While economic and geopolitical uncertainties have created headwinds, they’re also generating opportunities. A reset in valuations, the availability of capital and the increased competitiveness from corporates should provide openings for dealmakers in the year ahead.

According to PwC’s survey, the strong US dollar will fuel outbound investment, tempered by the underlying weakness in foreign markets and compressed foreign earnings.

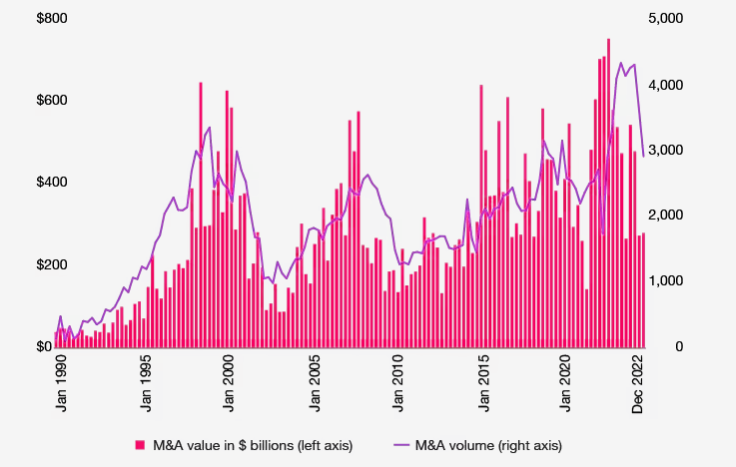

In 2022, M&A market activity continued to exceed historical norms while retreating from the new heights of the previous year.

Global M&A activity will slow in 2023. Big-ticket M&A activity is off to a slow start in 2023 as the regulatory environment makes executing large deals more challenging Once the final stats are tallied, 2022 will end up as one of the strongest years outside of 2021.

Successful dealmakers will find opportunities

The need for speed in business transformation, which is accelerating thanks to technological advances and the evolving economy, will keep dealmaking front and center. Whether changing supply chains, adopting new go-to-market approaches or adding capabilities, the market is impatient. The fastest way to transform a business is through M&A, divestitures or other deals.

While doing deals, leaders must also keep a close eye on stakeholder trust — among customers, investors, regulators and business partners.

PwC’s surveys of consumers and business executives on issues of trust reveal substantial gaps between what consumers say is important and what executives believe. Since trust — and distrust — can alter consumer behavior, protecting it must be a top priority to preserve value in dealmaking.

M&A activity down

We’ve entered a period of changing economic and financial fundamentals. Interest rates, inflation and wages have all been rising. A number of macro factors, from trade wars to shooting wars, are driving economic uncertainty.

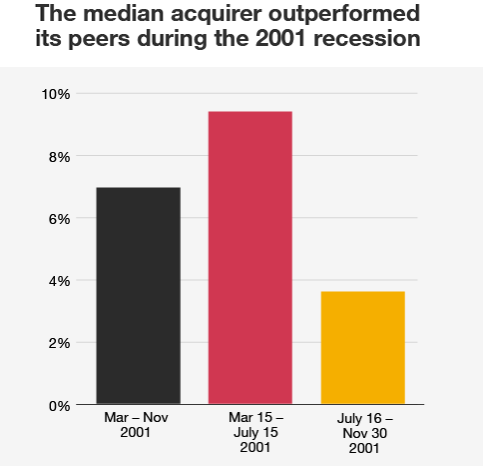

This is not an unprecedented environment though. It’s a return to conditions we’ve navigated in the past.

According to Global M&A Performance Report, business leaders recognize the challenges. Some 90% of executives tell us in the November Pulse Survey they’re concerned about macroeconomic conditions, and 81% expect a recession in the next few months.

Still, most business leaders also know they can’t cut their way to growth. And as we saw in the past five years, deals have been a key fuel to business resurgence and economic expansion. Executives say they are confident they’ll be able to hit near-term growth goals and execute on strategic transformational initiatives.

Over the next 12 to 18 months, 44% plan to hire talent with specific skill sets to drive growth. And a growing number of executives — 35% in PwC’s November Pulse Survey — say they’re planning an acquisition or divestiture over the same period. That’s up 10 percentage points from August 2021 (see Global M&A Activity in Insurance).

What will drive successful deals?

Consider these factors:

- Capital discipline, including the power of portfolio renewal and the value in divestitures

- Navigating uncertainty

- Speed to unlocking value from transformational deals

- Increasing resilience and security

Despite headwinds, the insurance deals market remains resilient

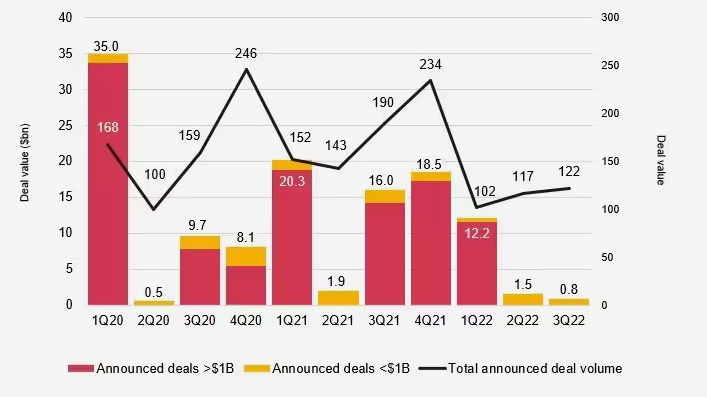

Insurance deal activity continued to slow in the second half of 2022 as a result of increased borrowing costs, economic uncertainty and inflation.

For the six-month period from mid-May 2022 through mid-November 2022, there were 205 announced transactions, with $2 billion in announced deal value and no megadeals, compared to 343 announced transactions with $15.4 billion in deal value announced in the previous six-month period from mid-November 2021 through mid-May 2022.

Toward the end of the year, we began to see a more pronounced impact from economic uncertainty, as deal activity slowed even further, with only 29 announced deals from the end of September through mid-November.

However, while activity has pulled back from its 2020-21 peak, insurance dealmaking has still been relatively resilient compared to other sectors.

Insurance brokerage transactions have continued to drive announced deal volume. Of the 203 insurance deals announced, 189 were related to brokers, with the remaining 14 to underwriters.

One of the more notable insurance transactions was Mitsui Sumitomo Insurance Company’s agreement to acquire Transverse Insurance Group from Virgo Investment Group for $550 million. The acquisition will give the Japanese property insurer access to a historically strong US MGA and fronting business as they seek to grow in the US.

In other key developments, Blackstone Inc. and Resolution Life announced a partnership in October. Blackstone’s investment is $500 million and will help raise roughly an additional $2.5 billion in new equity capital commitments, bringing Resolution Life’s total equity capital base to more than $8 billion.

The deal will give Blackstone $25 billion in assets to manage in the first year and up to $60 billion of assets to manage over the next six years.

In November, Voya announced a $570 million acquisition of Benefitfocus, Inc., a benefits administrator, demonstrating a continued interest among insurers in acquiring benefit administration capabilities that supplement their group benefit offerings.

Insurance outlook

We expect economic headwinds to persist into the first quarter of 2023 as companies evaluate the impacts of inflation and interest rates on deal values. As has been the case historically, we expect private equity buyer demand for resilient, EBITDA generating business, such as insurance brokerage companies, to remain strong.

As the cost of borrowing increases, we expect valuations to decline, specifically for insurance brokerage targets where many of the brokerage consolidators are private equity backed and rely heavily on debt financing to fund these acquisitions.

Given the recent rise in interest rates, the cost of funds has increased dramatically, which is likely to impact valuations of these targets into 2023.

Deal activity in the life and annuity sector has remained strong, as long duration blocks have benefited from a rising rate environment. Acquirers of these in-force/legacy blocks don’t rely on debt financing, which makes these transactions appealing to buyers in a rising rate environment. As a result, we’ve seen increased demand and rising valuations for these assets as private equity seeks to deploy its extensive dry powder (see TOP 25 Largest Insurance Companies in the World by Assets).

Furthermore, as valuations decline in the cooling economy, corporate buyers with strong balance sheets may have renewed interest in the insurance deals market.

US Insurance M&A deal value & volume

For some specialty insurance underwriters, rising claims costs and insurance risks have negatively impacted financial results. For example, carriers in catastrophe heavy areas and companies with a large portfolio of cyber risk have indicated that incurred losses and reserve increases could be significant.

While insurance deals have declined from the record levels of 2021, we continue to see healthy demand from private equity for high-quality insurance brokerage and life and annuity blocks

While we have seen these specialty insurance underwriters counteract rising claims costs with premium rate hikes, some may turn to the M&A market to sell portfolios or raise capital. The increase in specialty premium rates and related commissions will also have a favorable impact on brokers and MGAs writing specialty business.

Divestitures of fee generating businesses and legacy blocks

We expect to see corporate entities evaluate divestitures, carve-outs or minority investments of their specific businesses, specifically fee-generating MGA businesses and legacy blocks of life insurance business.

A seller’s strategic rationale would be to confirm valuations of the overall company and generate capital in a time when debt markets are expensive and issuing stock is dilutive to current shareholders, as well as to free up capital that could be deployed for other strategic initiatives or to focus on core businesses.

We saw an example of this kind of activity in the July 2022 announcement of the carveout of the managing general underwriting business from UK-based Fidelis Insurance Holdings Limited, with principal equity investors of Capital Z Partners, Travelers, Blackstone, Further Global Capital Management and Alfa Insurance.

This transaction separated the MGU from the carrier and helped Fidelis focus on its core functions and specialties. Another case in point was Nassau Life Insurance Company’s announcement in late November that it will acquire Delaware Life Insurance Company of New York and allow it to concentrate on its core business outside of New York.

One more example is Talcott Financial Group’s announcement that it entered a reinsurance agreement to assume Guardian Life Insurance Company of America’s variable annuity portfolio in October.

Dealmakers should be aware that expedience is important in these types of deals. An upcoming PwC study also has found that timely portfolio assessment and decision making helps improve the chances for value creation.

Key Insurance M&A deal drivers

Navigating uncertainty

While we have recently seen several high-profile announcements about workforce reductions in many sectors, the overall labor market remains strong, with unemployment at near record lows.

This is driving continued demand for employee benefits and many commercial lines products like workers compensation insurance.

Accordingly, insurance brokerages that distribute these products have continued to experience organic revenue growth. This increased demand, coupled with premium rate increases driven by inflation, is likely to attract continued interest from prospective buyers.

Capital discipline

As valuations are reassessed in a stagnant IPO market with rising debt costs, corporates with strong, well-capitalized balance sheets are in a good position to build their technological capabilities and distribution networks through M&A.

Insurtech valuations, for instance, have significantly decreased, and that could drive corporate demand for insurtechs with differentiated technology.

M&A in this space may hasten corporates’ ability to unlock competitive advantages, especially at a time when digital capabilities are increasingly vital due to shifts in insurance buying patterns and service expectations (see Global InsurTech Investment Trends).

Lastly, for corporates that were unable to match the multiples on MGAs offered by PE-backed buyers, a reset in valuations may provide them with an opportunity to expand their geographic footprint or diversify product offerings.

Increasing resilience and security

We continue to see strong demand for cyber insurance coverage, given the current geopolitical climate and ever-increasing cyber risk. At the same time, we’ve seen carriers with cyber programs struggle to adequately price their exposures.

In response, some carriers are seeking to alter terms and coverage levels, while others are considering if they should write the business at all or leave the market.

As a result, many companies have found themselves paying high premiums for coverages that may not adequately mitigate their risks.

Considering the state of the market, we expect to see M&A activity from carriers looking to exit the space and specialized insurers and MGAs/MGUs, especially ones with a track record of profitable underwriting, looking to expand their market share.

Bottom line

Companies that have strategic discipline and conviction will be able to find and execute good deals that create shareholder value.

High performing companies conduct regular portfolio reviews to assess which business units are strategic and which are no longer a fit for the core strategy.

This creates opportunities to divest and redeploy capital into transformative opportunities that create value through new technology, talent and ESG capabilities. It also allows management to shift focus in the direction dictated by corporate strategy.

This may create an opportunity for strategic buyers to acquire earlier-stage companies.

Acquirers with capital will likely have opportunities to do deals from a position of strength while factoring the rising cost of capital into dealmaking.

Markets will not be patient. C-suite leaders should seek out transformative deals that can help their company leapfrog forward and quickly generate value for shareholders. Despite some headwinds, we believe there will be opportunities for savvy dealmakers in 2023 and beyond.

…………………..

AUTHOR: Mark Friedman – PwC Insurance Deals Leader

Fact checked by Oleg Parashchak