The United Kingdom is positioned as a global leader in the field of insurtech. A flourishing ecosystem of start-ups, investors, and incumbents is working together to drive innovation and growth in the industry, from AI and machine learning to the Internet of Things. Beinsure Media has collected the opinions of insurtech experts and presents a UK InsurTech Sector review.

According to McKinsey analysis “The United Kingdom: The nexus of insurtech”, London has the same number of insurtech unicorns as the rest of Europe combined and globally is sec ond only to Silicon Valley.

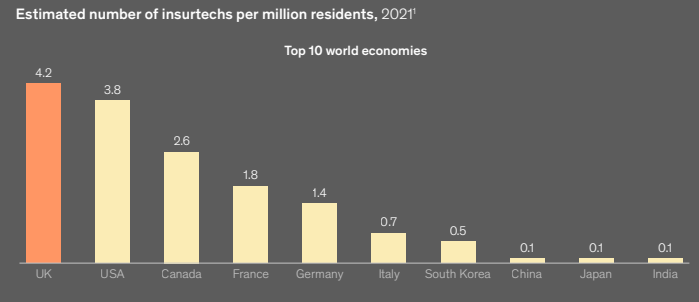

Indeed, of the estimated 3,000 insurtech firms in the world, approximately 280 are located in the United Kingdom—the highest number of insurtechs per capita among all major world economies

The United Kingdom’s insurtechs have not been immune to the recent global tightening on valuations. The multiples of some of the most successful publicly listed insurtechs fell from 15 times those of traditional peers to below the level of incumbent insurers, and private capital funding decreased 32% compared with the peak in 2021 (see InsurTech`s evolution and investment landscape).

UK insurtech sector has remained resilient

Competition from Big Tech and other non-insurance companies has also accelerated. Amazon launched the Amazon Home Insurance comparison site in the United Kingdom, and Tesla Insurance reached $300 million in premiums by the end of 2022, leveraging Tesla’s data availability and large customer base for better underwriting and distribution (see Global InsurTech Investment Trends).

Despite these global challenges, the UK insurtech sector has remained resilient, employing around 14,000 full-time-equivalent workers—almost 4% of the total UK insurance workforce, according to our estimates.

McKinsey estimate the UK insurtech sector brings in £2 billion to £3 billion in revenue per year—though calculate its full impact on UK GDP to be closer to £5 billion and 60,000 jobs.

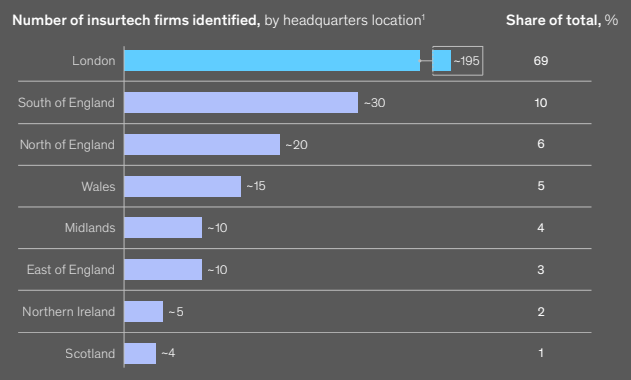

Not all of these jobs are in London: 31% of the country’s insurtechs are outside the capital.

Insurtechs help increase diversity and inclu sion in insurance through their young, diverse, and well-educated employee base. Approxi mately 39% of staff are non-British, and about two-thirds are younger than 40, according to our research.

The industry still faces key challenges that need to be addressed to ensure continued success, including protecting and enhancing the United Kingdom’s innovation ecosystem, especially access to talent and capital.

The UK insurtech industry

The research was carried out by McKinsey in the first half of 2023 with support from Insurtech UK. It focused on three primary sources of information: a survey of 50 British insurtech firms, a series of more than 20 interviews with CEOs, founders, investors, and other thought leaders across the industry, and the construction of a detailed database of UK insurtechs based on data from several sources.

The report is intended to provide value for a variety of audiences:

- Insurtech firms and entrepreneurs can benefit from increased awareness of the opportunities and challenges unique to the UK ecosystem. They can also learn from the experiences of leading insurtechs.

- Industry incumbents can explore the potential for insurtech to unlock the next wave of transformation across the industry. By learning about technological and pioneering proposi tions across products, services, and other benefits, incumbents can benefit from a greater awareness of the opportunities for deeper collaboration and partnership.

- Investors can gain a deeper understanding of the scale, diversity, and potential of the insur tech sector. We highlight emerging oppor tunities and areas in which value and activity are concentrated to help investors make informed decisions.

By understanding the challenges and opportunities in the industry, stakeholders can work together to drive innovation and growth, leading to a stronger and more vibrant insurtech ecosystem in the United Kingdom and around the world.

UK insurtech sector: An emerging world leader

The United Kingdom could arguably be seen as the birthplace of insurtechs, with the first major website for comparing insurance prices launched in the early 2000s, even before the term “insurtech” began to have meaning (see FinTech & InsurTech Funding Highlight & Investment Trends).

Today the United King dom’s insurtech sector has ample access to talent, sophisticated customers, financing, underwriting capacity, and a supportive regulatory environment.

Research identified about 280 UK insurtech firms in current operation, which gives the United Kingdom about a 10% market share of the estimated 3,000 insurtech firms globally. The UK cluster is the world’s second largest, exceeded only by the United States with about 1,300 firms.

Though many UK insurtech firms are still in their infancy, we estimate the total revenue of all UK insurtech firms reached £2 billion to £3 billion in 2022. This represents a sixfold increase over 2015 estimates, which placed the sector at a total estimated market size of about £400 million.

UK insurtech firms now employ an estimated 14,000 employees across the United Kingdom, around 4% of total employment in the country’s insurance industry.

In addition, we estimate that a further 23,000 UK jobs are supported indirectly through either the supply chain of insurtech firms or the consumer spending of the sector’s employees.

The value of UK insurtechs

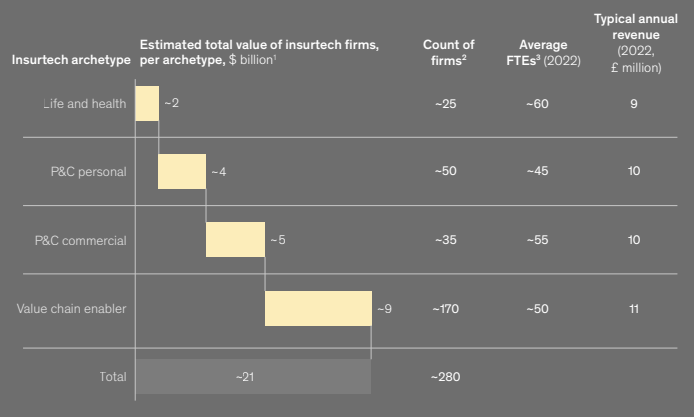

Overall, we estimate that UK-based insurtechs have a total enterprise value of about $21 billion, which puts the country third behind only the United States (approximately $100 billion in global value) and China (about $28 billion).

However, adjusting for the size of the population, the United Kingdom has the top concentration of insurtechs among all major world economies.

London has more insurtechs per capita than any other major economy

At the time of writing this report, London was home to five insurtech unicorns—the same number as in the rest of Europe combined. Across the pond in New York, another global center of finance and insurance, just three insurtech unicorns are in operation (see why InsurTech Market Faces a Valuation Decline).

But insurtech progress isn’t limited to the nation’s capital. Indeed, insurtechs are based in every one of the United Kingdom’s regions and nations—and we estimate that two-thirds of the insurtech workforce is located outside London, thanks to hybrid work. Three UK insurtech unicorns are headquartered outside London.

One-third of UK insurtechs are based outside of London

Emerging clusters in both the northwest and the south of England are of particular note, as is the Welsh industry, which has a particular focus on price-comparison websites, such as Confused.com, or insurer Admiral Group, the only FTSE 100 company based in Wales.

Insurtech Value by sector

In general, insurtechs can be organized into four categories: life and health (such as DeadHappy and YuLife), property and casualty (P&C) personal (such as ManyPets and Marshmallow), P&C commercial (such as CFC), and value chain enablers (such as Tractable).

In the United Kingdom, approximately 60% of firms are focused on value chain enablement, and these firms account for about 40% of the insurtech sector’s total value.

One-third of UK insurtechs are based outside of London

These firms service a specific point in the value chain, such as distribution (for instance, price-comparison websites), pricing and under writing, claims services, or data and risk modeling. Behind the unicorns and a small number of highly valued firms, the segment contains a long tail of smaller firms.

P&C commercial lines account for only about 13% of identified firms, but they hold a significant portion (approximately 25%) of the sector’s total value. This category is particu larly relevant for the United Kingdom because of its connections with the Lloyd’s market.

CFC Underwriting, for instance, started with an early focus on emerging risks associated with the internet and technology sectors and small and medium-size enterprises. It eventually expanded to cater to various industries and risk types across 90 countries, thanks to Lloyd’s reach with licensed rated insurance capacity.

Increasing diversity

Ample research has shown that a diverse work force has enormous benefits for businesses, and insurtechs are no exception. Our survey of UK insurtechs found that the industry is more gender-diverse, more international, and younger than the London labor market overall.

About 47% of the insurtech workforce is either female or nonbinary, a more even split than the approximately 40% estimated by Statista in the wider insurance industry.

Insurtech workers are also younger: approximately two-thirds are under 40 years old. This is not unexpected given the youth of the industry itself and the propensity of start-ups to attract young talent. By compar ison, in the London market, less than 50% of the workforce is under 40.

In addition, just 7% of UK insurance industry employees are from outside Europe, compared with 20% of insurtech employees, demonstrating a much more international workforce.

This diversity gives the industry access to a wider pool of the best global talent available. Reflecting this, about one-quarter of the founders of the United Kingdom’s most valuable 25 insurtechs are not from the United Kingdom.

Reaching the insurtech industry’s full potential

As part of our research, we surveyed approximately 50 members of Insurtech UK’s network about the opportunities and challenges facing the industry. When it comes to opportunities, global expansion and financial health were the clear priorities. Indeed, many companies find fertile ground in the United Kingdom thanks to the factors described above—but ultimately, the desire to scale larger than the UK market pushes firms to expand into new geographies.

Founders and CEOs highlight a common set of opportunities and challenges facing the industry

And of course, insurtechs are focused on profit optimization and cost reduction to build a clearer path to profitability—as well as to give burgeoning firms a longer runway to sustain operations and fund their own growth. Respondents also high lighted the role of insurtechs in developing propri etary technology tools for players across the insurance value chain, as well as the importance of partnerships for distribution.

On the challenges side, leaders broadly agreed that accessing funding and acquiring customers are the two biggest challenges their firms face.

While insurtechs have comparable access to earlier-stage funding in the United Kingdom and in other countries, UK founders have typically faced challenges accessing later-stage funding to support the scale-up and growth of their firms.

These challenges could be caused by UK-based venture capital (VC) and private equity (PE) investors having less capital than US investors or expecting profitability earlier in the growth pro cess, as well as by the current economic cycle potentially limiting VC money available to invest globally.

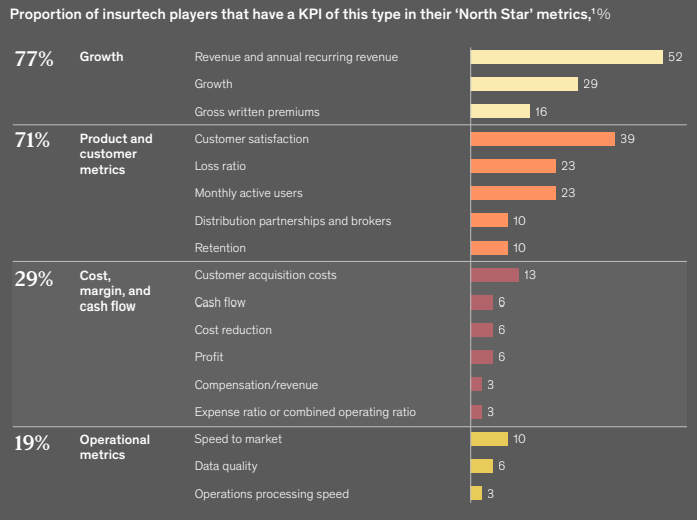

The insurtech industry remains focused on growth and customer outcomes over cost

Meanwhile, acquiring new customers is another priority challenge—particularly in a constrained funding environment, when the focus needs to be on profitability, unit economics, and maintaining that runway.

In response to changing market con ditions, particularly the tightening funding land scape, insurtech players are starting to evolve their KPIs. 45% of firms have changed their top three metrics. While growth remains the main mantra, about one-third of insurtechs also have metrics focused on margins or profitability.

Insurtech Investment strategies

The past decade has seen smooth and steady growth in investor interest in disruptive technology companies, including insurtechs—until recently. In 2021, investor interest peaked across all tech verti cals.

Total funds invested in insurtechs reached $16 billion globally, an increase of approximately 120% over 2020. At their peak, publicly listed insurtechs saw gross written premium multiples in excess of ten times.

Toward the end of 2021, however, the cycle started to turn. Total insurtech funding dropped an esti mated 40 to 50% in 2022, with continued quarter-over-quarter decreases. The “Tech Winter” had set in, with fewer company launches, less growth, more layoffs, and an increasingly difficult funding environment.

Today, investors are investing at lower valuations and placing increased expec tations on their investments to generate cash and shift faster toward attractive unit economics.

Some insurtechs achieved valuations as high as 25 times their annual premiums. Between their all-time high and March 2023, most publicly traded insurtechs saw valuations decline, on average, by approximately 89%. Indeed, some are now trading at a discount to the multiples enjoyed by traditional insurers.

These dramatic shifts in valuation should not be interpreted as a total cooling of investor interest in the sector—in the United Kingdom or around the world.

The most innovative players in the industry are exploring solutions across the entire value chain. In claims management, for example, generative AI can extract key insights and make recommend ations from unstructured data to assist adjusters.

It can also provide day-to-day support, training, and coaching for adjusters. Similarly, in under writing, generative AI can prepopulate relevant information, synthetize pertinent exposures and private or public data for risk assessment, generate draft communications for commercial quotes, and provide training to underwriters.

However, realizing the value of generative AI requires much more than the underlying foundational models. It requires leveraging pre-and post-model capabilities—such as query engineering, data engineering, teaching, and change management—to drive significant impact.

Furthermore, companies that adopt a comprehen sive business approach, foster an intentional culture of experimentation, and demonstrate openness to partnering with innovative players are likely to be better positioned to source the right capabilities and assets.

The United Kingdom has a deep well of talent, both from world-class universities and business schools and from the domestic insurance industry, including the world-leading Lloyd’s market.

The UK has also long been an attractive place for international entrepreneurs to launch businesses. According to our research, 25% of the United Kingdom’s top insurtechs have non-British founders. One major investor described the United Kingdom as the best place in the world “to build, test, and validate” a proposition.

Conclusion

Five of the United Kingdom’s eight insurtech unicorns achieved unicorn status after the peak in the market in 2021. Furthermore, six of the ten most valuable UK insurtechs were founded after 2016.

Insurtech is no longer a curiosity on the fringe of the UK insurance industry.

It is a driving force for growth and innovation—employing thousands, expanding coverage to underserved segments, and benefiting society as a whole. The UK insur tech ecosystem has the potential to help the whole industry transform.

To reach their full potential, insurtechs can focus on creating “painkillers, not vitamins” by offering new products that cover underserved segments or cater to new risks. Identifying these opportunities is not easy, but it can be done by closely observing the changes in technology and living habits and proactively identifying those new risks.

…………………

AUTHORS: Leda Zaharieva – Partner in McKinsey’s London office, Edward Allanson – consultant in McKinsey’s London office, Andrea Comina – Associate Partner in McKinsey, Pietro Richelli – Partner in McKinsey’s London office