When insurance providers tap into the vast repositories of Big Data that is available to them and combine this data with machine learning and AI capabilities, they can develop new policies that can reach new audiences. Beinsure Media has collected the opinions of experts and presents an overview of BigData technologies in insurance.

Most insurance companies don’t use a lot of data to create their products. They rely on demographic information that is 40 years old, and older. They are struggling to price policies correctly and many will miss out on huge financial opportunities because of this.

Insurance companies work to protect us and help us in certain situations. They form a pool of money, taken from different clients which we also call policyholders.

These companies guarantee us to give a sum of money when we require.

The insurance industry, like any other industry, has also shifted towards digital platforms. So, the exchange of data over the internet allows the insurance companies to utilize the technology of big data.

The implementation of big data results in 30% better access to insurance services, 40-70% cost savings, and 60% higher fraud detection rates that benefit both customers and stakeholders.

The adoption of Big Data Analitycs in the insurance industry is constantly increasing. Insurance companies to invest up to $4.6 bn by 2023.

We can say that big data has revolutionized the insurance industry for good. Its implications have allowed insurers to target customers more precisely.

The insurance industry, for a long time, has been known for leveraging traditional business models. The industry continued its legacy business and products for quite some time. But with the intervention of modern-day technologies, the industry witnessed some favorable outcomes.

The industry has witnessed the exponential growth of the use of technology like any other sector. Advanced technologies and digital platforms have allowed insurance companies to try new means of tracking, measuring, and controlling risk.

A report from McKinsey Global Institute estimates that Big Data could generate an additional $3 trillion in value every year in just seven industries. Of this, $1.3 trillion would benefit the United States.

Insurance companies form their plan of action/business model on the basic idea of anticipating and diversifying risk. The fundamental insurance model involves consolidating risk from individuals payer and reallocating it across a larger portfolio (see The Future of Digital Transformation in Insurance).

Why is big data analytics important?

Organizations can use big data analytics systems and software to make data-driven decisions that can improve business-related outcomes. The benefits may include more effective marketing, new revenue opportunities, customer personalization and improved operational efficiency.

How insurers use Big Data technology?

The insurance industry, for a long time, has been known for leveraging traditional business models. The industry continued its legacy business and products for quite some time. But with the intervention of modern-day technologies, the industry witnessed some favorable outcomes.

For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling.

The industry has witnessed the exponential growth of the use of technology like any other sector. Advanced technologies and digital platforms have allowed insurance companies to try new means of tracking, measuring, and controlling risk.

How do Big data and data mining affect global business? With the help of big data, companies aim at offering improved customer services, which can help increase profit. Enhanced customer experience is the primary goal of most companies (see 10 Key Technology Strategies for Insurance Companies).

Going forward, access to data, and the ability to derive new risk-related insights from it will be a key factor for competitiveness in the insurance industry.

Anna Maria D’Hulster, Secretary-General, The Geneva Association

New approaches to encourage prudent behavior can be envisaged through Big Data, thus new technologies allow the role of insurance to evolve from pure risk protection towards risk prediction and prevention.

The introduction of various technologies has evolved the insurance landscape. Tech solutions have enriched the industry. Some of the key technologies that are being used are the Internet of Things, artificial intelligence, Blockchain, Machine Learning, Big data analytics, and Insurance Management platforms.

Big data has the power to provide the information needed to reduce business costs. Specifically, companies are now using this technology to accurately find trends and predict future events within their respective industries. Knowing when something might happen improves forecasts and planning.

Introduction to Data Analytics in Insurance

The technological landscape changes, and so the industries do. In today a worldwide variety of insurance exists. Still, it is challenging for clients to understand through which insurance company they should start their insurance because many questions came into customers minds like:

- Whether this company is safe or not?

- Will this company give the best offer or not?

- What is the reputation of this company in the market? And more.

Similarly, insurers can also not understand customer behavior, frauds, policy risk, and claim surety, which is mandatory before giving policy to someone. It took years for insurers to sell directly to their customers and issue policies online while competing on price comparison websites. Many companies still have not achieved it (see How will Technology Impact Insurance?).

With the prefiltration of data, the use of advanced math and financial theory to analyze and understand the customer behavior and costs of risks have been the stalwarts of the insurance industry.

The analytics performed by actuaries are critically important to an insurer’s continued profitability and stability.

Traditionally companies are just looking for what happened in the past with Descriptive analytics. But now, the industry is demanding more such that what will happen in the future (predictive analytics) and how actions can change the outcome (Prescriptive analytics).

As we saw with the Willis Towers Watson study, big data in the insurance industry is highly effective for predictive analytics.

Data collection can predict customer behaviors, such as whether they are about to cancel or take out insurance. It can also be used to set prices by analyzing competitors’ prices or what consumers would be willing to pay.

In addition, as we have seen in other posts in which we talked about the benefits of big data, big data can also be used to save costs in some departments or optimize processes to be more productive: data analysis and visualization improve accounts and make work more efficient.

As we saw with the WTW study, big data in the insurance industry is highly effective for predictive analytics.

Data collection can predict customer behaviors, such as whether they are about to cancel or take out insurance.

It can also be used to set prices by analyzing competitors’ prices or what consumers would be willing to pay.

In addition, as we have seen in other posts in which we talked about the benefits of big data, big data can also be used to save costs in some departments or optimize processes to be more productive: data analysis and visualization improve accounts and make work more efficient.

Cloud computing improves the performance of Data analytics

Cloud computing improves the performance of analytics in real-time and in greater depth. It also speeds up machine learning processes. Thanks to this there is also greater personalization of products and services: premiums are tailored in real time to literally any customer.

This results in better customer experiences and more personalized marketing campaigns to attract new audiences or build loyalty among existing ones through policy renewals.

Because that is another major trend in the use of big data in the insurance industry: big data also serves to predict who is most likely to cancel their insurance and reach out to them to offer them a product of their interest.

Big Data in the insurance industry

The insurance industry has always thrived on data analytics to target its customers. Different types of insurance companies such as travel insurance companies, health, and life insurance companies, P&C insurance companies, etc., rely on statistics to segment their customers. Accident statistics, policyholder’s personal information, as well as third-party sources, help to group people into different risk categories, prevent fraud losses, and optimize expenses.

The shift towards digital platforms has opened the door for new sources of information that can be used to understand the complex behavioral patterns of a customer and precisely determine his or her segment.

For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing, and claims handling.

In short, the benefits of big data in insurance can benefit both customers looking for good products and insurers looking to reduce fraud and wasteful spending while offering better services to their audience.

If your company is interested in knowing the trends in policies, how to attract customers and build customer loyalty or change the business according to the needs of society, we work with you to get from the big data all the sense that we do not see in words and figures in isolation.

What are the challenges of the Insurance Industry?

Customers find the best company, but there might be a possibility that the client is fraud or life impaired that will create a huge problem for the insurer. Consistently evolving business environments are increasing competition and risk. Several other challenges, like theft and fraud, are also plaguing the insurance business.

The above challenges force insurers to generate insights from data to enhance pricing mechanisms, understand customers, safeguard fraud, and analyze risks. Data analytics collate more precise information about several transactions, product performance, customer satisfaction, etc.

How is big data affecting different segments?

It is known that via big data solutions, organizations generate insights and make well-informed decisions, discover trends, and improve productivity. But big data is more than that. Big data provides many opportunities for organizations and makes an impact on businesses, the workforce, and society.

Big data has the potential to improve internal efficiencies and operations through robotic process automation. Huge amounts of real-time data can be immediately analyzed and built into business processes for automated decision making.

Big data refers to large sets of info that are analyzed for trends and patterns that offer useful insights. Special emphasis is placed on analyzing people’s behavior and interactions online. The challenge, however, is in figuring out the best way to process, analyze and make useful insights of the information gathered.

When we look at the impact of big data technology on the insurance industry, it is quite evident that it has worked wonders for the insurance companies. The application of big data has already started benefitting insurance companies. We should also learn about the impact of big data on each particular sphere of the insurance sector.

Big Data in Health and Life Insurance

Including new information sources, insurance companies can for insurance models that will be more targeted and will also encourage customers to improve their lifestyle by offering discounts on increased activity. John Hancock, one of the oldest and largest North American life insurers, announced last year that he will be only selling interactive policies based on the data generated by health apps and wearable devices.

What big data can do, among other things, is to provide a new level of precision regarding what is actually happening on the ground to a business, to help analysts and portfolio managers make choices.

In any case, the ramifications of Big Data in medical coverage causes concerns identified with data security, protection, and morals. This field actually expects enactment to guarantee that punishing unfortunate conduct doesn’t hurt the individuals who truly need insurance.

Big Data in P&C Insurance

The situation is all the more encouraging for property and casualty insurance, as Big Data can assist with recognizing exact connections between client conduct and dangers. For instance, vehicle insurance agencies can grade roads dependent on the accidents that occurred and check their customers’ tracks. With Big Data, vehicle protection can get an exceptionally customized client profile dependent on drivers’ GPS locational information and use it to settle on an ultimate conclusion. As GPS information is protected, such a cycle doesn’t breach customers’ privacy.

Big Data in Travel Insurance

Contrasted with different fragments, travel protection embraces big data and, especially AI advancements, very well. The relatively low price value settles on travel insurance, a genuinely brisk choice, so this industry manages an amazing number of solicitations. Innovations can speed up the interaction with customers, give more tailored products and services, automate simple communication, improve customer satisfaction, and quickly configure the most beneficial offer.

Implementing Data analytics in the Insurance

The digital transformation of insurance companies has been going on for years. It has increased speed, efficiency, and accuracy across every branch of insurance companies. Advanced data and predictive analytics systems help the insurance industry to make data-driven business decisions. AI in Insurance has empowered companies with high-level data and information that is leveraged into improved insurance processes and new opportunities.

Let’s discuss an auto insurance example to understand the effect. A new level of innovation is emerging in all product lines and business functions using advanced data analytics.

Rather than just focusing on internal data sources like loss histories, auto insurance started work on behavior-based analytics and credit score from credit bureaus into their analysis.

Thus this analysis becomes evidence and generates insights to know the people who are paying their bills on time are safe drivers. It makes the traditional analytics advance and more productive in which they check claim histories, demographic and physical data.

New sources of external (third-party) data, tools for underwriting risk, and behavior-influencing data monitoring are the primary developments shaping up as game-changers.

Ways in which big data is used in the insurance industry

The insurance industry is using big data in several ways

- Customer Acquisition

- Customer Retention

- Risk Assessment

- Fraud Prevention and Detection

- Cost Reductions

- Personalized Service and Pricing

- Effects on internal processes

Customer Acquisition

Every business needs to acquire customers to generate revenue and if the process of acquisition can be made efficient, that would make things simpler. In the days of social media and the increased use of the internet, every person generates massive amounts of data via social networks, emails, and feedback.

The data collected from the online behavior of customers is categorized as unstructured data and a part of big data. Analyzing such unstructured data, insurance companies can create targeted marketing campaigns that will acquire new customers. Tracking this online behavior of customers gives much more precise information than any survey and questionnaire.

Customer Retention

No business likes to lose its customer base. A business is considered to be successful if its customer retention rate is higher. The insurance industry is no exception. So, it utilizes big data to retain its customers, who may part their ways with the company.

Based on customer activity, algorithms can predict the early signs of customer dissatisfaction. Working on the insights provided, companies can quickly react to improve their services and also find a solution to the grievances of that particular customer. Insurers can offer discounts or even change the pricing model for the client.

Risk Assessment

The whole idea of insurance companies revolves around diversifying risk. Insurers have always focused on the verification of customers’ information while assessing the risks. Customers are segmented into different risk classes based on their data.

Big data technology can increase the efficiency of the whole process of risk assessment. Before arriving at a final decision, an insurance company can utilize big data and use predictive modeling to count on possible issues, based on client’s data, and furthermore put them into a suitable risk class.

Fraud Prevention and Detection

According to Coalition Against Insurance Fraud, each year the United States’ insurance companies lose more than $80 billion due to fraud. Such fraudulent acts result in increased premiums for every stakeholder.

Big data can be used to save insurance companies against such frauds. Using predictive modeling, insurers can compare a person’s data against past fraudulent profiles and identify cases that require more investigation.

Cost Reductions

Cost-cutting is one of the many benefits of leveraging technology. The increased role of machines in the industry increases efficiency which eventually leads to cost reductions.

Big data technology can be leveraged to automate manual processes, making them more efficient and reducing the costs spent on handling claims and administration. This will allow the companies to offer lower premiums to their clients and hence stand tall in the competitive market.

Personalized Service and Pricing

We all like to be treated specially. Companies have understood the need for a personalized experience. The analysis of unstructured data can help companies to offer services that suit and meet the customers’ needs.

For example, life insurance based on big data can become more personalized by taking into account the medical history of a customer along with the habits perceived by the activity trackers. The data can also be utilized to decide a pricing model that fits into the budget of the client and also is profitable for the company.

Effects on internal processes

The implementation of big data algorithms can help increase the efficiency of most of the processes that require deep brainstorming. Big data technology allows insurers to work quickly on a customer’s profile. They can check their history, decide on a suitable risk class, form a pricing model, automate claims processing, and deliver the best services. A study by McKinsey and Company shows that automation saves 43% of the time of insurance employees.

How data analytics are used by insurance company?

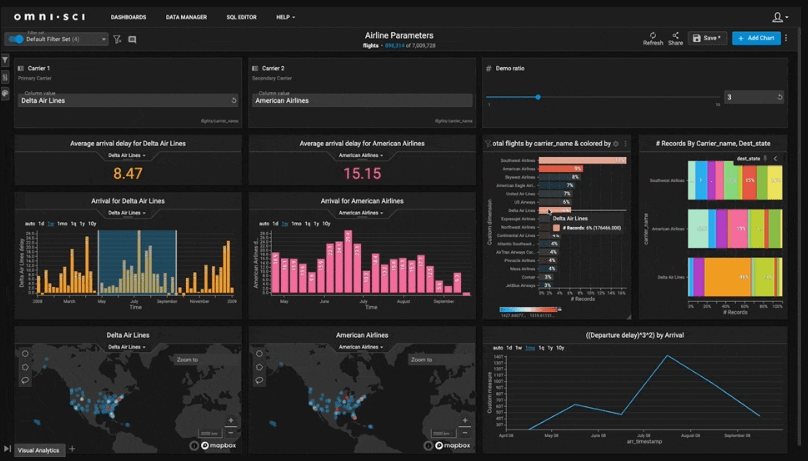

Insurance Pricing

Many insurance companies are seeing deteriorating underwriting results. Less sophisticated insurance carriers become exposed where they are mispriced to make a sale. Due to comparative ratings in the insurance market, prospects can instantly compare the prices of many companies, often choosing the lowest price. The lowest cost may win the business but may be underpriced relative to the risk. This results in costing a company potentially exorbitant amounts of money in the end.

- By automating the process of building and comparing models that explore cost versus risk, users can determine whether any risk they consider taking price appropriately.

- The above dashboards show the top 3 companies with the maximum number of customers, and the top 3 companies offer insurance at minimum cost. So it will be easy for customers to grab the best life insurance for their family.

- As the bar chart shows, for the 10 to 20 age group is SBI life insurance.

- With the algorithms, users can be confident in the prices they charge, which is a competitive advantage that pushes adverse selection on to competitors, which, over time, will increase growth and profitability.

Claim Payment Automation Modeling

Many insurance claims require a manual inspection to assess the damage, leading to a long wait for a payout. It can cause claim amounts to spike out of control, a significant drop in customer satisfaction, and a potential decrease in retention rates.

- The above dashboard shows the top 5 Policies in which customer investment maximum and age group from which we can generate maximum revenue.

- So this helps insurance companies to understand which policies are more in demand for a particular age.

- We can increase customer satisfaction through this, and claims are made more quickly and efficiently.

- Hence, users can be confident in how much to reserve for incurred But Not Reported (IBNR) loss amounts.

- The user will build more robust and accurate pricing models Using the predicted developed loss for each claim as the dependent variable.

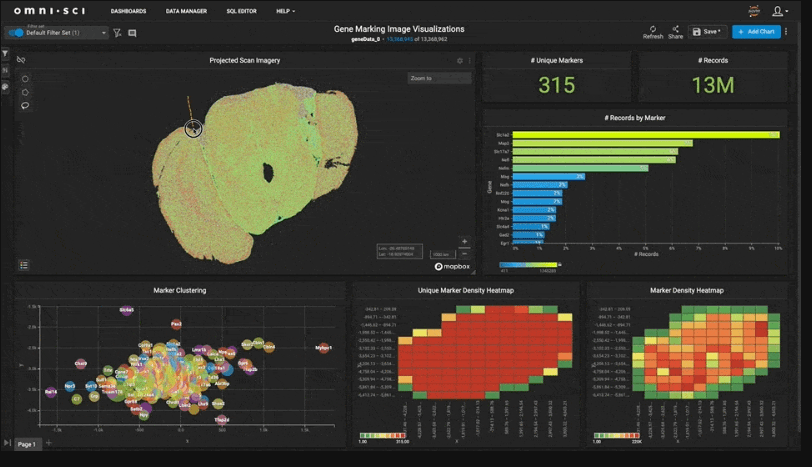

Claim Development Modeling

The claim amount can change drastically from an insurance claim’s initial filing to full payment. Hence the ability to predict the final claim amount significantly impacts financial statements, specifically the reserves and IBNR amounts reported in Quarterly Earning statements.

- An extremely accurate and automatic predictive model can be built to understand better how much a claim will ultimately cost.

- The above dashboard shows which policy grabs the maximum number of customers from different age groups.

- It also shows the trend in the number of claims over a year. So this helps them to predict the future and also helps to give the best recommendation according to customers’ needs.

Life insurance undertaking for impaired life Customers

Life insurance companies do not underwrite customers who suffer serious diseases; thus, doing so would require a long and expensive medical assessment process.

- A life reinsurer can use medical history and conditions to predict the risk of underwriting a serious disease survivor accurately.

- The insurer can identify which customers have good health prospects and directly underwrite them without a further assessment, leading to more customers and reduced medical costs.

- As we can see above, clients with blood cancer have maximum chances of dying.

- The person on stage 3 or 4 also has chances of dying soon. But we can compare that the death rate decreases with time, so it will be safe to offer cancer patients.

Fraudulent Claim Modeling

Fraudulent claims are too expensive and inefficient to investigate every claim. Moreover, investigating innocent customers could be a bad experience for the insured, leading some to leave the business.

- Accurate predictive models can be used to identify and prioritize likely fraudulent activity.

- As shown in the dashboard, we know from which age group maximum frauds are detected.

- By using this particular incident and occupation, maximum frauds happened. It helps in two folds.

- Resources will be deployed where users see the greatest return on their investigative investment.

- Moreover, an insurer can optimize customer satisfaction by not challenging innocent claims.

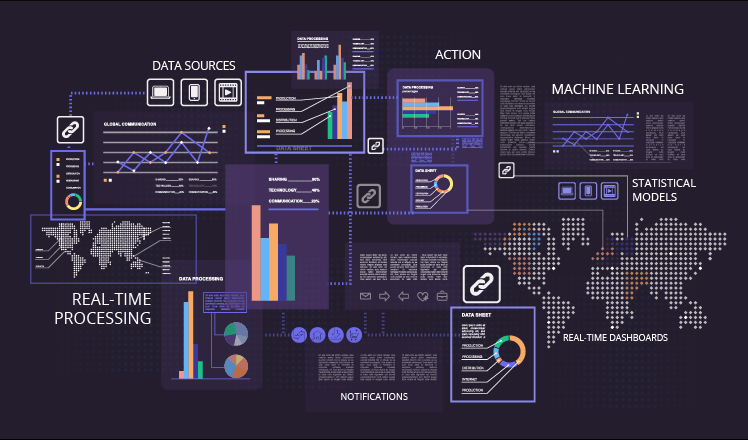

Powerful and Effortless Visual Analytics

Instantly inform your most critical decisions with stunning visualizations, accelerated geospatial intelligence, and advanced analytics.

Combine your operation’s background knowledge and creativity with accelerated graphics and computing to place people at the center of your data-driven decisions

- Fuse and cross-filter multi-dimensional data on common attributes

- Uncover surprising multi-factor relationships from any number of internal and external data sources

- Quickly iterate between dashboard parameters to perform projections, estimations, and comparisons

- Construct filter sets and track them over time and place to gain a more focused, visual understanding of related groups

The examles of use Big Data Visual Analytics Tools

Big data comes from myriad sources – some examples are transaction processing systems, customer databases, documents, emails, medical records, internet clickstream logs, mobile apps and social networks.

The Visual Analytics Experience for Modern Data

Human in the Loop

Combine your organization’s background knowledge and creativity with accelerated graphics and computing to place people at the center of your data-driven decisions

Monitor Behavior

Construct detailed filter sets and cohorts from your observational data and track them over time and space to gain a more focused, visual understanding of related groups

Prepare for All Scenarios

Quickly iterate between measure and dimension parameters to perform projections, estimations, and comparisons of your decision-quality data

Modern Data Challenges With Interactive Visual Analytics

Real-Time Visualization and Data Fusion

Eliminate the pain of heavy data engineering by visually joining and cross-filtering multi-dimensional data on common attributes, like location and time, without code

Reduce Time-to-Value

Rapidly expand your ability to configure dashboards and uncover surprising multi-factor relationships from your highest velocity big datasets

Wrangle Multi-Source Big Data

Use the same big data visual analytics dashboard to explore location and time-series data from any number of internal and external sources

Conclusions

A data and analytics company that is seeking to apply Big Data, machine learning, and AI to reinvent the insurance industry. Digital transformation of the insurance industry accelerated during the Covid-19 pandemic, as a growing number of consumers turned to digital channels to shop for insurance solutions. This prompted leading insurers to invigorate their digital transformation initiatives.

According to Yes Magazine, the implementation of big data results in 30% better access to insurance services, 40-70% cost savings, and 60% higher fraud detection rates that benefit both customers and stakeholders. We can say that big data has revolutionized the insurance industry for good.

To fully utilize this data, insurers must expand their collection to new avenues, including information in the public domain, collected user information from other industries such as retail and banking, and available unstructured content from shared digital resources including social media.

……………………………

Edited & fact-checked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media