Space and satellite insurance has evolved from simple launch coverage to a complex discipline combining contract analysis and advice, risk evaluation, alternative risk transfer concepts, insurance program design and implementation, and claims negotiation.

The insurance of satellites with complex and new types of payload is where the know-how and experience of our aerospace experts really pays off.

The deployment of previously untried satellites always raises questions about their insurability. A lot of hard work and dedication is required during all phases.

At present, space insurance market is a complex and volatile niche market, located at the frontier of existing technologies. It provides complete coverage of the risks to which a spacecraft is exposed during its lifecycle, from launch to in-orbit operations. Outer space activity represents a high or even catastrophic risk environment, with a relatively high loss frequency. Effective insurance solutions are therefore crucial to the development of profitable economic activity in space.

The market for space risks is extremely volatile by nature because it is driven by both innovation and catastrophic events, which have far-reaching consequences on activity and premiums. However, the space insurance market will soon have to face a new trend as space activity is on the brink of intensification, mainly due to the arrival of new players promoting a genuine paradigm shift.

What Insurance Risks covered

- assembly, integration and test (AIT) coverage during the manufacturing and testing phase

- pre-launch coverage during transport to the launch pad, at the launch pad, before launch, or in storage, as well as contingent exposures

- production facility / launch pad property damage and property cover for manufacturing and storage facilities

- cover for launch systems and commissioning equipment

- in-orbit — operational life insurance for the space satellite

- in-orbit incentives — cover for the manufacturer’s obligation to the client in the event of malfunction or non-performance

- service interruption / loss of revenue / broadcast events — cover for broadcasters or any organization that uses telecom networks

- liability — cover for third party liability during a launch or in-orbit activities

- captive services — cover for companies that self-insure space risks

Manufacturer’s technical specifications and presentations, discussions with the manufacturer, operator and broker all need to be analysed before the pieces of the puzzle can be assembled into a well-designed coverage concept.

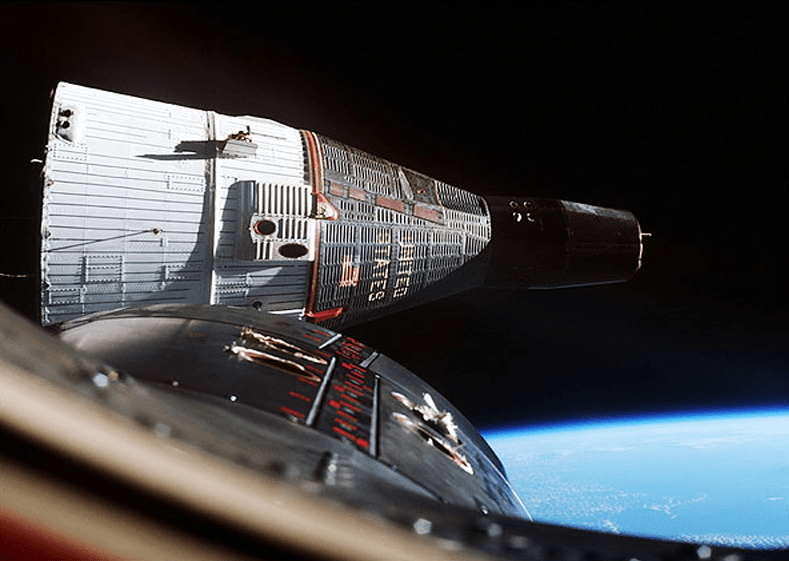

Pre-launch insurance

Pre-launch insurance provides all-risks coverage for material damage in the pre-launch phase. This phase comprises the satellite’s move from the manufacturer’s premises to the launch site; the satellite’s launch configuration, integration into the launch vehicle; and all launch preparations.

The coverage generally terminates when the ownership of the satellite – and hence the risk – passes from manufacturer to purchaser.

At the latest, the risk transfers when the launch can no longer be aborted – often a few seconds after ignition. In such cases, pre-launch insurance covers – if only for a very short time – the risk that the launch vehicle will fail to operate. If the cover has terminated at an earlier point in time, it may reattach if the launch is aborted (post-abort coverage).

Launch insurance

Launch insurance provides all-risks coverage for material damage and malfunctions occurring at any time between the beginning of the launch phase and the end of the positioning phase, i.e. until in-orbit testing has been completed. To accommodate policyholders in their wish for longer coverage period, launch insurance nowadays is usually granted for up to 365 days after launch.

A partial loss is to be assumed if the satellite has become only partially operational or if its service life has been curtailed. If the impairment caused by a partial loss exceeds a certain limit, we speak of a constructive total loss.

The amount of compensation payable in the event of a total loss is specified in advance (agreed value). It is usually derived from the replacement value of the satellite – essentially the cost of a new satellite, the cost of launching it, and the cost of launch insurance. In other words, the launch vehicle is not subject to a separate cover but is included as an additional cost factor in the insured replacement value.

In-orbit insurance

In-orbit insurance offers protection against the risk of a satellite’s complete or partial failure during the operating phase. As with launch insurance, the insured value is an agreed value, which at the beginning of the satellite’s service life is based on the replacement value. The sum covers the whole value of a satellite.

Physical destruction or complete inoperability results in a total loss, while a partial loss or a constructive total loss results if the performance or service life of the satellite is only partially impaired.In-orbit insurance offers protection against the risk of a satellite’s complete or partial failure during the operating phase. As with launch insurance, the insured value is an agreed value, which at the beginning of the satellite’s service life is based on the replacement value. The sum covers the whole value of a satellite.

Physical destruction or complete inoperability results in a total loss, while a partial loss or a constructive total loss results if the performance or service life of the satellite is only partially impaired.

Launch plus Life Insurance

Launch plus Life is the unique combination of launch insurance and in-orbit insurance. Launch plus Life provides all-risk coverage for material damage and malfunctions causing a complete or partial failure during all phases of a satellite life. In addition Launch plus Life insurance gives the operator full certainty with regard to market price changes restrictions over the satellite life and coverage restrictions introduced at in-orbit renewals.

A careful analysis of the satellite’s heritage, margins and redundancy is necessary to commit up to 15 years.

Space insurance is also unique in terms of the technical skill required of the brokers and underwriters. Insurance discussions and placements may take place years prior to a satellite launch. The insured and their manufacturer will share all details of the satellite’s systems and mission. Underwriters particularly want to be aware of any new technology that has not flown before.

Disciplines including electrical engineering and rocket science provide a good background. The involvement of a specialist space insurance broker is important in order to properly coordinate underwriter and insured requirements.

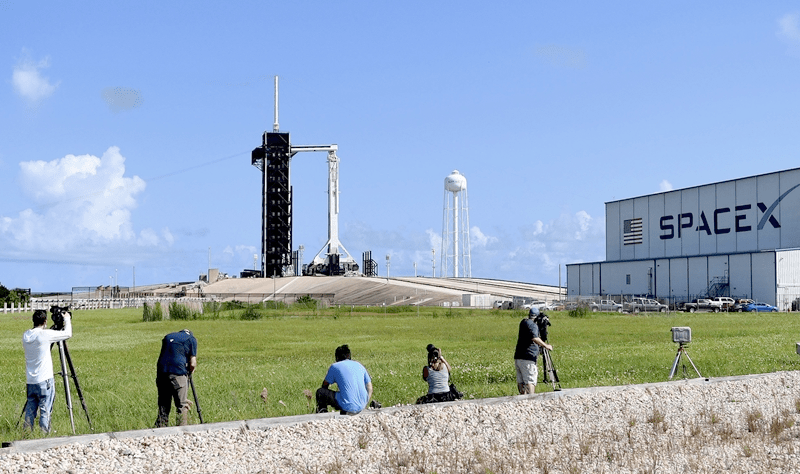

Human space flight brings new risks to the companies involved. The ISS will now host guests that are not sponsored by governments but by the private commercial sector.

These individuals could be NASA astronauts as with the SpaceX crew, but they could also be employees of the launch company or space tourists.

NASA and the FAA are still refining how these new risks are addressed. The space underwriters are working with the private space companies and NASA/FAA to create the insurance product that appropriately addresses the risks facing s the private sector when it comes to human flight. As the space industry evolves so too do the insurance programs that address the hazards.