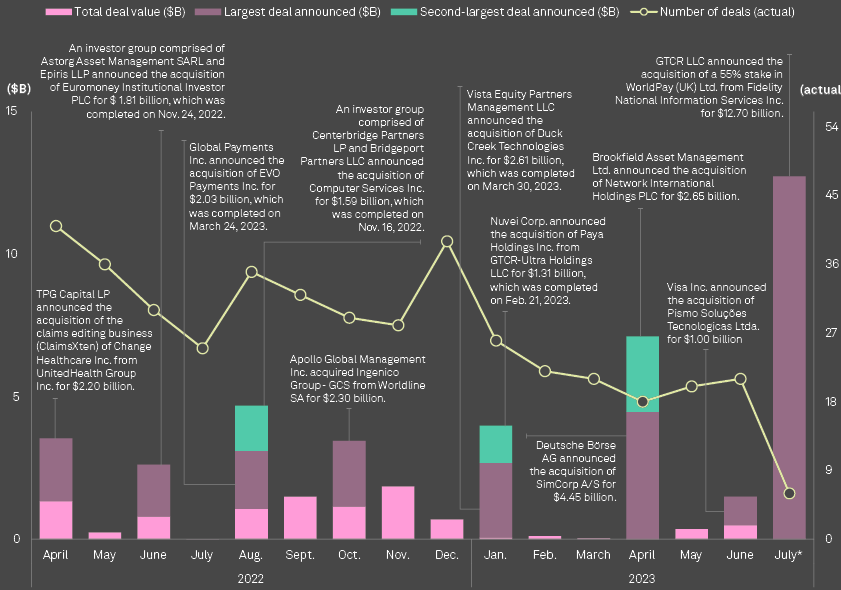

A slowdown in financial technology sector deal flow is lingering, with a wait-and-see sentiment extending into the second half of the year. From January through June 2023, the global fintech sector recorded 128 M&A transactions, compared to 248 in the first half of 2022 and 188 in the second half of 2022, according to data compiled by S&P Global Market Intelligence.

The slashed valuations of some publicly traded financial technology companies will continue to prompt M&A interest from strategic and private equity buyers.

According to Private Equity & Venture Capital Investment in FinTech, many fintech companies went public with lofty valuations during the latest peak around 2021 only to see their share prices plummet in 2022-2023.

With economic uncertainty remaining persistent, targets in recent deals are locking in the market premium offered by the buyer instead of waiting for a rebound of stock prices.

Fintech has moved from the fringes of European finance to its core, but performance varies widely

If all countries could match the best in region, the economic benefits would be considerable (see Biggest FinTech Unicorns in the World).

This sentiment among sellers has the potential to pick up in 2023, and there is no shortage of smaller publicly traded fintech companies — particularly in the payments sector — that private equity firms or larger corporate players can covet, according to equity analysts.

We are talking to a lot of companies that are thinking about engaging bankers just to get prepared, but maybe launch a process late this year or early next year, or at some unforeseen time when market conditions improve

Kegan Greene, managing director in fintech investment banking at Jefferies

Many companies, while interested in exploring options, remain cautious of launching a sale process anytime soon.

Private equity and venture capital investment in financial technology and payments companies in Europe has been dwarfed by the $10 billion put into US companies in the first five months of the year (see about Value of Global Private Equity Deals).

FinTech M&A deals

The gloomy deal market had a bright spot in July, when banking software company Fidelity National Information Services Inc. unwound its 2019 acquisition of Worldpay Group Ltd. and sold 55% of the payment processing company to GTCR LLC at an announced valuation of $12.7 billion, according to Global FinTech & InsurTech Funding Highlights.

But the deal was a planned strategic move and does not necessarily reflect the M&A appetite in the broader market.

FinTech sellers on the sidelines

The slowdown is not a result of companies losing M&A interest, but rather a sign that the market has accumulated a backlog of companies seeking to sell or raise capital, dealmakers said.

Potential sellers on the sidelines are mainly gauging the right timing, waiting for more favorable valuations.

Recent deal flow has picked up slightly from the extremely low levels of a couple of months ago

Ganesh Rao, managing director at THL Partners

Sellers are now testing the market. Some sellers have an incentive to explore deals to avoid a potential rush of M&A when the deal backlog clears.

When COVID-19 hit the US in early 2020, the M&A global market soon got quiet as companies and investors weathered the early months of the pandemic. But as soon as they gained more clarity, many sellers rushed into the market to launch processes around Labor Day of 2020.

The market became so crowded so quickly that for any particular company, they almost couldn’t get the attention of a strategic acquirer or a private equity firm because they were getting 10 teasers a day in their inbox.

Some sellers now fear missing out on a time window in which valuations start to increase, but not enough to make the market too competitive. It is still unclear when that window will be.

FinTech Valuation gap still large

The main complicating factor continues to be the gap in valuation expectations. While global M&A has suffered in 2023, the Fintech sector saw M&A activity rise sharply this year, with 591 deals recorded.

This represents a 46% increase on numbers, and a whopping 70% increase on pre-pandemic figures.

Buyers and sellers of fintech assets are getting closer to each other on valuations, but the gap is still wide

Roshan Punjabi, senior managing director in fintech investment banking at Guggenheim Securities

Looking ahead, the valuation of fintech stocks in the public market is showing signs of recovery, with a higher level of confidence and M&A dialogue in the market.

The number of private equity acquisitions of fintech targets has increased, while the share of PE acquisitions as a percentage of total number of deals remains in line with prior periods at 31%.

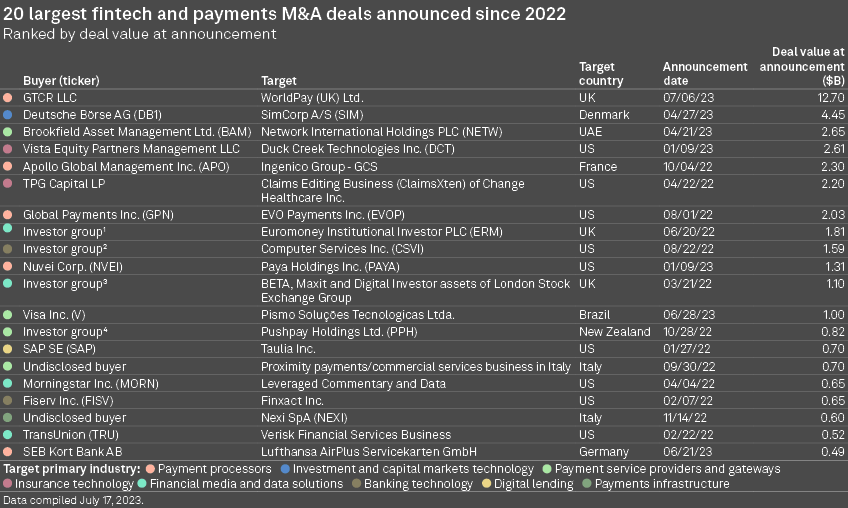

TOP 20 largest fintech M&A deals

According to Hampleton Report, valuations have remained steady: 2023 saw the trailing 30-month median revenue multiple reach 3.1x – broadly in line with the levels seen in the past two years. The trailing 30-month median EBITDA multiple came in at 14.2x, firmly within the 13x to 15x range monitored since 2015.

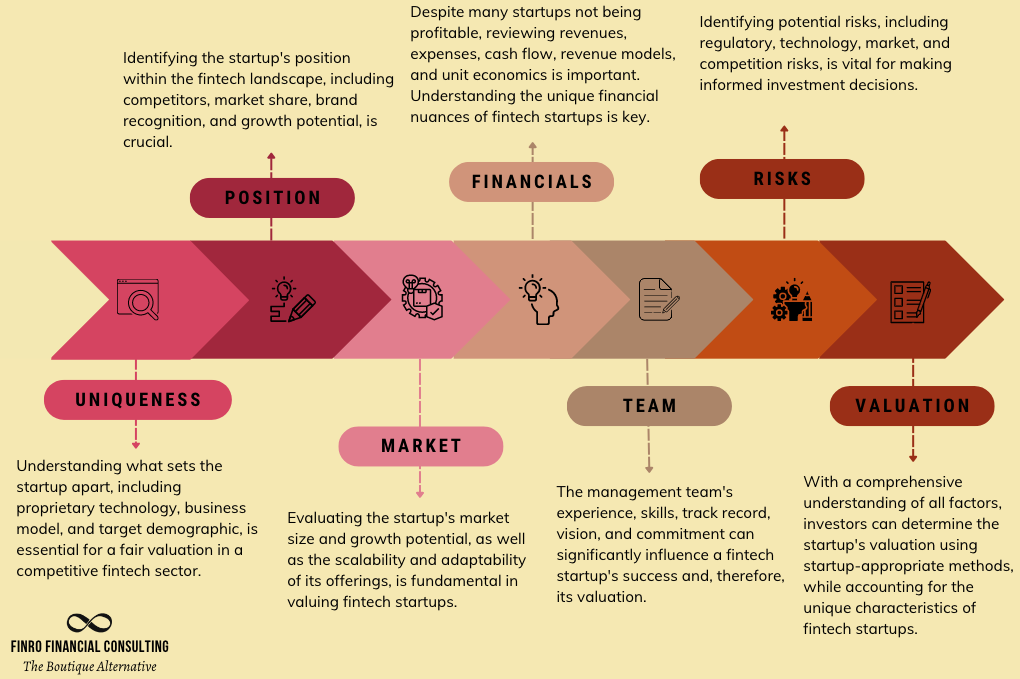

FinTech startup valuation process

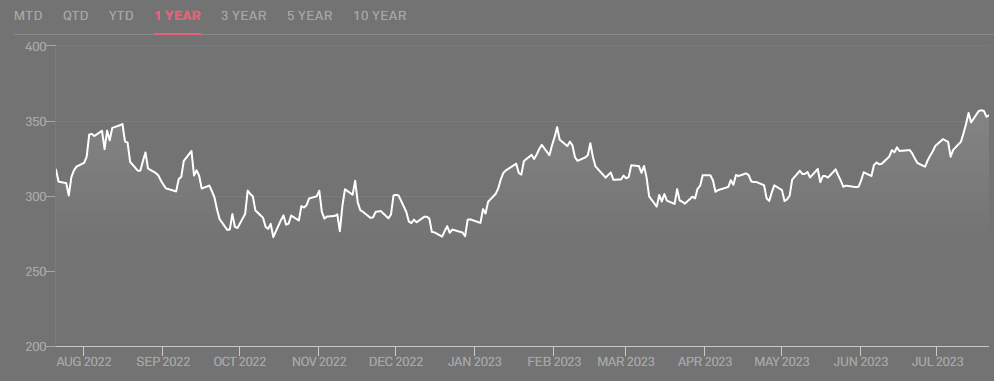

S&P Kensho Future Payments Index

As of July 17, the one-year total return of the S&P Kensho Future Payments Index had climbed up to 22.7%. The index is currently close to its levels of July 2020, with a modest value drop of 1.8% on a three-year basis.

The S&P Kensho Future Payments Index is designed to measure the performance of companies involved in providing products or services related to general-purpose platforms that allow consumers to transact using a digital balance.

A subsector index within the S&P Kensho New Economy Index Series, the S&P Kensho Future Payments Index intends to represent companies that are focused on building the next generation of payment capabilities, such as digital wallets; platforms that allow merchants to manage multi-channel payments in one system, real-time payments, and transfers across consumer and merchant accounts; transaction security; and biometrically enabled payments.

FinTech segments with M&A interest

Corporate carve-outs, treasury management software and payments are areas particularly gaining M&A traction across fintech segments.

The M&A boom from mid-2020 to mid-2022 was driven in part by corporations on acquisition sprees to take advantage of low interest rates.

Many fintechs are now rethinking what is core to their business and whether it is better to simplify their company, sometimes under shareholder pressure

Payment company Fleetcor Technologies Inc. has said it is weighing a split-up of its three core business lines. NCR Corp. has filed with the SEC to split its digital banking business and ATM business.

In another area of focus, treasury management software is drawing interest because, coming out of the recent regional bank turmoil, companies are more conscious of managing risks associated with their cash.

That provides a growth catalyst for fintech solutions that automate tasks in the office of CFO, such as managing account payables, account receivables and other treasury functions.

In payments, card networks Visa and Mastercard could continue to use M&A to strengthen their value-added services.

Value-added services are features that can improve experiences around payments, such as loyalty and rewards, fraud prevention and advisory services. Both companies have been touting growth in the segment in recent years.

…………………..

AUTHORS: Yizhu Wang, Gaby Villaluz – S&P Global Market Intelligence analytics

Quotes by Kegan Greene – managing director in fintech investment banking at Jefferies, Ganesh Rao – managing director at THL Partners, Roshan Punjabi – senior managing director in fintech investment banking at Guggenheim Securities