Transformative trends are shaping the future risk landscape, creating $200+ billion of market potential for insurers by 2030. The top 10 opportunities will enable insurers to respond to customer demand while increasing the industry’s relevance, growth, and diversification, according to AON`s Transformative Trends Report.

To capture this growth, insurers need to understand relevant trends and begin transforming their businesses through product development, talent and business culture.

Global transformative forces have been changing the way we live for centuries. Think electricity, automobiles, the Internet.

An Opportunity To Create New Insurance Markets

Today, we see a multitude of megatrends emerging that will profoundly change our world, from climate change to artificial intelligence and the Metaverse.

These trends will also drive the reinsurance market of the future, creating demand for both traditional and new protection products, as well as services that prevent and mitigate risk.

The rapidly growing global market for shared mobility, which is expected to reach almost $1 trillion by 2030.

The shift to electric autonomous vehicles could create a $300 billion global market by 2030, predominantly in motor, but also cyber, casualty and aviation.

Using in depth analysis, Aon’s Strategy and Technology Group (STG) has identified the ten most promising megatrends with the potential to generate billions of dollars in additional premium for insurers.

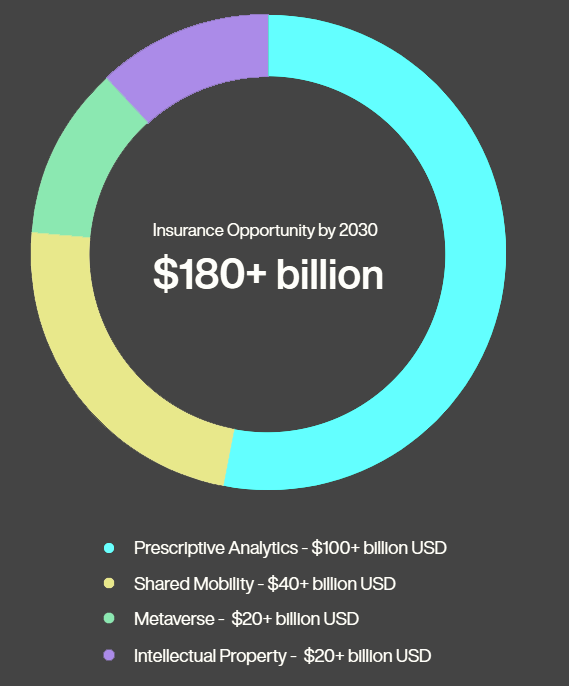

Combined, Prescriptive Analytics, Shared Mobility, the Metaverse and IP could generate some $180+ billion in GWP by 2030

At a time when the value proposition of insurance is under growing pressure, megatrends present an opportunity for the industry to increase its relevance, while also creating new markets and increasing overall premium (see how Technologies are Transform Insurance & Automotive Landscape).

Top 10 Transformative Trends for Insurers

- Electrification

- Biotechnology

- Emergence of Nature Based Solutions and Impact on Biodiversity

- Carbon Capture Storage

- Decommissioning of Carbon Intensive Assets

- Rise in Intellectual Property (IP)

- Metaverse

- Shared Mobility

- Prescriptive Analytics

- Build Back Better – Resilient Infrastructure Development

Many of the megatrends growth opportunities are immediate or would require relatively small investment in talent or technology by insurers. Other trends are less well developed at present, yet they represent potentially huge future markets for insurance.

At a time when the value proposition of (re)insurance is under growing pressure, megatrends present an opportunity for the industry to grow its relevance, while also creating new markets and increasing overall premium.

Combined, the Metaverse, Shared Mobility and Intellectual Property combined could generate some $80 billion in gross written premium by 2030.

Prescriptive analytics, which is less well developed, alone could generate some $100 billion in additional premiums (see How Metaverse & Visual Intelligence Can Transform Insurance?).

Not all megatrends will create opportunities for insurance. Some are just too vast and uncertain to justify significant investment. But many demonstrate clear demand for risk transfer products and the chance to create entirely new markets for insurance.

As an industry, we cannot afford to sit on the sidelines and wait for these trends to crystalize. We have the expertise and ability to anticipate the future landscape and develop innovative products and solutions.

Sherif Zakhary CEO, Strategy and Technology Group, AON

The challenge for the industry is to sift through the bewildering array of interconnected megatrends and sub-trends, to identify and prioritize the ones that are most relevant for individual (re)insurers to act upon.

Identifying (re)insurance megatrends early will enable (re)insurers to seize opportunities and manage risks proactively (see how AI Technology & Data Analytics Helps Insurers).

(Re)Insurers will need an informed and deliberate strategy – supported by data, artificial intelligence and insights – to make better decisions around protecting and growing their business in the context of a changing risk environment.

Attracting a wider range of skills and talent, harnessing technology, and creating the right culture to spur innovation will help transform their business for the future.

In a rapidly changing and volatile world, (re)insurers clearly play a critical role in protecting communities and building resilience.

Megatrends will create new risks and challenges for society over the coming decades, as individuals and businesses adapt to a changing environment and fast-paced advances in technology.

As risk experts, (re)insurers are well-positioned to help deepen our understanding of these risks, enable innovation, and absorb the risks that others cannot.

Future Disruptors

Climate change, new and emerging technology, as well as socioeconomic, demographic, and geopolitical shifts are creating tomorrow’s risk landscape, driving future demand for (re)insurance.

But which of these trends creates the most attractive opportunities for (re)insurers, and what will solutions look like?

For an (re)insurer, the challenge is to identify the megatrends that are most relevant to their business.

The shift in power from the U.S. to China, ageing population, artificial intelligence, antimicrobial resistance or the next pandemic, could all have major social and economic consequences. Yet not all trends have a direct impact on the property-casualty (re)insurance market, and many will not have an (re)insurance solution at all.

Some involve gradual change that (re)insurers are already well positioned to respond to, while others may be too vast and generic to break down.

Megatrends that will be future disruptors, however require a major shift in the pace of innovation to capitalize on the opportunities.

Some, like electrification and biotechnology, offer immediate premium potential, or require a relatively small investment in expertise or product development to unlock. Others, like the Metaverse and biodiversity, have big premium potential, but involve longer time horizons or uncertainty around trend development and market size.

Top Transformative Trends

STG analyzed over 80 megatrends, identifying those that present the biggest growth opportunities for insurers. We performed a series of deep dives into the most promising opportunities to better understand trend drivers, time horizons and required response, as well as to quantify the potential (re)insurance market size.

Prescriptive Analytics

Prescriptive Analytics is the single largest megatrend (re)insurance opportunity of our top ten and can be witnessed to have an impact on many other megatrends (see How Big Data analytics works & why it matters?).

The overall AI market is estimated to reach $0.5tn-$2tn in revenues by 2030 at a 30-40% CAGR, with potential gross written premium expected to exceed $100 billion.

Increasing demand for data-driven decision-making and the adoption of big data and AI technologies are driving market growth, but the technology is still in initial stages of development. Re(Insurers) are focusing on greater operational efficiencies rather than developing specialized insurance products to protect against associated risks.

Shared Mobility

Shared Mobility, which includes sharedautonomous vehicles, hailed vehicles, car sharing and air taxis, is the second largest megatrend (re)insurance opportunity of our top ten, with potential gross written premium expected to exceed $40 billion by 2030.

Under certain scenarios, the mobility (re)insurance market could be worth some $90 billion.

Hailed mobility and car sharing represent the largest premium pools, while micro mobility is a much smaller market, and aerial mobility remains in its infancy.

Intellectual Property

Intellectual Property (IP) is the next largest megatrend (re)insurance opportunity, with the potential to generate gross written premiums in excess of $20 billion by 2030. The IP market presents an immediate opportunity for insurers, driven by a global economic shift from tangible to intangible assets.

The global intangible asset value was estimated at around $60 trillion.

Few carriers currently participate in this market, leaving room for new entrants and the development of new products, including forms of IP business interruption.

Technology is The Biggest Driver

Technology emerges as the biggest driver of megatrend (re)insurance opportunities. In fact, all top three megatrends are technology-led and every one of the top 10 opportunities involves a technology driver.

Technology megatrends can also be facilitators of growth and efficiency for insurers. For example, artificial intelligence and natural language processing is driving automation and prescriptive analytics across industries.

AI and prescriptive analytics can optimize insurers’ pricing and underwriting, streamline claims processes, help evaluate and model risks and detect fraud. All in, predictive analytics could generate approximately $100 billion in value for the property-casualty (re)insurance industry by 2030.

Reflecting the threat posed by climate change and growing interest in sustainability and biodiversity, environmental megatrends are also notable.

They account for half of the top ten, with carbon capture, decommissioning carbon intensive assets, biodiversity, resilient infrastructure and electrification, estimated to have combined premium potential as high as $25 billion.

The availability of (re)insurance solutions for the nature-based solutions market, for example, is currently limited. Yet, there is considerable scope to create a new market for carbon and biodiversity offsets and water credits.

The concentration of opportunities on technology, environmental and economic megatrends largely reflect the focus of property-casualty insurance.

Social and political macro trends, such as the rise of the middle class, the U.S. health gap, or mental health issues, however, would mean more relevant drivers for opportunities in the life and health (re)insurance sector.

Prioritizing Megatrends for Insurance

Megatrends (re)insurance opportunities can also be considered in terms of time and response. Some trends are easier to grasp, require lower levels of investment and present more immediate opportunities. Others are more complex, with longer time horizons and higher levels of uncertainty.

Half of the top ten (re)insurance megatrend opportunities – including IP and decommissioning carbon assets – fall within the opportunity horizon 1, and therefore present potentially immediate premium potential.

Horizon 2 trends, which include the biggest single opportunity of shared mobility, also offer immediate premium opportunities, but may require some innovation and/or investment in capabilities.

Horizon 3 trends are the most challenging, but include some potentially large premium opportunities, such as the Metaverse.

The development and scale of horizon 3 opportunities are long-term and challenging to predict, as they may be dependent on future policy and regulatory changes. For example, automation and artificial intelligence have huge potential for premium, but it is currently difficult to accurately predict the size of opportunities.

Metaverse & NFT for Insurance

The Metaverse presents a similarly sizedopportunity to IP, with an estimated (re)insurance market value in excess of $20 billion by 2030.

At present there are few (re)insurance products servicing the Metaverse, with non-fungible token (NFT) insurance being the most prevalent (see Metaverse and NFT Market Trends Outlook for 2023-2024).

However, expected growth in digital economic activity will create opportunities for (re)insurers to cover virtual assets, cyber attacks and potentially even liability insurance in the Metaverse.

The development of the Metaverse is potentially revolutionary. Widely seen as the next iteration of the internet, the Metaverse promises to provide a more immersive and interactive digital environment for consumers and businesses.

The Metaverse could generate economic value of up to $5 trillion by 2030, which is roughly the size of Japan’s economy – the third largest in the world.

Investment in the Metaverse doubled, with U.S. technology group Meta spending at least $10 billion annually on Metaverse development.

Essentially, the Metaverse is the internet in 3D. It enables people to interact remotely, share content and experiences, collaborate and create in a virtual environment. While still in development, there are a wide number of potential use cases, including entertainment and e-commerce. Businesses are also looking to use the Metaverse and virtual reality for training, marketing, events, remote collaboration and product design.

Despite the size of investment in the Metaverse, there are currently few (re)insurance products that serve this market.

However, the Metaverse will have wide-ranging implications for insurance Aon analysis estimates gross written premium potential related to the Metaverse in excess of $20 billion by 2030.

This will include new (re)insurance products to cover virtual assets and the extension of existing lines of business for emerging risks.

The Metaverse is synonymous with growth in virtual assets, such as cryptocurrency, gaming tokens and non-fungible tokens (NFTs), which are ownership rights to unique digital assets, such as a piece of digital art or music. In 2021, a London auction house sold a digital artwork for almost $70 million, while musician Grimes sold digital art for more than $6 million.

The (re)insurance market is now exploring (re)insurance cover for NFTs, focused on their authentication or loss due to a cyber attack.

As the Metaverse develops there could be further opportunities for (re)insurance to cover emerging risks such as cyberattacks on the metaverse, infringement of IP and real-world rights and damage caused by unexpected events. There may also be opportunities for (re)insurers as the virtual property market takes off, while accident and health (re)insurers could provide cover for avatars.

Interconnectivity

The analysis of (re)insurance megatrends highlights a high degree of interconnectivity between drivers. Many opportunities are driven by multiple trends.

The transition of high carbon emitting industries, for example, touches on issues like energy and natural resource security, access to technology, climate adaptation and resilience, as well as the weakening of global supply chains, urbanization and changing attitudes and values.

Predicting The Future Landscape

Megatrends like climate change and technology are already on most (re)insurers’ radar. While historically most view large global macro trends through the lens of risk, rather than opportunity, more and more (re)insurers are starting to look at the impact of megatrends more strategically. They are asking themselves how they can respond to megatrends, rather than just monitor them.

Capturing megatrend (re)insurance opportunities will require a systematic and disciplined approach to identify and assess both risks and opportunities.

(Re)Insurers will need to establish a framework to understand the future landscape, using intelligence and insights to anticipate global macro-trends, prioritize opportunities and begin to formulate a response.

Using a structured process, a (re)insurer can consider high-level megatrends, break them down into individual sub-trends, and carry out more targeted, detailed analysis to better understand the drivers and scope of opportunity.

For example, environmental trends include climate mitigation and adaptation, the green energy transition, natural resource insecurity and biodiversity. These can be further broken down to sub-trends, such as carbon capture and storage, decommissioning of carbon-assets and resilient infrastructure development.

Likewise, technology can be separated into sub-trends like artificial intelligence, 3-D printing, biotechnology, cryptocurrency, space tourism and so forth.

It’s important to note that the magnitude and scope of each megatrend opportunity will differ by insurer, influenced by a range of criteria, such as market profile, existing expertise and capabilities, risk appetite etc.

A customized framework can help individual (re)insurers prioritize trends, weigh up the risks and rewards, and consider potential solutions.

5-Step Insurance Framework

Capturing megatrend insurance opportunities will require a systematic and disciplined approach to identify and assess both risks and opportunities.

Insurers will need to establish a framework to understand the future landscape, using intelligence and insights to anticipate global macro trends, prioritise opportunities and begin to formulate a response.

- Step 1: Develop an understanding of the future landscape

- Step 2: Consider how the insurance industry will be impacted

- Step 3: Identify and prioritize trends that will create insurance opportunities

- Step 4: Carry out in-depth analysis to quantify the opportunity

- Step 5: Develop a roadmap for action

Using Talent and Technology to Drive Innovation

Getting the right talent, infrastructure and business culture will be key to understanding the future landscape and capturing opportunities. In order to turbo-charge innovation, (re)insurers must attract a broader range of talent and make use of cutting edge technology, including advanced analytics.

Underwriters, for example, will need a better understanding of the risks their clients want to transfer, including entirely new areas of risk, such as digital assets or carbon capture and storage.

Future underwriters will need to be more forward looking and make informed decisions with advanced data analytics to gain insights, assess and price risks, and create products that meet the evolving needs of customers.

More than ever, (re)insurers will need people with diverse skills and subject-matter expertise across a wide range of risks and industries, from biotechnology to green energy.

They will also need people with the skills to transform their businesses in areas like data science, analytics, and AI. In competition with other sectors, (re)insurers must identify and attract talent from outside the industry, while creating a strong environment and culture to retain employees.

Equipping a business for future megatrends will be challenging. (Re)Insurers will need to be more flexible, agile and dynamic to respond quickly to changes in the risk landscape and address new obstacles.

Developing (re)insurance solutions for megatrends will require increased levels of collaboration, new ways to engage a broad range of talent and information sharing, both internally and externally.

Be Proactive Not Reactive

Megatrends are key for shaping the future risk landscape and driving demand for (re)insurance protection. To reach their full potential, new technologies like the Metaverse, AI and carbon capture will require risk transfer solutions. But fast-moving markets will not wait for (re)insurers to get comfortable with the risks.

The scale and complexity of many megatrends can paralyze (re)insurers if they passively wait for greater clarity and data.

Ignored, some megatrends pose an existential threat. With proactive planning and foresight, however, they offer opportunities to grow and create entirely new (re)insurance products and markets. (Re)Insurers cannot afford to sit on the side lines and wait for these trends to crystallize.

They must get on the front foot, predict where the future landscape is heading, and position themselves for transformative success.

………………….

AUTHORS: Wouter Bosschaart – Director Aon’s Strategy and Technology Group, Amy Harding – Strategy Consultant Aon Capital Advisory team