Marsh McLennan’s new Unity facility to cover Ukrainian grain exports could pave the way for more insurance solutions to support the country amid the ongoing war. The full extent of insurance and reinsurance losses stemming from the war between Russia and Ukraine remains a murky subject with many unknown factors, but analysts are confident that the war will prove to be a “contained risk” for the market, according to Insured Losses for Ukraine War Outlook.

Unity’s unique structure will enable underwriters to price risks at more affordable levels than those experienced in recent months.

The first projects on the procedure of cheaper insurance of maritime shipments in Ukraine’s territorial waters are already being implemented jointly with the insurance market, which contributes to the safety of maritime transportation and to increasing the Ukrainian exports.

The new arrangement for insurance of maritime shipments in Ukraine’s territorial waters will lower the grain insurance cost by around 2.5 percentage points of the insurance tariff, which will give grain traders the opportunity to save around UAH 100-140 per tonne of cargo, and overall, agricultural producers will gain an additional UAH 4 billion. These funds will be channeled to farmers both by increasing the purchase price and for additional purchases.

Ship insurance is one of the most complex projects involving dozens of stakeholders. This clearly demonstrates that the international insurance market is ready to operate in Ukraine.

Yulia Sviridenko, Ukrainian First Deputy Prime Minister and Economy Minister

“Our further joint steps will be aimed at expanding the introduction of similar insurance instruments for other types of exports,” Sviridenko says.

Unity Facility to Cover Ukrainian Grain Exports

According to Beinsure, Marsh in collaboration with the Ukrainian government, the Export Credit Agency of Ukraine, Ukreximbank, Ukrgasbank and DZ Bank, launched of a new facility – Unity – to provide affordable insurance supporting the export of grain and other critical food supplies globally from Ukraine’s Black Sea ports.

Launched in November, Unity will provide up to $50 mn in hull and separate P&I war risk insurance underwritten by Lloyd’s of London insurers

Ukraine’s ports have been closed since Russia’s invasion in February with marine insurers based in Lloyd’s of London and the wider London commercial insurance market awaiting more assurances given the potential losses involved with every ship.

The program aims to enable shipowners to get coverage to transport grain and other goods by sea from Ukraine, which relies heavily on revenue from its agricultural exports, in the absence of safe corridors.

The Unity facility is expected to significantly reduce the costs of insuring ships exporting Ukrainian grain, thereby easing the ongoing pressure on supply chains and bolstering global food security.

Unity initiative is beneficial to developing nations

This initiative is particularly beneficial to developing nations that are major purchasers of Ukraine’s grain. Moreover, it aligns with Marsh McLennan’s commitment to leveraging its expertise in supporting global food security and stability, as well as aiding Ukraine’s future recovery and reconstruction efforts (see how War in Ukraine Slows Growth of Global Re/Insurance Market).

We have done something like this 20 years ago, but not for a country that was physically at war. That’s a key differentiator here. But it’s also created a huge challenge

Marcus Baker, global head of marine, cargo & logistics at Marsh

“The issue of getting money out of a country like Ukraine, and especially when it’s at war, is very difficult. So, finding a mechanism where everybody trusts what’s going on has been part of the challenge.”

“It has taken up a fair amount of time, but if we can have some success in reducing the price of the grain shipments coming out in Ukraine, the advantage that’s going to have for the world and global food scarcity is payment enough,” said Baker.

The launch of Unity follows Marsh’s earlier commitment to provide its services and expertise, pro bono, to the Ukrainian government.

New data platform to assess war risks in Ukraine

The ongoing efforts include the creation of a data platform to assess war risks in Ukraine, strategic advisory services from Oliver Wyman, and catastrophe reinsurance modelling from Guy Carpenter.

Though brokers acknowledged the considerable benefit of a facility of this scale, he said the market was still taking a substantial risk.

Because of the financial support that the Ukrainian government has given, the market will be able to reimburse themselves if there is a claim, but that’s finite. The market must take on a level of risk.

Marsh are hoping that the insurance limit doesn’t get exhausted. Despite the financial risks of a program like Unity, there is also a tremendous moral reward.

What is the essence of the problem of Russia blocking Ukrainian grain ports?

The blockade of Ukrainian grain ports by Russia is a complex issue affecting global food security, international trade, and the insurance market, with wide-ranging economic, social, and political implications.

The blockade of Ukrainian grain ports by Russia has significant implications both economically and geopolitically. Here’s an overview of the key issues:

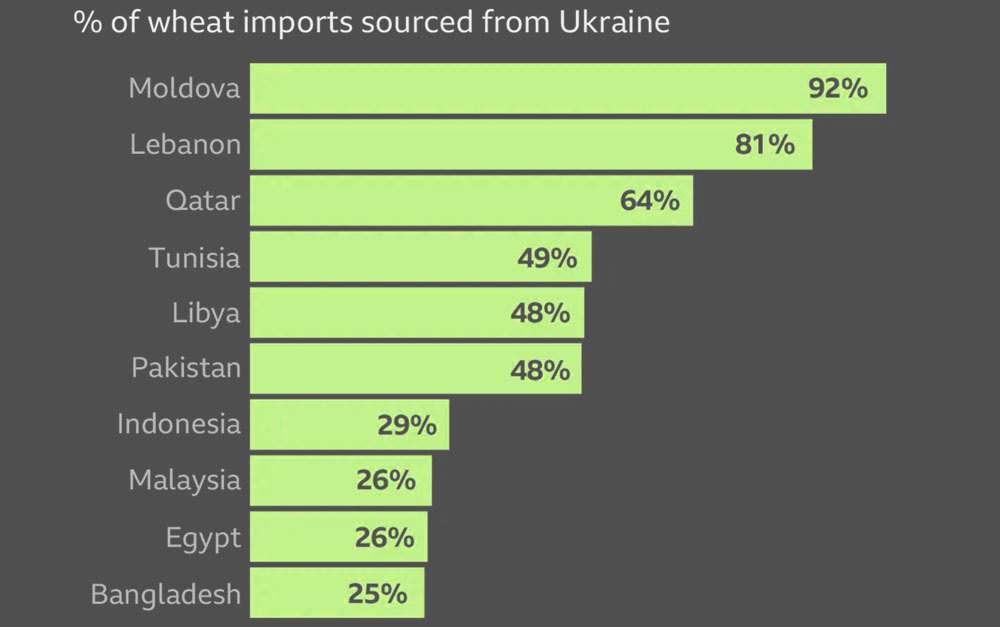

- Global Food Security: Ukraine is a major global supplier of grain, particularly wheat and corn. The blockade of its ports severely restricts the country’s ability to export these critical commodities, leading to potential shortages in countries that rely heavily on Ukrainian grain. This can exacerbate food insecurity, particularly in regions already facing food scarcity.

- Impact on Global Grain Prices: With a significant portion of the world’s grain supply stuck in Ukraine, global grain prices are likely to increase. This can lead to higher food prices worldwide, impacting consumers and potentially leading to economic and social unrest in more vulnerable regions.

- Insurance Market: The blockade poses a high risk to shipping in the Black Sea region. Insurers may deem the area as a war zone, leading to increased premiums and additional war risk surcharges for ships operating in the region. This can further complicate and increase the cost of shipping commodities from not only Ukraine but also other Black Sea countries.

- Risk of Loss and Damage: The risk of loss or damage to cargo, ships, and port infrastructure due to military actions is a significant concern. This increases the demand for maritime insurance, but also complicates the assessment and underwriting of risks. Insurers and reinsurers may become more cautious in underwriting risks in this region, leading to a tightening of capacity and coverage terms.

- Complications in Trade and Logistics: The blockade disrupts the logistics chain for grain distribution worldwide. Alternative routes, such as rail or road transport, are less efficient and more costly than maritime transport, further complicating the global supply chain.

- Political and Diplomatic Tensions: The situation heightens geopolitical tensions and may lead to further economic sanctions against Russia, impacting international trade and finance, including the insurance sector.

- Humanitarian Crisis: Besides the economic impact, there’s a potential humanitarian crisis due to food shortages in countries that depend on Ukrainian grain, which may require international aid and intervention.

Ukraine plays cruitical role in the global food supply

How to mitigate the impacts of the blockade of Ukrainian grain ports?

Ukraine and insurers have been working on solutions to mitigate the impacts of the blockade of Ukrainian grain ports by Russia.

One of the key initiatives in this regard is the establishment of insurance facilities to cover the risks associated with exporting grain from Ukraine under these challenging circumstances.

Ukraine’s ports have been closed since Russia’s invasion in February with marine insurers based in Lloyd’s of London and the wider London commercial insurance market awaiting more assurances given the potential losses involved with every ship.

Marsh McLennan, in collaboration with the Ukrainian government and various financial institutions, has launched a new facility named Unity to provide cost-effective insurance for the export of grain and other critical food supplies from Ukraine’s Black Sea ports. This initiative is designed to support global food security and assist in the stabilization of the Ukrainian economy during ongoing conflicts.

The launch of the Unity facility will enable Ukraine to provide vital food supplies to the world at the same time as supporting the Ukrainian economy and keeping the Black Sea open for international trade

Denys Shmyhal, Prime Minister of Ukraine

“This partnership between the Ukrainian government, Marsh McLennan and Lloyd’s of London is a sign of confidence in our economy and demonstrates that Ukraine is open for business”, Denys Shmyhal says.

Ukreximbank, the State Export-Import Bank of Ukraine, and state-owned Ukrainian bank Ukrgasbank will provide standby letters of credit, each confirmed by DZ Bank, to support the facility which itself is backed by the Ukraine Ministry of the Economy, providing shipowners and charterers with war risk insurance in the absence of safe corridors. Global law firm, Norton Rose Fulbright, provided advisory services.

As with the ‘As One’ facility launched to provide insurance under the now defunct Black Sea Grain Initiative in July 2022, Marsh will extend the new Unity facility to clients of Lloyd’s of London registered brokers, to provide added support to ongoing humanitarian efforts and alleviate continued pressure on supply chains and global food security.

How insurers have addressed the problem?

- Insurance Facilities: As exemplified by Marsh McLennan’s Unity facility, insurance companies have created specialized facilities to provide war risk insurance for ships and cargoes exporting grain from Ukraine.

- Public-Private Collaboration: These facilities are often the result of collaboration between governments (such as the Ukrainian government), financial institutions (like Ukreximbank and Ukrgasbank), and insurers. This collaboration aims to ensure that insurance coverage is feasible and cost-effective, given the heightened risks in the region.

- Ensuring Food Security: By securing the export of grain and other food supplies from Ukraine’s Black Sea ports, these insurance solutions help alleviate global food security concerns. This is particularly important for developing countries that rely heavily on Ukrainian grain.

- Facilitating Trade: Providing insurance coverage helps maintain trade flows from Ukraine, ensuring that grain can reach global markets despite the ongoing conflict and risks. This is crucial for stabilizing global food supply chains and keeping grain prices in check.

- Supporting Ukraine’s Economy: Enabling grain exports is also vital for the Ukrainian economy. The agricultural sector is a significant part of Ukraine’s economy, and facilitating exports helps support the country financially during the conflict.

- Risk Management and Assessment: Insurers have developed methods to assess and manage the heightened risks of operating in conflict zones. This involves careful analysis of geopolitical developments, security measures, and route planning to minimize risks to cargo and vessels.

- Alternative Routes and Logistics: In addition to securing maritime routes, there has been a focus on developing alternative logistics and transportation methods, such as rail and road transport, to bypass blocked ports and reduce dependency on risk-prone sea routes.

- International Diplomacy and Negotiations: Efforts at the diplomatic level, including negotiations and agreements facilitated by international bodies, have been critical in attempting to secure safe passages and corridors for the transportation of grains from Ukraine.

In conclusion, the solution to the problem of the blockade of Ukrainian grain ports has been multifaceted, involving innovative insurance solutions, international collaboration, and adaptive logistics strategies, all aimed at ensuring the continuous flow of vital commodities from Ukraine to the global market.

………………..

AUTHORS: Oleg Parashchak – CEO Finance Media and Beinsure Media