World’s most valuable insurance brands retain their ranks through adaptability and innovation insurance strategies. Brand Finance compiles a Sustainability Perceptions Index which determines the role of sustainability in driving brand consideration across global insurance market.

Most Valuable Insurance Brands Index calculates the proportion of brand value attributable to sustainability perceptions, also known as Sustainability Perceptions Value (SPV).

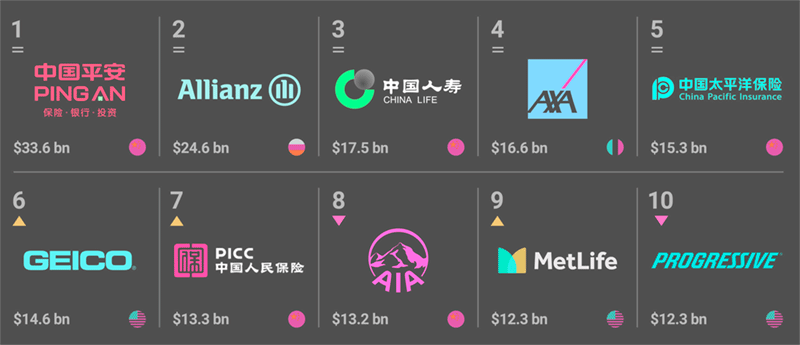

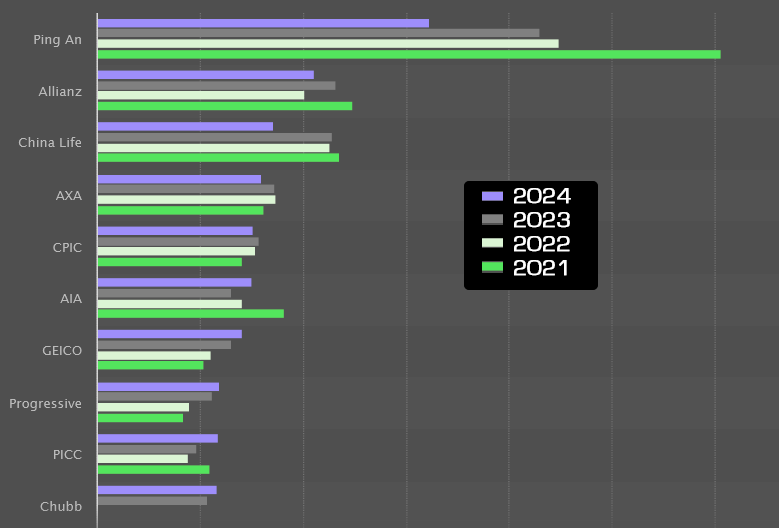

According to Brand Finance report, chinese brands continue to dominate the ranking of the world’s most valuable insurance brands, with Ping An (brand value up 4% to $33.6 bn), China Life Insurance (brand value up 2% to $17.5 bn) and CPIC (brand value up 1% to $15.3 bn) defending their respective 1st, 3rd and 5th places (see Top 10 Risks for the Global Insurance Industry by Beinsure Media).

- China’s Ping An prevails as the world’s most valuable insurance brand for six years running

- LIC from India is the world’s strongest insurance brand

- NRMA Insurance from Australia is the world’s fastest-growing insurance brand

- Germany’s Allianz clocks highest Sustainability Perceptions Value of $3.7 bn

Meanwhile, Germany’s Allianz (brand value up 17% to $24.6 bn) and France’s AXA (brand value up 4% to $16.6 bn) retain their spots in 2nd and 4th place respectively to form the Top 5 (see Largest Insurance Companies in the World).

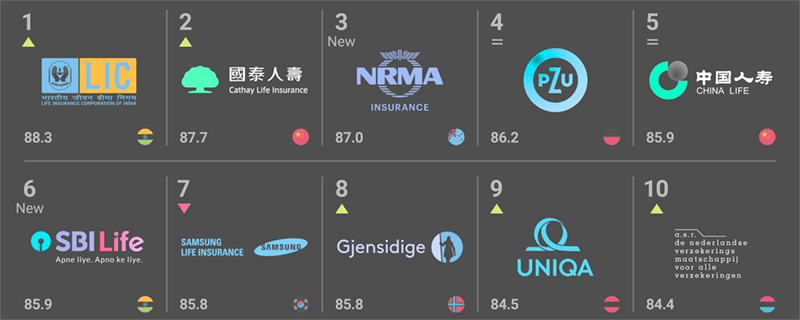

TOP 10 Strongest Insurance Brands 2024

| Rank | Insurer | Index |

| 1 | LIC | 88.3 |

| 2 | Cathay Life Insurance | 87.7 |

| 3 | NRMA Insurance | 87.0 |

| 4 | PZU | 86.2 |

| 5 | China Life | 85.9 |

| 6 | SBI Life | 85.9 |

| 7 | Samsung Life Insurance | 85.8 |

| 8 | Gjensidige | 85.8 |

| 9 | UNIQA | 84.5 |

| 10 | A.S.R. | 84.4 |

India’s LIC (brand value steady at $9.8 bn) has become the strongest insurance brand, with a brand strength index score of 88.3 and associated AAA brand strength rating. The second strongest brand is Cathay Life Insurance (brand value up 9% to $4.9 bn) just ahead of NRMA Insurance (brand value up 82% to $1.3 bn).

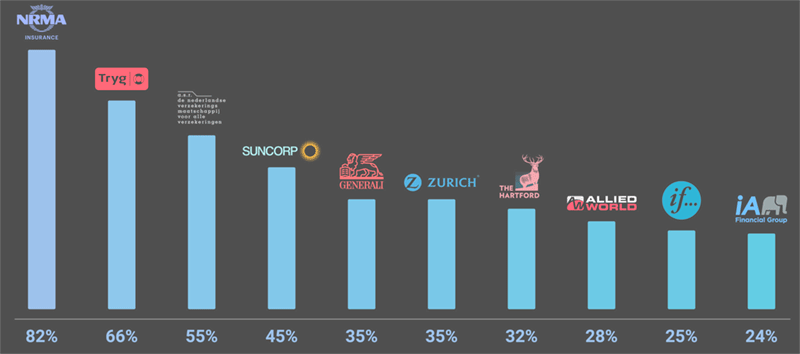

Brand Value Change

| Rank | Insurer | Change |

| 1 | NRMA Insurance | 82% |

| 2 | Tryg | 66% |

| 3 | A.S.R. | 55% |

| 4 | Suncorp | 45% |

| 5 | Generali | 35% |

| 6 | Zurich | 35% |

| 7 | The Hartford | 32% |

| 8 | Allied World | 28% |

| 9 | if Insurance | 25% |

| 10 | iA Finance Group | 24% |

Among the 74 brands that have seen their brand values grow from 2023’s rankings, Australia’s NRMA Insurance (brand value up 82% to $1.3 bn) and Denmark’s Tryg (brand value up 66% to $1.6 bn) are the fastest-growing brands in the ranking (see Largest Global Reinsurance Groups in the World).

TOP 10 Most Valuable Insurance Brands

| Rank | Insurer | Value, $ bn |

| 1 | Ping An | 33.6 |

| 2 | Allianz | 24.6 |

| 3 | China Life | 17.5 |

| 4 | AXA | 16.6 |

| 5 | China Pacific Life | 15.3 |

| 6 | GEICO | 14.6 |

| 7 | PICC | 13.3 |

| 8 | AIA | 13.2 |

| 9 | MetLife | 12.3 |

| 10 | Progressive | 12.3 |

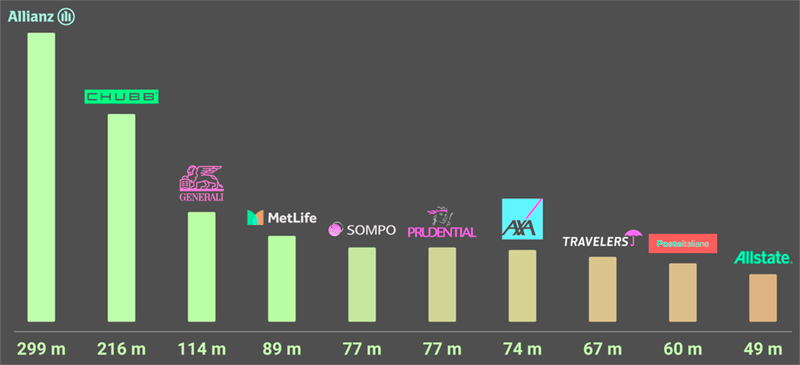

The latest iteration of the study finds that in the insurance sector, Allianz has the highest Sustainability Perceptions Value of $3.7 bn and the highest positive gap value of $299 mn (see about Digitalization in Insurance).

Both Allianz’s perceptual and performance scores on sustainability were above the insurance sector’s average across ESG dimensions.

This not only demonstrates strong external awareness of Allianz’s sustainability efforts and communications, but that the brand’s ESG performance supports this perception.

TOP 10 Largest Positive Sustainability Gap Value Insurance Brangs

| Rank | Insurer | Value, mn |

| 1 | Allianz | 299 |

| 2 | CHUBB | 216 |

| 3 | Generali | 114 |

| 4 | MetLife | 89 |

| 5 | Sompo | 77 |

| 6 | Prudential | 77 |

| 7 | AXA | 74 |

| 8 | Travelers | 67 |

| 9 | Posteitaliane | 60 |

| 10 | Allstate | 49 |

Allianz’ highest positive gap value among sector peers implies that it has the potential to generate an additional $299 mn in value given the brand’s continuous and comprehensive sustainability efforts.

TOP 10 Insurance Brands by Sustainability Perceptions Value

| Rank | Insurer | Value, $ bn |

| 1 | Allianz | 3.7 |

| 2 | Ping An | 3.5 |

| 3 | China Life | 1.5 |

| 4 | AXA | 1.3 |

| 5 | China Pacific Life | 1.2 |

| 6 | GEICO | 1.1 |

| 7 | PICC | 1.1 |

| 8 | AIA | 1.0 |

| 9 | Metlife | 0.9 |

| 10 | Progressive | 0.9 |

A positive gap value means that brand sustainability performance is stronger than perceived: brands can add value through enhanced communication about their sustainability efforts, so that perceptions are raised to fully account for the brand’s actual sustainability performance.

Leading insurance brands worldwide from 2021 to 2024, by brand value

Acting sustainably and being seen to do so is critical for brands, but sustainability is a multifaceted concept that can be hard for business leaders to navigate.

Investors, CFOs, and CEOs are told by campaigners, NGOs, consultants, and sustainability teams that committing to sustainability is both the right thing to do and a business imperative.

There are indeed many opportunities, whether in supplying products and services that facilitate the transition to a green economy, or simply by differentiating your brand as a sustainable alternative.

However, it can be hard to determine the business case for sustainability action without articulating it in financial terms. The Sustainability Perceptions Index is intended to be the first step to addressing this challenge. By quantifying the value of sustainability perceptions, we hope to make the value of action on sustainability more tangible.

………………….

Reviewed by Oleg Parashchak – Editor-in-Chief Beinsure Media, CEO Finance Media Holding.