The transportation and logistics sector plays a crucial role in driving global economic expansion. It is the backbone that ensures the seamless movement of goods worldwide, utilizing ships, aircraft, trucks, and trains. This industry not only facilitates the delivery of food to our tables but also plays a vital part in the journey of semiconductor chip components through various stages of production and assembly.

There’s a deep-rooted linkage between this industry and the Lloyd’s market. Historically, Lloyd’s has been at the forefront of insuring maritime ventures, dating back nearly 350 years, and it issuing the first-ever insurance policies for motor vehicles and aviation.

Lloyd’s and WTW published a joint report “Loose connections: rethinking semiconductor supply chains”, the series of reports exploring supply chain risk.

The Lloyd`s report “Rethinking transportation and logistics supply chains” examined the semiconductor sector’s risk challenges and aimed to spark product innovation through outlining the opportunities to develop new supply chain solutions.

Beinsure has delved the main trends and new opportunities for re/insurance innovation in transport and logistics chains, outlined in the Lloyd’s Report. This report in the series explores the transportation and logistics industry and its response to supply chain risks as the key mover of the world’s goods (see how War, Disruptions of Supply Chains & Climate Change Impacts on the Re/Insurance Industry).

A Key findings include:

- Over 120 transportation and logistics business have been surveyed and interviewed for their insights. The insurance industry has an opportunity to deepen its long partnership with an industry proactively challenging its supply chain risks to enable global resilience

- In the transportation and logistics sector, handling supply chain risks is a daily challenge. Interestingly, many initiated conversations with a disclaimer of not being supply chain experts, yet demonstrated a profound understanding of their risks. There’s a growing recognition among these companies that supply chains are not just cost-saving avenues but also a source of competitive advantage. Furthermore, there’s an eagerness to explore further enhancements in risk management and product development in collaboration with insurers.

- There exists a significant potential for informed, data-driven discussions between the technical experts in the transportation and logistics industry and the insurance sector. Such dialogues could facilitate better knowledge sharing, fostering innovation and leading to insurance solutions that more accurately address the specific needs of these companies. Notably, there are existing solutions for supply chain risks that some companies are unaware of, alongside identifiable areas where insurers could innovate further (see about Cyber Supply Chain Risk: Background & Innovation)

- The greatest opportunity for advancement and innovation in risk and insurance lies in enhancing supply chain data. With an abundance of information now available, there’s scope for comprehensive analysis of supply chains, scenario modeling, and the development of new insurance solutions. Collaborations with third-party providers focusing on operational efficiency, and the use of tools like risk management and supply chain diagnostics, can help in effectively interpreting and applying this data. This in turn can speed up the innovation process for insurers. The third section of this report series also highlights how new data is emerging from industry associations and regulatory bodies, the formation of standards, and instances of government investment in transportation infrastructure to bolster national and global resilience.

Transportation and logistics connections

The transportation and logistics sector has been famously resilient for being able to switch from one mode to another to keep goods on the move, but any disruption has vast ripple effects on all sectors of the economy (see about Risk Mitigation for Ukrainian Grain Exports in Global Insurance).

Talent shortages, the implementation of green technologies, climate risks such as changing river levels and heatwaves causing go-slows, rising instances of fires from batteries and the aggregation of goods in mega-warehouses all threaten the sector’s – and by extension global economic resilience.

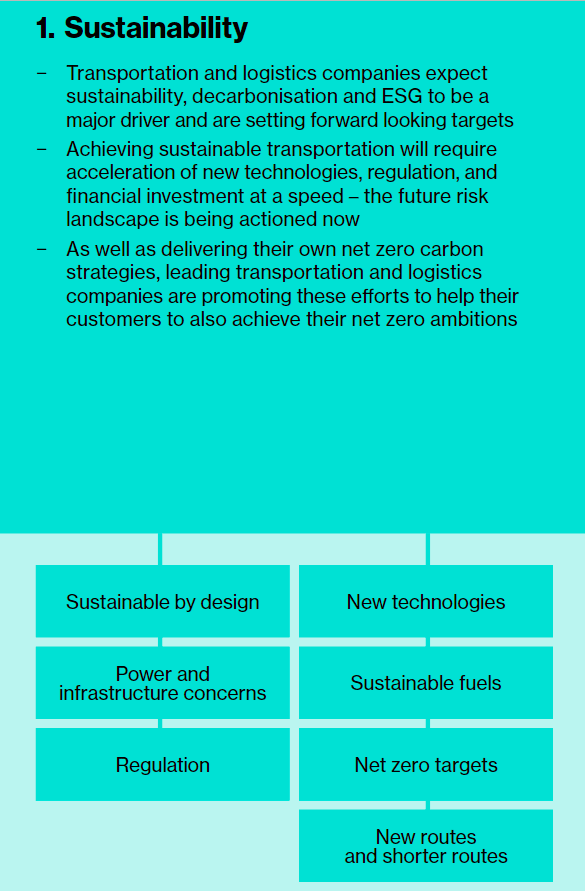

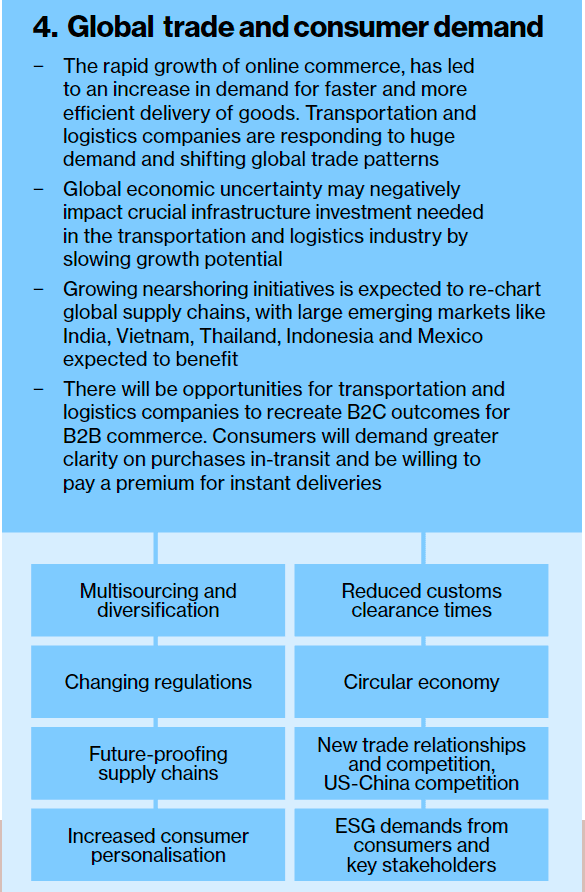

As the sector looks to decarbonise, meet consumer demand through last mile delivery, and connect emerging markets to global trade, businesses and governments around the world are reconsidering how they move and store goods between their supply chain nodes and looking to logistics providers to help them improve and optimise.

Industry research forecasts that the global transportation and logistics market may reach $13.77 trn by 2028, equivalent to a compound annual growth rate (CAGR) of 6.23%.

In the short-term, the conflict in Ukraine, inflation, and fears of a global recession threaten a slowdown in the performance of many companies and the associated logistics market. Looking forwards, the transport sector will play a significant role in increasing access to opportunities and is a crucial enabler for the 2030 Agenda for Sustainable Development.

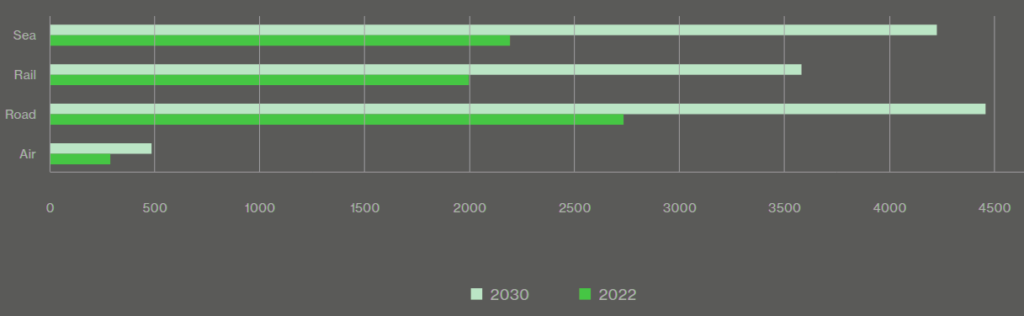

Global market value by transportation mode in $bn, 2022-2030

Of the transportation and logistics companies surveyed in WTW’s Global Supply Chain Survey, 54% said they had either completely overhauled or made significant changes to their supply chain in the last two years to manage the risks that they face and 64% said they would be making significant changes in the next 12 months. There is also recognition that they can do more, and interest in working with the insurance industry to act on this.

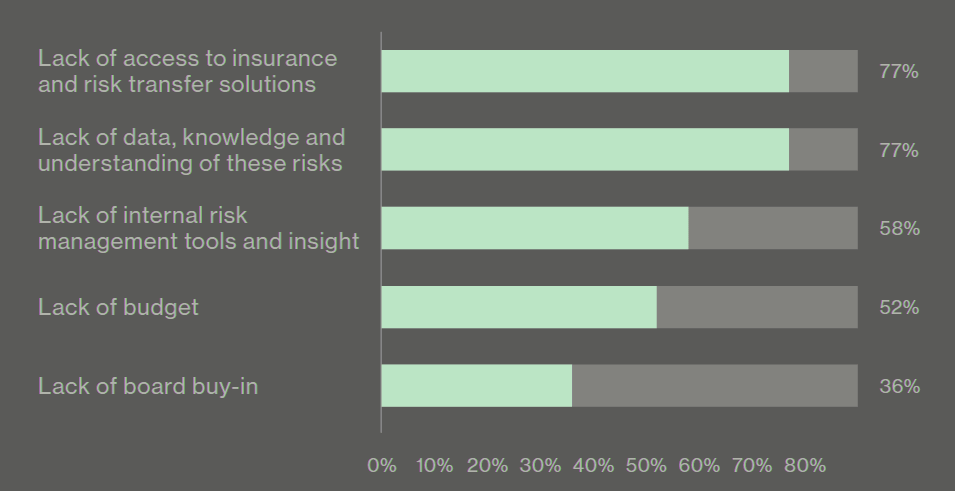

Looking forward, 77% said that a lack of insurance solutions was among the greatest challenges to addressing their risks, providing a clear signal to the insurance industry that the sector is a willing partner looking to explore new solutions to meet future challenges with risk transfer.

What are the three greatest challenges to addressing your risks over the next 3 to 5 years?

Transportation and logistics businesses are not alone in investing in supply chains. Governments, financial institutions and industry regulators are actively working towards transitioning to a low carbon economy, assessing national vulnerabilities and resilience of critical supply chains, with an example of this being the World Bank announcing a $50m project to repair and restore Ukraine’s transport network to support immediate humanitarian relief and recovery, and increase capacity of import and export corridors, with additional funding of up to $535m expected to follow.

Supply chain insurance and product innovation opportunities

To move forwards in supporting the transportation and logistics industry in transferring their risks, it is important to understand the current state of supply chain insurance for the industry and the challenges that have prevented further progress.

The global logistics insurance market alone is predicted to hit $70.5bn by 2030, expanding at a compound annual growth rate of 2.8% between 2023 and 2030

Across the interviews with transportation and logistics companies there was a range of knowledge of the insurance covers available for industry supply chain specific risks – with some companies very familiar with insurance solutions that would meet their needs and others describing perceived ‘gaps’ where solutions already exist (see Global Insurance Market Dynamics, Products & Regional Trends for 2024).

This has been a common feature across the topic of supply chain – it means different things to every company, and there is a need for all insurers and brokers to reopen conversations specifically on supply chain risks.

92% of transportation and logistics companies said that insurance for supply chain risks was either mission critical or necessary, and 60% shared they felt supply chain risks were covered by specific supply chain insurance.

However, this figure was only 17% for business interruption (BI) insurance with 57% sharing they felt they had no specific BI insurance but the risks were covered by other insurance. As well as building greater awareness of solutions there is a clear need for insurers and insureds to clarify what is and isn’t covered for supply chain risks, losses and consequences.

This is where business interruption reviews and specific supply chain risk assessments will be key cornerstones to establishing clarity. This is critical, as in the next 3-5 years.

The transportation and logistics industry are very aware of their supply chain risks and deal with them on an ongoing operational basis.

While risk maturity varied at the more strategic level, every company is working on multiple solutions to track, monitor, and surface additional data that will allow them to respond to delays and interruptions.

Current state of the supply chain insurance

Several products exist in the global insurance market affording some cover for supply chain risks, including business interruption (BI), with suppliers’ extensions typically included by endorsement to provide contingent business interruption (CBI) cover, and extending to other policies such as political violence, marine cargo (including Stock Throughput), or cyber can also be purchased to address specific supply chain risks.

Within the food and drink industry report it was suggested supply chain risks could be covered under an end-to -end policy given greater sharing of information, and in comparison, the transportation and logistics industry is even broader.

Transportation and logistics supply chains revolve around key routes and large aggregations in the case of large containerships and ports, so insurers are mindful of accumulations and their risk appetites when considering supply chain cover for these key suppliers.

In the marine industry alone the combined value of the global merchant fleet increased 26% to $1.2trn, while the average value of container shipments has also been rising with more high-value goods such as electronics and pharmaceuticals.

Looking forwards, the threat of global sanctions, ESG, inflationary costs, reputational risks and continued supply chain disruptions are all key considerations for insurers. As a result unspecified suppliers limits have been slowly reducing, and currently normal levels are typically around about £5m.

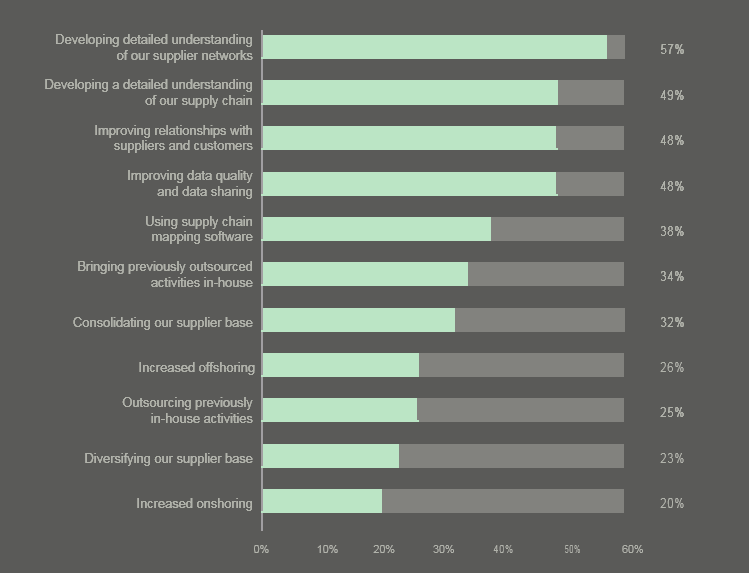

Measures with greatest impact on managing supply chain risks

Any supplier limit in excess of that would require a bespoke conversation between insurer and insured; however, many markets are prepared to provide limits, with this decision typically driven by robust business resilience arrangements. Insurers are keen to understand how the clients’ business actually works, what plans are in place to protect it, and how they can support (and ultimately reduce their exposure) with risk management, broker intervention, or insurance products.

Barriers and opportunities of the supply chain insurance

This research identifies several key barriers to solve that could help to address current protection gaps in transportation and logistics supply chains:

- There is a diverse range of supply chain risk maturity across the transport and logistics industry, with leaders taking a more strategic approach while others focus on operational aspects. However, all companies are working on digitalisation of their operations and have a strong desire to do more to manage their risks. Insurers are seen as key sources of information and transportation and logistics companies would like to work with them – in turn they hold a wealth of insights that can support risk understanding

- Awareness of insurance solutions varied across the industry, with many companies describing supply chain gaps where products already exist. Having an insurance-based conversation on supply chain as part of our interviews allowed new areas of interest to surface and this represents a key opportunity

- Following on this theme, awareness of Alternative Risk Transfer (ART) solutions ranges across the industry transportation modes. They are still relatively new to the market and depend on several data factors which can be difficult to articulate or quantify. In addition, where ART solutions are structured, the cost may be prohibitive for customers with one airline highlighting a lack of perceived value for the expense. However, gaps were described where solutions are being structured and could be supported by various industry data gathering initiatives

- Similar to the semiconductor industry, the transportation and logistics companies we spoke with feel that an end-to-end supply chain solution doesn’t exist or is seen as too difficult to procure – although they also highlighted the value of other standard insurance coverage they purchase. At the same time, risk mature transportation and logistics companies mirrored semiconductor company commentary around a lack of understanding of the extensive supply chain risk management practices undertaken by businesses in the sector and felt that insurers have been slow to the needs of the sector and its robust management

- In many instances, insurance solutions are already available but not fully understood or valued by customers. Building on this, when asked to provide the type of coverage, gap fillers or extensions that transportation and logistics companies typically seek, insurers often ask for significant volumes of information to enable a full consideration of their risk appetite and availability of capacity. As seen across the other industries explored in this series, a factor behind this appears to stem from legacy concerns around historic supply chain losses. A thorough assessment of existing pre-conceptions is therefore important to enable progress around supply chain insurance.

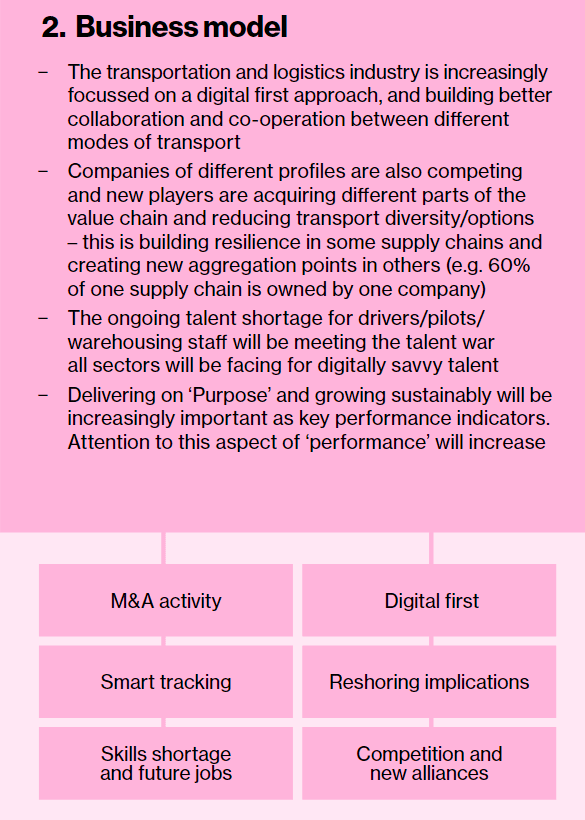

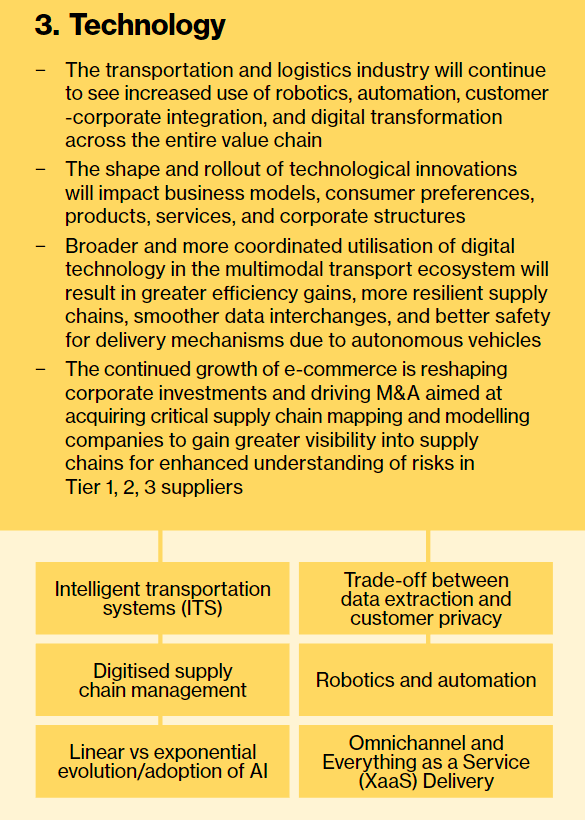

A forward look at drivers, trends and risks

A chance for insurers to keep goods on the move

The challenge of accessing high-quality, timely, and practical data throughout supply chains has been a longstanding issue for businesses and their insurers.

With the progression of digitization, companies in the transportation and logistics sector are actively investing in technological solutions like enterprise resource planning (ERP), electronic data interchange (EDI), and application programming interface (API) systems.

These investments aim to boost operational efficiency and fortify customer relationships across the entire value chain.

This trend is corroborated by the 2023 WTW Supply Chain Survey, which reveals that 81% of transportation and logistics firms have either fully identified their data needs and established robust data gathering processes or are in the process of doing so.

This figure surpasses that of semiconductor companies by 11%. Additionally, 57% of respondents are delving into a comprehensive understanding of their supplier networks, and 48% are enhancing relationships with suppliers and customers to facilitate this.

Insurers stand to benefit from these emerging data sources, leveraging them to spur product innovation, including the development of new offerings, customization of existing products, or gaining deeper insights into potential risk areas.

Notable examples of third-party companies like Oracle, SAP, Blue Yonder’s Luminate Logistics, CH Robinson’s Navisphere, project44, and Shippeo are using technology, risk engineering, and insurance expertise to assist clients in identifying, evaluating, mitigating, and transferring supply chain risks.

An opportunities for Re/Insurance industry

Innovative solutions:

The (re)insurance industry can help to build long-term resilience by deploying its capital to remove risks from customers’ balance sheets and reduce their exposure to supply chain risks.

The increasing turbulence of the risk landscape and the demand for more bespoke coverages raises expectations of the insurance industry to innovate in the way that it provides services and improve its communication around how existing products can respond to supply chain risks.

In some cases those interviewed for this research described perceived product gaps where solutions already existed; however, a series of protection gaps have been identified which insurers could look to address. In some cases further modelling, data partnerships and in-depth conversations with the transportations and logistics industry may be required.

Collaborative action:

Insurers, brokers and risk management service providers have a unique opportunity to support conversations between insurers and insureds.

As an industry built on the principle of bringing teams together to discuss and share risk, opening the dialogue on supply chains and forming new partnerships will allow insurance to respond to a fast-moving landscape.

Transportation and logistics companies are acting now, and brave and agile insurers can harness this opportunity. This also extends to exploring public private partnerships as governments around the world look to secure national supply chain resilience and critical transportation and logistics infrastructure.

Explore new data sources and partnerships:

The improved visibility of supply chain related exposures from new data sources will be a key factor in helping insurance play a meaningful role.

The transportation and logistics industry recognises that providing insurers with better data and having a more bespoke conversation with insurance partners will be critical to ensuring that their capacity and coverage requirements can be met.

Provide expert advice:

The insurance industry has an opportunity to actively help customers reduce their supply chain risk. Insurers have a unique opportunity to partner with an industry in that is already exploring its supply chain risks by supporting their risk management planning, mapping and modelling efforts.

Entering into dialogue with businesses operating across the transportation and logistics industry can help both insurers and customers better understand the challenges around obtaining specialist insurance cover, and whether cover could be restructured, segmented or consolidated to make it more effective and sustainable.

………………….

This report – a collaborative effort between Lloyd’s Futureset and WTW – aims to highlight the supply chain challenges facing the transportation and logistics industry and the potential role that insurance industry could play to boost the resilience of a sector that has become essential for keeping global trade on the move. Over the past four months, analytics surveyed and interviewed over 179 risk, supply chain, and insurance practitioners.

Edited by Oleg Parashchak – CEO Finance Media and Beinsure Media