Catastrophe and green bonds in the private sector have become the most prominent innovations in the field of sustainable finance in the last 15 years.

Yet, the issuances at the sovereign level have been relatively recent and not well documented in the literature. This Note discusses the benefits of issuing these instruments as well as practical implementation challenges impairing the scaling-up of these markets.

Financial markets will play a catalytic role in financing the adaptation and mitigation to climate change

According Sovereign Climate Debt Instruments IMF`s Report, the issuance of these instruments could provide an additional source of stable financing with more favorable market access conditions, mitigate the stress of climate risks on public finances and facilitate the transition to greener low-carbon economies. Emerging market and developing economies stand to benefit the most from these financial innovations.

When it comes to dealing with climate change, fiscal policy is crucial

In addition to the essential carbonpricing that incentivizes low-carbon activities, fiscal policy can aid the transition to a greener low-carbon economy by investing in climate-smart infrastructures, such as renewable energy generation, and encouraging climate-smart technology research and development. Even though these policies would yield substantial long-term economic benefits, they require a substantial amount of financing.

The prepandemic research by G20 Foundations Platform calculated that the world needs 2.2% of GDP invested annually to deliver commitments from the 2030 Sustainable Development Goals and the Paris Agreement.

Furthermore, adapting to the consequences of climate change and minimizing damage from climate-related natural disasters usually necessitates an increase in government spending, among other things, which must be accommodated within a country’s overall budgetary structure.

Financial innovation can then play a crucial role in financing these interventions

The development of greenand catastrophe bonds has been one of the most important financial breakthroughs in the domain of sustainable finance during the last 15 years. Green bonds are often structured similarly to traditional “plain vanilla” bonds, with the distinction that the bond contains a “use of proceeds” clause stating that the funds would be utilized for green investments.

A catastrophe bond is a debt instrument that allows the issuer to get funding from the capital market, if and only if catastrophic conditions, such as a hurricane, occur.

Climate change is expected to increase the likelihood and severity of these extreme weather events. Although the two instruments are of different nature, this paper analyzes them together given that both of them can contribute to the resilience to climate risks and have been recently issued at the sovereign level.

These innovative finance instruments allow policymakers to tap wider capital markets for the financing of Sustainable Development Goal–related projects (green bonds) and mitigate the stress on debt sustainability after natural disasters (catastrophe bonds). Thus the financial industry is becoming increasingly important in accelerating the transition to sustainability and carbon neutrality.

While green and catastrophe bonds have gained significant popularity, their markets remain fairly shallow at the sovereign level

For instance, sovereign green bonds make up about 0.2 percent of all government debtsecurities in the Organisation for Economic Co -operation and Development (OECD) area. In emerging market and developing economies (EMDEs), sovereign green bond issuances account for 12 percent of total green bond issuances (OECD 2021). However, the sovereign green bond market is likely to expand as more countries see green bond issuance as a vital tool for demonstrating moral leadership on climate change and sustainability, as well as funding commitments under the Paris Agreement. Similarly, a few countries have insured themselves against natural disasters, and even large catastrophe bonds only cover a small portion of the total possible damage.

The literature on sovereign green and catastrophe bonds is minimal

Since both green and catastrophebonds issuances at the sovereign level are a recent development, most of the literature on sustainable finance has focused on the issuances by the corporate sector and local governments. This note fills this gap and studies the developing markets for sovereign green and catastrophe bonds, examines the characteristics of these instruments, and analyzes their costs and benefits. Our analysis contributes to the understanding of the markets for climate financing and the workstream of the Fund to help mobilize both public and private finance

Green Bonds

A wide range of instruments is available for governments to finance green projects

For example, Rose(2021) discusses green bonds as well as other instruments, including green Sukuk, green loans, and green Schuldschein. World Wildlife Fund (2018) describes other examples including equity finance and debt for climate swaps. Among these instruments, the green bond is one of the fastest-growing segments. In this section, we overview sovereign green bonds, highlighting the recent development and policy issues.

What is a green bond?

Green bonds refer to debt securities issued to raise capital earmarked for green projects

The exactdefinition, however, varies depending on what constitutes green projects. For example, the Green Bond Principles (GBPs), which were established in 2014 and are maintained by the International Capital Market Association (ICMA), provide guidelines and green project categories (ICMA 2021). The Climate Bonds Standards (CBSs), built on top of the GBPs by the Climate Bonds Initiative (CBI), provide a sector-specific definition of “green” and are used for the certification of green bonds by CBI (Climate Bonds Initiative).

Green bond data can differ across databases

ICMA explores four databases and discusses the difference in the definitions. For example, Bloomberg tags the “Green Bond” label when an issuer self-labels its bond as green or declares its compliance with the GBPs on the use of proceeds.

The Green Bond Database by Environmental Finance lists all bonds that are self-labeled as “Green.” Eikon is another database that provides green bond data, whose definition is aligned with the CBSs; the data are reviewed by CBI.

Thus the analysis of green bonds, in general, should be understood with caveats on the data. The analysis in this paper relies on Eikon as it is consistent with the CBSs and has been used extensively in the literature of the sovereign green bond. For sovereign green bonds, Eikon and Bloomberg are comparable.

Evolution of sovereign green bonds

Sovereign green bonds are a recent phenomenon

The literature often cites the bond issuedby the European Investment Bank in 2007 as the first green bond (Cortellini and Panetta 2021; OECD 2021). Since 2007, international organizations, municipalities, and private sectors have increased the issuance. Until 2015, although the annual issuance of green bonds had reached $40 billion, no issuance by central governments was recorded.

In 2016, building on the momentum of the Paris Agreement adopted in 2015, Poland became the first issuer of sovereign green bonds.

A wide range of sovereigns has issued green bonds

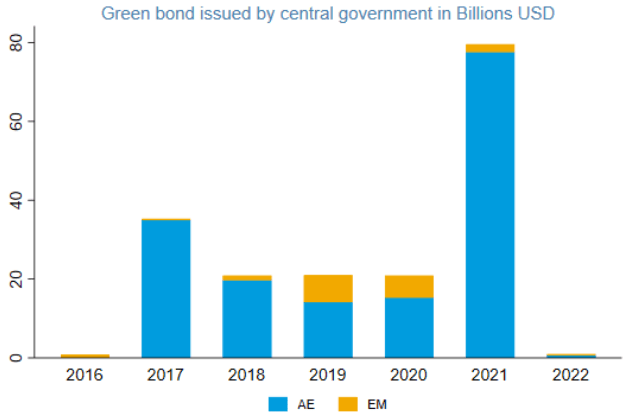

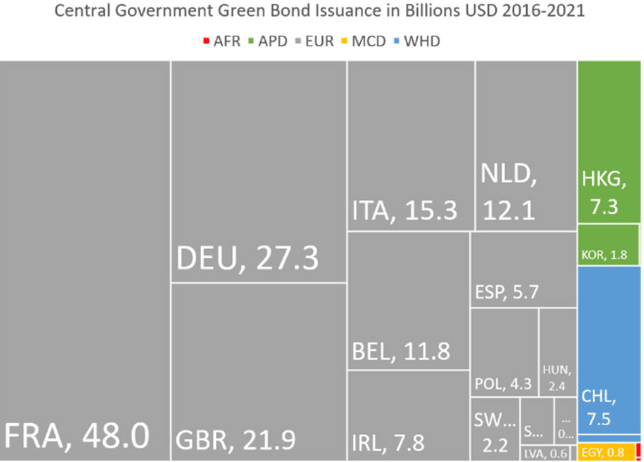

Poland was the first country to issue a sovereign green bond in 2016, followed by France in 2017, and the issuance recorded nearly $80 billion in 2021. Most issuance was by advanced economies until February 2022. Geographically, the cumulative issuance from 2016 to 2021 is mostly concentrated in European countries ($161 billion), followed by Asian Pacific countries ($9 billion), Western hemisphere countries ($8 billion), the Middle East and Central Asian countries (less than $1 billion), and African countries (less than $1 billion).

Green bonds issued by central government in billions of US dollars

France has issued nearly $48 billion for green projects and is the largest issuer as of February 2022. In terms of cumulative green bond issuance relative to GDP at the country level, Chile has the highest ratio of 2.37 percent (relative to its GDP in 2021). Others are all below 2 percent as of February 2022.

The average maturity as of issuance is 12.6 years with a standard deviation of 8.4 years

Although the holder’s information is not available from Eikon, Doronzo, Siracusa, and Antonelli (2021) suggest that real money investors, such as pension funds, sovereign funds, and insurance companies, invest their money with a long-term perspective and a buy-and-hold strategy in Europe.

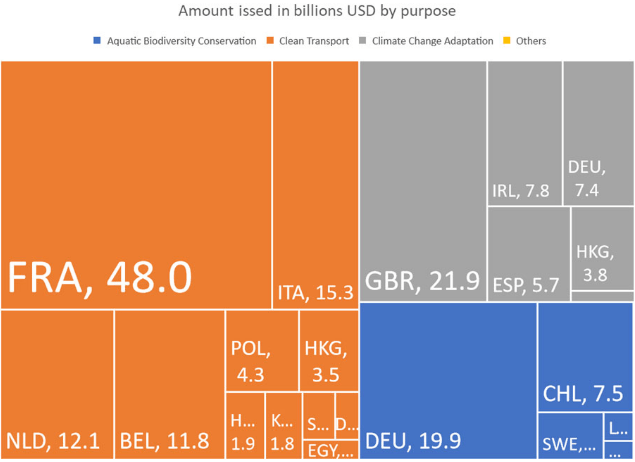

The main purpose of issuing green bonds in the sample is clean transport

The classification ofpurpose is not necessarily mutually exclusive, but the available data in Eikon shows that clean transport is the main purpose of green bonds. The share of climate change adaptation and aquatic biodiversity conservation is also significant. One caveat is that the purpose of green bonds is classified by Eikon and may not reflect all purposes of each bond issued.

Green bond issued amount by purpose

Costs and benefits of sovereign green bond issuance

Several costs associated with sovereign green bond issuance have been discussed in the literature.

For example, Doronzo, Siracusa, and Antonelli discusses three types of costs relative to the costs of the conventional bond:

- Green bond requires more disclosure and tracking for the use of proceeds. For example, if a green bond issuer wants certification from CBI, documentation to show that the CBS is met and engagement with verifiers is needed. But more information provision could lead to less uncertainty for buyers, so the net impact is not clear.

- The reputation of the issuer could be damaged if the green project that the green bonds finance fails or is perceived as greenwashing (falsely claiming that the financed investment is green). The net impact is again ambiguous since the green bond plays the role of a commitment device and thus can lower the probability of failure by motivating better planning and governance of the projects.

- The issuance of green bonds can crowd out that of conventional bonds, resulting in lower liquidity and higher funding costs for both segments. Doronzo, Siracusa, and Antonelli summarize Danish and German techniques to mitigate the liquidity problems. For example, the Germany Finance Agency mitigates the impact on the liquidity of conventional bonds by increasing its stock of conventional bonds at the time it issues green bonds by the same amount. The additional own holdings in conventional bonds can be used on the secondary market for repo transactions or for lending activities.

OECD (2021) also points to gaps in supply constraints.

A pipeline of green projects needs to be establishedto sustain the supply and liquidity of the green bonds. OECD (2021) argues that the supply constraints can be mitigated by utilizing technical assistance from experts and aggregation of small-scale projects with securitization. Another obstacle to sovereign green bonds is that most sovereign debt legal frameworks do not allow the earmarking of proceeds.

The literature discusses a wide range of benefits.

OECD (2017) points out their reputational benefits and theirrole as a commitment device, among other benefits. Unlike conventional bonds whose proceeds can be used for general purposes, the proceeds from green bonds need to finance green projects, tying the hands of the issuer. This commitment to finance green projects can send signals and improve the reputation of the issuer, leading to a higher price of the issuer’s nongreen bonds (halo effect).

For sovereign issuers, Doronzo, Siracusa, and Antonelli mention that the issuance of sovereign green bonds can encourage other issuers to enter the green bond market as it provides a market benchmark.

Doronzo, Siracusa, and Antonelli also argue that green bonds tend to be issued with a long maturity, so the refinancing risk is lower, and the benefit could be larger for emerging or less-developed countries that have less stable demand for extra-long maturities.

The literature on sovereign green bond greenium is limited.

Doronzo, Siracusa, and Antonelli discussthat the evidence of sovereign greenium reported by private financial institutions is mixed and estimate greenium in both the primary and secondary market using Eikon’s data.

They show that the greenium is negative in the primary market but is slightly positive (0.5 bps) in the secondary market. IMF shows that the greenium of 5- and 10-year green bonds are around 3 to 5 bps and that the greenium implied by swap spreads from 1 to 7 bps for six EU countries. In the context of the US municipal bonds, Karpf and Mandel (2018) find that the greenium was negative but has turned positive recently, suggesting that green bonds have become more attractive to investors in recent years.

Baker and others also find that the greenium is positive except when it is issued simultaneously with ordinary bonds from the same issuer; in that case, a premium emerges over time on the secondary market.

Catastrophe Bonds

Extreme weather is expected to be one of the consequences of climate change, and will result in both physical and fiscal damage.

Debt with maturity extension provisions such as hurricane clauses is another alternative. A debt instrument with a unique structure is catastrophe bonds.

There are many ways to mitigate fiscal risks that originate from extreme weatherevents. For example, OECD and World Bank list both ex ante and ex post financing tools to mitigate the fiscal risks.

What is a catastrophe bond?

A catastrophe bond is a debt instrument that allows the cedent (the insured) to get funding from the capital market, if and only if catastrophic conditions, such as an earthquake or hurricane, occur. From aneconomic point of view, the instrument insures the cedent against the loss from catastrophic events (called peril) by shifting risks to the holders who bet on the nonoccurrence of catastrophic events.

The insurance against natural disasters can be considered an adaptation policy for countries with exposure to climate change risks.

The catastrophic conditions can be defined by various types of triggers

For example, a trigger based onactual monetary losses experienced by the cedent is called an indemnity trigger, the one based on industrywide losses is called an industry loss trigger, and the one based on noneconomic catastrophic conditions such as the magnitude of an earthquake or wind speed of a hurricane is referred to as parametric index trigger.

The advantage of indemnity type is that it insures cedents against the actual loss, while a disadvantage is time – consuming loss verification since the damages need to be assessed.

In contrast, the parametric type may not insure cedents against the amount of actual loss, but it has the advantage of speedy settlement since parameters such as wind speed and magnitude of an earthquake are easier to measure. The idea can be extended to noncatastrophic conditions, such as mortality rates, in which case the concept of catastrophe bonds is generalized to insurance-linked securities (ILS).

The legal structure of a typical catastrophe bond is designed to minimize counterparty risk

Specifically, aspecial purpose vehicle (SPV) is set up, and the cedent (often called the sponsor) enters an insurance agreement with the SPV. Cedents pay premiums upfront in exchange for future reimbursement conditional on catastrophic events.

The SPV issues catastrophe bonds to the holders in exchange for cash, promising future principal and interest payments conditional on the nonoccurrence of catastrophic events.

Thus, what an SPV does is to collect cash from cedent and investors, keep the cash typically in safe assets, and disburse it to either cedent or investors depending on the occurrence of catastrophic events. In this way, an SPV can secure the cash for later distribution, and who owns the bond does not affect the capacity to pay cedents, so the bond can be traded in the secondary market.

The legal structure has financial, statistical, and economic implications

Financially, the catastrophe bondis insulated from the cedent’s financial condition, so the credit rating is different from that of the cedent. Statistically, the catastrophe bond is issued by the SPV and not by the cedent, so the cedent’s debt does not increase. Economically, the cash proceeds are kept by the SPV, so they cannot be used by the cedent to spend on items including consumption, investment, etc., until triggered.

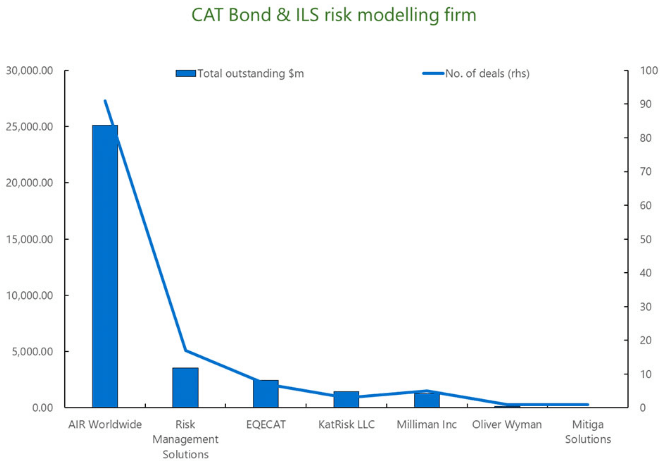

CAT bond and ILS risk modelling

A notable difference from the traditional bond is the modeling of catastrophe risks

In additionto credit ratings, the risk modeling is prepared by a third-party risk modeler, such as AIR Worldwide (or Verisk), and the results including the expected loss are disclosed in the bond’s offering documentation. Investors can ask questions to the modeler in the marketing process of the bond, and they often have their own modeling team to assess the risks. The modeler also calculates the actual loss after catastrophe events.

The modeling often involves the assessment of extreme but nontail events since many catastrophe bonds are structured in the way that investors incur loss only if the loss from catastrophic events exceeds a certain threshold (attachment point), and the investors’ loss is bounded by the principal (exhaustion point). The typical maturity is three to five years, so the long-term impact of climate change risks may not be fully reflected.

Evolution of sovereign catastrophe bonds

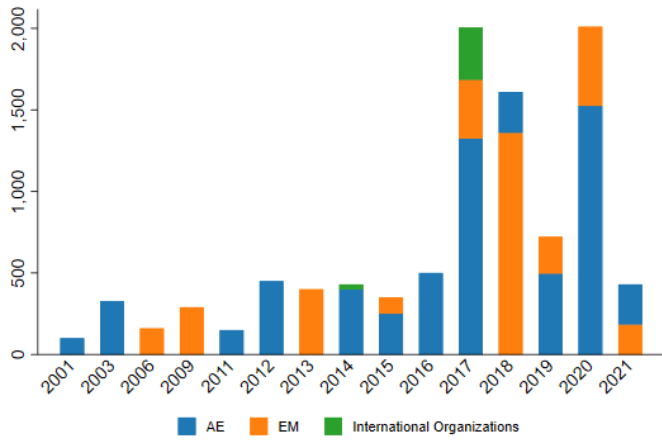

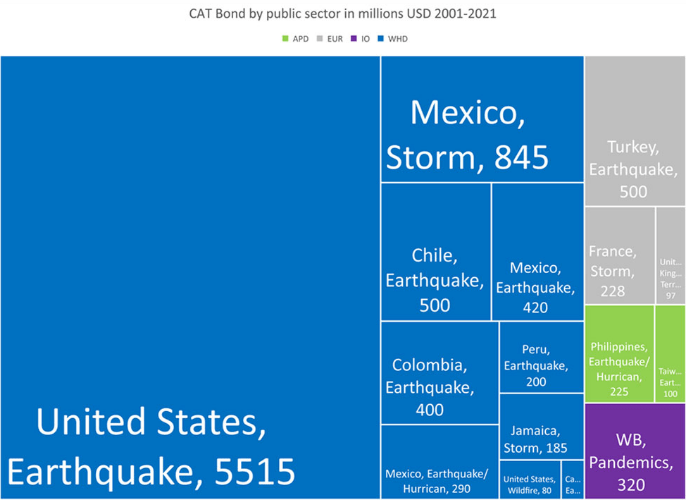

The catastrophe bond issuance by the public sector is increasing over time

The largest player is the United States, accounting cumulatively for nearly $5.6 billion, followed by Mexico, Chile, Turkey, etc. Some of them, including the California Earthquake Authority, are local state agencies, but the central governments themselves can be the cedents, including the recent examples of Jamaica, Mexico, and the Philippines.

CAT bond issued amount in millions of US dollars

However, climate-related catastrophic events such as storms and hurricanes also constitute a significant share.Importantly, pandemics can be the perils: in 2017, the World Bank issued a five-year coverage, and then received payment for the COVID-19 pandemic.

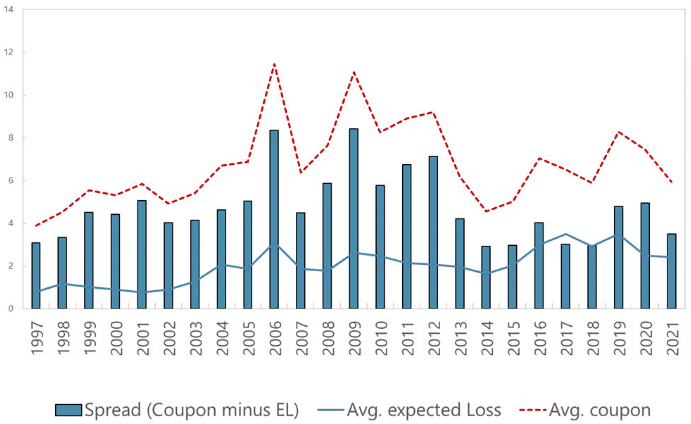

Pricing of sovereign catastrophe bonds

Empirically, the cedents pay more than they receive in expectation. According to Artemis, from which onlythe aggregated data of private and public catastrophe bonds is available, the investors’ average return to catastrophe bond in coupon is around 2 to 4 times the expected loss.

Difiore, Drui, and Ware note that risk spreads have widened materially following major catastrophes in the past, such as 2006 following a US hurricane and 2012 following earthquakes in Japan and New Zealand.

Whether the positive spread is expensive depends on the benchmark to compare. For example, self-insurance can save the coupon payment to investors, and thus can be an inexpensive alternative. The cash, however, needs to be stored in a dedicated fund and cannot be used for other illiquid purposes.

Therefore, for countries with large opportunity costs, self-insurance can be more expensive than catastrophe bonds. A comparison can also be made with traditional reinsurance.

Michael-Kerjan and others argue that the premiums that traditional reinsurance charges range from 3 to 5 times the expected loss, which is not very different from catastrophe bonds.

CAT bond and ILS issuance average expected loss and coupon

Some literature argues that the catastrophe bond market is inefficient.

In theory, the premium that cedentspay should be independent of the cedents’ credit risks since the SPV stores and disburses cash. Chatoro, Pantelous, and Shao and Gotze and Gurtler, however, argue that, in both the primary and secondary markets, the risk premium depends on the cedent’s characteristics, such as the cedent’s length of the time in the market, credit ratings, etc. Thus, new cedents can face challenges not only due to positive spread but also due to higher premiums than other experienced cedents.

Intermediation by the World Bank has mitigated the challenges that countries face in utilizing catastrophe bonds.

Since 2016, all the sovereign catastrophe bonds in the data set compiled by Artemis have beenintermediated by the World Bank. By providing the service of an SPV, the World Bank simplifies the procurement process as setting up an offshore SPV could be a legal barrier for countries. Anecdotally, the reputation and experience of the World Bank also contribute to narrowing the spread. Thus, catastrophe bond issuance through the World Bank offers an attractive venue for the countries that seek insurance against natural disasters. For example, a case study by the World Bank on its collaboration with Mexico can be found in World Bank.

Broadening the investor base to the public sector can help correct the market failure of climate change and improve crisis management.

Since climate change has a heterogeneous impact on different regions on theearth, the cost of climate change in one region may not be internalized by other regions. Investing in catastrophe bonds can be an effective mechanism to internalize climate risks that are physically far away from the investors. In other words, by investing in catastrophe bonds, governments can show commitment by putting their “skin in the game” while earning a positive return on average.

Conclusions

Financial markets will play a catalytic role in financing the adaptation and mitigation to climate change.

While catastrophe and green bonds in the private sector have become the most prominent innovations in the field of sustainable finance in the last 15 years, the issuances at the sovereign level have been relatively recent and not well documented in the literature. This note filled this gap by presenting an overview of the development of markets for these instruments, as well as discussing their benefits and the barriers for further development.

Sovereign green bonds can provide various benefits for issuers but also face several challenges.

Thedemand for green instruments can potentially allow governments to issue bonds with a longer maturity (as green projects are long-term projects) and to borrow at lower costs. While the estimated greenium in this note is not large, it has been increasing over time alongside the level of sovereign green bond issuances. Whether the administrative costs associated with green bond issuance exceed the benefit is a country-specific question, but strengthening peer learning and climate information architecture could help reduce the costs and increase the benefits over time (Ferreira and others).

It remains an open question whether the purpose of the project associated with the green bond is a key determinant of the greenium, and whether green bonds have resulted in the climate outcomes they intended to achieve. The further development of the green bond market could be facilitated by improving transparency and creating clearer national guidelines and standards relating to eligibility and green definitions.

Sovereign catastrophe bonds are an effective tool to transfer risks to bond investors amid the increasing frequency of natural disasters due to climate change.

However, this note has identified several obstacles tothe more widespread use of catastrophe bonds. These challenges include their high transaction costs and limited investor base.

Catastrophe bond issuance through the World Bank has mitigated some of these barriers and offers an attractive venue for the countries that seek insurance against natural disasters and could also help in broadening the investor base.

Although fiscally constrained climate-vulnerable economies face the tradeoff between investing in resilience-enhancing adaptation and buying catastrophe bonds, one should note that the former could reduce the disaster risks, and thus the premium for the catastrophe bonds, and the latter could improve financial sustainability for the former. In this sense, green and catastrophe bonds can complement each other, and policymakers need to optimize their use.

Emerging and developing economies should work to foster larger sovereign issuances of these new instruments as they are the most susceptible to climate change.

In the case of green bonds, a greaterissuance (with appropriate institutions to prevent greenwashing) would facilitate the financing of climate-related projects and, hence, the transition to greener low-carbon economies.

Moreover, increasing the size of the market could make the greenium more sizable, as observed in advanced economies.

EMDEs usually face higher premiums and volatility in regular bond markets and thus stand to benefit greatly from green bond issuance by tapping the wider capital markets at reasonable rates.

In turn, catastrophe bonds could be critical for EMDEs which face the highest climate risks but still feature low adaptive capacities. Strengthening countries’ debt absorption capacity is an important necessary condition to leap the gains from these financial instruments given the large climate finance needs.

Overall, the issuance of green bonds seems to be a potentially useful resource for EMDEs at high risk of climate change that need to undertake large green mitigation projects (which may be the reason behind the larger greenium for these countries), while catastrophe bonds seem more appropriate for countries which are already exposed to natural disasters or those in which climate change is expected to increase the likelihood and severity of these events (such as small islands).

………………………….

AUTHORS: Sakai Ando, Francisco Roch, Ursula Wiriadinata and Chenxu Fu – International Monetary Fund