U.S. property and casualty insurers will see some relief in 2024 year following a rough 2023 as a personal auto line recovery contributes to statutory profit improvement, according to Fitch Ratings in 2024 sector outlook report.

Projections for the year include continued strong industry premium growth, with improvement moderated by a combined ratio that remains above 100% and a return on surplus of approximately 5% that is still below historical norms.

Fitch Ratings expects the U.S. property casualty insurance industry to generate modest underwriting improvement in 2024, following poor auto insurance results and inordinate catastrophe losses in 2023.

However, persistently high inflation and slowing economic growth, with Fitch’s expectation for GDP to drop to 1.2% in 2024 from 2.4% in 2023, raise the potential for an unfavorable shift in loss reserve adequacy that clouds the earnings picture, led by commercial auto and other liability product lines.

Analytics anticipate that a higher proportion of individual companies will report unfavorable loss reserve development in this environment. However, few insurers are expected to have material capital deterioration from forthcoming loss reserve weakness, with capital for issuers expected to remain within ratings expectations.

U.S. P&C Insurance Outlook 2024

The 2024 sector outlook for U.S. property and casualty insurance, as analyzed by Fitch Ratings, presents a mixed scenario.

The overall sentiment for the sector is neutral, encompassing both the commercial and personal lines.

This outlook reflects the anticipated influence of various underlying fundamentals on the financial performance of the sector, especially in comparison to the results observed in 2023.

The industry broadly maintains capital strength to support obligations and withstand significant adverse experiences.

Overall statutory performance in 2023 suffered from continued weak auto insurance performance and above-average catastrophe losses from a wide number of convective storm events, leading to a larger 2023 statutory underwriting loss relative to 2022, with a combined ratio projected at 103%, and an estimated 15% decrease in statutory earnings, despite continued strong written premium growth.

Insurance industry performance is anticipated to improve in 2024

Industry performance is anticipated to improve in 2024, fueled by better personal auto performance as rate increases take hold and claims severity trends moderate, and growth in investment income from higher yields.

The market combined ratio is projected at slightly over 100% for 2024. The industry return on surplus (ROS) is projected to remain below historical norms at approximately 5% in 2024, compared with 3% in 2023.

The commercial lines sector is expected to continue to generate an underwriting profit and earnings stability in 2024. Claims cost volatility from inflation, macroeconomic uncertainty and higher litigation activity adds to underwriting and loss reserve risk.

Signs of a broad softening market are not evident, despite over four consecutive years of rising premium rates.

One of the key aspects highlighted in the outlook is the expectation of modest underwriting improvement in 2024. This improvement comes after a year of challenges in 2023, marked by poor auto insurance results and significant catastrophe losses. The recovery in 2024 is thus seen as a positive.

Sector outlook for the U.S. P&C industry remains neutral

Fitch’s sector outlook for the U.S. P&C industry remains neutral. The outlook for the individual commercial and personal lines sectors are neutral as well. Meager financial results in 2023 reflect larger year over year underwriting losses and lower statutory earnings, driven by poorer personal auto and homeowners performance.

Following two years of large underwriting losses, auto results will show more material improvement as rate increases take hold and claims severity trends moderate, though a return to segment underwriting profits is less likely

Jim Auden, Fitch’s Managing Director

“Countering the auto rebound are continued challenges P/C insurers are facing in managing catastrophe exposures and loss-cost uncertainty in many segments amid higher inflation and growing claims litigation activity and costs.”

The commercial lines sector continues to generate underwriting profits. Sector underwriting gains may narrow in 2024, but pricing trends are anticipated to remain largely positive. Property and commercial auto lines remain as segments with greater performance uncertainty.

Natural catastrophe losses were above prior norms in 2023 despite a respite from large hurricane events due to an elevated number of convective storm events.

Primary Insurers are likely to retain a higher piece of catastrophe losses going forward as recent reinsurance renewal periods led to notable increases in catastrophe reinsurance attachment points for many insurers.

US property and casualty players

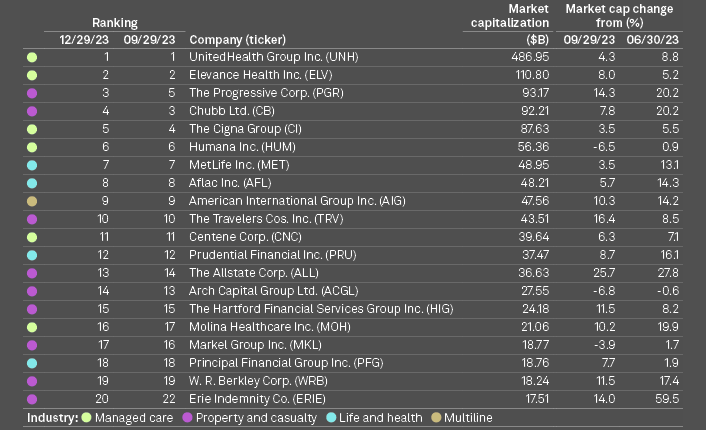

Seventeen of the 20 largest insurers trading on major US exchanges saw their market capitalization rise during the fourth quarter of 2023, according to an S&P Global Market Intelligence analysis.

Most of the increases were by 6% or more, but the nine largest gains were all realized by property and casualty (P&C) insurers.

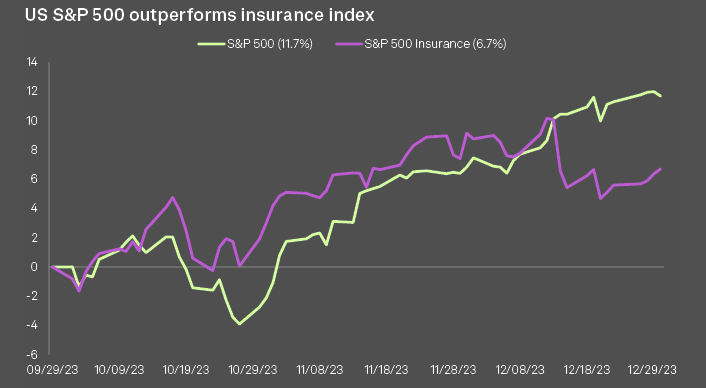

The S&P 500 Insurance index as a whole was up 6.7% nearing the end of 2023, but the sector lagged the broader market as the S&P 500 Index rose 11.7%.

Despite booking a pretax loss in the third quarter for the sixth consecutive quarter, The Allstate Corp.’s property-liability underwriting and ratios have improved. The P&C insurer had the largest gain in market capitalization this quarter, a 25.7% increase to $36.63 billion, compared to $29.14 billion in the prior quarter. Allstate now ranks as the 13th-largest US insurer by market capitalization, rising one rank from the previous quarter.

TOP 20 US P&C insurance companies

The Progressive Corp.’s market capitalization also improved quarter over quarter, rising to third place from fifth.

Another P&C insurer, The Travelers Cos. Inc., reported the second-largest percentage rise, increasing 16.4% to $43.51 billion, compared to $37.39 billion in the third quarter.

Inflation boosts US P&C insurers’ reserve risk

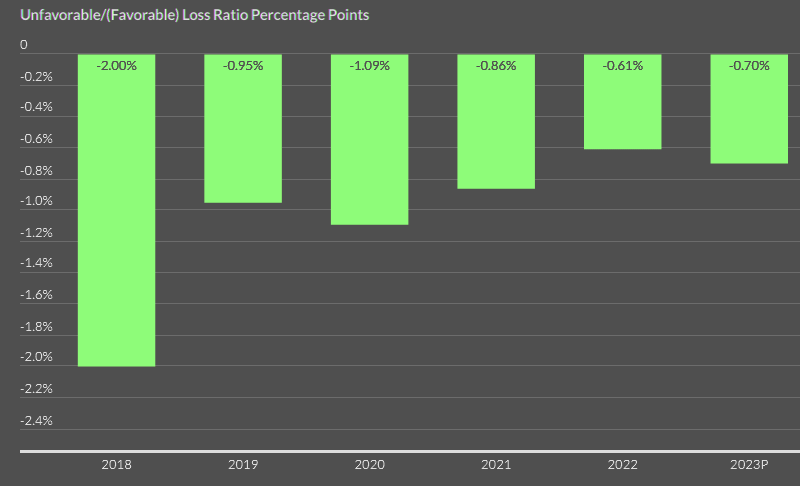

The accuracy of insurers’ loss projections for claims severity tied to inflation and litigation risks in commercial auto and other liability business will determine if the p/c industry will reach its 18 consecutive year streak of favorable calendar-year loss reserve development in 2024.

It will also largely dictate if uncharacteristic adverse reserve development persists in personal auto business.

P&C industry has generated modest calendar year reserve development of approximately 1% of earned premiums for the last five years, including 2023.

The industry’s long-run trend of reserve adequacy reflects balance sheet conservatism and improvements in information systems, claims processes and loss modeling over time.

US P&C Industry CY Reserve Development/Earned Premiums

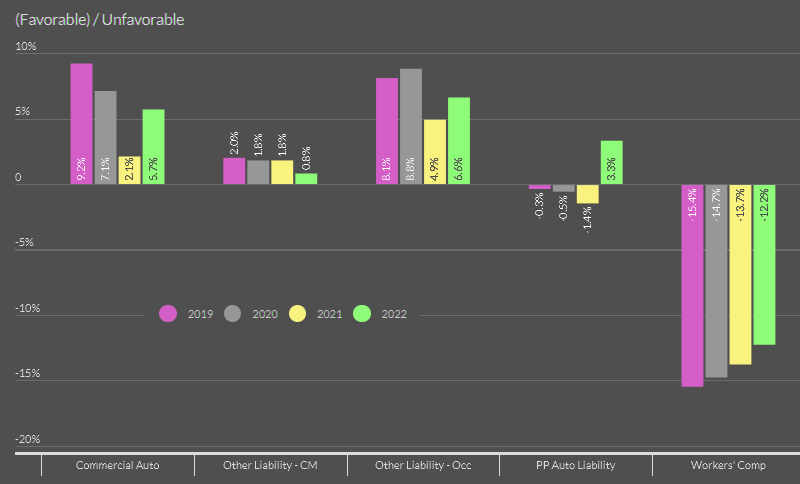

Loss reserve experience has varied by product line. While segments including fidelity & surety, medical professional liability and special property reported reserve redundancies over the last five years. However, workers’ compensation represented over 90% of all industry-favorable development from 2018-2022, averaging 14% of the segment’s calendar year earned premiums for this period.

Segment Calendar Year Development as a Percentage of Earned Premium

Workers’ compensation loss reserves are likely still significantly redundant, but carriers’ ability to maintain large redundancies in a weakening pricing environment remains uncertain, with declining workers’ compensation premium rates point to higher future loss ratios going forward. The segment benefits from a long-term trend of declining claims frequency, but a significant rise in medical inflation could lead to a reduction in reserve strength.

The commercial auto liability and other liability – occurrence (OL-OCC) and claims made (OL-CM) segments have reported significant unfavorable calendar year reserve development in each of the last five years. OL-OCC reported reserve deficiencies averaging 7% of segment earned premiums from 2018-2022 and commercial auto averaged 6%.

On an accident year basis, these segments continued to exhibit weakness in the 2015-2019 accident years. Reserve experience thus far is better in the 2020-2021 underwriting periods.

However, potential for segment reserve weakness in the 2022 and 2023 accident years is elevated by recent economic inflation and rising social inflation from increases in litigation activity and nuclear verdicts.

The personal auto line is traditionally a source of reserve stability with a history of generating modest reserve redundancies over time.

However, auto writers’ slow recognition of sharp increases in claims severity from pandemic-related supply chain shortages, higher parts and labor costs, and greater litigation exposure led to large underwriting losses and adverse reserve development in 2022 and 2023.

While underwriting changes and large premium rate increases will foster better personal auto performance in 2024, reserve deficiencies may continue to emerge in this segment over the near term.

…………………….

AUTHORS: James Auden, CFA – Managing Director Fitch Ratings North American Insurance, Laura Kaster, CFA – Senior Director Fitch Wire – North and South American Financial Institutions