The U.S. property and casualty insurance sector experienced subdued statutory financial performance, primarily due to a decline in personal lines.

Fitch Ratings anticipates a modest improvement in the segment’s underwriting results and profitability in 2024, although risks from catastrophe events and variable loss costs remain.

For 2024, the U.S. P&C insurance sector holds a neutral outlook across both commercial and personal lines, expecting stable or better results, especially with the anticipated recovery in personal auto and steady performance in commercial lines.

Notwithstanding a robust 9% increase in earned premiums for 9M2023, the sector’s overall performance was impacted by weak auto insurance and higher-than-average catastrophe losses (see about US Auto Insurance Rates by States).

P&C Insurance Underwriting Results

The underwriting combined ratio escalated to 103.5% in 9M2022, from 102.3% in the previous year, leading to a 28% drop in net earnings to $17.4 billion, primarily due to greater underwriting losses, partially offset by increased investment income.

The annualized net income return on policyholders’ surplus was significantly below the norm at 2.4% for 9M2023, with a 1% decrease in policyholders’ surplus to $970 billion compared to the end of 2022 (ыуу фищге Impact of Social Inflation for P&C Insurance).

These results have been adjusted for extraordinary items reported by Berkshire Hathaway, including a significant $48.1 billion investment gain in 2023 and a one-time $10.8 billion investment distribution in 2022.

P&C Insurance Industry Performance Highlights

| 9M2023 | Change | |

| Loss Ratio | 78.4% | 2.0% |

| Expense Ratio | 24.8% | -0.8% |

| Dividend Ratio | 0.3% | 0.0% |

| Combined Ratio | 103.5% | 1.2% |

| Return on Surplus | 2.4% | -0.9% |

| Net Written Premiums | 645.2 | 10.2% |

| Underwriting Gain Excl Policy Divs | (32.0) | 46.3% |

| Investment Income | 51.0 | 19.4% |

| Realized Investment Gains | 3.5 | 16.1% |

| Net Income | 17.4 | -28.1 |

| Policyholders’ Surplus | 970.4 | 4.8% |

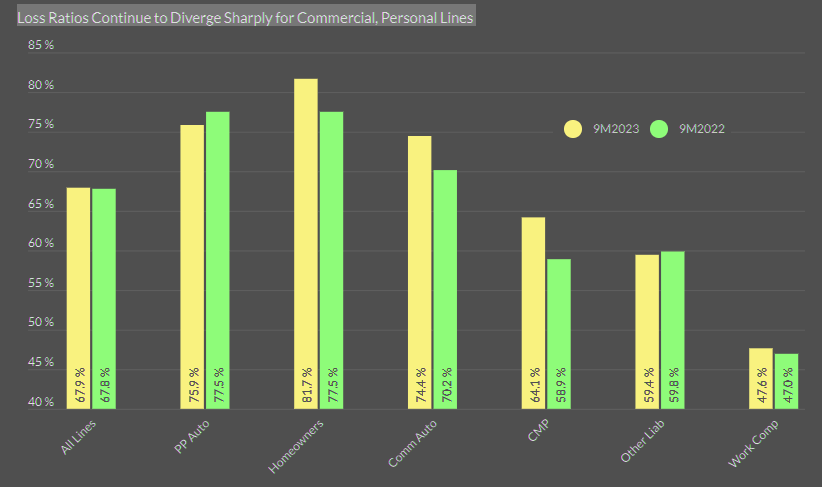

In the interim reporting period, there’s a clear disparity in underwriting performance between personal and commercial lines, as evidenced by the direct loss ratios. The personal auto sector continues to grapple with escalating loss severity, impacting incurred losses.

For 2024, we anticipate a slight improvement in the auto industry’s combined ratio, decreasing to 109% from 112% in 2022.

Although there’s been a notable increase in premium rates, the direct loss ratio for personal auto has marginally declined by 1.5 percentage points year-over-year to 76%. Additionally, the homeowners’ direct loss ratio rose by 4 percentage points to 82% in 9M2023, largely due to higher-than-average natural catastrophe losses, particularly from an unusual frequency of severe convective storm events.

P&C Industry Direct Loss Ratios

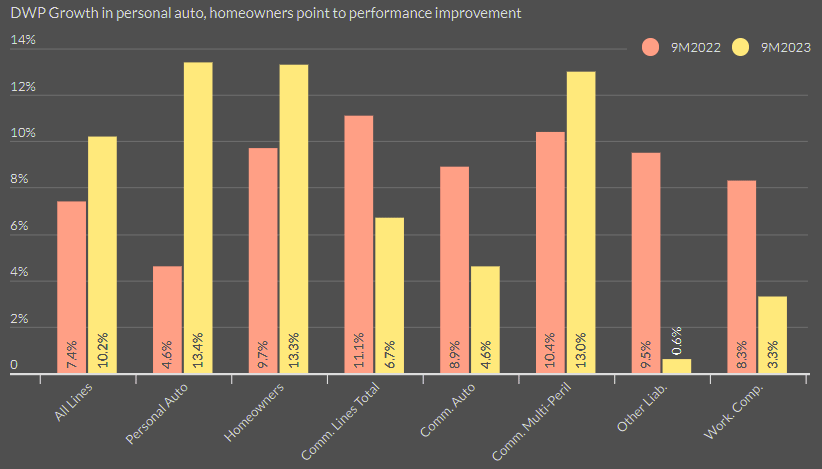

According to Fitch report, it’s notable that both personal auto and homeowners sectors have seen a 13% growth in direct written premiums (DWP) this year, with indications of diminishing loss severity in 2024. This suggests a gradual improvement in personal lines, though achieving underwriting profits will require time.

For homeowners, underwriting strategies and a return to normal catastrophe levels are expected to enhance results in 2024.

However, the challenge lies in adjusting to inflation impacts on building costs and property values.

P&C Insurance Segment Growth in Direct Written Premium

Contrastingly, the commercial lines sector has maintained underwriting profitability in 2023, a trend likely to persist into 2024.

The direct loss ratio for commercial lines remained stable year-over-year at 58% in 9M2023. Workers’ compensation and other liability lines showed strong performance, whereas commercial auto and multi-peril faced some decline.

The growth of commercial lines DWP decelerated to 7% in 9M2023, down from 11% previously. With pricing trends expected to soften in 2024, further reductions in premium growth are anticipated.

Despite these challenges, including loss cost inflation and increased litigation, underwriting ratios below 100% are projected for the commercial sector in 2024, though profitability margins may compress.

P&C Insurance Underwriting Forcast

The U.S. property and casualty (P&C) insurance industry is forecasted to return to underwriting profitability in 2024, with an anticipated combined ratio below 100%. This follows a 100.8% combined ratio in 2023, an improvement from 102.6% in 2022, but still above the break-even threshold for underwriting profitability.

Fitch Ratings’ holds a neutral fundamental sector outlook for the U.S. property & casualty insurance, and for both the commercial and personal lines sector in 2024. The sector outlook considers the influence of underlying fundamentals foreseen for the coming year on financial performance relative to results in 2023. The industry broadly maintains capital strength to support obligations and withstand significant adverse experiences.

Insurance industry experienced significant growth, with double-digit increases in direct premiums written across the P&C sector. This growth is attributed to corrective actions by carriers in private auto, residential, and commercial property insurance.

Notably, private auto insurance saw the most rapid growth in direct premiums in at least the last 25 years.

The commercial auto sector, however, recorded a combined ratio of 105.4% in 2022, a rise from below 100% in 2021. Conversely, workers’ compensation achieved a combined ratio of 83.9% in 2022, nearly 3.3 percentage points down from 2021 and the second-lowest in the past 25 years.

Overall, the P&C industry is projected to continue experiencing robust growth, marking the first time in 21 years to witness such a level of expansion in direct premiums written

…………………….

AUTHORS: James Auden, CFA – Managing Director Fitch Ratings North American Insurance, Christopher Grimes, CFA – Senior Director Fitch Ratings, Laura Kaster, CFA – Senior Director Fitch Wire – North and South American Financial Institutions