Technology and data-enabled solutions are creating the tailwinds for change in the commercial property insurance market. Insurers have a tremendous opportunity to rethink how they serve their customers, according to Intelligent AI survey.

The research was conducted by Insurance Post on behalf of Intelligent AI. The results show the responses from 82 leading insurance companies and brokers.

What are the big challenges impacting the commercial property insurance ecosystem?

It is a matter of public record that commercial property underwriting has been a loss making endeavour for at least the last 5 years, with Lloyds of London reporting that on £50bn of premiums the market had lost over £4.7bn, which is bad news for insurers and customers alike with insurance pricing increasing in response to the mounting losses (see How Russian War in Ukraine Impacts for Global Insurance Sector?).

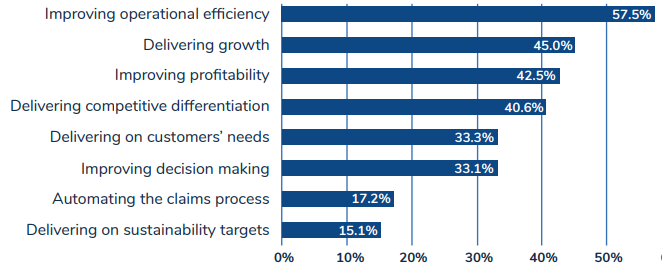

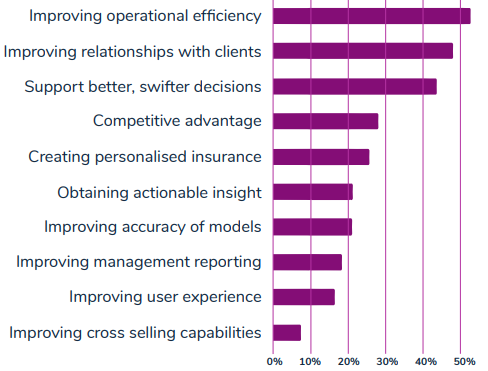

We can see from the graph above that there is a big drive to improve operational efficiency, drive growth and profitability, and reduce costs whilst improving customer experience and delivering competitive advantage in the marketplace.

The big question is how? The survey asked whether new technology is already being adopted to address these needs.

How is the P&C insurance and risk industry using new technology and real time data?

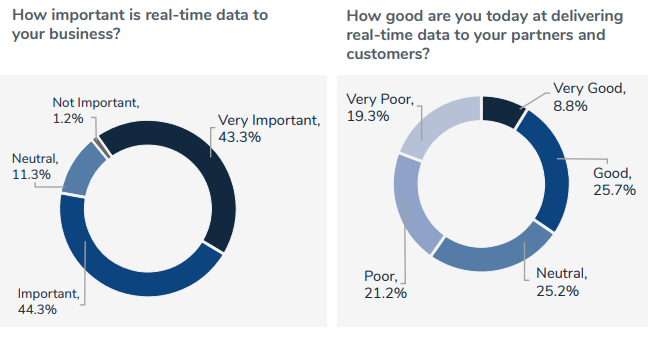

87.6% of insurer and broker respondents stated that real-time data is very important or important to their business. However, only 34.5% feel that their business is very good or good at delivering real-time data to benefit their employees, partners and customers.

The survey has identified a big gap between intent and reality in the use of new technology and real time data.

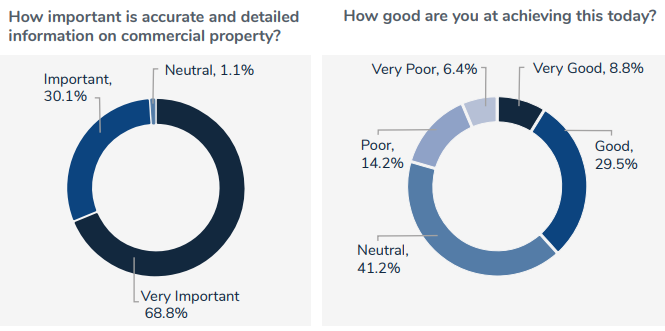

98.9% of insurer and broker respondents stated that having accurate and detailed information on commercial property would be very important or important for their business.

However, the majority struggle to achieve this with only 38.3% saying that they are very good or good when it comes to delivering accurate commercial property data.

The drive for Digital Twins & Location Intelligent for commercial insurance

Insurers are striving to move from only surveying 1 in 10 commercial properties and having little detailed data of the other 90% of the portfolio, to gathering detailed location intelligence from open data, natural catastrophe data, satellite data, IoT data and AI extraction of data from risk reports, to create near real-time digital twins of the risks across 100% of their portfolios, in order to price more competitively and identify risks far more accurately (see How Digital Twins Can Help Insurance Industry?).

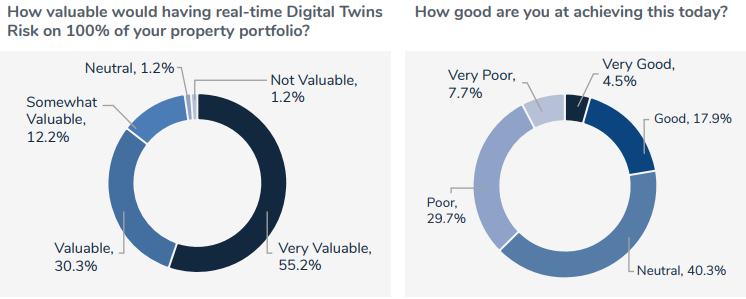

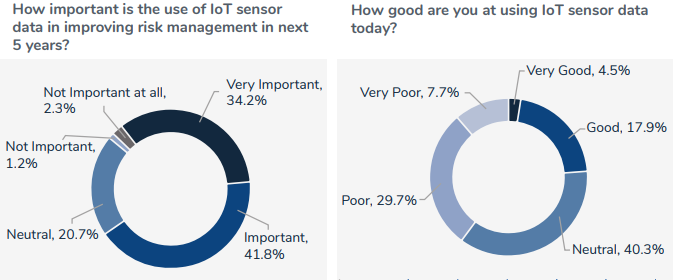

85.5% of insurers and broker respondents stated that Digital Twins of Risk are very valuable or valuable, whereas only 22.4% of insurers and brokers stated they are very good or good at delivering digital twins today.

Looking to the next phase of location intelligence data, 76% of insurer and broker respondents stated that IoT (Internet of Things) sensor data is either very important or important in helping them improve their risk knowledge both within commercial properties (e.g. real-time data from fire sensors or from pressure sensors) and also around the property (e.g. near real-time data on temperature, wind, river flow etc). However, only 22.4% of insurers and brokers feel they are very good or good at using sensor data today.

It is clear that the insurance industry is currently struggling to use real time data in a fully meaningful way today, either in the underwriting process or to support risk management and risk mitigation initiatives.

Insurers currently rely far too much on traditional manual or annual processes to help them understand risk, such as physical site visits by risk engineers to upwards of 10% of the portfolio and underwrite with minimal data on the rest of the portfolio.

It is also clear that high operational costs are not sustainable and there is an urgent need to automate processes, apply artificial intelligence to unlock data insight, and to adopt digital twins to help insurers to move to real-time location intelligence and to significantly lower operational costs (see How Artificial Intelligence Can Help Insurers).

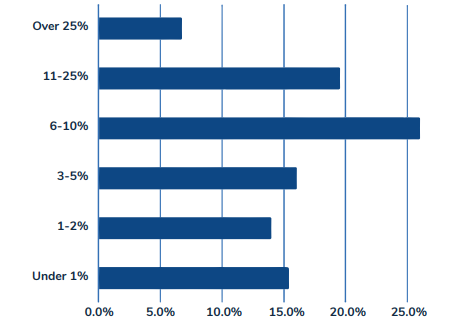

What % of commercial property sites in your portfolio receive a physical property risk survey each year?

The survey has found that only less than 5% of commercial properties are physically surveyed by 45% of insurers and brokers, with a further 28% surveying up to 10% of sites. Today only 6.8% of insurers survey over 25% of sites.

Additionally, previous research undertaken by Intelligent AI from over 5,000 risk engineering visits showed that for many insurers less than 1 in 7 major risks identified through the visits are resolved within 5 years.

The real potential of AI and Digital Twins for the insurance industry is not just in lowering operational costs, but also in freeing up risk managers and underwriters to focus far more time to support client in delivering risk mitigation programmes to increase the clients business continuity and lower claims.

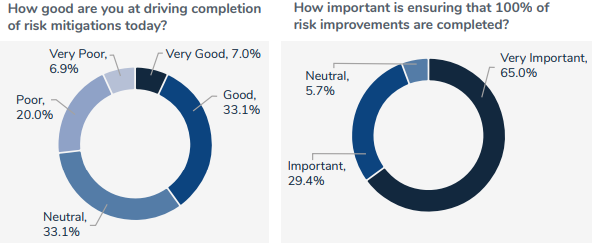

Over 94% of insurers and brokers stated that it is very important or important to ensure risk mitigations are completed by their clients. Risk insight and risk mitigation has always been the key to profitable underwriting for insurers. It is therefore alarming that only 7% feel they are very good at driving risk mitigation programmes, with a further 33.1% saying they are good at this key task.

What are the benefits of new technology and real-time data for managing commercial property risk?

The good news is that the insurance industry is recognising the opportunity to build competitive advantage by translating the mass of available data into actionable insights, leading to better decision making, better and more profitable underwriting and to lowering operational expenses, with the goal of improving both the customer experience and ultimately, reduce the total cost of risk.

What do you see as the benefits of real-time data sharing?

The survey addressed these potential benefits as highlighted in the table to the right.

The challenges to adopting innovativenew technology and real time data?

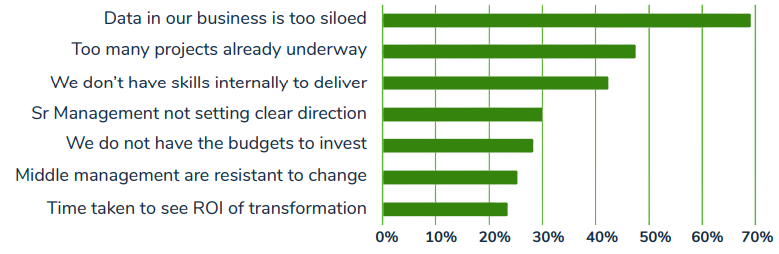

In order to accelerate the adoption of real-time data, digital twins, AI and IoT, we need to overcome some immediate barriers as outlined in the chart below. Siloed data and lack of internal skills are amongst the key barriers.

What do you see as the challenges to adoption of innovation and real-time data in your business?

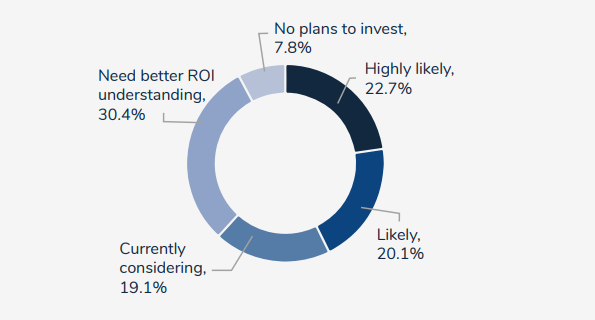

How likely are you to invest in improved real-time data in the next 12 months to deliver better services and/or lower costs?

These findings highlight both the challenge and the opportunity for the insurance and risk management community. It is very positive to see that over 60% of insurers and brokers are already highly likely, likely or are currently considering investing in real-time data, AI and digital twins in the next 12 months as we build back better from the pandemic.

Survey Conclusions

From the survey, Intelligence AI identified the following themes around real-time data and digital twins:

- Digital Twins of risk have huge potential to drive new insights into commercial property risk and underwriting. New sources of data can be extracted to help modernize commercial property underwriting and provide greater value to customers seeking to buy commercial property cover.

- The real-time data provides the opportunity to drive proactive risk management, prevent losses and enable the competitive underwriting of risks, based upon a forward looking view of risk.

- Customers already using real-time location intelligence and IoT in property underwriting are generating immediate financial returns and quantifiable benefits such as more accurate risk pricing and lower claims and losses. Extending those benefits with real-time data driven risk management and underwriting will deliver major competitive advantage to insurers and brokers. There will always be challenges that insurer and brokers face in adoption of any new technology. However, the survey has demonstrated that current risk management and underwriting processes rely to much on fragmented and manual data gathering that is leading to high losses in commercial property underwriting today.

- However, It was really encouraging to see that nearly 2/3rds of those surveyed are already looking to invest in real-time data and digital twins of risk and that the majority of the remaining 1/3rd are investigating the return on investment.

- It is clear that insurers see immediate advantages to adopting AI and digital twins to drive smarter underwriting and risk management. This is leading to better decision making and lower operating costs.

……………

AUTHORS: Anthony Peake – CEO & Co-Founder Intelligent AI, Neil Strickland – CCO & Co-Founder Intelligent AI