It’s increasingly clear that offshore wind power is looking to be a crucial part of the renewable energy transition. Yet in many parts of the world, building turbines out at sea requires new floating foundations, so far largely untested at scale. These floating foundations bring a new set of risks and challenges for the wind power industry and its insurers, according to Gallagher Re’s Navigating New Waters report.

The wind power industry has welcomed the move. Matthieu Hue, CEO of EDF Renewables UK, was quoted by the government: “The framework set out in relation to floating wind places us in a strong position to start to realise the many benefits that this emerging technology offers.”

The insurance sector should engage with the developers of a fast-developing new technology that may be crucial to the renewable energy transition

But of course, any new technology means new risks for the insurance industry to grapple with (see Insurance Industry Transition to a Net-Zero Emissions Economy). A recent visit to Japan made clear that there needs to be more information-sharing between the designers and manufacturers on the one hand, and the insurance industry on the other.

The need for floating wind farms

The UK, with one of the most advanced wind industries in the world, is proving to be an important testing ground for floating technology. But in other parts of the world, notably Japan and some areas of the US, the need is more acute.

These places have fewer shallow-water coastal sites that are suitable for installing the conventional fixed-bottom wind turbines.

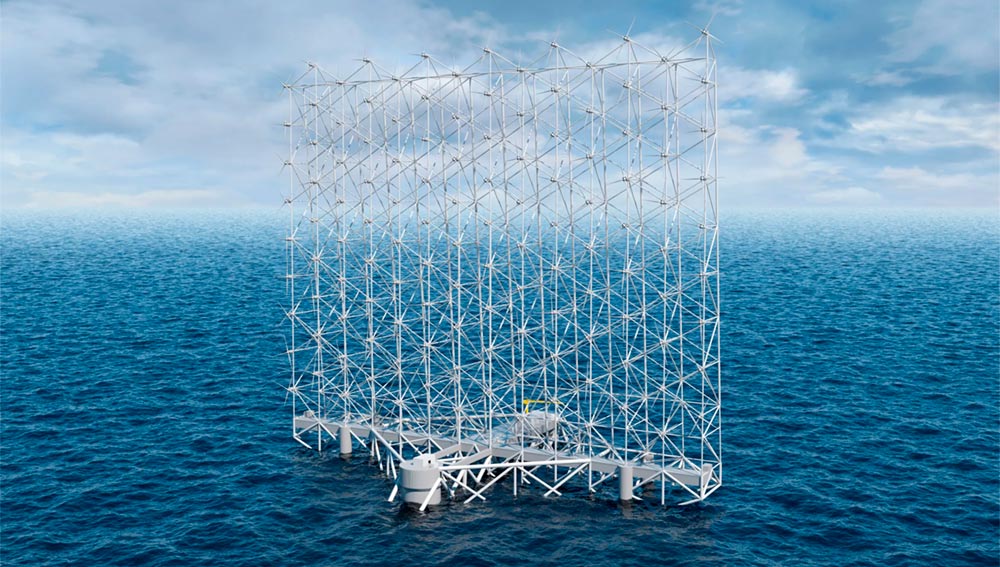

Floating wind turbines can be deployed in much deeper waters than fixed-bottom wind turbines. The design of both types of turbines tends to be similar, but floating wind turbines are built upon pontoon foundations that are tethered to the seabed.

Several Japanese companies are specialised in the technologies that make wind turbines buoyant.

Manufacturers are advancing rapidly with prototypes and demonstration projects, but what doesn’t yet seem to be happening is the crucial conversation between the industry and its insurers about the risk implications.

How will commercial-scale projects differ from the fixed-bottom turbines that insurers already know and are comfortable covering?

Sharing knowledge gained from early development could allow the insurance industry to be more pointed in its scope and premiums, and ensure its products are fit for purpose.

For example, the Lloyd’s Market Association’s Joint Natural Resources Committee (formerly the JRC) has already produced relevant clauses for offshore wind policies — including Serial Defects and Loss, Cable Protection Systems (CPS), Marine Warranty Surveyors (MWS) and Obsolescence.

Having a similar pro-active offering for the new floating technologies could create a worthy standard. The International Association of Engineering Insurers has done valuable work in this area.

As with any new technology, lead underwriters should familiarise themselves with the idiosyncratic risks inherent in each project. A good starting point is the hazard identification (HAZID) process that takes place before construction, in which designers, engineers and other operational staff discuss risks and mitigation strategies in detail. Ideally, insurers should also be in the room — or if not, then at least avail themselves of the conclusions.

The key differences between floating and fixed-bottom offshore wind farms

The core difference in design — the floating platform — comes with a multitude of challenges in commercial-scale projects. So what are the implications for insurers and reinsurers?

The key subjects for consideration divide into five areas: business case, foundation to seabed interface, construction and logistics, the associated infrastructure, and access and maintenance.

The business case for floating windfarms

Floating offshore turbines are more expensive to build for several reasons. The amount of steel required for foundations, longer cables and tethering materials are all cost adders compared to conventional installations. As a result, floating windfarms will likely have higher power prices requested and received.

For insurers, that price will have a significant effect on estimated maximum losses (EMLs) from any disasters that occur, from both a property damage (PD) and business interruption (BI) perspective.

Floating turbine foundation-to-seabed interface

The largest significant engineering difference is the tethering of the floating foundations and the necessary multi-turbine cable management. Tethers and cables will require some give and take, and may be subject to tidal and wave-related wear.

Potential failures, perhaps in a natural catastrophe, could cause the turbine to come off position or be damaged. This catastrophe could also cause damage to shipping, posing a risk for operators’ liability insurers.

Installations will need to be positioned to minimise their potential as a hazard. Nevertheless, strong HAZID procedures should help manage these risks, and insurers can learn some lessons from fixed-bottom projects.

Initial offshore turbine construction and logistics

The new era of offshore turbine construction — with larger 14/15MW towers now increasingly more prevalent than the 5/6MW models common several years ago — already requires significantly stronger port facilities.

But floating turbines are likely to increase these requirements still further — bigger and stronger cranes, larger storage areas for materials. Towing to the wind farm may mean slower assembly and commissioning times than conventional installations — plus the need for additional transport vessels. Current installation methods for floating turbines require up to four vessels, whereas fixed-bottom towers need only a single jack-up vessel.

Associated infrastructure

The other key component of any offshore windfarm is the substation, which collects electricity from the towers and transfers it to shore. If floating windfarms are installed far out to sea in deep waters, they are likely to require floating substations.

These substations will face similar risks as the turbines — cable management, tether wear, storm damage and so on — but the EMLs can be up to four times greater than what’s currently built.

Access to floating wind turbines

For regular maintenance, access can be a little more challenging than conventional installations — but not to the point where it poses a significant problem. The same cannot be said for major component change-outs. This maintenance would likely have to take place in port or require very clever and bespoke equipment.

The potential to have modular parts manageable offshore offers a leaner solution, otherwise the risks inherent in towing back and forth have a negative impact for both PD and BI insurers.

Despite the need to manage these challenges, we’re at a very exciting stage of growth for the offshore wind industry, and floating technology offers enormous potential. What’s needed now is joined-up thinking between the industry and its insurers.

For example, industry codes of practice are being championed as potential mitigation towards the cable issues. Applied more broadly, this kind of approach can be invaluable in setting everyone’s expectations.

The role of regulators in standardising floating windfarms

The worldwide industry can also benefit from noting the debate currently taking place in Europe about standardising offshore turbine design. Some of the sector’s leading lights have called on regulators to take a lead here.

Henrik Stiesdal, the Danish wind power pioneer and founder of the eponymous climate technology firm, was quoted in the industry publication EnergyWatch on the need to stop the race towards ever-larger offshore turbines.

He suggested that EU authorities should set a maximum tip height of 300 meters. Similarly, Vestas’ Chief Technology Officer Anders Nielsen said that the race would come to a natural end as the benefits of larger wind turbines become smaller and smaller.

This push toward regulation is particularly important for the new floating installations, where there’s currently large variation in potential design solutions.

A more consistent and standardised delivery of turbine models and sizes into the floating wind sector will make it easier to roll out this technology at scale and enable supply-chain manufacturers to devote more research and development time and money to improvements such as safety features.

As this new technology rolls out around the world in the coming years, the insurance industry needs to be part of the conversation around reducing the inevitable risks. The list outlined above is of course non-exhaustive, and there will always be further project-specific considerations.

There’s also the challenging economic backdrop to consider — high inflation, the rising cost of capital and supply-chain disruptions have led to the cancellation of several high-profile offshore wind projects in the US recently, for example.

Add new floating technology into the mix, and the challenges multiply. This is why the UK’s decision to increase power prices is so significant.

For insurers, the time to start having these conversations is now. In the long run, well-designed and affordable (re)insurance products will be a valuable contribution to the success of commercial scale floating offshore wind.

……….

AUTHOR: Robert McMillan – Renewable Energy Practice Leader at Gallagher Re