The underwriting margins for reinsurers are anticipated to reach their peak in 2024, driven by significant price increases and stricter terms and conditions established in 2023 and during the renewals in early January 2024.

However, the reinsurance market is expected to begin softening in 2025 as the attractive returns draw more new capital into the sector, according to a report by Fitch Ratings.

The renewals in January 2024 reflected price adjustments in line with claims inflation, estimated between 5%-10% across most business lines.

Challenges were particularly noted in lines affected by geopolitical tensions, such as those in Russia/Ukraine and Gaza, impacting areas like war on land, political violence, and terrorism.

Reinsurers’ Underwriting Margins

Global reinsurance groups are cutting back on the cover they provide against medium-sized natural catastrophe risks due to investor pressure after several years of large catastrophe losses and improved profitability in other parts of the reinsurance market.

Underwriting results at global reinsurance companies should remain favourable in 2023 and 2024 as rate increases stay ahead of loss cost trends.

The underwriting profits of reinsurers have a critical impact on the insurance industry. These profits, derived from the difference between premiums collected and claims paid, along with investment income, reflect the financial health and risk management efficacy of reinsurers.

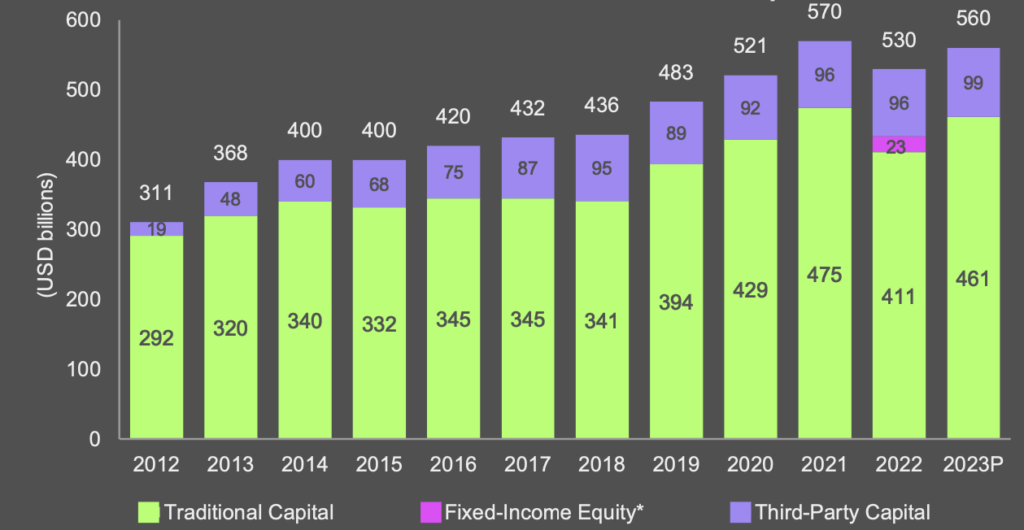

The year 2023 saw a double-digit growth in available capital from both traditional reinsurers and alternative capital providers, bolstered by strong earnings, market stabilization, and the transition to the IFRS17 accounting standard for some.

Analysis indicates that the top global reinsurance groups experienced a nearly 17% reduction in shareholders’ equity due to rising interest rates, driving their available capital down from $475 bn to $411 bn.

In 2023, catastrophe bonds saw a record level of issuance, spurred by the lack of major loss events, favorable pricing, and strong returns from collateral pools.

This increase in capital indicates a potential rise in reinsurance capacity for 2024. Despite no major U.S. hurricane, insured natural catastrophe claims were notably high, reaching USD 100 billion, well above the ten-year average.

The industry covered about 40% of total economic losses, highlighting a significant protection gap.

Reinsurance rate increases for property catastrophe business are likely to slow to below 10% on average when contracts are renewed in January 2024. Improvements in underwriting margins will therefore be less significant than in 2023. Typically, two-thirds of non-facultative reinsurance business is renewed in January, mostly in Europe.

Improvement in Underlying Global Reinsurance Profitability

Fitch forecasts an improvement in underlying profitability for the global reinsurance sector in 2024 on continued strong underwriting margins and rising investment income, and is maintaining its improving fundamental sector outlook.

According to Beinsure’s Reinsurance Renewals review, the global reinsurance market is still facing an imbalance between the rising demand for protection being seen and the fact inflows of capital to the sector remain sluggish.

The increase follows a challenging insurance renewal in January 2023, during which reinsurers made less capacity available for working layers and aggregate covers, amid fundamental shifts in pricing and increases to attachment levels

Price increases, and better terms and conditions in 2023, and to a lesser degree in 2024, will continue to support underwriting margins. Normalised for major losses, we expect margins to peak in 2024.

Some reinsurance companies were already retreating from the property-casualty insurance market but even the strongest reinsurers have now pulled back, largely through tightening their terms and conditions to limit their aggregate covers and low layers of natural catastrophe protection.

Reinsurers Defend New Business Margins

Fitch Ratings forecasts that underwriting margins for global reinsurance rates will reach their highest point in 2024, with a shift towards softer market conditions expected in 2025.

Reinsurers have pushed up rates in recent years in response to the COVID-19 pandemic, war, inflation and climate change-fuelled natural catastrophes, boosting their profitability.

Property catastrophe reinsurance rates were likely to rise in the low double digit percentage range next year, while casualty – or liability – reinsurance would stay flat, due to increased competition in the market.

Moody’s has indicated that reinsurance prices are poised to experience further upward momentum across all sectors in the year 2024, continuing the trend observed in recent times.

The change is anticipated as increased risk appetite and strong financial returns draw more capital from both traditional reinsurers and institutional investors.

The January 2024 renewals experienced modest price adjustments, closely aligning with claims inflation rates and resulting in 5%-10% increases across most lines of business, except for certain areas impacted by geopolitical tensions and cyber insurance, which saw significant price declines due to an oversupply.

Reinsurance capital saw a substantial rebound in 2023, driven by solid earnings, market stabilization, and the adoption of the IFRS17 accounting standard by major players.

This recovery is expected to continue into 2024, supported by a record issuance of catastrophe bonds in 2023 and the attractive returns they offered to investors, bolstering reinsurance capacity.

Global reinsurance capital

The decline was primarily attributed to unrealised investment losses on fixed-income holdings, which comprise over 60% of the average investment portfolio.

The survey findings reveal that the expected price hikes are primarily driven by persisting claims inflation, particularly evident in property-related sectors where reinsurance capacity appears somewhat constrained.

Despite these escalating costs associated with reinsurance protection, the majority of buyers do not plan to expand their reinsurance purchases in 2024. This indicates that primary insurers are gearing up to shoulder a more substantial portion of future losses (see Global Reinsurance Sector Forecasts for 2024).

A strong underwriting performance can indicate a robust reinsurance market, capable of supporting insurers through risk transfer, thereby enhancing their capacity to underwrite new policies.

Weaker underwriting results may signal increased claims or pricing pressures, impacting reinsurers’ ability to provide competitive coverage options.

For insurers, the underwriting results of their reinsurers are pivotal in determining reinsurance availability, pricing, and terms, which in turn affect insurers’ risk management strategies and financial stability.

This dynamic underscores the interconnected nature of the insurance and reinsurance markets, with reinsurers’ underwriting performance playing a key role in the broader industry ecosystem.

……………..

AUTHORS: Robert Mazzuoli – Director Fitch Ratings, David Prowse – Senior Director Fitch Wire