U.S. workers compensation insurers were able to underwrite profitably between 2019 and 2023 even as significant changes occurred in the nation’s workforce due to the pandemic, according to the Insurance Information Institute, Workers Compensation: State of the Risk.

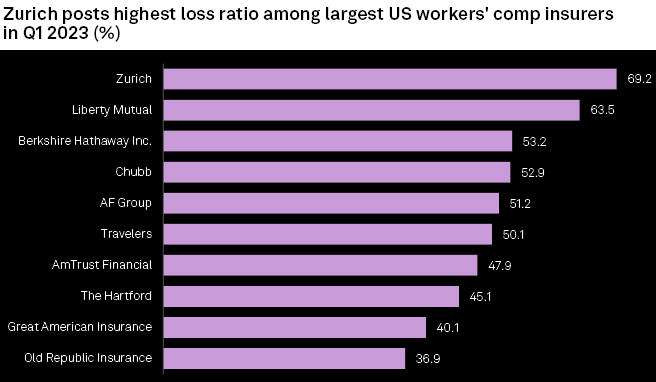

US workers compensation premiums earned rose 4.3% year over year in the first quarter, and the industry’s overall direct loss ratio deteriorated by 2.3 percentage points. Direct premiums earned grew to $13.5 billion from $12.95 billion a year earlier

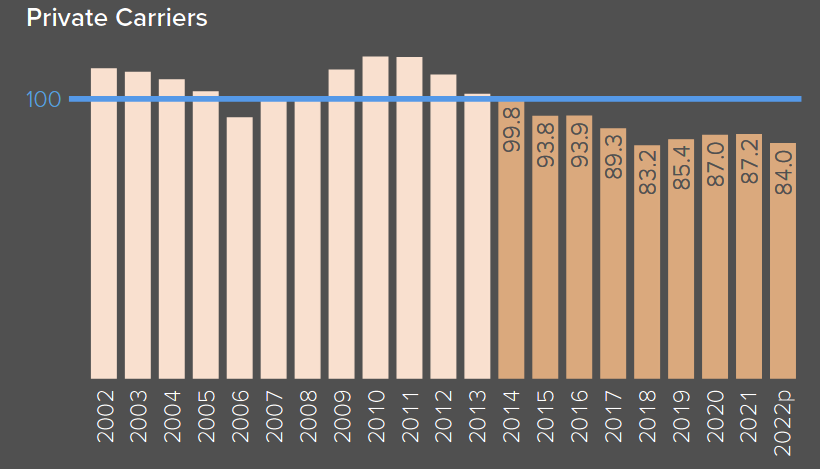

The line’s underwriting profitability for private carriers represented by the combined ratio remains strong, stated the just-released Triple-I Issues Brief, citing data dating back nearly a decade.

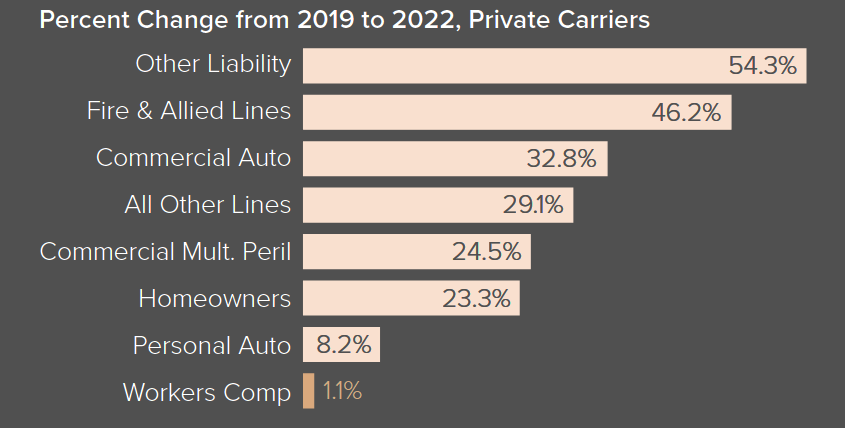

Commercial lines achieved lower net combined ratios than personal lines in both 2021 and 2022, and we forecast that to continue through at least 2025

Dale Porfilio, FCAS, MAAA, chief insurance officer, Triple-I

Workers comp had the lowest combined ratio among major product lines in 2021 and 2022, resulting from many years of deliberate efforts by insurance carriers and their policyholders to improve workplace safety.

Combined ratio represents claims and expenses paid divided by premiums collected. A combined ratio below 100 represents an underwriting profit and one above 100 represents a loss.

WC Net Combined Ratio

Workers’ compensation is considered a social insurance because it relies on a social contract between management and labor, wherein exchange for purchasing workers’ compensation insurance, business owners are protected from civil suits from their workers who become injured on the job.

U.S. workers’ compensation loss ratio

Net favorable prior-year reserve development amounted to $19 million in the first quarter, which was driven by a better-than-expected loss experience in the domestic operations workers’ compensation line for multiple accident years, according to a regulatory filing.

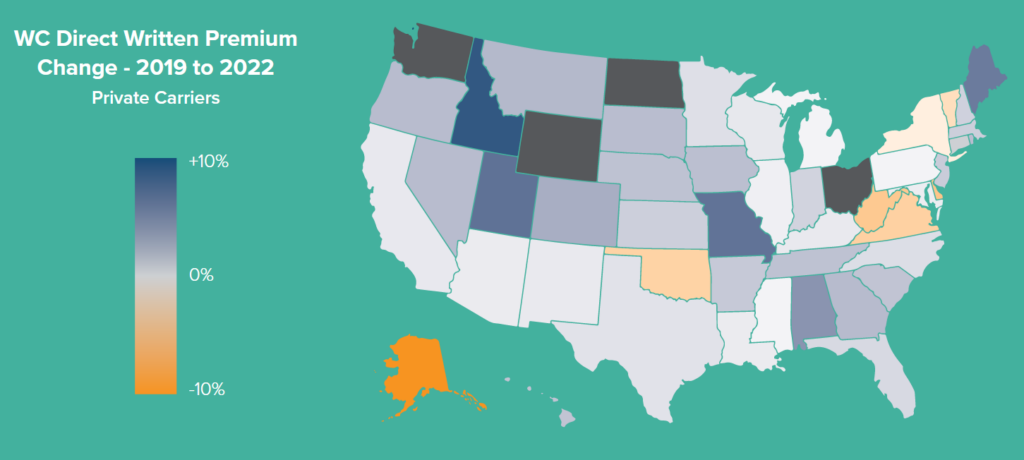

WC Direct written premium

In recent years, workers compensation insurance has been the most profitable property/casualty line of business, having experienced its sixth consecutive year of combined ratios under 90 and its ninth straight year of underwriting gains.

While the broader industry has suffered, workers comp has benefited from a generally strong economy and, in particular, strong growth in payrolls.

- Claim frequency is the main cost driver in workers comp. Due to improved workplace safety and increased use of automation, frequency has been low.

- Unlike claim frequency, medical and indemnity severity have increased about 60 percent over the past two decades.

- Current trends bode well for workers comp, but the industry needs to recognize and be responsive to emerging issues – for example, increased introduction of mental-injury bills in state legislatures.

P&C Industry Net Written Premium Growth

Workers compensation insurance pays for the medical care and physical rehabilitation of injured workers and helps to replace lost wages while they are unable to work. State laws govern the amount of the benefits paid and other compensation provisions.

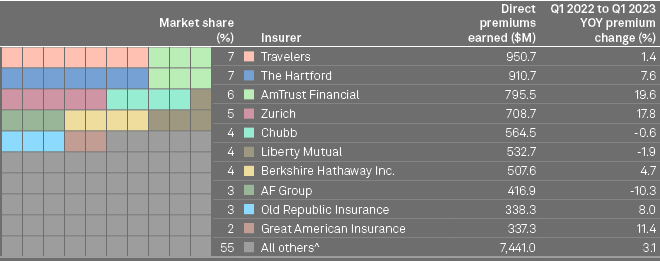

U.S. Largest insurers of workers’ compensation

Travelers kept its position as the largest writer of workers’ compensation in the US in the first quarter of 2023, with $950.7 million in direct premiums earned. It was followed closely by The Hartford, which claimed second place, with $910.7 million in direct premiums earned.

The Hartford and Travelers both control about 7% of the overall workers’ compensation market each, while AmTrust Financial’s 6% of the market makes it the third-largest insurer in the business line.

Largest US workers’ insurers

In addition, while private insurers account for much of the nation’s workers compensation insurance market share, a few states, like New York and California, have governmental agencies which compete with them.

Since 2014, workers compensation insurers cumulatively saw a net combined ratio of below 100 and, since 2017, that figure has consistently stayed below 90, with a 2022 net combined ratio of 87.4 for workers compensation insurers.

U.S. auto, home, and business insurers, across all insurance lines, had a net combined ratio last year of 102.4, according to Triple-I’s Issues Brief.

Workers compensation has benefited from a generally strong economy in recent years, most notably due to the growth in payrolls.

Private employment surpassed its pre-pandemic level in 2022 and employment growth remains faster than pre-pandemic norms, according to the U.S. Department of Labor’s Bureau of Labor Statistics.

Improved workplace safety, coupled with more employers allowing remote work arrangements, have combined to drive down the number of workers compensation insurance claims filed annually since 2021.

Many states have medical fee schedules, reducing medical inflation as insurers and medical providers set fixed prices for the services and products needed by injured workers.

………………………….

Edited & Fact checked by