At least of Deloitte’s Global Survey respondents expect to increase head count in most of their functional areas. That’s likely because insurers in general are preparing for even greater economic recovery and a boost in their own business volume, spurring the need for additional resources to manage a rising workload.

The big question insurers face is where will all that talent come from, and how will they be able to recruit and retain the skill sets to maintain and advance increasingly digitized operations?

Insurers will likely face an even bigger challenge as they compete for top talent

When we narrow the lens to technology, insurers will likely face an even bigger challenge as they compete for top talent not only with industry peers, but also global tech giants.

Some of that talent gap may be closed via rehiringsin departments hit in 2020 by staff reductions, as insurers trimmed operating expenses in some areas in response to the pandemic’s initial economic fallout. Another option is to ask retired personnel to return on a part-time and perhaps even remote basis, and/or seek similar transitional relationships with current employees close to retirement. But that will still likely leave a significant gap, making talent acquisition and retention perhaps the industry’s biggest operational challenge in 2022 and beyond.

Insurers should go beyond geography and professional background boundaries to tap into a wider talent pool. They should also consider supplementing full-time roles with part-time, transitional, and contract workers to access talent with specialized expertise and experience.

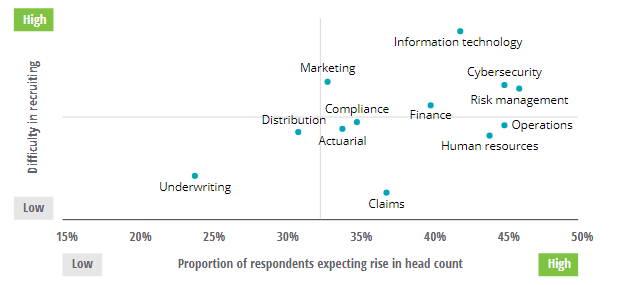

Deloitte’s global survey found that 43% of insurance talent respondents feel it’s getting harder to find skilled candidates in a number of functional areas—with information technology topping the list in terms of degree of recruiting difficulty.

Furthermore, when asked which specific capabilities are the most difficult to acquire, the top five ranked by respondents all involved technology skills: cloud engineering, data science and analytics, artificial intelligence (AI) and machine learning, software development, and cybersecurity.

This could undermine transformation efforts at a time when digitization is likely to be accelerated both internally with staff and externally with customers and business partners.

Insurers could face recruitment challenges in several key areas

Difficulties in adding talent to bolster cybersecurity could also hamper insurer efforts to strengthen their defenses at a particularly vulnerable time, given the steep rise in cyber exposures, led by the proliferation of ransomware attacks.

Ransomware continued to ravage the bottom lines

Ransomware attacks continued to ravage the bottom lines of both their victims and insurance carriers. In fact, during the first six months of 2022 we saw $590 million paid in ransom payments, as opposed to $416 million paid in all of 2021.

In recent years, malware and ransomware cyberattacks have been causing severe disruption for global businesses and their supply chains. In addition to the rise in malware and ransomware attacks, the threat of state-sponsored cyber-attacks has become a significant focus for businesses and governments.

Insurer data may also be at greater risk in the wake of most or all employees working remotely on personal networks and equipment since the pandemic hit, and the corresponding expansion of data infrastructure to accommodate the transition to a virtual workplace.

Over the last two years alone, breaches in the insurance industry may have compromised sensitive customer data of over 100 million US insurance policyholders.

Even the fact that marketing was cited by many respondents as one of the most difficult functions for which to recruit likely has a technology rationale, due to the need for more digitally savvy marketers.

Insurers should therefore be expanding the traditional boundaries of their organization in terms of geography and professional background to tap a wider variety of sources for more highly skilled talent. Recruitment and retention strategies likely also need to be reexamined to supplement those on a company’s full-time payroll with part-time, transitional, or contract workers, thus further widening the recruiting lens for specialized expertise and experience.

Insurers should take a multipronged approach to attract, train, and retain tech-fluent workers

Given these challenges, insurers should consider taking a more holistic approach to bolster their ability to hire and retain talent, especially those with general IT and more specialized technology-related capabilities such as machine learning, analytics, digital marketing, and cybersecurity

This includes upskilling existing staff as well as improving recruiting by communicating the advantages of working specifically in tech at insurance companies.

They might start by emphasizing the industry’s unique value proposition as the economy’s financial first responders, protecting consumers from unforeseen risks and catastrophic losses with respect to their life, health, retirement, personal property, and businesses. The industry is also playing a leading role in combating climate change and taking on other sustainability challenges— elements that could resonate with and appeal to more socially conscious candidates entering the job market.

In addition, offering the opportunity to build and launch a more advanced digital insurance organization may whet the appetite of those starting out and looking to make an immediate impact in their work. This is especially so if insurers offer an attractive career path for technology specialists, so they not only join a company but stick with the job in anticipation of greater responsibility and faster promotions.

Concurrently, a robust skill enhancement program offering similar paths for rapid advancement to those already working in insurance IT, cybersecurity, or other tech-related functions could stem attrition, while creating a more attractive landing spot for future insurer recruits by demonstrating ongoing learning and capability growth.

Strategize hiring and retention of talent with requisite skill sets

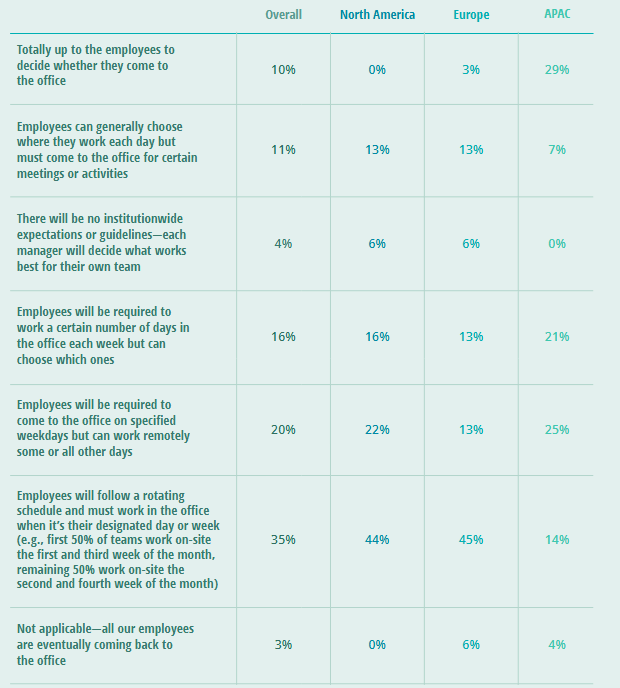

Given the accelerated virtualization and digitization of insurance operations over the past two years, the nature of work itself is changing (How Digital Transformation Accelerating the Insurers Growth, see our review). Thus, even those returning to a central workplace will likely not be doing their jobs the same way as before the pandemic. And while many insurers surveyed for this outlook are already looking to adopt a permanent model combining remote and office-based work—with only 3% of respondents indicating all employees are likely to come back to the office full time—making that decision should just be the start of an ongoing series of moves to execute a hybrid policy and adapt to any complications that arise.

Insurers should be striving to build a digital-ready workplace that can accommodate those on site and others functioning remotely, providing a shared digital environment enabled by virtual collaboration and communication tools.

But beyond the digital infrastructure, a new talent approach should be adopted as well. Insurers should therefore start examining how each employee’s tasks, activities, individual situations, and needs have already changed,

as well as assessing a hybrid system’s implications for corporate culture and human resource policies. No matter the ultimate outcome, there is unlikely to be a “one size fits all” approach. Trial and error should be the norm as insurers test different plans and judge their effect on productivity, collaboration, innovation, and general workforce satisfaction over time, making necessary adjustments along the way.

Indeed, when asked what type of hybrid model would be adopted in 2022, insurance talent officer responses were mixed. While 35% of respondents indicated employees would follow a rotating schedule and go to an office on designated days, the remaining 65% had a host of other options in mind. There were regional differences in approach as well, given that a significant segment of North American and European respondents leaned toward rotating schedules for employees, while those in APAC did not express any clear majority path.

Respondents are looking at a wide range of hybrid return-to-office options

Given that about 87% of our survey respondents across all regions at least somewhat agree their company is likely to hire remote employees and gig professionals going forward, insurance workers in general should have more opportunities to change jobs and work far from their company’s office locations, providing them with choices and leverage in what will likely remain a very competitive job market over the long term.

Insurers should, therefore, be offering a clear and strong value proposition to employees to justify whatever return-to-office strategy they pursue, backed by compelling benefits and a clear career growth path to strengthen retention.

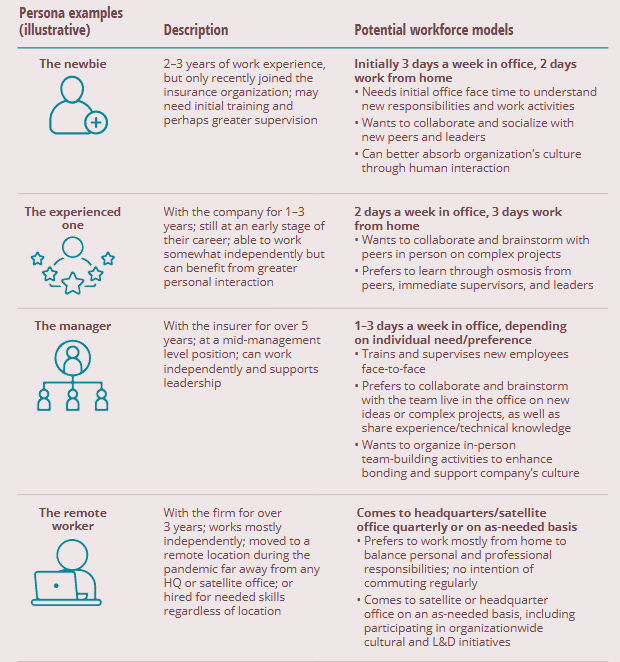

One way to accomplish this might be to focus less on which teams or job roles (claims, underwriting, etc.) should return to an office, and think more from the perspective of individual employee personas. For example, those who have just joined the organization may need more office face time initially to collaborate and socialize with peers and leaders, as well as assimilate into the organization’s culture. Yet those who have been with the company longer may prefer to have the flexibility to work from home on most days and choose to come to the office a few days each month to learn through osmosis from peers and immediate supervisors.

Insurers should consider customizing workplace system based on employee personas

Whichever model an insurer adopts, however, they should communicate clear reasons justifying the purpose of coming to an office, even if only part time, in terms of the benefit for employees as well as for the company.

Such communications should include general rationales, as well as specific reasoning for offering a range of options depending on an individual’s situation, needs, and preferences.

………………..

AUTHOR: Gary Shaw, Vice chairman – US Insurance leader Deloitte