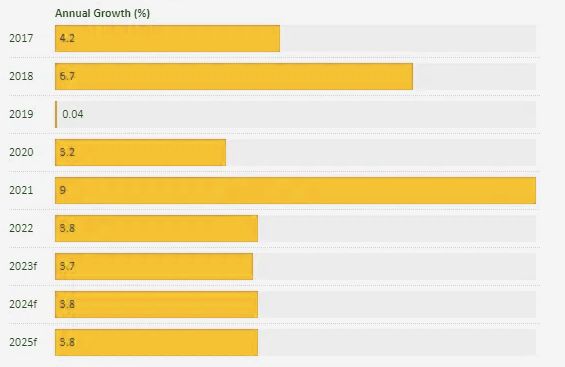

Property insurance growth in Europe recovered in 2022 at 3.2% as compared to a flat growth due to premium price hardening owing to escalating natural catastrophe losses. Climate change is taking an increasing toll. The natural disaster figures for 2022 are dominated by events that are more intense or are occurring more frequently. In some cases, both trends apply.

According to GlobalData’s Outlook, Europe’s vulnerability to large-scale losses resulting from flooding, storms, drought, heat waves, and forest fires will see more insurers adopting selective underwriting and increased adoption of technology such as risk-hazard mapping and ariel imagery.

Property Insurance Industry Outlook in Europe

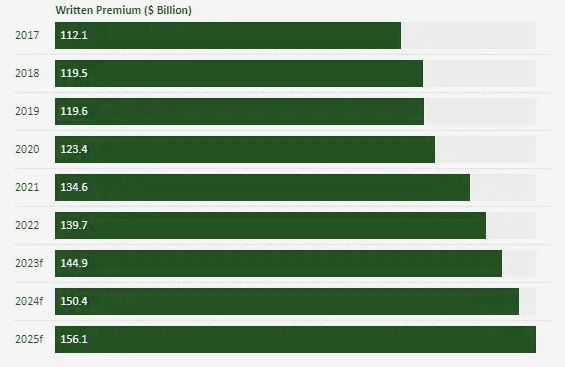

The rise in commercial property renewal prices supported the growth of property insurance premiums in the region. Overall, property insurance is expected to grow by 3.8% in 2023 to reach $145 billion.

Property insurers are expected to leverage data and behavioral technologies such as AI, machine learning, and IoT to develop personalized insurance products and improve profitability.

- The top 10 insurers accounted for 38.9% of Europe’s property insurance premiums in 2022 – indicating a fragmented competitive landscape

- All top 10 insurers were European groups and had a strong solvency position due to prudential underwriting practices and diversified business operations beyond Europe

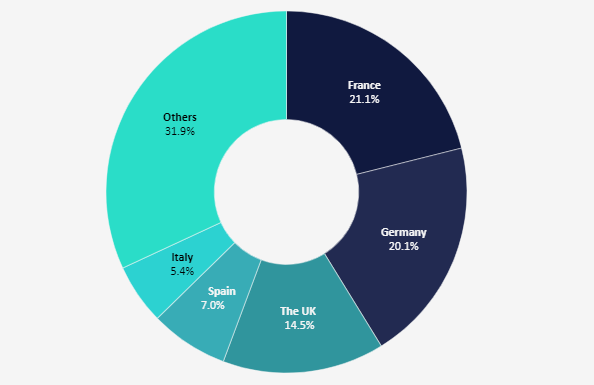

- France was the leading regional market with a 21.1% share in 2022. The other top four markets were – Germany, the UK, Spain, and Italy with a collective share of 47% of the region’s premiums

This includes the use of home-telematics systems/smart home solutions to ensure a more actual, risk-based accurate premium pricing. Allianz, one of the top insurers in the region, collaborated with Panasonic in Germany to develop its smart home solution (see about P&C Insurance Claims Landscape).

Climatic factors will remain key risks influencing premium prices over the next five years. While the developments related to the green economy and digitalized insurance solutions will be key insurance trends.

Private insurance and reinsurance companies have pledged an annual sum assurance of EUR2 billion. Any loss above this amount will be covered by the government.

Europe Property Insurance Industry – Written Premium

Industry stakeholders and governments across the globe are engaging in discussion about the creation of a similar system to address future pandemics.

Trends at Europe’s largest insurers illustrate an upward movement in commercial insurance pricing which is set to continue, albeit at a slower pace.

Europe Property Insurance Industry – Annual Growth

European P&C insurers’ results will provide further evidence of increased pricing as the industry responds to inflation-driven raw material and labour cost increases.

Greater investment returns as interest rates rise and as reinvestment rates surpass current yields should boost future earnings.

Increasing rates for personal lines have been even more challenging, yet here too pricing is beginning to respond, particularly where motor insurers face higher expenses due to spare parts inflation and cars’ increased technical complexity (see How P&C Insurance Companies Can Increase Inflation Resilience?).

Insurance revenue’s recovery extended through 3Q for insurance groups, with revenues recording a strong pickup as economies recovered and travel insurance volume increased with the lifting of pandemic airline restrictions.

Country-Wise Distribution of Property Insurance Premium

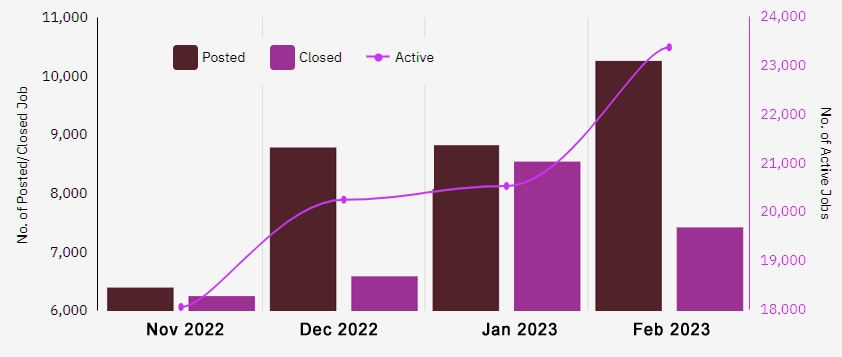

Job Trends in the Insurance Sector

The number of active job in the Insurance sector of the Europe region increased by 13.8% MoM, and increased by 29.4% since December 2022, reaching 23,400 active job postings in February 2023.

A total of 10,251 new jobs were posted, witnessing an increase of 16.3% as compared to the previous month. On the other hand, 7,410 jobs were closed in the same month implying that companies took out 13.2% fewer jobs than the month earlier.

For the period from past 3 months, the number of new jobs posted increased by 60.6% and the number of jobs closed increased by 18.8%.

Job Trends in the Insurance

In terms of Compound Monthly Growth Rate (CMGR) between September 2022 and December 2022, the number of new jobs posted observed a growth rate of 17.11%, the number of active job postings observed a growth rate of 8.98% and the number of jobs closed observed a growth rate of 5.91% (see TOP 50 P&C Insurance Companies).

Between December 2022 and February 2023, the average number of jobs posted stood at 8,554, number of jobs closed stood at 7,188 and number of active jobs stood at 20,579.

European property insurance market was fragmented and highly competitive

Generali, the Italian conglomerate, was the leading property insurer with 5.6% of the market share in 2022. It operates in over 50 countries worldwide. Apart from Europe, the insurer has a strong presence in the Asia-Pacific and South and Central American property insurance markets.

Finland-based Sampo Plc with a share of 4.7% was the second-largest insurer in 2022. The group has a substantial presence in the Nordic region via its subsidiaries including Mandatum Holdings and Topdanmark.

Germany-based Allianz SE was the third-largest European property insurer in 2022 with a 4.1% share. Allianz’s global subsidiaries include AGCS, which provides corporate and specialty insurance solutions such as risk transfer, captive insurance services, energy insurance, engineering insurance, property insurance, and fire insurance, among other lines.

To address future disasters resulting from pandemics, riots, natural catastrophic events, and terrorist attacks, French insurance industry stakeholders started working on an insurance pool ‘CATEX’.

CATEX will cover small enterprises against business interruption (BI) losses arising from such disasters. The insurance will be included in a fire insurance policy and standard BI cover.

Fact checked by Oleg Parashchak