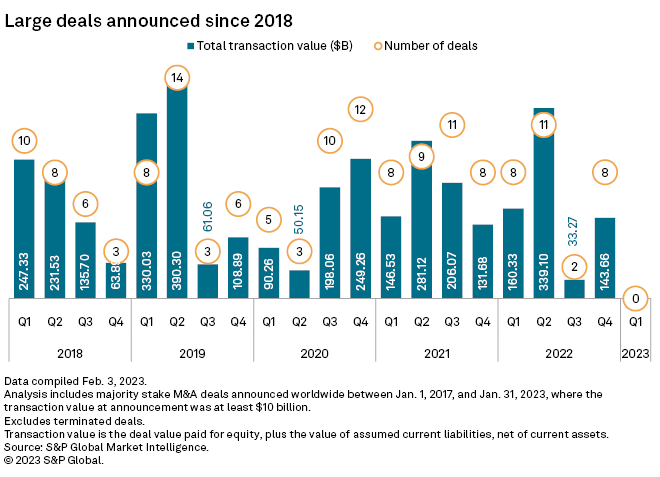

Big-ticket M&A activity is off to a slow start in 2023 as the regulatory environment makes executing large deals more challenging, according to S&P Global Market Intelligence data.

- 19 global deals announced since 2018 with a value greater than $10 bn were pending

- Regulators are not succeeding and blocking a lot of deals

- A longer approval time can make a transaction more costly and delay the benefits

No global deals announced in January had a transaction value that reached $10 billion

This marked the fourth calendar month since the start of 2022 that ended without an M&A deal surpassing that threshold.

The drop in larger deal activity suggests that acquirers are growing more cautious and avoiding the risks associated with more complex deals, as well as spending more time on due diligence in response to increased regulatory oversight.

Despite the challenges of rising interest rates, higher inflation, geopolitical tensions and a looming recession, M&A shows significant resilience, the report found.

Markets have seen a ‘flight to quality’ as investors avoid high-yield and exotic assets, instead focusing on more stable and defensive businesses of sufficient quality to mitigate the short-term market concerns.

However, two unsolicited offers in February provided signs that the thaw is starting to break. Denver-based Newmont, a gold mining company, made an $18.33 billion offer to Australia-based Newcrest Mining. Also, in a potential tie-up between U.S.-based self-storage real estate investment trusts, Public Storage made a $14.48 billion bid to purchase Life Storage Inc.

The deals would serve as a welcome sign for investment bankers who work on large transactions (see how Global M&A Activity in Insurance Slowing from Uncertain Economy).

At the end of January, 19 global deals announced since 2018 with a value greater than $10 billion were pending after five deals of that size announced in 2022 were terminated.

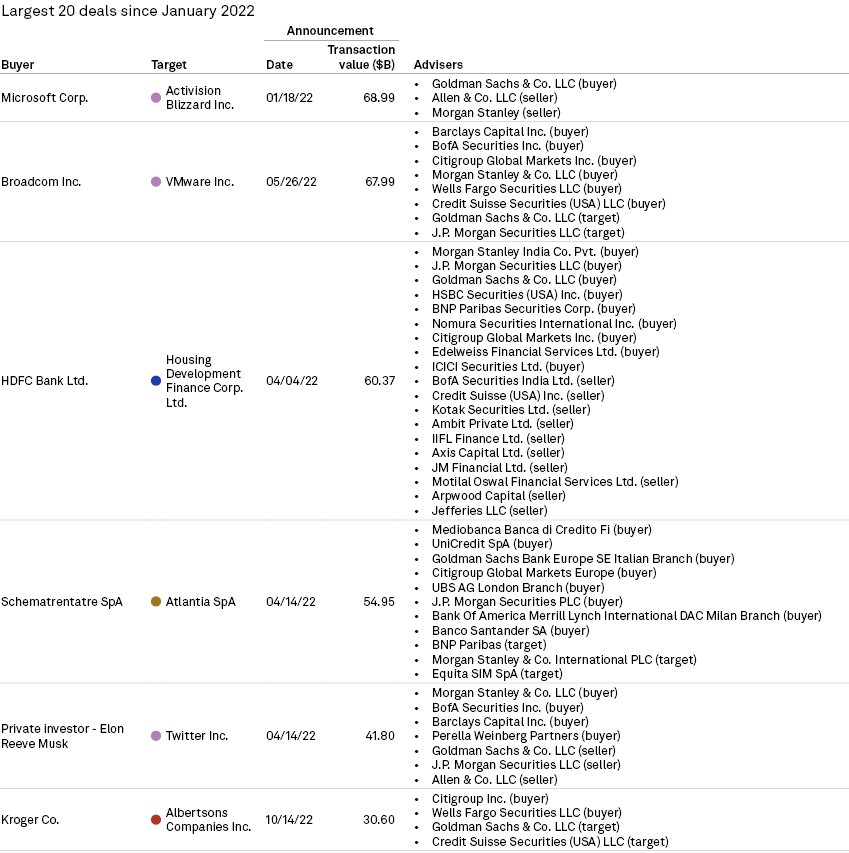

Some of the pending deals in the pipeline — such as Microsoft $68.99 billion agreement to purchase Activision Blizzard — are facing regulatory scrutiny.

According to Global M&A Performance Report, in the U.S., the Biden administration has made more robust antitrust reviews a priority, and regulators in other parts of the world have done the same. But just because regulators scrutinize a deal, that does not mean it will get nixed.

Regulators are not succeeding and blocking a lot of deals. But they certainly, I think, around the world have been a little bit slower to sort of approve deals and let them flow through.

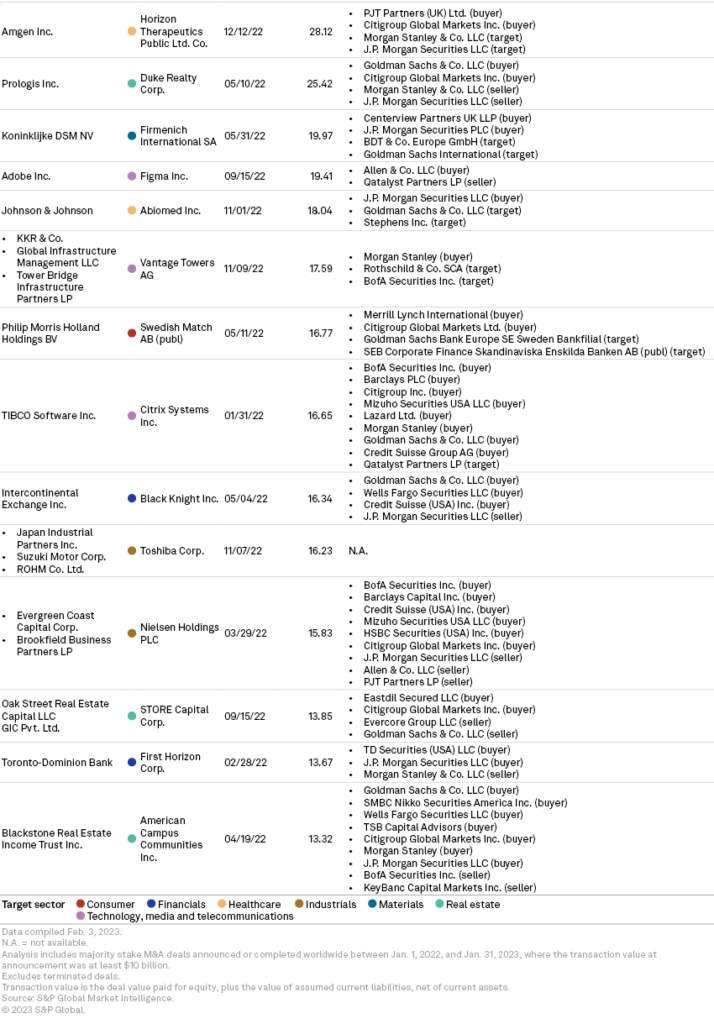

Largest M&A Deals Worldwide 2022

A longer approval time can make a transaction more costly and delay the benefits the companies can realize by combining forces. Executives who are considering M&A are factoring in the regulatory pushback they might receive on a potential combination.

Companies are still contemplating pursuing large deals. M&A activity is likely to continue with a more cautious tone as we head towards the end of the year. The flight to quality reinforces the need for companies to set their sights on assets with a clear, well-articulated strategic rationale.

Fact checked by Oleg Parashchak