The U.S. life insurance sector outlook remains neutral, and issuers are well positioned to withstand commercial real estate challenges and expected asset deterioration, with rising losses expected to remain within ratings sensitivities, Fitch Ratings says.

In recent years indirect CRE investments, which include all forms of lending and equity holdings in real-estate investment vehicles, have comfortably exceeded direct CRE exposures and have grown at a faster rate than direct CRE exposures over the past four years (4% CAGR for indirect vs 1% CAGR for direct).

For the last several years, U.S. life insurers were under continued pressure to improve yields to support their products, while limiting investment risk in a low interest rate environment.

As a result, they increased allocations to asset classes outside of bonds, including mortgages, to improve overall general investment portfolio yields (see Global Insurance Markets Trends).

Life insurers’ portfolios are largely comprised of high-quality loans

Life insurers’ portfolios are largely comprised of high-quality loans, with 90% of commercial mortgage loans (CML) rated CM1 or CM2 on an NAIC basis, along with de minimis troubled mortgages and an average LTV ratio of 54% for 2022 (see TOP 20 Largest Life Insurance Companies).

Fitch expect to see continued deterioration in CML portfolios, as valuations normalize and losses increase amid the worsening economic backdrop.

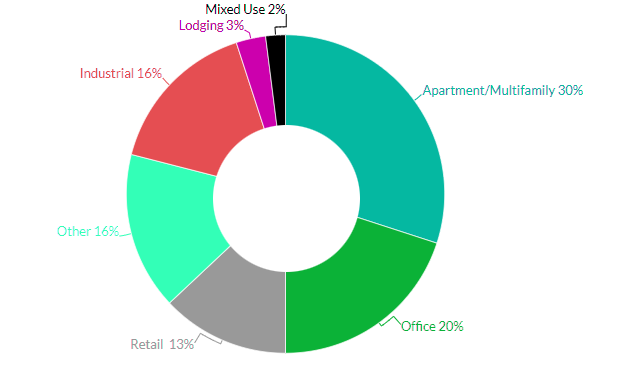

U.S. life insurers allocated 13% of their total investment portfolios to mortgage loans, or 1.6x capital, which is stable yoy but above historic levels of 8%-12%. Life insurer commercial mortgage portfolios as of YE 2022 were comprised of multifamily loans at 30%, office at 20%, industrial at 16%, other mortgages at 16%, retail at 13%, hotel at 3% and mixed-use properties at 2%.

U.S. Life Insurer Commercial Mortgages by Type

Office and retail valuations are expected to drop further over the intermediate term amid a slowing economy, increased vacancies, continued workforce reductions and higher interest rates.

Insurers have continued to de-emphasize these subsectors, and are focusing on multifamily and industrial, which is expected to persist.

Life insurers’ net investment in commercial mortgage-backed securities (CMBS) represents less than 5% of cash and invested assets.

U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors. However, the Fed’s monetary tightening and the current recession will pressure some sectors of commercial mortgages over the midterm, with consistently high inflation and rising interest rates negatively affecting some property valuations.

More modest growth in mortgage loans in life insurance

Recent CMBS trends for hotel, office, retail and multifamily are deteriorating from increasing macroeconomic and banking-sector headwinds. U.S. CMBS loan delinquencies at 1.7% as of April 2023 fell from a peak of 5% in July 2020 but should increase to 4.0%-4.5% by YE 2023.

Fitch expects more modest growth in mortgage loans over the near term as a result of deterioration across property types and growing recessionary risks.

Single-family origination growth will slow to moderate levels in 2H2023 and 2024 given higher interest rates, which is slowing demand amid deteriorating economic conditions.

According to Life Insurance Value Chain Review, traditional problems that have plagued the Life Insurance industry for decades—such as earnings sensitivity to external factors and opaque risks that investors are challenged to underwrite—will remain.

More recently, fundamental changes in industry structure have created significant competitive pressure. Specifically, the emergence of private capital–backed platforms—which have evolved their primary focus to include new sales as well as the acquisition of legacy blocks of business—has changed the game in new-product development, where such platforms have become leaders in several retail and institutional categories.

……………………..

AUTHORS: David Marek – Director, North American Insurance Ratings at Fitch Ratings, Robert M. Vrchota – Managing Director, Commercial Mortgage Ratings at Fitch Ratings, Laura Kaster, CFA – Senior Director, Fitch Wire

Edited & Fact checked by