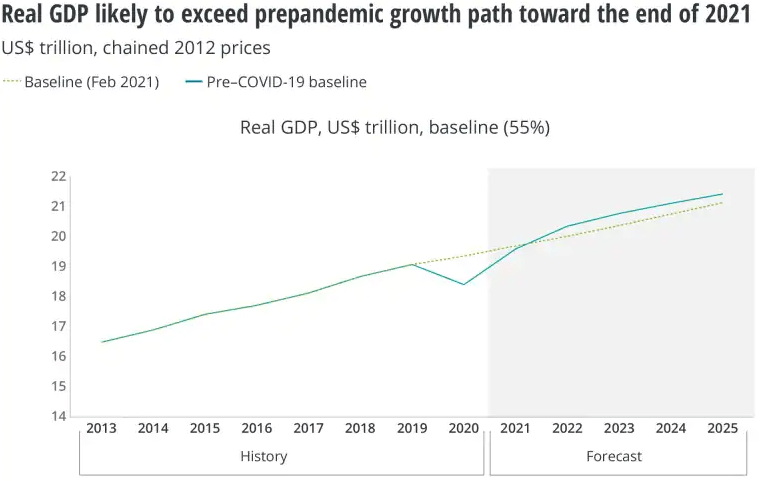

In a Deloitte survey of senior US insurance financial executives about the postpandemic scenario for insurance companies, optimism about the near future was tempered by awareness of challenges that could become speed bumps in pivoting to a growth mode. As society gradually returns to normal and the economic recovery gathers momentum, bolstering GDP, most insurers should be looking to build on the foundation of innovation and adaptability that helped transform their operating models, talent structure, and customer experience practically overnight in response to the COVID-19 outbreak.

With business activity continuing to pick up and COVID-19 restrictions being relaxed or removed in many areas despite a rise in variant infections, most US insurers are looking to capitalize on the innovations they implemented during the pandemic in terms of going virtual and digital.

Yet even though the industry as a whole may have adapted remarkably well to the extraordinary challenges raised during the past 18 months, there is still much work to be done and many critical decisions to be made over the rest of this year and into 2022.

More insurers bullish about growth as pandemic restrictions ease

Key messages

- Most US insurers surveyed by Deloitte have already pivoted to a postpandemic growth strategy, often doubling down on technology investments that allowed them to work and engage with customers remotely in order to drive further efficiencies and enable longer-term business model upgrades.

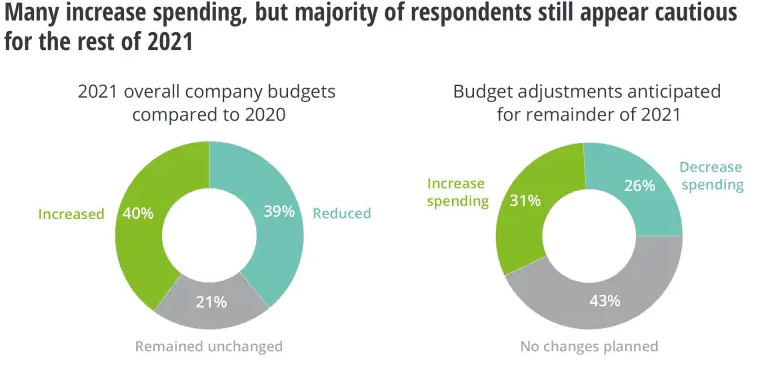

- While some carriers are still trying to rationalize expenses and avoid balance sheet deterioration due to the pandemic’s impact, 40% of those surveyed already increased their budgets for 2021, and 31% expect to boost spending even more over the rest of this year. Over half anticipate both higher revenues and an improved bottom line.

- As COVID-19 restrictions are lifted across the United States, many insurers are struggling to determine how to safely reintegrate remote employees into an office environment and/or transition to a hybrid system where many continue working from home in what may turn out to be the industry’s biggest operational challenge.

- Insurers should be capitalizing on the innovations and operational flexibility adopted during the pandemic to accelerate their transformation to a more agile, customer-centric business while aspiring to a “higher bottom line” that addresses emerging environmental, social, and governance (ESG) expectations among stakeholders.

- Many employees who were enabled to do their jobs from home during lockdowns may soon have to be safely reintegrated into an office environment, while some insurers will seek to retain the best of both worlds by adopting a hybrid model—which may be easier said than done.

- Most engagement with policyholders via agents, brokers, and claims adjusters had to go virtual due to the pandemic, but with COVID-19 restrictions being removed across the United States, many insurers will be reassessing the value of face-to-face interactions and considering how customer preferences might have changed long term.

- How might insurers fully integrate more nimble and innovative approaches into their culture without needing a crisis to drive them?

To get a sense of how insurers are feeling about their top and bottom lines, investment priorities, transformation progress, and talent plans for the rest of 2021, the DCFS surveyed various senior US insurance financial executives. While generally optimistic about the near future, the leaders surveyed also raised a number of challenges that could become significant speed bumps depending on how insurers respond.

Financial expectations mostly positive, but some remain cautious on spending

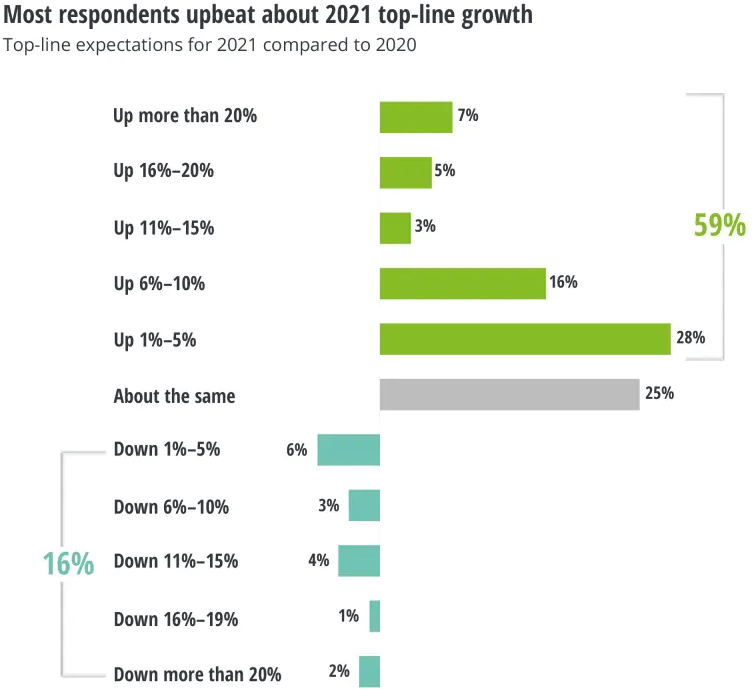

Revenue expectations for 2021 among respondents were fairly positive, with 59% anticipating a higher top line, against only 16% predicting a decline. Modest gains of 1%–5% are predicted by 28% of respondents, but 31% expect even more robust growth—including 12% seeing jumps of over 15% ahead.

Property and casualty (P&C) respondents were a bit more bullish than those from the life and annuity (L&A) sector, with 66% expecting growth in P&C (including 18% anticipating revenue gains of over 10%), versus 57% in L&A overall, and only 11% expecting more than 10% top-line growth.

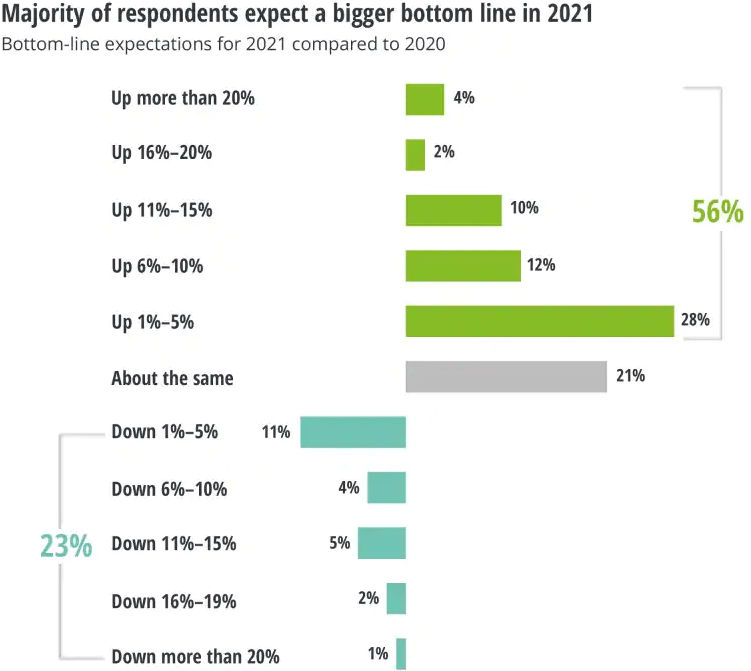

The same overall trend holds for the bottom line, with just 23% of respondents anticipating a drop in net income, versus 56% expecting higher profits in 2021. Indeed, 28% surveyed predict growth of over 5%, including 16% forecasting gains of more than 10%. But unlike differences within the industry about the top-line outlook, expectations among P&C and L&A carriers for bottom line gains tracked closely.

77% of those surveyed are concerned about possible fundamental changes that may have been prompted by the pandemic, both in the economy as well as in consumer behavior. That could in part explain why generally upbeat revenue and profit expectations have not yet translated into higher spending plans among a larger portion of respondents, as many insurers wait to see how all this shakes out before making any additional financial commitments.

Many companies shifting focus to growth

The cautious stance toward increased spending among a majority of respondents notwithstanding, 69% said their company has moved beyond the respond and recover phase and is starting to pivot or already has shifted to thrive mode by adopting a proactive, growth-focused approach.

Our midyear outlook survey found companies that maintained strategic long-term initiatives even during the pandemic are now more likely prepared to pivot to a growth mindset.

Respondents at such companies are close to three times as likely to increase spending in the remainder of 2021 than are those that have not yet shifted gears toward growth.

This tracks with our observation in the 2021 insurance outlook published in December 2020, when we noted that while most companies were looking to contain spending rather than cutting budgets across the board, many were shifting allocations to bolster strategic initiatives, such as technology modernization, that could help them adapt to the pandemic in the short term while positioning them for longer-term growth.2

Technology to the rescue

Given the need to digitize and virtualize their operations overnight, it’s no wonder that even though 52% of respondents trimmed discretionary spending, often in areas such as talent, only 6% cancelled or postponed long-term technology projects, while 96% are accelerating digital transformation initiatives.

Meanwhile, the top two actions prioritized by responding insurers to support financial and operational stability over the next 6–12 months involved implementation of new technology—first, to enhance efficiency (70%) and second, to improve customer experience (68%).

That sentiment appears to be fueling more aggressive technology investment, with 68% of those surveyed planning to increase spending on data analytics (up from 49% in Deloitte’s 2021 outlook survey taken last summer) and 66% allocating more to upgrade customer relationship management software. Fifty-nine percent will increase spending on artificial intelligence (compared to 40% in our last survey), while about half of respondents also plan to boost budgets for robotic process automation (up from 30%).

The insurance workplace may never be the same

Transitioning to a postpandemic workplace model may be the biggest challenge insurers face for the rest of 2021. Fewer US insurers are being forced to consider workforce-related actions to counter COVID-19’s financial impact as exposure concerns ease and the economy regains its strength. Only 10% of insurers surveyed in May 2021 by Deloitte said they are likely to rationalize employee headcount and compensation in the next 6–12 months, compared to 60% of respondents in Deloitte’s 2021 outlook survey last summer.

Instead, insurer attention is likely focused on determining the preferred workplace business model going forward, as well as what actions and policies should be put in place to manage the transition.

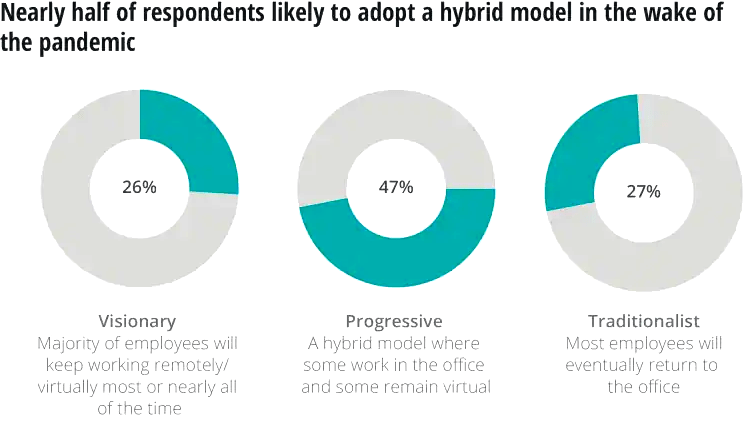

Deloitte’s survey found only about one in four likely to revert to the “traditionalist” model of having nearly all employees work together in centralized offices. Nearly half of those surveyed are planning to adopt a “progressive” hybrid model incorporating a fluid, often remote, workforce alongside those in offices, while the remaining quarter considers a more “visionary” path maintaining a mostly virtual environment. Nationwide Insurance, for instance, anticipates that at least 50% of its workforce will either operate out of their homes for good or in a hybrid model.

Nontraditional models should allow insurers to tap an expanded talent pool, since at least some staff may no longer be required to live within commuting distance. Such shifts are already having an impact, as nearly 51% of respondents are now hiring employees irrespective of their location, while 58% are augmenting their teams with gig workers. This trend may also lower real estate expenses as well, as less office space may be required.

Many insurers may have a difficult time

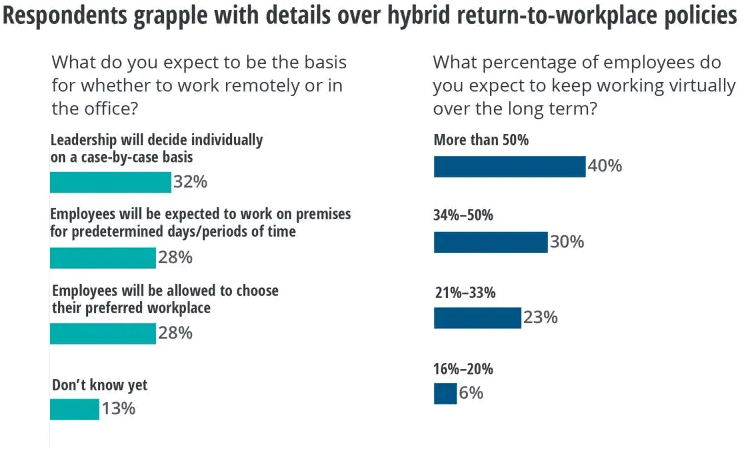

Over the next few months, many insurers may have a difficult time determining what proportion of the workforce should be asked to return to an office, how to decide which individuals can remain remote, and how much autonomy employees should be given in making such decisions. Insurers may also struggle with whether these questions call for different responses at the enterprise level versus individual business units or operating functions.

Over the long term, changes in talent needs and management models will present a number of fundamental opportunities and challenges. But in the interim, insurers will likely have to consider changes in human resource policies, workspace design, and employee engagement. They should also upskill managers on how to adapt, manage, and effectively engage a hybrid workforce while maintaining the corporate culture and team productivity.

Most employees have been working out of their homes for over a year now, and while some may be eager to return to the office, others are likely to prefer continuing to work from home.

Getting employees onboard with whatever model is adopted while accommodating personal priorities and preferences will be important in achieving a successful transition. It is therefore encouraging that among those surveyed, 87% said they were able to maintain a strong engagement with employees during the pandemic, including 30% who strongly agree with that sentiment.

Regulation: ESG concerns on the front burner

Insurers are likely to face several compliance challenges in the second half of 2021, including the potential for heightened market conduct exams, with regulators checking to make sure consumers were adequately and fairly addressed given that most client interactions went virtual during the pandemic.

In addition, renewed focus is likely to be devoted to ESG issues. Two-thirds of survey respondents asserted that the pandemic has already prompted more attention at their companies to ESG concerns.

The “E” of ESG should be a particularly hot topic in the second half of 2021, with two-thirds of respondents taking additional steps to address and disclose climate risks, while about half are reconsidering their investment strategy and portfolio to better reflect climate risk concerns and goals. More carriers are also appointing chief sustainability officers or their equivalent to at least orchestrate ESG initiatives and reporting, while many are taking steps to reduce their own carbon footprint.

At a minimum, insurers are expected to face new climate risk reporting expectations laid down by the New York Department of Financial Services. Based on public feedback collected through June 23, the department will issue a timeframe by which insurers should have fully embedded approaches to climate risk management in their governance structures, risk management frameworks and processes, business strategies, metrics, targets, and disclosure methods.

Life insurance: Stars align to build on pandemic-fueled momentum

Life insurance premium income was down 8% for 2020 while revenue overall fell by 4%, cutting net income in half. However, the pandemic prompted heightened awareness about the need for mortality coverage, with record growth in applications setting the stage for a sales rebound in 2021.

After years of low-to-no growth, there was a 4% surge in life insurance applications last year. That trend continued into at least the first quarter of 2021 with another 10.1% uptick in activity. In fact, in March 2021 individual life applications were 18.5% higher compared to the same month last year.

On the operational side, lockdowns accelerated the adoption of online applications and underwriting, as well as virtual sales and service interaction among insurers, customers, and intermediaries. Since January 2020, online life insurance sales increased between 30% and 50% for companies with digital capabilities and algorithm-driven underwriting, while agent-driven sales were down by as much as 50%.

The pandemic has already accelerated online competition from digital startups, and if consumer preferences continue in this direction, such competition is likely to intensify into 2022.

Yet, despite all the upheaval caused by COVID-19, the percentage of US adults who say they have a gap in their life insurance coverage continues to grow. Only 52% of Americans said they had life insurance in 2021, down from 54% in 2020 and a much more significant drop from 63% in 2011, according to a study by LIMRA. Some 102 million uninsured or underinsured Americans believe they need to either buy or increase their life insurance coverage, the LIMRA study found.

Group insurance: Offsets to top-line pressure position carriers to rebound

Since group insurance revenues are tied directly to employment levels, all of the layoffs, business shutdowns, and subsequent benefit plan cancellations prompted by the COVID-19 outbreak could have exerted enormous top-line pressure on insurers. There was also concern over a sharp increase in claims fueled by employees exposed to the virus. However, the overall impact was buffered to some extent by several factors.

First, as opposed to the 2008 financial crisis, there were far more closures last year among smaller businesses that are less likely to offer group benefits.

Moreover, some larger companies were able to stave off revenue blows and maintain most of their workforce as government payroll protection programs helped keep millions of employees and their benefits in place.

The impact on claims varied based on a carrier’s product mix. Mortality claims from COVID-19-related deaths did escalate, negatively impacting term life carriers. However, many insured employees shelved various health screenings, dental visits, and other wellness activities during the period, driving claims down in related group lines. Even US maternity claims dropped as people put off having children, with an estimated 300,000 fewer babies expected in 2021.

The anticipated rise in disability claims related to the virus were balanced out by the insureds who put off elective surgeries, as well as those who had been on disability but now could work from home as a response to the lockdowns.

Throughout all the uncertainty, carriers scrambled to pivot from traditional processes and services to accelerate digital capabilities while accommodating a virtual workforce and online customer interactions. For example, to enable online disability claims, insurers not only had to work out how to convince people to use telemedicine and share electronic health records, but also make them comfortable with digital claims and payments.

Meanwhile, many took the opportunity to upgrade their longer-term digital capabilities. One life insurer, for example, streamlined and automated group administration processes with cloud-based benefits software designed to digitize enrollment, provider directories, and plan configuration via a member portal. In addition, another life insurer offers customers capabilities to use a virtual assistant to check balances of their medical, dental, and vision care accounts.

Property-casualty insurance: Microsegmenting may be the path to sustained growth

Forecasts of outsized claims, especially in more heavily impacted lines such as workers’ compensation and business interruption, did not materialize to the extent initially feared, helping the US P&C industry generate a 52% rise in 2021 underwriting profit of US$11.8 billion, with a combined ratio of 98.8% that was nearly the same as in 2020, although some lines fared better than others.

Private auto business, for example, delivered a direct incurred loss ratio of 58.3% in 2021—an improvement of nine percentage points from 2020, thanks in part to the fact that far fewer miles were driven during the pandemic lockdowns.

The industry overall posted a 2.4% increase in net written premiums, primarily driven by rate increases in most lines—particularly significant on the commercial side. Net income, on the other hand, fell by 3.7% to US$60.7 billion due mostly to lower investment income, which will likely remain under pressure in this low interest rate environment.

Pandemic raised the bar for insurer stakeholder engagement

Tremendous progress has been made during the most difficult of times, setting the stage for significant growth and transformation if insurers remain bold and proactive.

It was encouraging to see that 97% of those surveyed by Deloitte believed they maintained strong engagement with existing policyholders during the pandemic—including 40% who strongly agreed with that sentiment.

38% of respondents did not feel engaged with new sales prospects, and only half felt adequately connected with their distribution force. This likely indicates insurers still have to work on digitizing operations without losing their personal connection with customers and other stakeholders.

If nothing else, the pandemic demonstrated how adaptive the insurance industry can be when the chips are down. That lesson should not be forgotten as insurers consider how they might alter product design, underwriting, and pricing methods, as well as distribution and service platforms to address emerging customer needs and societal problems. Innovative thinking and decisive action should be front and center, not just during a pandemic or some other crisis, but as part of an insurer’s core culture and operating model.

The insurance industry should therefore capitalize on the innovations and operational flexibility adopted during the pandemic while accelerating their transformation to a more omnichannel, user-friendly, stakeholder-centric business.

……………………………..

AUTHOR: Gary Shaw – Senior Client Partner, Advisor to Insurance CFOs Deloitte