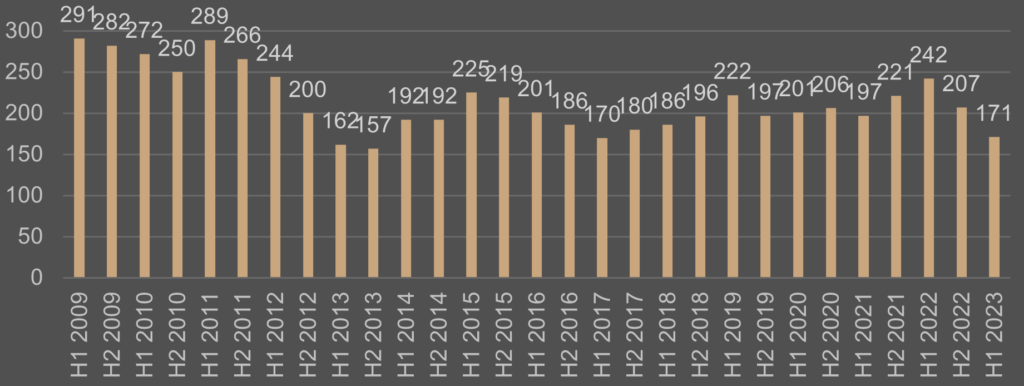

Mergers and acquisitions M&A in the global insurance industry dropped sharply in the first half of 2023 with 171 completed deals worldwide, down from 207 in the second half of 2022 and 242 at the same point last year, according to Clyde & Co’s Insurance Growth Report.

The Report is based on data by Refinitiv (previously trading as Thomson Reuters and Alacra) for completed mergers and acquisitions in the global insurance industry in the period 2009-2023 for Life Insurance, Accident and Health Insurance, Fire, Marine, and Casualty Insurance, Surety Insurance, Title Insurance businesses and Insurance Carriers.

According to Insurance M&A Deals Outlook, in the face of stark economic pressures – inflation, rising energy costs, and looming recession – insurers remain focused on growth opportunities. The volume of M&A in the global insurance industry reached its highest rate of growth for ten years, up 9.5% in 2023.

Insurers are less dependent on bank financing for strategic transactions as they are restricted to leveraging a smaller proportion of the transaction anyway

Eva-Maria Barbosa, Partner at Clyde & Co in Munich

With insurers typically balance sheet-heavy at present, the break in carrier M&A activity is likely to be over. Meanwhile, private equity capital is returning to the market for broker deals.

- Completed insurance carrier M&A worldwide down 17%

- Americas see 24% decrease in deal volume, Europe down 22%, APAC dips 9%

- Appetite for insurtech and changing regulatory landscape key future deal drivers

- Transactions expected to bounce back in coming months

Change in M&A insurance deal numbers by region

| Region | H1’2023 | % change, 2023/2022 |

| Global | 171 | -17.4% |

| Americas | 79 | -24.0% |

| Europe | 47 | -21.6% |

| APAC | 29 | -12.1% |

| ME&A | 9 | 12.5% |

Volume of M&A deals in insurance globaly

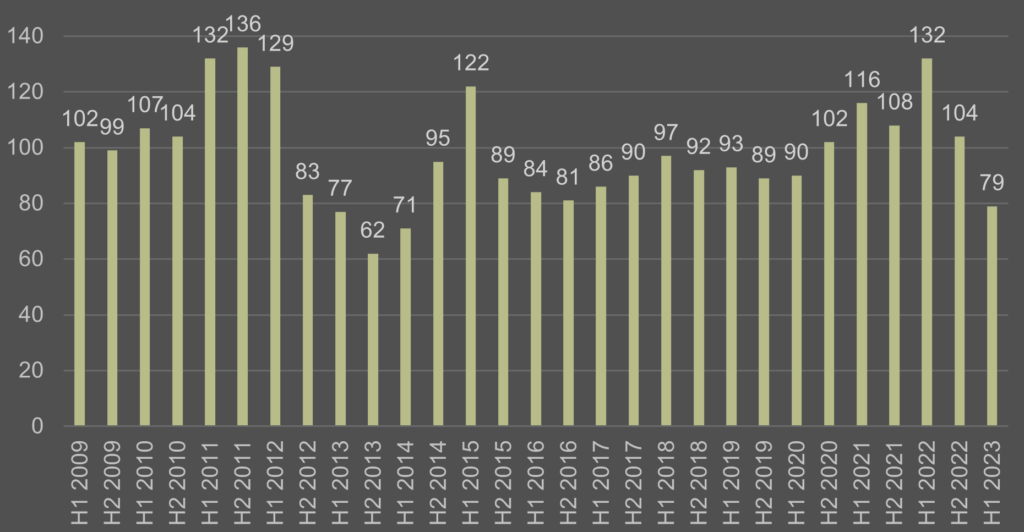

The drop-off in activity was most pronounced in the Americas, which had 79 deals, down from 104 in H2 2002, as M&A in the region fell to its lowest level since 2014 (see US bank M&A deals).

The US was still the most active country worldwide with 60 completed transactions in H1 2023, down from 83 in the previous six months.

Volume of M&A deals in insurance – Americas

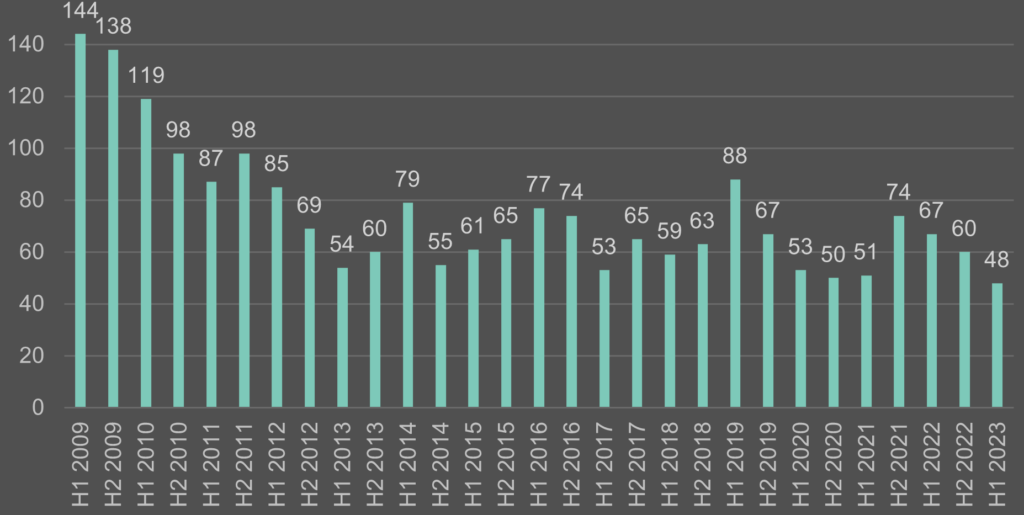

With 47 deals in the first half of 2023, activity in Europe was at its lowest level for more than a decade. The UK was the leading European country in terms of deals with 11 – ahead of France and Germany – but dropped to fourth place globally behind Canada and Japan.

Volume of M&A deals in insurance – Europe

Asian Emerging Insurance Market saw completed M&A fall from 33 to 29 – but saw a spread of transactions across the region with Japan out in front with 14 M&A deals, ahead of Australia, China, Hong Kong and South Korea with three each.

The Middle East and Africa was the only region to see an increase in M&A in H1 2023, with nine completed deals compared to eight in the previous six months.

Volume of M&A deals in insurance – Asia Pacific

The lull in insurer M&A will be short-lived. Despite ongoing geopolitical and economic uncertainty, insurance businesses are adopting a ‘Keep Calm and Carry On’ approach.

Mixed insurtech market impacting transactions

Diminishing appetite in some regions for insurtech businesses has been one factor in the overall drop in M&A activity.

Mergers and acquisitions activity at the beginning of 2023 is expected to remain somewhat muted, consistent with the environment in the second half of 2022. But looking further ahead to the second half of 2023 and beyond, deal-making is likely to accelerate, according to Morgan Stanley.

Deal values and deal multiples decline as sellers hold back and acquirers lose conviction.

As uncertainty impacts both the base business of acquirers and targets, it becomes harder to make decisions about deals. It’s no wonder why many executives lose their appetites for the deal process during turbulent times.

In Europe, finding capital for insurtech businesses is proving difficult due to continuing inflation and rising interest rates, while the US has been impacted by a lack of true insurtechs coming to market – rather than traditional carriers seeking new distribution channels (see report Global M&A Activity in Insurance Slowing from Uncertain Economy).

Private equity firms are looking at investing in some of the Asia tech players around the region, at all stages of development, with prospective capital providers fairly evenly split between international PE firms and regional asset managers

Joyce Chan, Partner at Clyde & Co in Hong Kong

However, interest in insurtech elsewhere, including from private equity remains strong, including in Latin America and Asia, particularly in countries with high levels of internet penetration such as Indonesia, Vietnam, the Philippines and Thailand – for a range of personal lines business.

Meanwhile, as the use of AI in insurance becomes better established, investment is likely to return to insurtech in other regions – as the sector best-placed to leverage the emerging technology.

Regulation activities brakes on insurance M&A activity

While regulatory enforcement activities are putting the brakes on some insurance activity due to the increased cost of doing business, new legislation in other territories is helping to drive business opportunities.

Hong Kong’s new risk-based capital regime for insurers will come into force in 2024, which could lead to a spate of transactions as those who struggle to comply look to exit certain lines of business.

And in the Middle East, the growing regulatory burden will force incumbents to adopt international best practice and open up M&A opportunities as the market consolidates further.

We are seeing regulators become more proactive in the Middle East, but it isn’t dampening M&A activity currently.

Peter Hodgins – Clyde & Co Partner in Dubai

There is a continuing drive by regulators to get carriers to clean up their act and to squeeze out less financially able players. That is creating opportunity through encouraging further consolidation in the market.

Cyber offers and M&A opportunities

Cyber continues to rise up the leaderboard, both as a growth opportunity for carriers and a risk management concern. The potential impact of cyber exposures on M&A is a growing focus for deal-makers.

Many acquirors have revealed that due diligence around cyber risks of target companies has risen from a top ten to a top five concern when considering potential acquisitions.

Correctly worded warranties in relation to IT systems and cyber issues are a key concern, as the broad wordings in existing agreements are less likely to pick up potential post-transaction issues.

A real risk of cyber incidents is the nature of interlinked systems – when there is a compromise and the related legal issue of who is the data controller

Rosehana Amin – Clyde & Co Partner in London

When a purchaser acquires the target company’s data, will the contract make it clear who retains responsibility? Is there an understanding of legacy data that it might be acquiring? If data is compromised, the relevant entity may be subject to scrutiny and liable for potential regulatory fines.

Outlook for insurance M&A market

While deal volume is not expected to return to the highs of 2022 in the immediate future, M&A activity is expected to rebound in the second half of the year.

Given that growth in M&A activity typically lags behind improvements in underlying market conditions by anywhere from eight to 12 months, the dip in completed transactions over the last six months is unsurprising.

We anticipate that the volume of transactions will start to rise again towards the end of 2023 as insurance businesses acclimatise to the new operating environment, with the broker segment leading the way.

Those with growth ambitions are also looking further afield. Activity in the US will pick up as we have seen an increase in interest from those looking to obtain direct access to the world’s largest insurance market via strategic acquisitions.

Meanwhile, international capital has been re-entering the Middle East through investments in regional brokers and third-party administrators, a trend that is set to continue.

……………………..

AUTHORS: Eva-Maria Barbosa – Partner at Clyde & Co in Munich, Joyce Chan – Partner at Clyde & Co in Hong Kong, Peter Hodgins – Clyde & Co Partner in Dubai, Rosehana Amin – Clyde & Co Partner in London