Mergers and acquisitions activity at the beginning of 2023 is expected to remain somewhat muted, consistent with the environment in the second half of 2022. But looking further ahead to the second half of 2023 and beyond, deal-making is likely to accelerate, according to Morgan Stanley.

Unlike past M&A down cycles, such as after the dot-com bubble of the early 2000s and the financial crisis of 2008-2009, it is the recent reduction in activity will be shorter lived. The growth in the private equity industry, sophistication of corporate clients and overall strength of corporate balance sheets and earnings should result in increased M&A activity in 2023 and beyond.

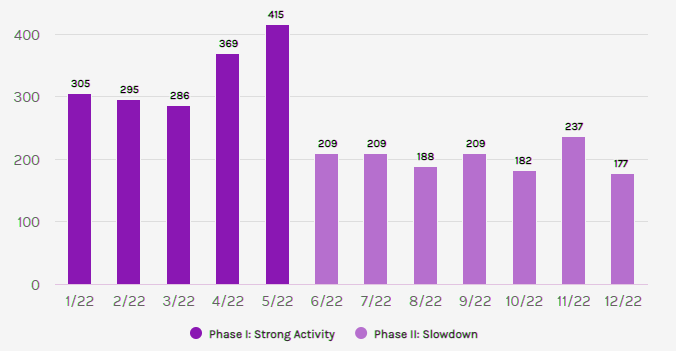

The 2022 mergers and acquisitions market experienced stark contrasts between the two halves of the year. In the first five months, deal activity was strong—a continuation of the record environment that existed in 2021.

The volume and number of mergers and acquisitions in the first half of 2022 were better than historical norms, including several “mega deals” valued at over $10 billion. But in the second half of the year, deal activity slowed meaningfully.

Experienced dealmakers are familiar with the cyclical nature of the M&A market, according to Bain Report. Bain research on M&A in times of turbulence validates how M&A was part of the winning response in previous down cycles.

Deal values and deal multiples decline as sellers hold back and acquirers lose conviction. As uncertainty impacts both the base business of acquirers and targets, it becomes harder to make decisions about deals. It’s no wonder why many executives lose their appetites for the deal process during turbulent times.

Factors most likely to drive activity include:

- Well-capitalized companies making acquisitions in their core businesses

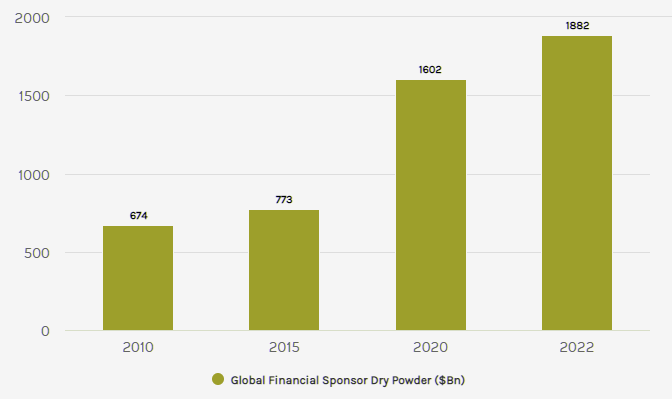

- Financial sponsors, which are holding record amounts of capital, deploying it in acquisitions

- Uneven performance among companies stoking shareholder activism

- Cross-border M&A making a comeback

Macroeconomic uncertainty, volatile capital markets, rapidly rising interest rates and the impact of inflation caused many corporations to focus internally versus making acquisitions.

Potential sellers faced declining valuations and were reluctant to transact at prices that were down significantly from earlier in 2022 (see report Global M&A Activity in Insurance Slowing from Uncertain Economy).

In addition, large, transformational transactions faced increased regulatory scrutiny. The rapidly rising interest rate environment essentially shut down leveraged finance markets as banks and other lenders dealt with a large backlog of transactions needing to get financed, reducing financial sponsor activity.

Global Announced M&A Volume

$bn

While the number of announcements slowed in 2022, dialogues about potential strategic transactions have continued. As some of the headwinds the M&A markets faced in the back half of 2022 abate, M&A activity should return quickly.

There may be an explosive return of activity. It may take some time for buyers and sellers to gain clarity on how inflation, foreign exchange rates, interest rates and consumer demand will affect revenues and valuations.

There has to be agreement between the buyer and seller on the outlook and the multiple to pay for today’s cash flows. While that may take time to work itself out, I believe it will happen within the next couple of quarters.

Deal practitioners are prepared to take advantage of this moment. Respondents anticipate closing a similar number of deals, if not more, in the year ahead, encouraged by more attractive asset availability and decreased competition.

2022 was a tale of two halves for M&A

The beginning of the 2023 year was active, as robust dealmaking carried over from the record-breaking levels of 2022 to drive approximately $2.2 trillion worth of global deals through the first half of the year, compared to approximately $2.7 trillion worth of such deals announced over the same time period in the previous year, according to Harvard Law School Forum Review.

M&A activity slowed considerably after the first half of 2022, however, as significant dislocation in financing markets, an increasingly volatile stock market, declining share prices, concerns over inflation, rapidly increasing interest rates, war in Europe, supply chain disruption and the possibility of a global recession undermined business and consumer confidence and created hesitancy to agree to major transactions.

The year ended with total deal volume of $3.6 trillion globally, down from $5.7 trillion in 2021 but in line with the $3.5 trillion of volume in 2020 as well as with the five-year average (excluding 2021), and in a sense was the inverse of 2020, which saw a precipitous decline in M&A activity in the first half at the outset of the Covid-19 pandemic, followed by a surge in the second half driven by massive liquidity and low interest rates.

Transactions involving U.S. targets and acquirors continued to represent a substantial percentage of overall deal volume, with U.S. M&A totaling over $1.5 trillion (approximately 43% of global M&A volume) for the year, as compared to approximately $2.5 trillion (roughly 43% of global M&A volume) in 2021 (see Global Private Equity & Venture Capital).

As volatility in valuations eventually declines, interest rates eventually settle and post-pandemic winners and losers become clearer, we expect that tech will continue to be an active area of M&A in 2023.

Strategic acquirors that have thoughtfully managed their balance sheets and private equity funds that have ample dry powder may be eager to pursue tech (and other) targets that would have previously been out of reach at the much higher valuations many companies enjoyed in 2021.

Further, the trends that support dealmaking—a desire to expand and diversify product offerings, drive growth, enhance efficiency, remain competitive and respond to innovation—remain just as present as ever.

Technology will continue to revolutionize the market for products and threaten existing business models, which may create opportunities for M&A and other corporate transactions.

Cash-rich companies making strategic, bold moves

In 2008–2009, numerous industry-defining deals positioned acquirers for faster, more profitable growth out of the downturn. In the current cycle, too, companies with a strong market position, cash on hand, and debt capacity will have the upper hand to execute transactions.

The companies should be confirming their strategic M&A roadmaps, revisiting deal models, and laying the groundwork to move fast on desirable targets. Nearly every sector has a few cash-rich market leaders.

Energy, industrials, and technology stand out as sectors in which the top players have solid balance sheets to make bold moves. Strong performing companies with an experienced track record of M&A will be the best positioned to do the largest transformational deals.

Continued prevalence of small to midsize deals

Thousands of deals valued at less than $500 million make up the bulk of M&A activity each year. We expect this to continue. Companies look to M&A to address strategic needs to expand markets, build new engines for growth, and fill capability gaps.

Nearly 40% of surveyed M&A practitioners tell us that a volatile market is making the deal process take longer.

Smaller to midsize deals will be easier than megadeals to complete given relatively lower risk, less reliance on financing, and less regulatory scrutiny.

Dealmakers in many industries may shy away from pursuing deals that could wind up in regulatory crosshairs as extended pre-close periods incur many direct and indirect costs. Sectors with struggling assets, such as banking in Europe and telcos in developing economies, may find more tolerance among regulators for large consolidation deals.

4 Themes to Shape the 2023 M&A Market

After a muted 2H2022 for M&A, activity should pick up in 2023 as financial sponsors deploy capital, activist investors press for corporate change and buyers and sellers agree on valuations and pricing.

Morgan Stanley’s bankers anticipate the following 4 themes to shape the 2023 M&A market.

Well-capitalized companies making acquisitions in their core businesses

While the consensus view among economists and strategists calls for a mild recession in 2023, company balance sheets are relatively strong compared to previous recessionary periods, and that could help drive corporate acquisition activity despite an economic downturn.

Morgan Stanley’s investment bankers anticipate large corporates to make additive acquisitions in their core businesses.

In a market environment with valuations remaining in flux, that activity could also take the form of unsolicited or “hostile” acquisition proposals.

In particular, three industries are well suited to lead the way to greater activity:

- Healthcare: Coming out of the COVID-19 pandemic, some healthcare companies are seeking to grow through M&A. For example, pharmaceutical companies with expiring patents need to replace those products and are on the hunt to acquire biotechnology companies.

- Technology: After a difficult year for technology stock performance in 2022, some tech companies are continuing to consider leaving public markets via go private transactions. Private equity sponsors with expertise in technology are showing a strong interest in take-private transactions, where publicly-traded companies return to private status after a sale to one or more financial buyers. Corporates seeking technology capabilities are also potential buyers in this more buyer-friendly valuation environment.

- Energy: With substantial capital on hand from soaring energy prices in 2022, energy companies are seeking to deploy it via acquisition or to return it to shareholders. Mid-sized energy companies need scale to compete and may seek consolidation opportunities. In addition, some energy companies are attempting to improve their environmental, social and governance (ESG) practices through capabilities such as carbon capture or energy transition preparedness; M&A is one tool to achieve that goal.

Separately, lower valuations make corporate separations more likely—especially for high value assets trapped inside larger corporates.

Companies that have a valuation overhang from mis-priced assets within their portfolio will seek to spin off or sell parts of the business to unlock overall value for their shareholders.

Financial sponsors are primed to deploy capital and to exit existing investments

In the last decade, private equity firms have become more specialized in industries and sub-sectors, which has helped funds make investing decisions with a higher degree of confidence in how their businesses might perform in different market cycles.

10 years ago, private equity firms wanted to wait for a certain time in the cycle before investing. Now, they invest more consistently through the ups and downs of the business cycle.

This trend, in combination with private equity funds’ record amount of uninvested capital, could help drive more M&A activity later this year despite choppy debt financing markets, Miles said.

Global Financial Sponsor Available Equity Capital ($bn)

Private equity firms own approximately 11,000 companies, and with average holding periods of three to five years, many could seek to monetize their portfolio holdings in the near term.

There are a lot of portfolio companies that private equity owners would like to sell but the market has been challenging to get deals done.

Once the financing markets stabilize, we will see a number of private equity firms bring more companies to market.

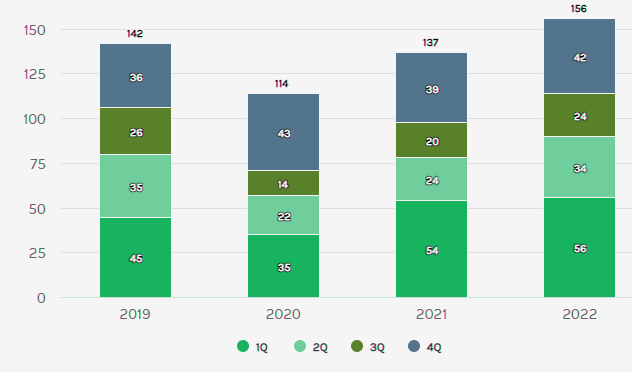

An environment suited for shareholder activism

Companies handled last year’s inflationary environment differently, which caused a significant amount of performance variance between stocks in the same sectors, Miles said. For the underperforming companies, activists have already launched campaigns to push for changes they believe will create value, and that is expected to continue in 2023.

The number of activism campaigns at U.S. companies in 2022 exceeded 2021 levels by approximately 14%, with M&A and improvement in operations as the most common activist demands last year, each occurring in 49% of campaigns.

At these overall lower valuation levels and with varying operating performances between companies, an activist can develop a stake in a public company and launch a campaign with less downside valuation risk.

New Activist Campaign Activity Exceeds Historical Averages

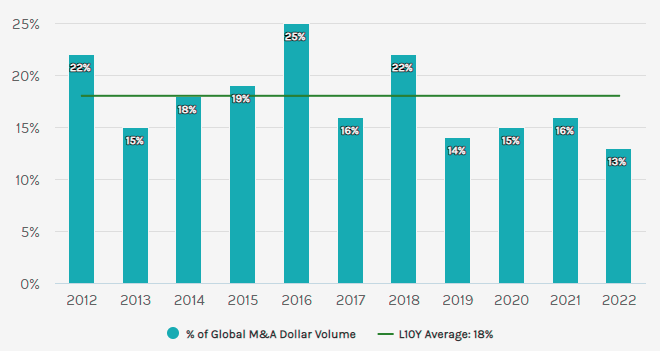

Cross-border M&A could be on the rise

The pandemic, trade tensions between the U.S. and China, and varying economic conditions by geography significantly dampened deal-making across international borders in 2022.

Cross-Regional M&A by Corporates

As the overhang from these headwinds diminishes, cross-border activity should rise during the next two years.

Companies around the world are seeking to fortify global supply chains, and many are likely to invest more internationally to achieve that goal.

While in the near term, China and Japan are likely more focused domestically, we could expect higher cross-border volumes between geographic regions longer term.

Portfolio reshaping through separation and divestitures

Down cycles and uncertainty force companies to reevaluate their portfolios under new scenarios. While we expect boards to consider divestitures more seriously, it takes a lot of conviction to do one in a downturn.

Corporate executives often drag their feet on selling underperforming assets “at a loss.” Yet this fear is often misplaced: at some point, no amount of multiple expansion can offset declining performance in the business itself, especially one that is no longer receiving attention or investment.

The most divestiture activity in sectors in transition, where divestitures can help fund new investments.

For example, the shift to renewable energy from fossil fuels and internal combustion engines could spur more divestment activity in the energy and automobile industries—see the chapter “M&A in Automotive and Mobility”.

Moreover, a quick sale unlocks not only capital but also leadership focus. For this reason, we expect the relatively high level of divestiture activity in consumer products to continue.

The M&A forecast for the next 12 months is decidedly split, nearly evenly so, among two camps: those who expect a brief and shallow downturn in the global economy, and those who project a longer, deeper recession.

The first camp expects M&A activity to accelerate as soon as Q2 while the latter camp expects an increase in dealmaking to arrive closer to Q4.

Regardless of which projection proves more accurate, CFOs should recognize that a slowdown in dealmaking volume is unlikely to affect all industries the same way.

Transportation, logistics, healthcare, life sciences, banking and other industries that have more of an ability to pass through higher costs to end customers will be better positioned to sustain, or even increase, profit margins.

These companies will also have the cash needed to execute deals. In addition, private equity firms have plenty of dry powder on hand and they may be eager to deploy their cash given how much valuations have decreased in some sectors. Those PE firms are, in fact, more likely to focus on M&A as an exit strategy than on capital markets transactions such as IPOs or De-SPACs.

………………………..

AUTHOR: Tom Miles – Co-Head of Americas M&A at Morgan Stanley, Brian Healy – Managing Director and Co-Head of Americas M&A at Morgan Stanley, David Rosewater – Head of Morgan Stanley’s shareholder activist defense practice, David Harding – Advisory Partner in the Bain’s Corporate Finance practice (Boston), Kai Grass – Partner, Dusseldorf ‘s office Bain

Fact checked by Oleg Parashchak