TOP 25 Largest Insurance Companies in Worldwide are lists of the insurers in the world, as measured by total non-banking assets. The list is based on the 2024 report of the 25 largest insurance companies in the world by total assets from AM Best Rating Agency.

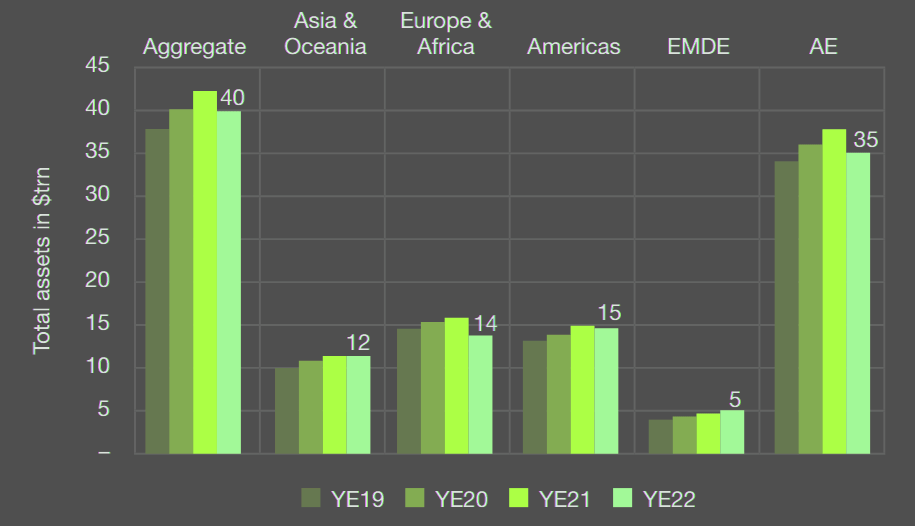

Total assets as reported ideclined by 5.5% to $40 trillion and total liabilities declined by 5.8% to $35 trillion. Key drivers behind the decline in total assets are declines in equity prices and widened credit spreads on corporate and sovereign debt. Declines in liabilities were mainly driven by increased interest rates, according to the IAIS’ Global Insurance Market report.

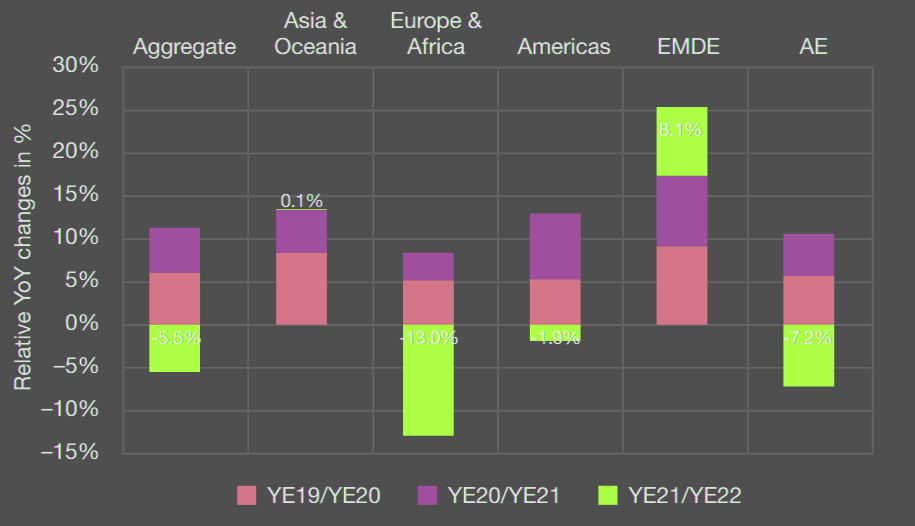

Comparing developments in emerging markets and developing economies (EMDEs) to advanced economies (AE), EMDEs have seen several consecutive years of growth in total assets, including from year-end 2022 to year-end 2023 (+8.1%).

In contrast, AEs have seen a decline in the last year (–7.2%) after two consecutive years of growth. A similar trend is observed for total liabilities.

TOP World’s 25 Insurers by Total Assets, $ bn

| № | Company | Country | Total assets, $ bn |

|---|---|---|---|

| 1 | Allianz | Germany | 1,261.9 |

| 2 | Axa | France | 950.6 |

| 3 | Prudential Financial | United States | 940.7 |

| 4 | Ping An Insurance | China | 883.9 |

| 5 | Berkshire Hathaway | United States | 773.7 |

| 6 | MetLife | United States | 795.1 |

| 7 | Nippon Life | Japan | 776.7 |

| 8 | China Life Insurance | China | 776.4 |

| 9 | Legal & General | United Kingdom | 774.8 |

| 10 | Manulife Financial | Canada | 688.8 |

| 11 | Assicurazioni Generali | Italy | 669.1 |

| 12 | Aviva | United Kingdom | 651.6 |

| 13 | Japan Post Insurance | Japan | 636.8 |

| 14 | AIG | United States | 586.5 |

| 15 | Dai-ichi Life | Japan | 577.1 |

| 16 | Aegon N.V. | Netherlands | 546.5 |

| 17 | CNP Assurances | France | 543.7 |

| 18 | Credit Africole Assaurances | France | 536.8 |

| 19 | JA Kyosai | Japan | 531.6 |

| 20 | Life Insurance Corporation | India | 520.5 |

| 21 | Prudential plc | United Kingdom | 516.1 |

| 22 | Great-West Lifeco | Canada | 469.8 |

| 23 | Zurich Insurance Group | Switzerland | 439.3 |

| 24 | Meiji Yasuda Life | Japan | 417.2 |

| 25 | New York Life Insurance | United States | 414.3 |

Source: AM Best

Total insurers assets

Total insurers assets changes

The insurers’ assets are still mostly composed of fixed-income investments, notably corporate debt (27% of total general account, or GA, assets), sovereign debt (22%) and loans and mortgages (L&M) (6%). The second largest asset class is equities (11%).

On aggregate, liabilities were mostly composed of gross technical provisions for life insurance (54%), gross technical provisions for non-life insurance (13%) and gross technical provisions for unit-linked insurance (9%).

The overall amount of borrowing remained limited at 3%, showing no change compared with the previous year.

…………..

Fact-checked by Oleg Parashchak – Editor-in-Chief Beinsure Media, CEO Finance Media Holding