A global fixed income allocation maximizes diversification across all markets and issuers. It also reduces the likelihood of the portfolio being positioned in ways that could alter its risk- and-return profile.

The key question for the second half of 2022 has been whether central banks can raise interest rates to a level that will bring inflation down without causing a (severe) recession. With central banks aggressively raising interest rates, investors have been positioned short in duration – waiting for evidence that inflation is falling, which would provide central banks with an opportunity to pause rate hikes.

According to JPMorgan Asset Management`s Insurance Team, inflation data in the U.S. has shown signs of peaking: the last two prints surprised to the downside and headline inflation for November came in at 7.1% after peaking at 9.1% year-on-year in June.

Nearly every major category showed easing price pressure, implying that rate hikes are starting to have an impact. While the broader inflation picture has improved, shelter and wages continue to be sticky.

This stands in contrast to Europe, where high inflation remains broad based and neither headline nor core inflation has peaked yet.

Highlights from this quarter’s IQ:

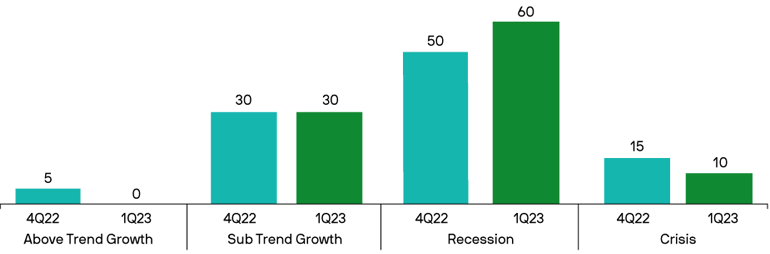

- Recession remains our base case scenario, at 60%, given rapidly rising policy rates, early-stage quantitative tightening and still-high inflation. We’re keeping the likelihood of Sub Trend Growth at 30% while reducing Above Trend Growth to 0% and Crisis to 10%.

- Following the 50bps hike in December, we expect the Federal Reserve to raise rates by a string of 25bps hikes, depending on inflation.

- Though the labor market offers some hope for a soft landing, wage growth would have to decline to reduce core inflation. That could mean a recession is necessary.

- The primary risk is that the Fed gets to 5% and pauses, but inflation flares up and policymakers have to restart rate hikes, heading to 6% and higher.

Scenario Probabilities (%)

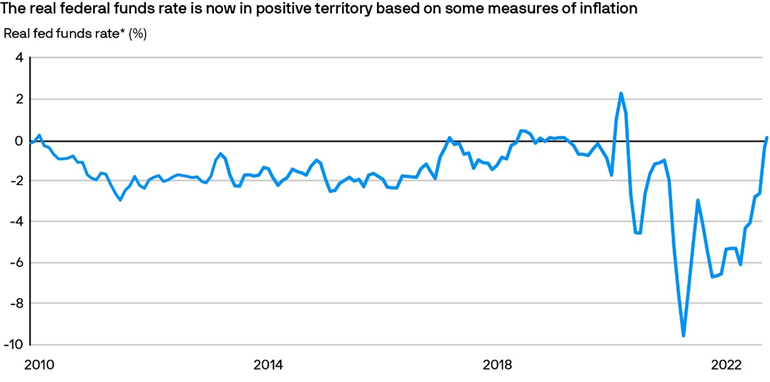

Throughout the year, one important data point we have been monitoring is the real (inflation-adjusted) federal funds rate. Historically, the Federal Reserve (Fed) has not stopped hiking interest rates when the real federal rate was negative.

Crucial to this analysis is the measure of inflation used to calculate real rates; in our view, the year-on-year headline and core Consumer Price Index (CPI) figures may not fully take into account the recent progress on U.S. inflation.

Instead, we believe three-month annualized core CPI, which is now at 4.26%, is more appropriate for the current circumstances (data as of November 30, 2022). With the real federal funds rate now being positive on this measure, the Fed has additional tools to combat a recession, which could allow it to pause the hiking cycle in 1Q 2023.

Historically, yields peak somewhere at or before the last rate hike and then tend to fall very quickly, especially at the front end of the yield curve. Therefore, now may be the time to consider backups in yields as an opportunity to add duration to portfolios. Meanwhile, the increased stickiness of inflation in the eurozone and a later starting point in the hiking cycle leaves European real rates in negative territory.

The base case is that the European Central Bank (ECB) continues its tightening path. Compared to what the market is currently pricing in, we expect a slower pace of hikes but to a potentially higher level – concluding at a terminal rate of 3%.

In addition to different drivers of inflation, technical factors, such as expected supply for early 2023 and the extent to which fiscal measures have been implemented, suggest that the European bond market is facing more headwinds compared to the U.S. market. While 2022 net supply (gross issuance less gross purchases) for the euro area is around EUR 600 billion, it is expected to be nearly EUR 1 trillion in 2023. In the eurozone, quantitative tightening is expected to start in 2Q with a phased ending of the ECB’s asset purchase program’s reinvestments.

In addition, over EUR 1.5 trillion of targeted longer-term refinancing operation securities (TLTROs) will mature by June 2023, triggering the release of collateral (mainly Bunds) into the market. These dynamics will lead to a big jump in net supply and a weakened technical picture relative to the U.S., potentially putting upward pressure on European yields.

After the most painful bond market returns in history, relief is on the horizon – with the top idea coming out of meeting being to use every backup in yields to add high-quality duration to portfolios.

We know from client conversations that there is tremendous interest in adding broad market bonds to their portfolios.

Much of clients’ money currently sits in cash or in bond portfolios that are positioned shorter relative to their duration targets. Government bonds now offer the highest real yield (1%–1.5%) since the financial crisis. (Investment Grade) IG corporate bonds – especially Yankee banks – were at the top of our list of best ideas. Securitized credit, municipals (both tax-exempt and taxable) and local emerging market government bonds also had considerable support.

U.S. Life Insurance companies

Yields are back. Corporations, consumers and municipalities are all in a place of relative strength compared to pre-COVID, and yet, the “r” word (recession) has crept into the minds of investors. Our clients have been particularly focused on prudently reinvesting capital to take advantage of higher yields without adding unnecessary risks in the face of a looming recession. If market participants do in fact start pricing in a recession toward the latter half of 2Q, this should move Treasury yields lower, and owning high-quality duration will be the key to a successful year.

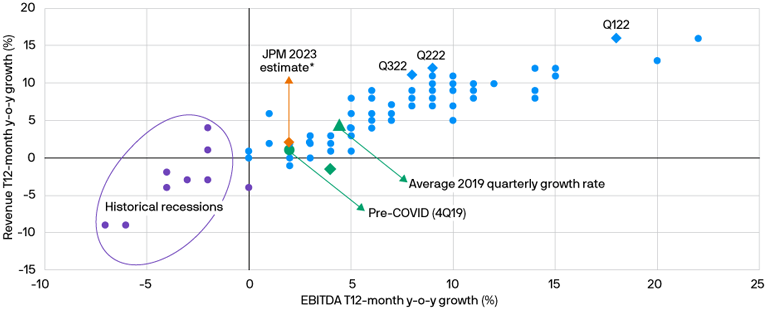

To start, in the IG market, it’s true that EBITDA and revenue growth continue to roll over, but it’s equally important to recognize the levels at which they are coming from, and the strength of the market as we move toward recession.

When we look across the sectors within the space and compare balance sheet and liquidity health now versus pre-COVID, nearly all sectors (save Cap Goods, Telecom and Airlines) look healthier. On top of that, we are entering 2023 with some of the lowest gross debt growth we have experienced since the Great Financial Crisis.

And while positive ratings migration over the past five months has slowed, we don’t see much known risk of fallen angels either. There are just three issuers in the U.S. on the verge of HY. Lastly, most corporations took advantage of low yields throughout COVID, limiting the amount of near-term refinancing required.

Absent some catalyst our current expectation is for gross issuance to be flat to 2022. Both of these factors should be a tailwind from a technical perspective, providing ballast for spreads as we move closer to recession.

The consumer too, is coming from a place of strength. Savings rates are coming down and credit card balances are slowly ticking up, but both figures are coming off historically strong levels.

Research further suggests that the bite of inflation is hitting low-income earners the hardest, causing them to carry card balances and delay car payments.

In the CMBS (Commercial Mortgage-backed Securities) space, hybrid and work-from-home arrangements have stalled progress in the office sector, yet multifamily securities look attractive despite vacancy rates coming back to more normal levels and rents stabilizing. For securitized credit then, it is crucially important to maintain an up-in-quality bias and avoid areas that have experienced structural shifts from COVID.

In portfolios, we continue to take advantage of the yield uptick, but remain defensive as we move closer toward recession. We’ve continued to focus on high-quality duration as a way to weather the pending storm and remain vigilant in our credit surveillance.

U.S. P&C (Property & Casualty) insurance companies

JPMorgan think the intermediate part of the IG curve screens more attractive than the long end and provides some opportunities to take advantage of higher yields, especially for insurers that are limited in their ability to participate in securitized assets.

JPMorgan expect ratings migration to skew positive across IG in the near term given the robust fundamental position, but acknowledge that rating agencies don’t always rate through the credit cycle.

With valuations not pricing a recession on the horizon, we continue to utilize our credit research team’s bottom-up fundamental analysis to identify the most attractive parts of the IG market to help insurers take advantage of higher yields, while mitigating downgrade risk and subjecting clients to higher capital charges.

Specifically, JPMorgan believe retail and DIY (Do It Yourself)-related sectors will experience the most weakness in a recession given the impact on the consumer. Banks, especially Yankee issuers, are our top pick as they continue to trade wide to industrials and are well capitalized heading into a recession.

JPMorgan’ll look to issuance in the first part of the year to add Yankee banks where appropriate. “We also see value in taxable munis, as ratios to corporate bonds look attractive while reserves and unused federal aid provide a buffer and flexibility if revenues weaken or expenditures surge”.

Within the securitized credit market, various sectors have felt the effects of tightening in U.S. financial conditions. Higher all-in borrowing costs, increased interest rate volatility and demand destruction are all weighing on the sector amid elevated inflation.

Despite headwinds, the sector remains a story of the haves and have-nots. The juggernaut of the U.S. economy, the consumer, remains intact. Household leverage is rising, but is quite low in aggregate. Only small pockets of the consumer are showing signs of stress, such as deep subprime and select areas of the marketplace lending channel. Wage growth, job stability/openings, borrowing capacity and manageable debt service are acting as buffers to any significant deterioration.

JPMorgan remain rooted in the tenets of our bottom-up fundamental research as our outlook calls for further economic stress into 2023, and advocate for up-in-quality securitized cashflows within strong sponsors that will be able to perform into a down cycle. Wide spreads and higher front-end government bond yields are resulting in attractive entry points and breakevens for U.S. P&C insurers looking to provide liquidity.

Real estate, in both residential and commercial, is cooling. However, we now envision a clearer picture into the remaining balance of the Fed hiking cycle, and recommend P&C insurers to use the recent widening of high-quality Agency MBS to add to their portfolios.

Specifically, we prefer better convexity in certain sectors of the market, such as Agency multifamily and specified pools. As a result of our view on the Fed, the path of future interest rate volatility is also clearer – removing some of the more recent tail risks the market had been pricing in. Domestic banks, historically a large buyer, have proven largely absent the multifamily sector, leaving marginal buyers to enter the space at more attractive spreads.

UK & European insurers

Our discussion in the last IQ update centred around our client’s unease of large unrealized losses emerging on insurance balance sheets. We discussed how many of our clients began to impose restrictions around crystalizing those losses.

The incessant rise in underlying yields, driven mainly by rates and not credit spreads, offered some comfort to clients.

JPMorgan credit ratings forecasting framework currently shows the resiliency of credit risks inherent in portfolios.

However, more and more clients have questioned the trajectory of the unrealized losses over time. Have they reached a peak, and when will they start to decline? We developed a new methodology to project the market value at a position level using a combination of a straight-line amortization (the pull to par effect) and a proportion of the price impact from rate shocks.

JPMorgan used a three-year forecasting period as requested by most clients. The output showed a steady decline in the unrealized loss position, assuming rates follow the appropriate forward curve over the next three years. On the flipside, the cause of the unrealized losses, higher yields, has improved the reinvestment rate environment for our clients.

The newfound attractiveness of core assets will likely upend last year’s strategic asset allocations as the risk-adjusted expected yields have shifted. Insurance assets will now have a variety of yield plays available. In the days of negative yields, investors were forced into credit spreads and further down the risk spectrum as time went on.

High-quality duration has finally become an attractive alternative given the considerable repricing that took place in 2022.

As JPMorgan move toward a potential recession, reducing credit spread risk in preference of duration risk as inflation finally subsides offers insurance companies a timely reallocation of risk. Yield levels will also offer certain insurers the optionality of more closely matching the duration of their liabilities with that of their assets. This, in addition to a possible reallocation from spread risk, will enhance solvency capital and quality of insurance company balance sheets.

Asian insurers

Have 10- and 30-year Treasuries hit their peak? It’s always hard to predict with certainty, but if they haven’t already, then they likely soon will. Throughout most of 2022, we were advising our clients to remain short duration via cash, investing on the front end of the curve, or adding securitized assets to their permissible investment list.

As a result, we are starting to see the early signs of market participants pricing in a recession, and with that will come the peak in yields. We are taking any back up in yields as an opportunity to add duration in portfolios.

Throughout 2022 we focused on improving liquidity by moving up the curve and protecting total returns. Now, we are focused on adding high quality duration and reinvesting capital in sectors that tend to outperform during recessionary periods. As always, we continue to rely on our time-tested investment process and remain stringent with our credit surveillance as we move toward the end of the cycle.

The Morgan Stanley Global Fixed Income Opportunities Strategy is a value-oriented fixed income strategy that seeks total return including a high level of current income by investing across the fixed income asset spectrum, inclusive of investment-grade and high-yield credit, convertible bonds, securitized assets.

……………………….