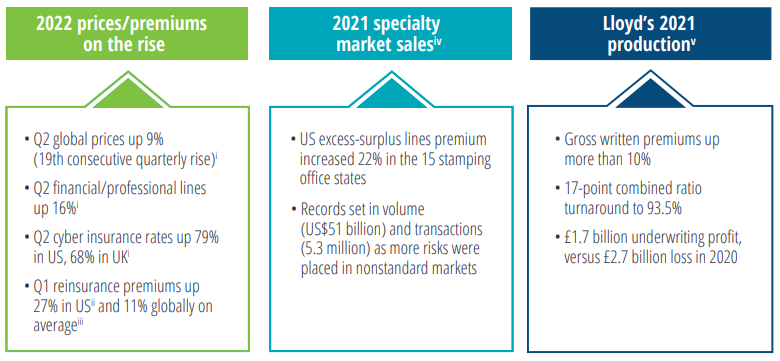

Raising revenue hasn’t been an issue for most nonlife insurers, thanks to some of the highest property-casualty insurance rate increases posted in years—although not all product lines and individual country markets experienced the same growth levels.

Commercial insurance lines generally saw more robust growth than personal lines, while homeowners’ premiums usually rose faster and higher than for personal auto—trends that are likely to continue into 2023 given ongoing competitive, macroeconomic, and geopolitical conditions.

Raising revenue insurers

Meanwhile, Europe and North America accounted for two-thirds of 2021’s 6.3% gain in global nonlife premium volume—a major change from recent historical trends, when Asia (especially China) drove the majority of the sector’s expansion. And growth wasn’t even uniform across Europe, as German insurers saw a 2.4% rise in a more sluggish economy.

The same goes for price increase trends— which, while moderating somewhat, are still quite high by historical standards.

This year, second-quarter rates are up an average of 11% for the United Kingdom and 10% for the United States, versus only 6% for continental Europe and just 3% for Asia.

Yet while price hikes were among the drivers pumping up premium volume and sending US consolidated surplus over the US$1 trillion mark for the first time, inflation is driving loss costs even higher and faster in most markets, undermining underwriting profitability.

Average replacement costs were up 16.3%—nearly twice the consumer price index rise. This is in addition to the ongoing effects of social inflation, which elevate insurance claims costs because of increased litigation frequency, broader liability definitions, and legal decisions trending more in favor of plaintiffs—including higher compensatory awards from juries, particularly in the United States.

These factors—along with the increasing impact of catastrophic weather events and cyber risk—were all likely major contributors to the US$3.8 billion net underwriting loss reported by US nonlife insurers in 2021 despite robust written premium gains.

These effects should linger this year and perhaps into 2023. S&P Global Market Intelligence expects inflation to raise the US combined ratio above 100% for the first time in five years in 2022 despite anticipated direct written premium growth of 9.8%.

Prices, premium volume are soaring across commercial lines

Rising reinsurance rates and shrinking coverage availability are also contributing to market hardening while adding to primary carrier operating costs. Midyear property reinsurance renewals were particularly challenging, as concerns over inflation’s impact on loss costs as well as scarcity of retrocessional coverage prompted capacity withdrawals.

A survey by Reinsurance News found 77% of respondents expecting manycarriers to be unable to secure their desired protection level.

Insurers and their intermediaries may also face the prospect that many commercial and personal insurance customers could seek coverage reductions or even allow policies to lapse as a means of dealing with broader inflationary cost pressures. About half of UK consumers surveyed by Guidewire said they were at least somewhat likely to cut their spending on insurance in response to cost-of-living increases.

Opportunities knock for proactive players

Even in a problematic economy like this, there are likely to be multiple opportunities to improve top-and bottom-line results through organic growth as well as enhanced operational efficiencies.

The small-business insurance market appears primed for reinvention, with many buyers surveyed by Deloitte Global seeking new types of policies, greater flexibility in terms, pricing, and payment options, as well as more holistic loss control services.

Cyber insurance in particular appears to be in greater demand—although carriers should proceed with caution as ransomware frequency was up 235% in 2021 compared to 2019, while average ransom payments skyrocketed 370% over the same two-year period.

Meanwhile, the London insurance market could double in size just by covering the global transition to green energy for policyholders looking to achieve net zero on carbon emissions, according to the London & International Insurance Brokers’ Association (LIIBA).

Buyers around the world will annually spend an additional US$125 billion in insurance-related transition costs by 2030, according to LIIBA’s CEO Christopher Croft, who said that “if a significant proportion of that $125 billion came to London, it would transform our market and London’s standing for decades to come.”

In personal lines, concerns over whether the rise of autonomous vehicles might divert billions of premiums into product and professional liability coverages (since the technology and software running the car, not the driver, may be at fault in accidents) are unlikely to materialize anytime soon, given reports that self-driving technology remains largely experimental.

As more such vehicles hit the roads, however, auto insurers should consider designing split coverage—perhaps similar to hybrid policies already marketed to ride-share drivers in which personal auto applies when off-duty, with separate commercial coverage activating when driving for hire.

The same bifurcated policies could be marketed for when autonomous systems are on versus when drivers are in control.

More carriers should also be exploring potential partnerships to capitalize on the growing embedded insurance market—with coverage purchased at the point of sale of some other product or service.

Gross premiums are forecast to grow by as much as six times, to US$722 billion by 2030, with China and North America expected to account for more than two-thirds of the global market.

The world of intangible assets—nonphysical properties with monetary value—is also expanding and creating new exposures to cover, from cryptocurrency and NFTs to virtual activities on the metaverse. Only 17% of such assets are currently insured, according to research by Aon and Ponemon.

Other specialty lines likely to see increasing demand include a wide range of coverages for cannabis providers, packagers, and sellers as more US states legalize medical and recreational use.

The legal market size was valued at US$20 billion globally in 2020 and is predicted to grow to US$129 billion by 2028, according to a report by Vantage Market Research.

Beyond product innovation, insurers should also be accelerating technology transformation initiatives to upgrade operational efficiency, pricing accuracy, claims management, and insurance customer experience—in parallel with efforts to enhance staff capabilities to exponential levels in underwriting and claims.

This should help carriers realize the full potential of all the new data, analytical tools, and enabling technologies at their disposal—from artificial intelligence to the cloud.

More carriers might also consider outsourcing noncore functions to transition from variable to fixed costs as well as provide greater experience and expertise in areas ranging from human capital to cybersecurity.

Group insurers get innovative amid shifting dynamics

Group insurance remains a significant growth opportunity in the North American market. Life loss ratios and short-term disability incidence, while still elevated, appear to be returning to pre-COVID levels as pandemic-related severity falls, Deloitte has observed during discussions with insurance industry executives. Dental claims, which decreased during the height of COVID, are also reverting to the norm as people resume their pre-lockdown lives.

As metrics across the sector begin to stabilize, however, insurers will likely now grapple with how to adapt to emerging challenges, such as uncovering new areas of sustainable growth to differentiate in a competitive market, as well as serving multigenerational employees with vastly diverse, evolving expectations.

Those seeking long-term organic growth may consider addressing increasing demands for more holistic employee benefits packages. Moving forward from traditional one-size-fits-all plans for such a diverse segment base will likely require offerings that span a broader lifestyle experience across health, wealth, and wellness in a comprehensive way instead of separate transactions or policies for each.

To facilitate portfolio expansion, many insurers are beginning to develop partnerships with other providers as well as third-party vendors. But they should also be looking to eliminate points of friction, if any, among different participants in the group sales ecosystem.

The opportunity to combine employer data with employee-generated information could provide a foundation to create more personalized experiences and tailored offerings that can drive increased and broader enrollment in benefits, while building long-term loyalty.

For example, Guardian Life is partnering with InsurTechs, including Noyo and Ideon, which enable connectivity between carriers and other partners to standardize data exchange.

Development of “as a service” solutions offers another potential competitive advantage group insurers can explore. For example, several states including New Jersey, Massachusetts, and Connecticut are increasingly mandating that employers cover paid family and medical leaves.

While navigating the myriad of nuances in these state mandates may have been a challenge for large multinational employers previously, this issue now also concerns small companies operating in a virtual setup with multidomiciled employees.

Administrating this patchwork of mandated laws on leave requirements for employers of all sizes could not only create new sources of fee-based revenue for group disability insurers, but it may also potentially increase the competitive advantage for those that take on this pain point for clients.

There is also likely to be increasing pressure from the distribution force for further innovation. Brokers increasingly expect carriers to help their productivity by providing technology capabilities for digitalization and virtualization across all activities. With enhanced technology capabilities, carriers should be sharing more data with brokers as well as employers to design meaningful benefit options and help employees live healthier lives, which could drive down claim costs.

…………………….

AUTHORS: Karl Hersch – US Insurance leader, Principal Deloitte Consulting, Neal Baumann – Global Financial Services Industry leader, Principal Deloitte Consulting, Michelle Canaan – manager Deloitte Center, Sam Friedman – senior manager, insurance research leader Deloitte Center