The imbalance in property catastrophe reinsurance demand and supply at January 1 showed signs of easing at the April 1 renewal, where we were able to place property catastrophe limits, albeit at a price and with higher retentions. With mid-year renewal negotiations now underway, the demand-supply balance is delicately poised, yet we are optimistic that the market is now on a more stable footing following a turbulent 1/1, according to AON Reinsurance Market Dynamics Report of the April 1, 2023 renewals period.

Geopolitical and macro-economic uncertainty remain key considerations. To date, the difficulties seen in the banking sector have not materially impacted underwriting appetites, or investor interest in the reinsurance sector.

April 1 is an important renewal for the Asia Pacific region, dominated by Japan, which is home to some of the world’s largest catastrophe reinsurance placements.

These recent developments do contribute to macro-economic uncertainty in the near term as the potential impact of reduced available credit from banks in the wake of these events remains unclear.

Property catastrophe capacity was adequate at April 1, but at a price. APAC experienced meaningful rate increases and adjustments to retentions, however, the impact was less severe than for U.S. and Europe at 1/1 (see Reinsurance Rates for Property Catastrophe Forecast 2023).

The catastrophe market in Japan, in particular, benefited from robust pricing levels established in the wake of large quake and windstorm losses.

Reinsurer Capital constraints begin to ease

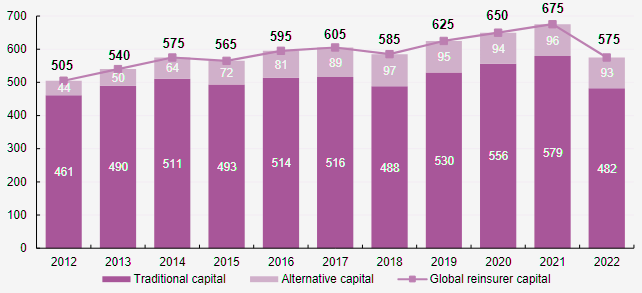

Reinsurance demand and supply was more aligned at April 1, having been constrained at the end of 2022. Aon estimates that global reinsurer capital declined by 15% to $575 billion over the year to December 31, 2022, principally driven by substantial unrealized losses on investment portfolios.

New reinsurance capital formation is limited, and investors remain concerned about the impact of climate change and inflation.

However, the prospect of higher returns is expected to attract additional capital to the sector, particularly as the benefit of higher pricing and investment yields becomes visible in earnings.

Global Reinsurer Capital, 2012-2022 ($ bn)

At projected 2023 rate levels, the property cat market should be attractive to investors, and there were some encouraging signs at the April renewal that reinsurers are prepared to readily deploy capacity at the right terms (see ILS, Cat Bond & Post Hurricane Ian Reinsurance Market Update Q1 2023).

The catastrophe bond market is also back in full swing after a difficult fourth quarter, 2022. Pricing has tightened since the year-end peak and deal sizes have bounced back.

Aon expect ILS inflows to continue in 2023, as the case for diversification is resonating given the broader environment.

Cautiously optimistic

While April 1 provides grounds for optimism, only a handful of U.S. property catastrophe programs renewed at April 1, and APAC renewals reflected existing cat pricing levels and lower inflation. Market conditions for the remainder of 2023 and beyond will depend on future inflation, catastrophe losses and financial market stability.

Demand for reinsurance was stable at April 1, reflecting relatively low levels of inflation in renewing APAC markets.

High inflation in the U.S. and Europe drove increased demand at the January 1 renewals, although insurers held off buying increased limit in the face of challenging market conditions.

Demand pressures have eased, although financial market volatility could result in ‘higher for longer’ inflation, which could place retentions and limits under renewed pressure at future renewals.

Although challenging, Aon anticipate a manageable mid-year renewal, with capacity available at a price.

All things being constant, the market should continue to stabilize, although inflation and 2023 catastrophe loss activity will be key: The first quarter has already seen devastating earthquakes in Turkey and Syria, floods in New Zealand and deadly tornadoes in the U.S. state of Mississippi.

However, for a prolonged sustainable market, reinsurers and investors will want to see improvement in returns before committing more meaningful capacity.

Traditional reinsurance capital

Most reinsurers group reported significant premium growth in 2022, driven by rate increases, robust demand and foreign exchange movements.

Underwriting performance was again impacted by above-average insured losses from natural catastrophes.

The dominant event was Hurricane Ian, which became the second largest insurance loss ever (behind Hurricane Katrina), at an estimated cost of $52.5 billion according to Aon’s Impact Forecasting.

Most reinsurers posted positive results, reflecting the benefits of the shift in pricing and coverage seen in recent years. The net combined ratio across Aon’s Reinsurance Aggregate (the ARA) was 96.2%.

Capital markets were volatile in 2022, with uncertainty associated with Russia’s invasion of Ukraine weighing on sentiment and policymakers’ efforts to bring inflation down from 40-year highs, via sharp hikes in interest rates, prompting fears of recession (see How Russian War in Ukraine Impacts for Global Insurance Sector?).

Ordinary investment yields stabilized, but total returns were heavily impacted by declines in asset values, driven by rising bond yields, widening credit spreads and declining equity markets.

Consequently, it was a poor year for reinsurance sector earnings overall. The ARA posted a return on equity of 5.2% based on reported net income, which was well below the cost of equity. However, this outcome is misleading as it only includes a portion of the mark-to-market losses seen in 2022. Based on total comprehensive income, the return on equity was -14.7%.

Over the six years from 2017 to 2022, the ARA reported an average net combined ratio of 100.3% and an average return on equity of 5.9%.

Resultant pressure from investors, and in some cases rating agencies, is one of the driving forces behind the hard market seen in recent property reinsurance renewals. Valuation metrics have improved post-Hurricane Ian, as investors have reassessed the sector’s future earnings prospects, including the benefit of higher interest rates on investment returns.

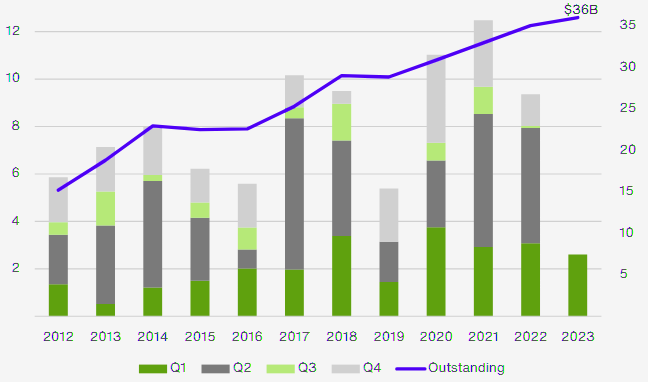

Alternative reinsurance capital & catastrophe bond market returns

After a difficult Q4 2022, the catastrophe bond market has reassumed its growth trajectory during the first quarter of 2023. Transaction sizes have increased markedly from the second half of 2022, with total deal sizes YTD 67% greater on average than those issued during H2 2022.

While pricing remains elevated from levels achieved in 2021, it has tightened during the first three months of 2023 from peak levels seen at year-end 2022, a development welcomed by both insurers and reinsurers particularly at a time when pricing in the reinsurance and retrocession markets remain heightened relative to the prior decade.

Capital markets investors have taken note of the relative value of the catastrophe bond market compared with other alternative asset classes, especially considering the persistent volatility that continues to pervade the broader financial markets.

Elsewhere in the alternative capital markets, collateralized reinsurance remains somewhat constrained. While the sidecar market has not grown substantially, existing investors in the space are committing to existing transactions with meaningfully higher margins.

Property Catastrophe Bonds Issued and Outstanding, 2012-2023 ($ bn)

2023 started quietly with two transactions comprising of $320 million of issuance. Issuance activity remained relatively muted in February with two transactions totaling an additional $480 million.

Investors kept busy, working with their own end-investors to encourage further deployment of capital into the market.

Investors were largely successful in their respective capital raises, came to the market eager to deploy freshly raised funds at heightened pricing levels. Net capital inflows during the first two months of 2023 combined with the relatively quiet start resulted in price tightening of approximately 12% during the quarter.

The sponsors benefited from the improved economics compared to year-end; that said, current margin levels have still proved very attractive to investors.

In March, the catastrophe bond market saw a significant increase in new issuance activity.

Seven transactions totaling more than $1.8 billion were closed during the month of March, including $500 million sponsored by Florida Citizens Property Insurance Company, in a deal that saw pricing decrease below the initially announced guidance (11.5 to 12.5%, settling at 11%) for a total issuance size 150% greater than what was initially targeted.

March proved to be a very significant month for new issuance, which investors welcomed, particularly given the ~$4.4 billion of maturing capacity during the second quarter of 2023.

Investors are keen to see abundant issuance volume during the second quarter to ensure maturing capital is deployed, but also to put to work newly raised capital from end investors who are seeking to capitalize on the healthy margin environment.

………………

AUTHORS: Mike Van Slooten – Head of Business Intelligence for Aon’s Reinsurance Solutions division, Richard Pennay – CEO of Insurance-Linked Securities for Aon Securities