Geopolitics added to substantial loss volatility in 2022. The war in Ukraine has brought devastating humanitarian consequences first and foremost, but also unexpected losses and economic shocks. The Ukraine war and covid-19 demonstrate the vast loss potential from systemic perils, according to Howden Report.

The full extent of insurance and reinsurance losses stemming from the war between Russia and Ukraine remains a murky subject with many unknown factors, but analysts at Fitch Ratings are confident that the war will prove to be a “contained risk” for the market (see how War in Ukraine Slows Growth of Global Re/Insurance Market).

The convergence of geopolitical and macroeconomic shocks – war in Ukraine, fractured energy markets, 40-year high inflation, interest rate hikes, depleted capital – as well as the second most expensive natural disaster ever (Hurricane Ian), has introduced significant volatility into the market.

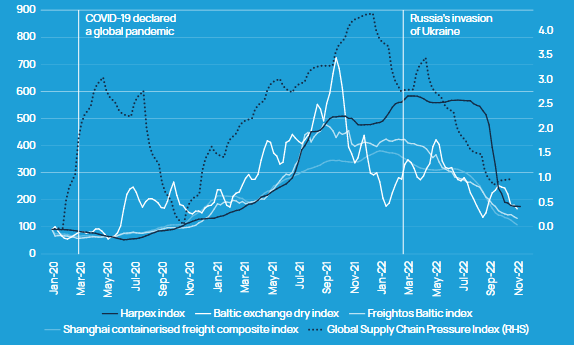

The crisis early last year impaired already stressed supply chains, before shipping costs and overall pressures subsequently subsided through the course of the year.

Both the war and COVID underscore the need for companies to secure supply chains and reduce reliance on geopolitical hotspots.

Pricing cycles in the commercial insurance and reinsurance sectors are now converging, marked by price increase moderation overall for the former, albeit with strengthening in challenged areas, and rapid acceleration (dislocation even) for the latter (see How Global Reinsurance Market Endured a 2023 Renewals?).

Global supply chain pressures

Heightened tensions in Ukraine and elsewhere, including the Taiwan Strait, along with the global economic downturn, potential COVID disruption in China, energy security concerns and climate change, will continue to pose a significant threat to global supply chains in 2023. Indeed, analysts are predicting semi-permanent disruption for the next decade (see How Russian War in Ukraine Impacts for Global Insurance Sector?).

The challenges and inefficiencies that come from building greater supply chain resilience (e.g. near-shoring or friend-shoring) will only add to cost pressures confronting businesses around the world, especially at a time of heightened gas supply uncertainty in Europe and a global shortage of semiconductors.

Whilst claims from the Ukraine war are likely to be manageable overall for the (re)insurance sector, the concentration of losses amongst premium-light lines of business will lead to disproportionate pain.

Specific segments of the speciality (re)insurance market, covering niche areas like aviation war, marine, political risk, political violence and trade credit, are undergoing varying degrees of corrections from the sizeable losses that have and will transpire, albeit over a prolonged period.

War-related losses reported by individual (re)insurers

After a series of announcements in the first half, with losses aggregating to around USD 2.5 billion, only a handful of carriers added to reserves in 3Q22. This was due in large part to ongoing hostilities (making access for loss adjustors difficult) and little additional visibility on how losses will develop.

Most carriers to report losses have yet to include aviation in their provisions. With several cases destined for court and verdicts potentially years away, this will act as an overhang for those exposed for some time to come (see CEE Insurance Market Review & War in Ukraine Impacts).

Reported (re)insured losses for Ukraine war vs ultimate industry loss estimates

Reported losses have some way to travel before they get close to the expected ultimate industry loss of USD 10 billion to USD 20 billion. Amidst widespread acknowledgement that additional reserves will be booked in 2023 and potentially beyond, specialty reinsurance treaties underwent significant repricing at 1 January 2023, alongside tightened terms and stripped back composite covers.

With the Ukraine crisis coming fast on the heels of COVID-19, it demonstrates the vast loss potential associated with systemic perils.

Both events have shown that losses emanating from what appear to be distinct perils like business interruption, cyber, supply chain failures or price shocks are often connected and can strike simultaneously.

They straddle multiple classes of business and bring sizeable loss accumulation potential by flouting traditional controls around correlations, boundaries and duration.

The scale of such events has moved loss scenarios from the theoretical to the real world and, in doing so, caused a marked shift in risk perceptions.

Additionally, uncertainty also surrounds potential claims arising from the Ukraine-Russia conflict, although, the report noted, exposures in this case seem to be much more concentrated in the largest industry players.

Even though the conflict’s impact in the industry is estimated to be comparable to a medium-sized property catastrophe event, individual approaches to booking reserves vary widely. When aggregated, it noted, reserves booked as of mid-year 2022 fall far short of whole industry estimates.

As in the case with COVID-19, there is a high level of uncertainty with regard to reserves at the primary carrier level; determining estimates for reinsurers becomes even more challenging due to data issues and differences in interpretation regarding accumulation.

Last year the agency noted early signs of a rise in reserve releases as a percentage of premiums, which also spotted this year. Yet AM Best still believes that it is too early to tell if there is a trend, and is confident that, in general, the global reinsurance segment maintains a prudent approach to claims reserving.

Russia-Ukraine war as a contained risk for re/insurance sector

There have been a variety of strategies utilised by individual companies in reserving for this event, with many looking to “bleed” in the results for losses on their estimates, as they come in.

The industry at large is still in the dark about where the overall loss figure from the war will end up.

This is similar to how many firms approached reporting for COVID-19 losses, much of which still remain incurred-but-not-reported (IBNR).

Unlike with the pandemic, most re/insurers will have been able to immediately drop their exposure to the conflict after an initial heavy loss.

We have to be aware that the industry – be it the cedants or the reinsurers themselves – will cut exposure to Russia and Ukraine relatively quickly, either because they have to, or because they consider it to be uninsurable or not to be priced.

………………..

AUTHORS: Julian Alovisi – Head of Research Howden, David Flandro – Head of Analytics Howden