2022 was a truly global year for InsurTech investing with 1,528 international investors participating in 521 deals, raising a total of almost $8 billion ($7.9 billion). Investors from over 60 countries participated in this very significant year. Beinsure Media has collected the opinions of insurtech experts and presents a InsurTech startups strategy review.

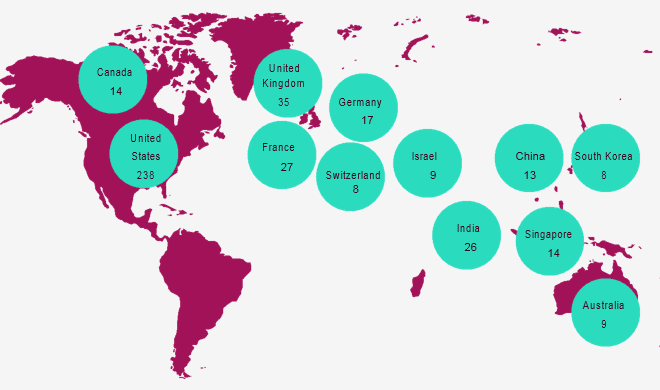

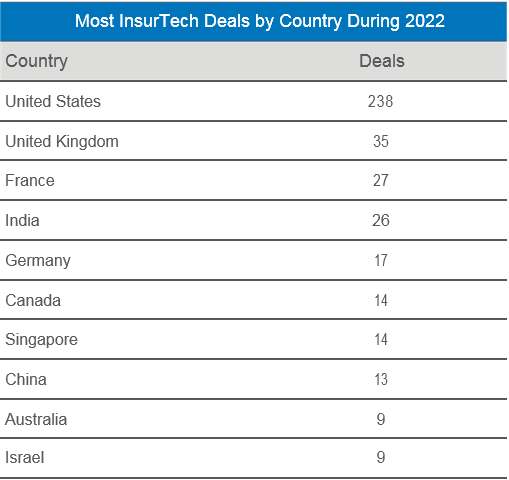

Unsurprisingly, the US topped the charts with 238 deals, then the United Kingdom with 35 deals, France with 27 deals, India with 26 deals (and a very notably active Q3), Germany with 17 deals, Canada with 14 deals, Singapore 14 deals, China with 13 deals, and in joint 9th place Australia and Israel with 9 deals each, respectively, according to Gallagher Re Global InsurTech Report.

The report follows on this year’s theme of ‘Geographic Trends and Regional Idiosyncrasies’, with a specific look at the EMEA region through an InsurTech lens. In addition to profiling various InsurTech businesses, clients and individuals, this report provides our readership with the most current InsurTech investment data and view on the general market (see How InsurTechs & Tech-Driven Innovation Changing the Insurance Industry?).

2022 was the most active year for global participation with many nations recording their first ever InsurTech deal this year.

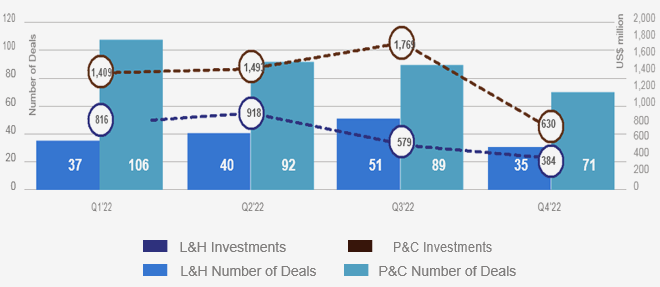

Over the course of 2022, quarterly funding has been remarkably consistent, especially when compared with the erratic quarterly results of 2021. As the graph below shows, over the course of the year, where P&C deals have sloped downwards, the aggregate total of approximately $2.4 billion per quarter has been propped up by an increase in L&H deals (see Global Private Equity & Venture Capital Report).

InsurTech ecosystem has met a very interesting juncture; at a macro-level, be swept up in the downgrading of public value, or represent a viable investment alternative to an investor’s portfolio that is otherwise being dragged into generalised bearishness, and at a micro-level; either capitalise on the availability of lower-priced assets or struggle to survive.

InsurTech investment deals by country

Deal count has similarly been consistent on a quarterly basis around the 140 mark. Q4 is the only outlier with a much-reduced period of activity. The consistent $2.4 billion seen previously dropped to just north of a billion, and deal count has dropped from the 140 mark to 106 (see How Insurers and InsurTechs Can Transform Insurance Platforms?)..

Given that it is quite possible that Q4 was a quarterly ‘blip’ (almost certainly caused by the lack of mega-round activity (without mega-rounds, Q3 funding did not exceed $1 billion)), and a more general rule that we shouldn’t read too much into the results of any one particular quarter, the three otherwise back to back consecutive quarters of consistent results across 2022 does provide us with a basis to draw upon some analysis (see Biggest InsurTech Unicorn Startups in the World).

Whereas venture capital historically preceded risk capital commitments, VCs are now looking to see that (re)insurers are actually going to come to the table (first in some cases) before writing a cheque. Understandably this has created a chicken and egg type situation for a number of InsurTechs looking to raise money in this environment.

What is possibly the most significant feature of 2022 (as we review the ‘key events’ of each year leading up until this point) is that the narrative around ‘disruption’ seems to be truly over.

We can draw from this that in the current environment, investors, fundraisers and clients alike have found some kind of (temporary) equilibrium and balance in InsurTech.

Another nod to the consolidation around a significant chapter closing/opening for InsurTech (see How InsurTechs & Tech-Driven Innovation Changing the Insurance?).

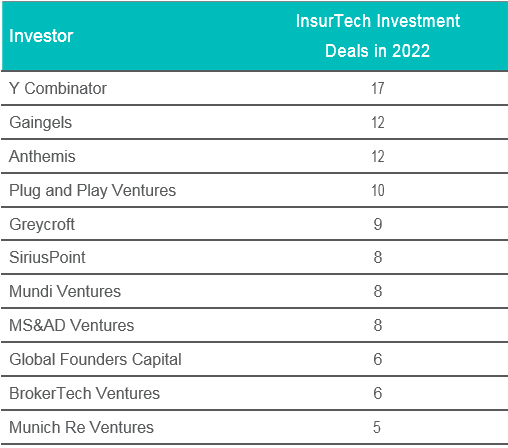

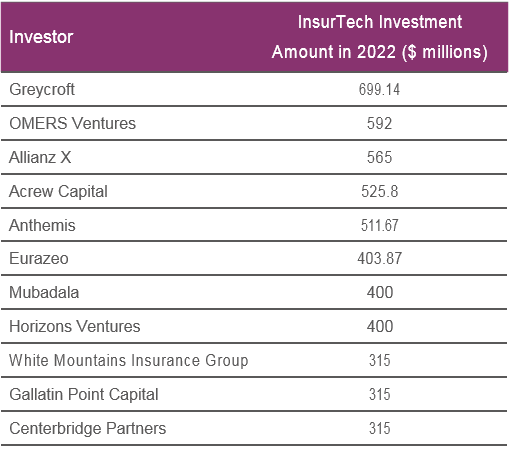

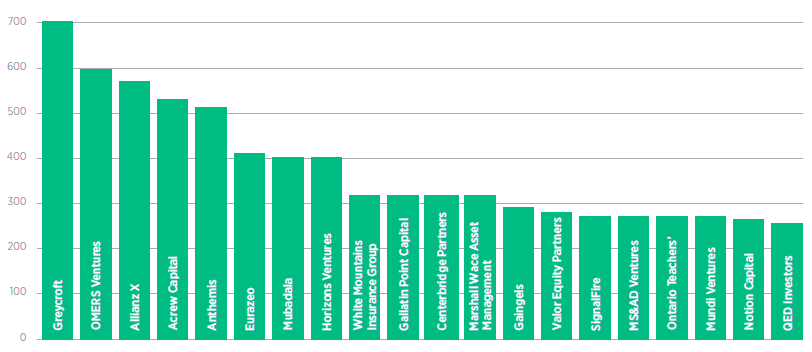

Globally, as mentioned, a significant number of individual investors have been active this year despite the overall downturn. Leading the year with the highest number of individual InsurTech deals is Y Combinator with 17 rounds completed. In joint-second place was Gaingels and Anthemis with 12 deals each.

Aggregating this activity of deals together produces some very impressive sum totals for a number of investors.

As an overall contribution, Greycroft top the total amount invested with $699 million conducted across 12 months. Per the table to the right, this is over nine individual transactions.

Of note for Greycroft was their significant participation in the $315 million raise conducted by Pie Insurance in September.

Next on the total amount invested chart is OMERS ventures with $592 million recorded. OMERS were the investor in Q4’s only mega-round deal, Clearcover (see Biggest FinTech Unicorns in the World).

In third place comes a CVC, Allianz X with $565 million across three deals. Allianz X similarly participated in Pie’s September round. Allianz X also participated in Coalition’s $250 million round earlier in 2022.

Quarterly InsurTech investment activity broken down

Quarterly InsurTech Investment activity broken down between L&H and P&C and deal count and total funding

Finally, coming in fourth place is Acrew Capital who invested $526 million across four deals in 2022. Similarly, Acrew was heavily involved in Pie Insurance’s 2022 raise.

It is not surprising that a handful of mega-round deals have skewed the top of this particular table given the enormity of some individual rounds during the course of 2022 (for example, OMERS ventures were in fifth place before their single (but significant) investment in Q4).

In fact, it serves as a microcosm for 2022 – dominated in percentage terms by mega-round deals, but overall funding and average deal sizes are down.

It isn’t until we get to our fifth spot where we observe Anthemis having invested an impressive $512 million across a wider number of deals (12).

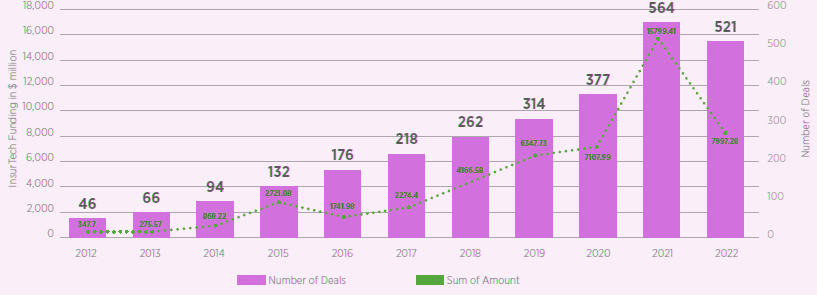

Total Annual InsurTech Funding

2016 to 2019 was awash with InsurTechs telling the industry to brace itself for the cataclysmic revolutionary forces it was preparing to unfold, and 2020 and 2021 seemed to really focus on spectacular raises, IPO’ing and blessings of unicorns (see InsurTech Market Faces a Valuation Decline). Neither evolutionary cycle seemed to demonstrate much robustness en masse.

However, was the creation of a select number of individual businesses, associated with the label of ‘InsurTech’ who have done remarkably well. They all have one thing in common, however; they treat the industry as the community that it is, and realise that giving is equally (if not more) important than to simply take.

They are conscientious partners who understand our industry, and utilise technology as an enabling force, not just a product to masquerade bad business behind.

Insurtech Investors by deals & value

While Greycroft clearly have been most active, what the graph does show is that there seems to be some consistency (and median averages) around the $300 million mark for major InsurTech investors during the course of 2022. Perhaps this is just coincidence, or a desire to commit a more disciplined amount of capital in a trying year.

As we have already mentioned, Greycroft, OMERS Ventures, Allianz X, Acrew capital and Anthemis top the charts predominately from their investments in larger deals, e.g. Pie Insurance, Clearcover, etc.

It is quite telling that of the top 20 investors, only two are part of CVCs.

(Re)insurers have been undoubtedly distracted through the course of 2022 with some of the hardest markets for the last two decades. There may also be a realisation that allowing other venture and growth capitalists to take on the equity risks while InsurTechs perfect their offering (or more likely survive or don’t survive this period of uncertainty) is a more prudent approach at this time. While they forgo the equity benefit in the case of a positive liquidity event, they protect valuable resources as the gladiatorial battle of InsurTech wages on.

Top 20 InsurTech Investors by Total Investment Amount

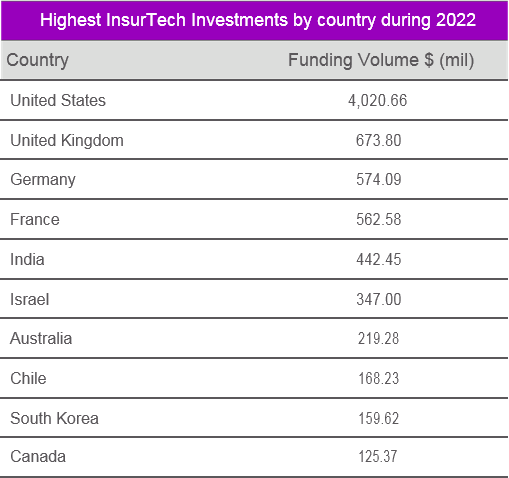

The Gallagher Re InsurTech report series of 2022 covered distinctive continental regions for the first three editions of the year. We now present a global and annual review of total InsurTech activity for the year. As already presented, the US has dominated this space once again with total deal count and total amount invested, with the United Kingdom coming second on both counts, respectively. The tables below show data for 2022 first, and then provide a historic overview (from 2012 onwards).

To provide some context to the numbers below, 2021 Q4 oversaw the two largest InsurTech deals to date; Integrity Marketing Group and Devoted Health both raised $1.2 billion respectively.

While 2022 did not usher in the largest ever InsurTech deals to date, it did still provide a number of high-profile rounds of funding.

Wefox raised an extremely impressive $400 million, Pie Insurance $315 million and Coalition $250 million. These three InsurTechs are all directly involved in risk origination and balance sheet capital management. There is clearly still appetite to support InsurTechs at the front-end coalface of our industry as they perfect their underwriting and distribution strategies.

Top 20 Countries by InsurTech deals & amount raised 2012–2022

| Country | Deals | Amount raised | 2012–2022 Q3 funding (deals) | |

| 2022 Q4 | 2022 Q4 | |||

| United States | 49 | $ 508.67 million | $ 30057.56 million (1313) | |

| United Kingdom | 5 | $ 56.95 million | $ 3176.78 million (223) | |

| China | – | – | $ 2739.01 million (156) | |

| India | 5 | $ 25.5 million | $ 2771.93 million (117) | |

| Germany | 3 | $ 32.51 million | $ 2287.73 million (97) | |

| France | 9 | $ 51.44 million | $ 1613.97 million (89) | |

| Canada | 3 | $ 5.2 million | $ 338.67 million (57) | |

| Singapore | 4 | $ 37.18 million | $ 716.3 million (47) | |

| Israel | 2 | $ 94 million | $ 925.62 million (47) | |

| Sweden | 3 | $ 9.23 million | $ 326.93 million (37) | |

| Australia | 2 | $ 70.87 million | $ 514.57 million (32) | |

| South Africa | – | – | $ 105.41 million (32) | |

| Brazil | – | – | $ 344.78 million (32) | |

| Spain | 1 | $ 41 million | $ 103.54 million (30) | |

| Switzerland | 1 | $ 1.5 million | $ 95.62 million (28) | |

| Japan | 1 | $ 1.72 million | $ 264.78 million (27) | |

| Italy | 2 | $ 4.03 million | $ 161.6 million (24) | |

| United Arab Emirates | 1 | $ 25 million | $ 87.3 million (22) | |

| South Korea | 2 | $ 4.22 million | $ 188.73 million (19) | |

| Chile | 1 | $ 10 million | $ 280.84 million (20) | |

In our final report of the year, it is our pleasure to be able to show some real life InsurTech examples of businesses who have caught the attention of the global InsurTech scene. Also to share the thoughts and experiences of some InsurTech specialists whose insights will paint a detailed picture of the art of the possible, and the reality of their own professional experiences.

……………………..

AUTHOR: Dr. Andrew Johnston – Global Head of Gallagher Re

Fact checked by Oleg Parashchak