The way auto insurance is underwritten and priced will also undergo a fundamental shift. With increasing connectivity, “pay-as-you-drive” and usage-based insurance (UBI) will emerge as natural complements to EVs. Gone will be mobile apps, aftermarket devices, and the actuarial challenges of surfacing underwriting insights after selection.

Instead, we will see insurance shifting with the help of the proliferation of connected data from self-reported, loss-correlated information about things such as marital status, gender, and age to independently observed, loss-causing information such as braking, acceleration, and speed—making the assessment and pricing of risk more accurate and convenient. Entities with access to these data will be the winners.

In the new future of mobility, insurers will be able to simplify, streamline, and automate the claims journey through connectivity and telematics technology such as cameras and sensors that provide real-time, accurate data.

Significant changes are ahead in AV and EV technology, and the Global car insurance market will need to adjust to the resulting disruptions.

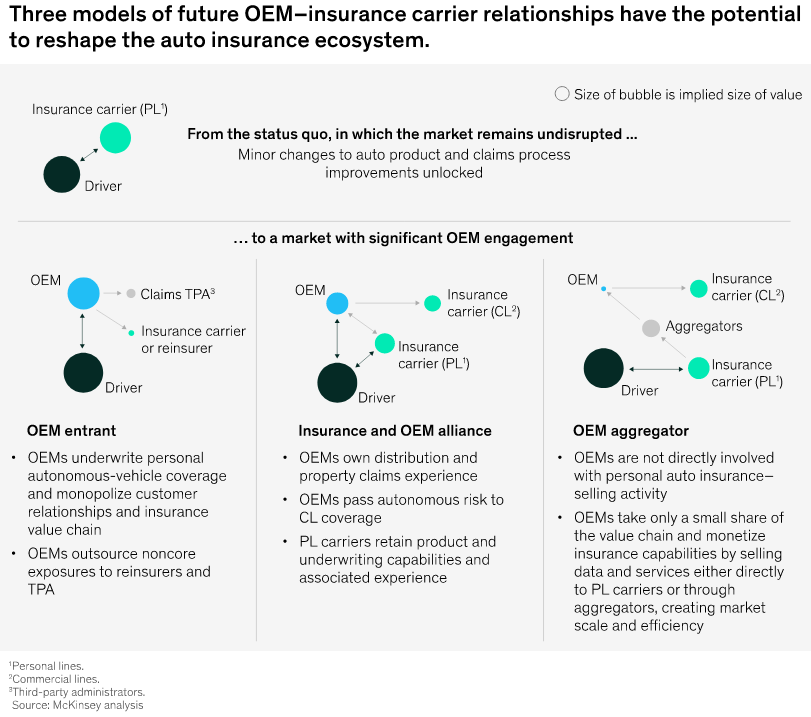

Three potential scenarios that could reshape the car insurance market

OEMs enter the market with in-house offerings

Some OEMs will choose to enter the insurance market, attracted by new revenue-generating possibilities as well as the ability to generate vehicle sales by leveraging the reduced cost of ownership proposition that comes with their access to data.

In this scenario, OEMs may choose to outsource certain noncore activities to third-party claims administrators and capital risk to reinsurers but may otherwise insource much of the insurance operation.

An OEM may do this if it determines that the customer’s insurance experience is an integral component of a differentiated mobility product and that its access to ongoing customer engagement and driving data presents a proprietary competitive asset.

OEMs and insurance carriers develop partnerships

Any hesitance or inability on the part of OEMs to assume full responsibility for the future of auto insurance will open up opportunities for insurers to maintain their market share through partnerships with OEMs. Such partnerships could benefit insurers because they would gain access to vehicle owners through the OEM, which in turn could leverage the OEM’s relationship with the insurer to provide insurance that is relatively cheaper, lowering the total cost of ownership and driving more vehicle sales.

At the moment, OEMs have significant competing priorities.

These include gaining greater customer adoption, adapting their manufacturing lines and supply chains from ICE vehicles to EVs, and resolving emerging dealership channel conflicts as OEMs experiment with direct-to-consumer digital-distribution models.

Additionally, some OEMs may be wary of the specialized expertise required to offer insurance and the regulatory environment that comes with it. As a result, many OEMs will choose to partner with insurers for assistance on insurance offerings, especially in the near term. In this scenario, the OEM acts as an agency and data provider, helping to price and distribute insurance and earning commissions and fees from the insurer.

While the OEM will own the distribution journey, the insurer will handle everything else, including underwriting, servicing, and claims. From the customer’s perspective, the OEM is effectively the agent while the insurance carrier is the insurer itself.

OEMs become tech-enabled distribution aggregators and data providers

In what would represent a deeper extension of the affinity partnerships that exist today, OEMs could work with insurance carriers to offer tech-enabled insurance offerings through the car via a connected marketplace.

As an aggregator, the OEM would provide data but would otherwise not play a significant role in the insurance customer journey, apart from providing access to the platform for customers and insurers.

This market evolution would favor the rise of independent data aggregators that would consolidate, standardize, and distribute underwriting data for insurance applications. OEMs may take this approach if they perceive the insurance experience to be noncore, adjacent, or incidental to their mobility product or otherwise beyond risk appetite or competency.

Key questions for insurers and OEMs

We see potential for one or more OEMs to take the first step beyond the partnerships they have started to capture a significant share of this new, connected automotive market. They have (or can quickly develop or acquire) all the necessary capabilities.

But before activating a plan, OEMs have several key questions to consider:

- What is the size of the opportunity?

- Are OEMs well positioned to pursue a greater role in the auto insurance customer journey? What is the value proposition for customers?

- How should OEMs participate in this ecosystem (build, buy, or partner)? How are insurance carriers likely to react?

- What capabilities are needed to enter the auto insurance market? What are the risks, and how can they be mitigated?

The market is also ripe for insurers to explore, but capitalizing on the opportunity will require the right market alignment. An insurance carrier’s ability to identify and implement the appropriate partnership model with OEMs will be key.

Insurers should pursue partnerships early and strategically, asserting themselves in a central role in the auto insurance journey.

Providing a differentiated customer experience will help insurers avoid disintermediation in the future, when OEMs may become more comfortable assuming an active role in insurance.

As they explore the opportunities, insurance carriers have several key questions to consider:

- What is the tipping point for market disruption? Will drivers embrace embedded insurance and AV technologies?

- What is the size of the disrupted personal-mobility insurance market?

- As the conventional market shrinks, how should insurers adapt, and what is the cost of doing nothing?

- What stages of the insurance value chain are at risk? And in what stages of the value chain are insurance carriers well positioned to compete?

- How will the regulatory environment, OEMs’ strategies, and customer sentiment affect insurers’ position in the new market?

While the EV insurance revolution may appear to be at a relatively early stage, one thing is clear: the status quo in the market structure of the auto insurance sector is set to experience far-reaching disruption. The global auto insurance profit pool is about to be realigned as autonomous-vehicle technology redraws the lines that have for decades defined how the opportunity is distributed between OEMs and insurers.

The advantage will accrue to players on both sides of the marketplace that act early enough to carefully assess and then capitalize on what promises to be a radically new landscape for auto insurance.

…………………

AUTHORS: Tanguy Catlin – Senior Partner McKinsey; Russell Hensley – Partner in McKinsey’s Detroit office; Philipp Kampshoff – Senior Partner in McKinsey’s Houston office