Surplus lines insurance premiums exceeded $31 billion, and premium bearing transactions neared 2.8 million, according to the report of the US Surplus Line Service and Stamping Offices.

Premium increased 32.4% compared to the same period last year, transactions were also up 9.4%.

Year-to-tear premium grew at the highest percentage rate, when the stamping offices started reporting on the data, the Wholesale & Specialty Insurance Association (WSIA) explained.

The increase in premium bearing transactions has also been the highest percentage growth since 2017, the report highlighted.

Stamping offices usually report higher premiums in quarters three and four than in quarters one and two. According Global Economic Outlook and Market Forecast, most of them predict that dynamic economic factors will drive continued growth in the market for the rest of the year.

A continuing hard market, and the New York numbers closely track the averages across the 15 states.

While an unprecedented level of startup carriers have entered the E&S market it has not yet resulted in insignificant downward pressure on rates.

The rate of return on bonds and treasuries has improved somewhat, but inflation, social inflation, property catastrophic risk exposures, including war and other risk exposures arising out of Russia’s attack on Ukraine, are all “counterweights to aggressive underwriting.”

Some states, like Texas, Florida and Nevara, reported record-setting numbers during the first two quarters of 2023. Premium reported in April exceeded the $1 bn milestone, a first for the State of Texas market. May and June have also exceeded the threshold.

Nevada’s largest increases were in construction, property and professional cyber insurance liability. This indicates that increasing prices for construction materials, and inflation generally, is likely driving at least some premium growth.

These upswings are due to a reduction in capacity in the admitted markets causing both a hardening of pricing and an increase in transactions with the E&S marketspace.

Freedom of rate and form, one might argue, is a key ingredient in the ability to surpass one’s contemporaries in a crowded and competitive P&C insurance market.

Which is not to say such success is easily earned. Several key hurdles must be traversed. Many E&S executives will tell you that rates still aren’t where they should be on several key lines, although some pockets of increases can be seen.

Overall it’s still a profitable business to be in, but operating in Surplus Lines remains as challenging as ever.

This is an exciting time in the E&S market. It continues to trend in a favorable direction, and has been gaining scale and size over the last few years.

While there has been uncertainty with the rates in the market, there has been an increased demand for carriers to provide solutions to complex risks as well as demand for carriers to develop new products to address the emerging issues that our customers are facing.

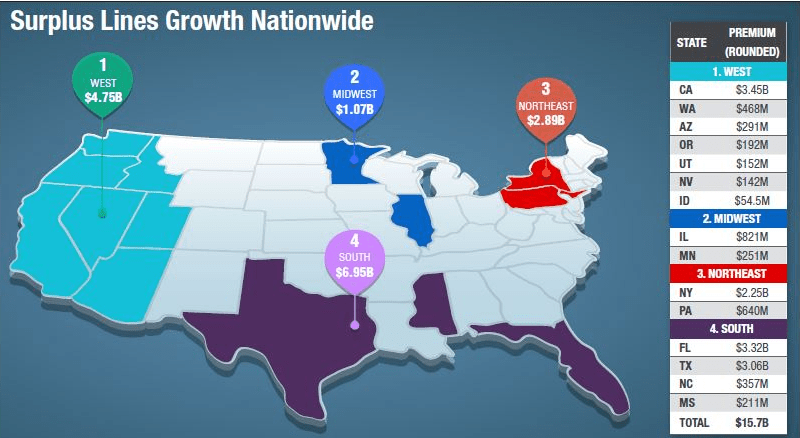

He points out that historically, 50% of U.S. E&S premiums came from five states: California, Florida, New York, Texas and Illinois.

But now, other states are seeing their own increases: Seven states saw an uptick in filings of more than 10% in the past year, the largest of which were seen in Washington (18%) and Utah (16%).

It will be interesting to see if this remains regional or will be more of a national expansion. As the market continues to evolve year-over-year, I anticipate this favorable growth trend will continue.

by Yana Keller