The world economy regained macroeconomic resilience, benefiting from the cyclical rebound from the COVID-19 crisis and rising long-dated interest rates during the year.

However, Swiss Re Institute estimate that the resilience lost in the 2020 COVID-19 crisis will only be recouped this year, and any economic deterioration in the coming months may throw the recovery off course.

Global insurance protection

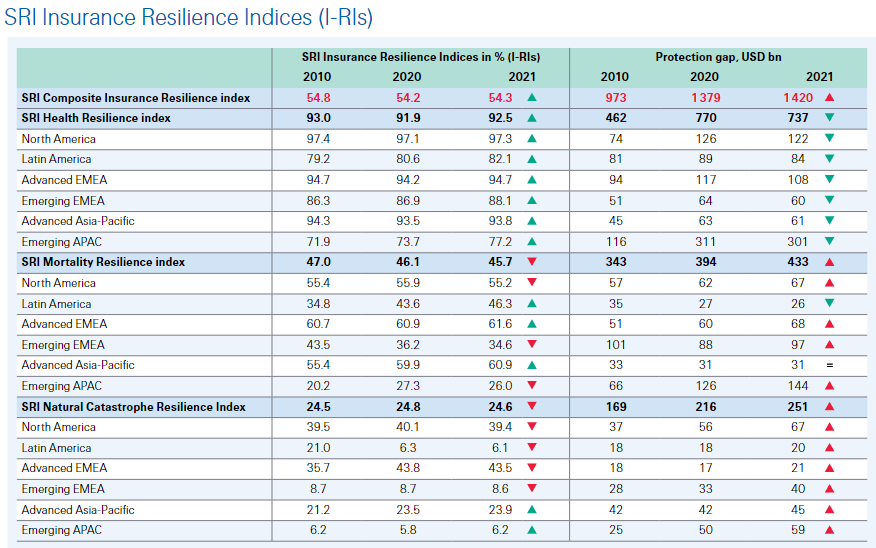

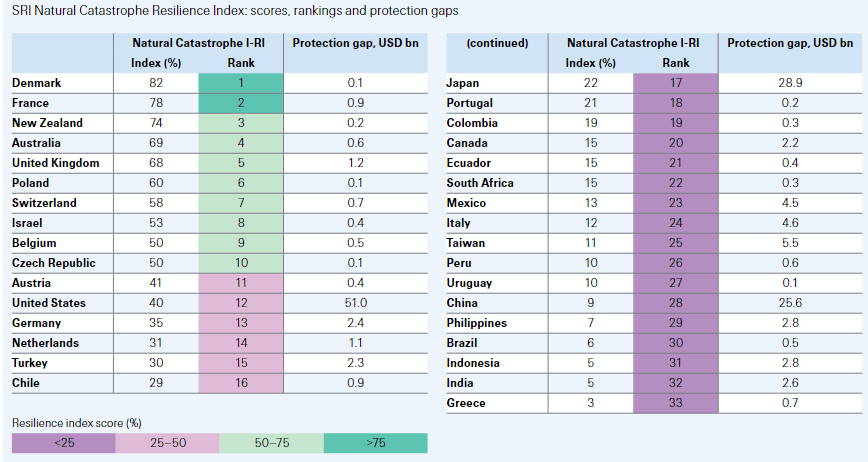

Higher penetration of property insurance in China improved natural catastrophe resilience in emerging Asia to 6.2%. We simulate the impact of inflation on protection gaps, estimating that 2022 inflation would widen global insurance protection gap by USD 55 billion, or about 3.8% of the total.

The global insurance protection gap for health, mortality and natural catastrophe risks rose by 3% in nominal terms to USD 1.42 trillion.

The health protection gap showed strength, narrowing by 4.3% to USD 737 billion globally, but mortality and natural catastrophe protection gaps widened, reflecting higher catastrophe losses as well as slower growth in life insurance coverage and social security benefits than the protection needed in North America, emerging Europe and emerging APAC.

Simulating how high inflation may affect protection gaps, price increases in 2022 could translate into a 3.8% widening in the global insurance protection gap.

Recovery macroeconomic

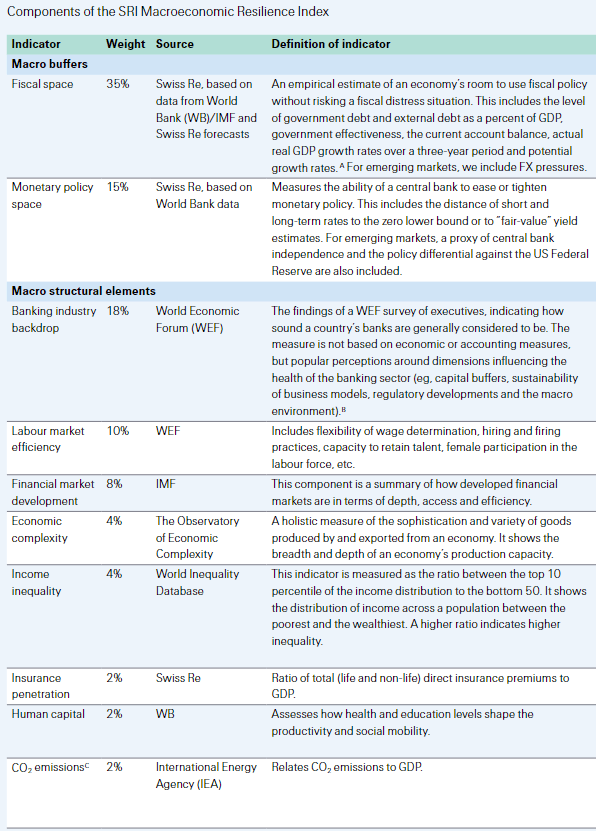

The recovery in macroeconomic resilience was supported by strong improvements in fiscal space, but advanced economies made less monetary policy space gains after falling behind the curve in tightening monetary policy. Structural macroeconomic indicators such as human capital and labour market efficiency continue to weigh on resilience, particularly in emerging markets. We estimate that this year, cyclical economic tailwinds will further support fiscal space, while central bank action to tame persistent inflation will expand monetary policy space.

Global insurance resilience

Global insurance resilience recovered, primarily due to strong improvement in health resilience, which offset weaker mortality and natural catastrophe resilience. However, insurance resilience overall is still lower than prior to the COVID-19 shock and the global financial crisis. The combined world protection gap for health, mortality and natural catastrophe risks rose marginally to a new record of USD 1.42 trillion. While insurance protection is still growing strongly in 2022, we expect scaled-back government benefits and declining asset values to erode insurance resilience overall.

The cyclical recovery in both macroeconomic and insurance resilience cannot hide the fact that deep structural reforms are still needed to drive long-term growth.

Jerome Jean Haegeli, Group Chief Economist, Swiss Re

To secure greater resilience and support long-term economic stability, structural parameters such as infrastructure and human capital need to be strengthened and inequality reduced.

Sums insured are estimated by combining two approaches for two different groups of markets. In some markets, sums insured are obtained by combining agro insurance premiums written with premium rates. For other countries, we combine claims paid with crop yield performance. An excess of yield directly implies there was no protection gap, while a shortfall of yield combined with the attainable yield and claims paid gives an estimate of sums insured.

The 28 countries in our sample cover around 75% of global crop production. Estimates only measure the resilience available through private and public crop insurance programmes. Other sources of protection, such as non-insurance disaster assistance from government programmes or charity organisations are not included, even though they may be significant in some markets.

To afford comparability with other perils, regional and global protection gaps estimated from the sample are scaled up to an artificial total using the share of the sample in aggregate crop production. Protection gaps are shown in so-called premium equivalents, to make them comparable with other perils and the size of existing insurance markets. These are derived by applying average premium rates from the insured exposures to the estimated uninsured values.

Macroeconomic resilience

Macroeconomic resilience replenished as a cyclical economic recovery expanded countries’ fiscal and monetary policy space. Our global SRI Macroeconomic Resilience Index gained 12% relative to the pandemic shock, to 0.50, albeit still below pre-pandemic and pre-global financial crisis levels.

Fiscal space benefited from the strong rebound in economic activity from easing lockdown measures and continued stimulus, while monetary policy space was somewhat supported by rising long-dated interest rates. However, a belief that inflationary pressures were transitory meant advanced economy central banks delayed actively tightening monetary policy. This limited the extent to which monetary policy space was replenished.

Global insurance resilience regained some ground as health resilience benefited

from a recovery in household incomes and higher public health funding. The SRI Global

Composite Insurance Resilience Index (I-RI), which aggregates the three resilience sub-

indices, improved marginally to 54.3% in 2021, from 54.2% in 2020.

Microinsurance can make affordable and efficient insurance products available to households through unconventional product design, distribution and claims management processes. The use of microinsurance has increased in recent years, particularly for life, property and agricultural exposures. The Microinsurance Network reports that up to 223 million people were recorded as covered by microinsurance in the 34 countries covered in 2022.

Life microinsurance became the most important product covering the highest number of people in both Asia and Latin America, including other mortality products such as credit life and funeral expense covers.

In Latin America, life insurance continued to be the dominant product line, with health microinsurance reaching a relatively low number of customers.66 For the emerging middle class, we see elevated financial vulnerability due to inflation. Affordable life and health insurance covers are even more important now, to prevent households from falling back into poverty in the event of a mortality or sickness event.

Insurance risks building

However, it remains lower than prior to both the COVID-19 shock and the GFC. In 2022, we see risks building that will put global insurance resilience under increasing pressure. While insurance protection is still growing strongly, we expect scaled-back government benefits and declining asset values to erode insurance resilience.

Mortality resilience is expected to face pressure as household financial assets decline and social security benefits lag behind the growth in protection needs.

We see health resilience weaken as governments withdraw pandemic support for public health systems and patients catch up on deferred elective medical treatment. However, rising risk awareness by consumers will continue to be a longer-term tailwind. We forecast heightened recession risk in the next 12–18 months, with weaker employment and insurance demand likely in 2023.

The combined world protection gap for health, mortality and natural catastrophe risks rose marginally to USD 1.42 trillion in 2021, despite the rise in the overall resilience index.

A reduction in the health protection gap could not offset a combined USD 74 billion worsening in the mortality and natural catastrophe protection gaps in 2021.

Emerging market`s Insurance resilience

Emerging markets accounted for 59% of the total global gap: emerging EMEA, emerging APAC and Latin America have a combined gap of USD 831 billion. We expect the total global protection gap to widen in 2022 and 2023 due to macroeconomic and climate related challenges, including the impact of high inflation this year.

Structural indicators continue to weigh on global macroeconomic resilience. Human capital and labour market efficiency are key headwinds, particularly in emerging markets.

Anticipated economic deterioration in the coming months suggests that policymakers should focus on lifting trend growth by strengthening structural parameters such as infrastructure, human capital and inequality.

The current cost of living crisis brings inequality into focus. Economic shocks typically hit the lowest-income households hardest, creating unequal outcomes that require a policy framework to support inclusive growth.

Insurance resilience recovered

Global insurance resilience recovered in 2021, primarily due to strong improvement in health resilience, which offset weaker mortality and natural catastrophe resilience.

The SRI Global Composite Insurance Resilience Index (I-RI) rose slightly to 54.3% in 2021 (2020: 54.2%), but remains lower than prior to the COVID-19 shock (54.4%) and the financial crisis (56.4%).

Global mortality resilience declined to 45.7% in 2021, led by falls in emerging Asia, emerging Europe and North America. Natural catastrophe resilience remained low, with 75% of global exposures unprotected in 2021.

The combined world protection gap for health, mortality and natural catastrophe risks rose marginally to a new record of USD 1.42 trillion in 2021 (2020: USD 1.38 trillion).

The global health protection gap narrowed by 4.3% to USD 737 billion in 2021, aided by robust insurance market growth and scaled-up government efforts to cover pandemic-related health spending.

While insurance protection is still growing strongly in 2022, we expect scaled-back government benefits and declining asset values to erode insurance resilience overall.

Simulating how high inflation may affect protection gaps, we estimate that price increases in 2022 could translate into USD 55 billion widening in the global insurance protection gap for 2021, or about 3.8% of the total gap.

World economy regained

The world economy regained macroeconomic resilience in 2021, benefiting from the cyclical rebound from the COVID-19 crisis and rising long-dated interest rates during the year.

SRI Macroeconomic Resilience Index rose 12% to 0.50 compared with 2020 globally, primarily due to improvement in fiscal space. Advanced economies fell behind the curve in tightening monetary policy, limiting monetary policy space gains.

We estimate that global macro resilience will only this year recoup its losses from the 2020 COVID-19 crisis. Cyclical economic tailwinds will further support fiscal space, while central bank action to tame persistent inflation will expand monetary policy space.

We estimate the global index to reach about 0.53 in 2022 (+7% vs 2021), on a par with the 2019 pre-COVID-19 level (0.54), though still well below the pre-global financial crisis level of 0.62 (2007).

…………………….

AUTHORS: Roopali Aggarwal – Insurance Research & Data Associate, Swiss Re Institute, Dr Thomas Holzheu – Chief Economist Americas, Deputy Head of Group Economic Research and Strategy Swiss Re Institute, Lucia Bevere – Senior Catastrophe Data Analyst, Swiss Re Institute, Dr Li Xing – Head Insurance Market Analysis Swiss Re Institute