sent inflation soaring to multi-decadal highs and elevated the threat of civil unrest (already at a high base) for businesses in both advanced and emerging economies, according to Howden.

This backdrop has added a big dose of complexity into an already complicated operating environment for political violence (PV) insurers and reinsurers.

Just as the market was navigating an unprecedented rise in claims from strikes, riots and civil commotion (SRCC) events, and an attendant surge in demand, the Ukraine war exposed considerable geopolitical risks and led to what will become one of the largest PV losses ever.

Risks are escalating as the world navigates a succession of crises. Economic and geopolitical shocks have dominated agendas over the last 12 months as the effects of COVID-19 have collided with the devastating fallout from Russia’s invasion of Ukraine (see How Russian War in Ukraine Impacts for Insurance Sector?).

The cascading impacts from these two events have created a new world (dis)order, characterised by a cross-border war in Europe, heightened security threats more generally, supply chain disruption, structurally higher inflation and rising interest rates.

Recent outbreaks of violence in Chile, the United States, South Africa and Peru reflect a highly dynamic and interconnected risk landscape. These events saw violence spiral quickly to affect multiple locations and are indicative of rising discontent globally, as demonstrated by other incidents of unrest last year in Iran, Kazakhstan, Sri Lanka and Argentina. 2023 has offered little respite, with protests in France and Israel hitting the headlines in recent weeks.

All of which has reset insurers’ views of risk. Property insurers are increasingly withdrawing SRCC cover whilst risk appetite in the standalone market has reduced significantly.

The fallout represents something akin to a perfect storm – demand up, supply down, triple-digit loss ratios and reinsurance retrenchment – resulting in a market-changing pricing correction.

Market pressures have been compounded further by the war in Ukraine, which in addition to causing one of the largest PV losses ever, has also exacerbated cost of living pressures and exposed other geopolitical risks that currently extend to rising tensions between China and the United States.

Conditions have unquestionably become more difficult, but few areas of (re)insurance have such an innate ability to respond to a rapidly changing threat landscape. The step-change in losses and demand will require the market to scale up considerably over the next few years: Howden is leading the charge by leveraging expertise within our group and engaging with an array of market participants to entice more capacity into the market and secure the best outcomes for clients.

Structural change to the SRCC loss environment

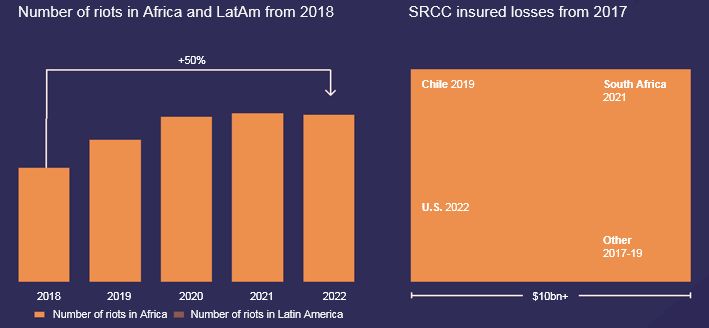

The shift in loss profile has been stark. Whereas major PV market-related losses were confined mostly to large-scale terrorist bomb attacks previously, multi-billion dollar SRCC events in Chile (2019), the United States (2020) and South Africa (2021) have led to considerable payouts for insurers and reinsurers.

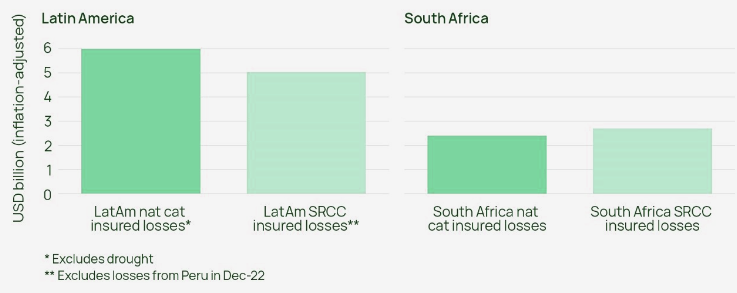

Increased frequency of severity has propelled the quantum of SRCC claims in South Africa and Latin America to rival or even surpass natural catastrophe losses. This is not down to a lull in catastrophe activity – both territories experienced a number of sizeable natural disaster losses during this time (including record-breaking floods in South Africa) – but a reflection of the unprecedented scale of civil unrest.

Natural catastrophe insured losses vs SRCC insured losses – 2015 to 2022

Such devastating losses have precipitated a correction in the PV market that looks set to persist for some time to come. Clients can therefore expect to continue to encounter difficult market conditions in 2023.

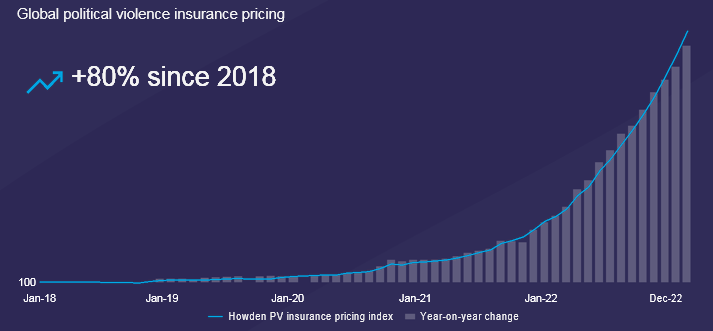

For the cover that is most sought after currently – namely SRCC and full PV – line sizes are being cut across the board and certain risks are difficult to place, especially in more volatile areas. Rates are up for all perils and territories, with our pricing index showing an average increase of 80% since 2018.

Tom Bradbrook, Executive Director, Howden Specialty

Now more than ever, risk transfer advice can make a crucial difference to renewal outcomes. With little prospect of a let up in market conditions, sector expertise, market-leading thought leadership and unrivalled relationships with insurers have never been more important.

Howden’s PV team provides all this and more and we look forward to supporting clients in managing change and securing the best coverage available in the marketplace.

Shock events have transformed the pricing environment

Interacting macroeconomic and geopolitical trends portend a structural shift in loss frequency and severity for the standalone political violence (PV) market.

Such devastating losses have eroded a sizeable share of the standalone market’s overall premium base, precipitating a correction that looks set to continue for some time to come.

Strikes, riots and civil commotion (SRCC) + war = market reset

In order to put the standalone PV market on a more sustainable footing, its premium base needs to grow significantly in the next few years.

Price is part of the equation but (disciplined) new capacity will also be needed to absorb the levels of losses and demand we are now seeing.

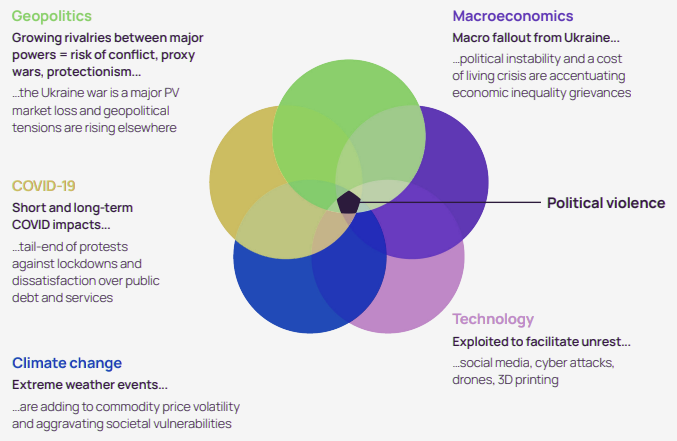

Pre-existing issues like economic malaise / inequality, protectionism, climate change, misinformation and technological risks exacerbating pressures, the corollary is a highly volatile and interconnected global risk landscape.

A cross-border war in europe, heightened security threats more generally, supply chain disruption, structurally higher inflation and rising interest rates have created a new world (dis)order.

Key takeaways

- Recent unrest in South Africa and Latin America has seen the value of strikes, riots and civil commotion (SRCC) claims rival or even surpass major natural catastrophe losses

- The PV loss profile has shifted significantly in recent years, with (re)insurers suffering more than USD 10 billion of SRCC losses since 2015 vs less than USD 1 billion for terrorism

- Growing discontent across the globe has sent SRCC costs spiralling to the point where they can impede economic growth or even trigger recessions

- The Ukraine war has also exposed considerable geopolitical risks: the conflict is set to become one of the biggest PV losses on record

- Standalone PV pricing is undergoing a correction as a result, rising by more than 80% since 2018

A Re/Insurance market reset

All of which has reset (re)insurers’ views of risk. Property carriers are increasingly withdrawing SRCC cover whilst risk appetite in the standalone market has reduced significantly. The fallout represents something akin to a perfect storm: demand up, supply down, triple-digit loss ratios, reinsurance retrenchment and a market-changing pricing correction.

With PV insurers holding significantly higher net positions post-1 January 2023 reinsurance renewals, the market could be one major loss away from dislocation.

Finding an equilibrium that continues to meet clients’ expectations around capacity commitments, coverage and affordability, whilst ensuring that rates are commensurate to the degree of risk assumed, will be crucial to market sustainability and long-term relevance. Ultimately, the step-change in losses and demand will require the market to scale up considerably over the next few years.

We look forward to supporting clients through this period of transition and working on their behalf to forge a path towards a more sustainable market designed to navigate today’s fast-moving threat environment.

Howden

Marketplace demands the very best intermediary expertise and leadership. It requires experience, market-leading thought leadership and unrivalled relationships with insurers.

Reinsurance market hardening

The correction in the PV market is likely to continue for much of this year, with pressures compounded by considerable tightening in the reinsurance sector during 1 January 2023 renewals. Retentions and pricing doubled in certain instances and considerable reinsurance protection was lost overall.

Treaty reinsurance appetite in this class declined at 1 January 2023, particularly for upfront carriers unwilling or unable to meet future treaty pricing expectations. The change was driven by the five key treaty reinsurers who, after recently sustaining disproportionately large losses from both standalone and all-risk policies, refused to continue on previous unprofitable conditions.

Steve Bessant, Executive Director, Howden Tiger

The effect of this change varied by peril, with capacity commitments reducing for SRCC and full PV by as much as 30% and 60%, respectively, and pricing increasing significantly across the board.

Event definitions and terms and conditions likewise tightened at 1 January 2023, as treaty reinsurers reduced exposures, particularly in the contingent business interruption space. These dramatic changes have cascaded down the value chain, forcing original insurers to pass on restricted wordings, higher costs and deductibles to buyers.

Heightened threat environment

The last few years have demonstrated how perils once viewed as distinct or independent – risks such as pandemics, conflicts, social unrest, extreme weather events, commodity price shocks and supply chain failures – can in fact be linked and strike simultaneously.

The scale of events has moved loss scenarios from the theoretical to the real world and, in doing so, caused a marked shift in risk perceptions.

These developments have fundamentally changed several areas of the (re)insurance market, none more so than PV. Indeed, the inherently volatile PV threat landscape has become even more unpredictable in recent years as SRCC events have escalated.

Widespread economic and political instability – fed by social disparities, legacy-COVID-19 impacts, reset macro-fundamentals, intensified rivalries between major powers and the tactical use of new technologies – was already generating more frequent acts of violence, only to be compounded further by Russia’s invasion of Ukraine, an event that looks set to become one of the biggest PV losses ever.

Megatrends driving unpredictability of PV risk landscape

With little prospect of these issues relenting, businesses need to prepare for, and protect themselves against, a sustained rise in PV-related incidents. Such a hostile risk environment not only brings direct financial risks from property damage and attendant business interruption, but can also threaten operations, personnel, supply chains and reputations.

SRCC frequency and severity

Intensifying SRCC risks are a reflection of these megatrends, as well as long-standing (and intensifying) grievances such as the rising cost of living, food and energy insecurity, falling real incomes, political populism / polarisation, perceived poor governance and corruption.

The use of social media has also added an element of unpredictability, as the reach and near real-time information provided by these platforms has seen incidents spiral quickly to affect several locations rather than remain localised risks that typically capped losses in prior years. The role social media can play in fermenting unrest to simultaneously impact cities / states or even countries (as was the case for the Black Lives Matter movement) has exposed the potential for systemic losses to the PV market. All this is occurring as demand for standalone cover is rising rapidly as several all-risks carriers withdraw from the SRCC space.

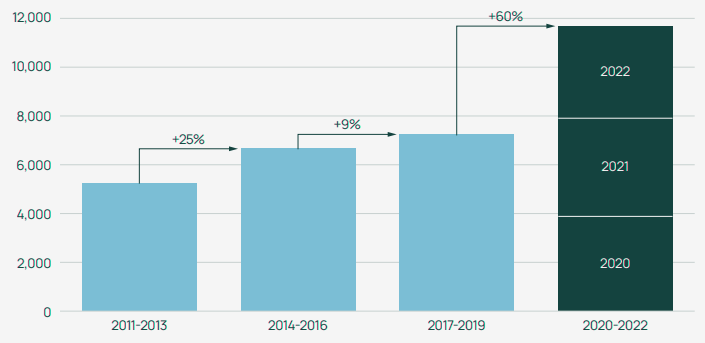

Using data from the Armed Conflict Location and Event Data Project (ACLED), Figure 3 shows the number of riots recorded in Africa over the last decade or so. Increased episodes of unrest shown in recent years especially are indicative of trends observed in most other regions. Riots in Africa were up 60% between 2020 and 2022 when compared to the preceding three-year period, which was already at a high historical base.

Number of recorded riots in Africa by 3-year period – 2011 to 2022

The accompanying step-change in severity, as demonstrated by a number of flashpoints in recent years, has been equally consequential.

A shift in SRCC loss escalation that first manifested in Chile in 2019, where the scale and intensity of unrest transcended anything seen previously, was repeated in other territories during COVID-19, including the United States (2020) and South Africa (2021), despite government-mandated lockdowns.

Financial impacts from these events were differentiated by the degree of property destruction and looting, as well as the targeting of global brands in multiple locations.

As the following case studies show, SRCC events have not only become more frequent across all regions, but their costs have spiralled to the point where they can impede economic growth or even trigger recessions. Incidents are also increasingly breaking out in more ‘stable’ territories.

Greater exposure at risk has culminated in damaging losses to businesses and unprecedented payouts for the (re)insurance market.

Effects of Ukraine war for Re/insurance market

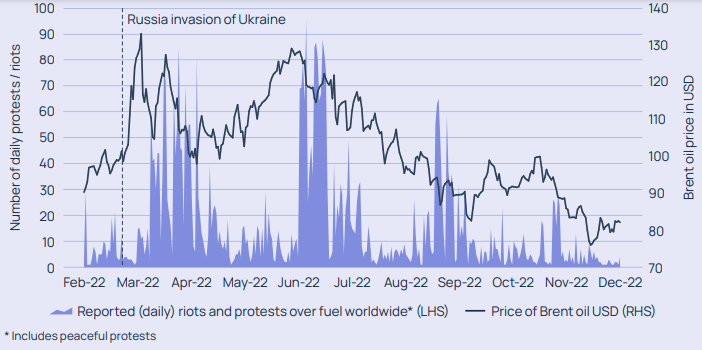

The spillover effects of the Ukraine war were instrumental in feeding protests last year. Whilst the causes of civil unrest are disparate and complex, and often tied to discrete national circumstances, sudden political and economic shocks, especially those that influence the cost of essential goods and services, can inflame grievances and lead to spontaneous protests (se How to Russia’s War in Ukraine is Changing the World and Insurance?).

Figure below uses ACLED data to plot the daily number of protests and riots worldwide linked to rising fuel prices last year and how they correlated to oil price fluctuations following Russia’s invasion of Ukraine.

Daily reported protests and riots over fuel prices vs cost of oil in 2022

In addition to being another billion dollar plus loss for the PV market, which carries considerable upside potential given the complexities and duration of the conflict, the Ukraine war has aggravated an already hostile backdrop.

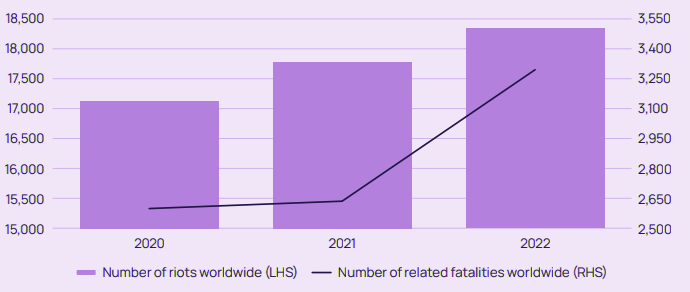

Number of riots and associated fatalities worldwide – 2020 to 2022

With violent demonstrations already at a historically elevated base, ACLED data shows 2022 marked an all-time high for global riots and related fatalities.

Global civil unrest is unlikely to abate any time soon

Indeed, 2023 has got off to an ominous start, with nationwide protests in Brazil, Peru and France causing further losses and even challenging the legitimacy of incumbent governments. The case study opposite provides more detail on the outbreak of unrest in Peru.

The frequency and severity of recent SRCC events are unlikely to be a series of random acts, but indicative of an elevated and interconnected risk landscape that has delivered a new reality in terms of loss frequency and loss expectations.

Interacting macro drivers are exposing businesses and (re)insurers to a greater degree of PV risk across all regions. As the rising cost of living continues to cause widespread grievances, conditions remain in place for unrest to continue.

Heightened geopolitical tensions remain a wild card for the PV threat landscape. Wholesale energy prices, which have fallen significantly in recent months, are tied closely to the Ukraine crisis. Risks also extend beyond Russia and Ukraine, with tensions mounting between the United States and China as well as within the Middle East, thereby accentuating the range of critical risks confronting businesses at this time.

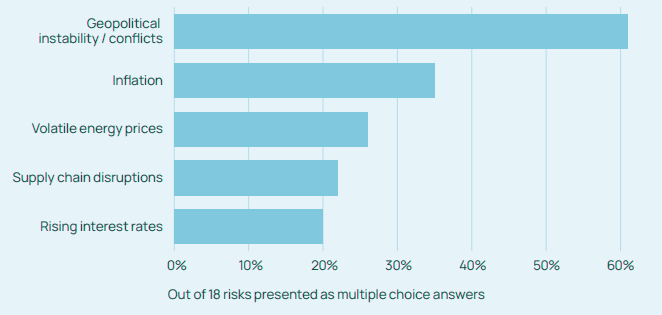

Potential risks to economic growth in 2023

All of which creates a febrile PV environment for (re)insurance buyers and underwriters. Shifting supply and demand dynamics, compounded by increasingly prevalent SRCC exclusions in property contracts, have led to the most significant recalibration since the PV market’s inception 20 plus years ago.

Specialty (re)insurers have long made a living by turning challenges into opportunities, and by providing clients with the capacity needed to protect assets against SRCC and broader PV risks they can once again showcase differentiation and relevance whilst also growing into firming market conditions.

The highly dynamic threat landscape has brought transformational change to the PV (re)insurance market. Following a period of high profitability for the best part of two decades, a series of historic losses since 2019, coinciding with a hard property market, attendant SRCC exclusions from all-risk policies and multi-decadal high inflation, have reset supply and demand dynamics.

The fallout represents something akin to a perfect storm: demand up, capacity down, triple-digit loss ratios, reinsurance retrenchment and a market-changing pricing correction.

Finding an equilibrium that continues to meet clients’ expectations around capacity commitments, coverage and affordability, whilst ensuring that rates are commensurate to the degree of risk assumed, will be crucial to market sustainability and long-term relevance.

The standalone PV market has a strong track record of responding quickly to the demands and needs of insurance buyers. It came to prominence after the 9.11 terrorist attacks, emerging from a small cohort of carriers that had underwritten SRCC coverage from the late 1980s for certain high-risk countries such as Colombia, South Africa and Sri Lanka.

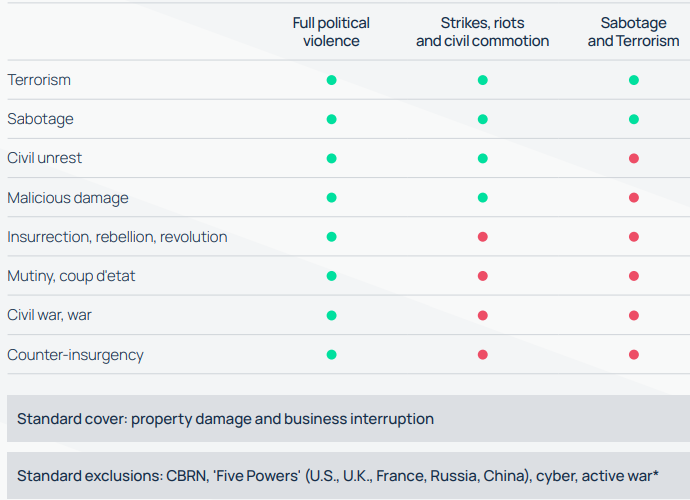

Core PV perils and insurance coverages

Several government-backed terrorism pools were created in the wake of the 9.11 attacks to ensure capacity was available when businesses needed it the most. The security provided by these backstops was crucial to the continued provision of terrorism insurance during this period and helped to support the growth and innovation of the private PV market.

Coverage designed to respond specifically to physical damage and business interruption losses arising out of acts of terrorism have evolved over time, with specialty carriers now offering a broad array of solutions that include sabotage and terrorism (S&T), as well as SRCC and full PV.

The scope of coverage has changed significantly as the market has matured, demonstrating its ability to respond to fast moving risk developments. Broader coverages to emerge over the years, including denial of access, loss of attraction, active shooter and cyber, are indicative of the PV market’s ability to adapt to buyers’ shifting coverage priorities. Long-held definitions have also come under review as recent events have blurred the boundaries between perils.

…………………………

AUTHORS: Julian Alovisi – Head of Research Howden Broking Group, Tom Bradbrook – Executive Director Howden Specialty, Steve Bessant – Executive Director Howden Tiger, James Hannan – Head of Crisis Management at Convex Insurance