For the global reinsurance industry, activities in 2022 and renewals for 2023 were set against a backdrop of significant economic and geopolitical uncertainties. The Russia-Ukraine war continues to disrupt the pace of global economic recovery from the COVID-19 pandemic, while the central banks’ rate hikes are yet to materialise in better-controlled inflation levels.

According to Gallagher Re Report, managing market and biometric risks amid such a volatile economic environment is among the key challenges faced by life, accident and health insurers globally, and reinsurance remains one of the core levers in a life company’s toolkit.

NORTH AMERICA Reinsurance Market

After absorbing material losses during 2020/2021, life reinsurers’ profitability in North America has recovered in 2022. COVID-19’s impact on mortality experience has subsided, while the low unemployment and higher interest rates has led to improved disability experience.

Despite these tailwinds, challenges remain for both cedants and reinsurers, as the risk of recession looms, while life expectancy continues to fall during the recent quarters, mainly affecting the individual life business.

Life reinsurance capacity remains constrained in certain areas such as catastrophe cover, as the large volume of losses suffered by reinsurers in the property and casualty lines of business has affected reinsurers’ overall appetite and pricing.

In the region, health insurers face increasing pressure on profit margins, due to delayed diagnosis and treatment following the pandemic, the rapid growth of very high-cost therapies such as cell/gene treatments, and significant competition, as new carriers have entered the space with low profit margin targets. This has led to a knock-on impact on reinsurers’ margins, where ample capacity remains.

2022 saw a slight slowdown in asset-intensive in-force transactions, largely due to the sharp rise in interest rates during the year.

Many companies are taking a wait-and-see approach to see how interest rates stabilise before taking further actions. This has been true particularly around legacy “high minimum guaranty” annuity blocks, where the rise in interest rates has alleviated the spread compression pressure insurance carriers have previously felt during the low interest rate environment.

The sharp rise in interest rates has also increased the level of unrealised losses in life and annuity investment portfolios. Higher unrealised loss positions can serve as a barrier to in-force reinsurance transactions as losses become realised upon deal funding at execution.

Several companies are turning their attention toward legacy long-term care and universal life business. These businesses, which also have high interest rate guarantees, have additional challenges around various management issues (morbidity, lapse, mortality, etc.).

Now that the low interest rate pressure is off, it opens the possibility to address ongoing management challenges through a potential in-force reinsurance transaction.

Several companies are reviewing this option, and the reinsurance markets for this are also expanding.

The other significant trend developing in the US is the expanded use of sidecar facilities. A sidecar is a captive insurance vehicle allowing a company to separate a portion of business into a reinsurance structure, and for outside investors to provide the capital to support that business. This is being used by many insurers and reinsurers to take advantage in two ways.

The first is the continued interest of outside capital providers to find a way to invest more readily in the asset-intensive annuity marketplace.

A sidecar facility allows for outside investors to participate in the business without the investor needing to set up their own reinsurance facility.

Secondly, by setting up the captive in a favourable jurisdiction, like Bermuda or the Cayman Islands, the sidecar can be structured to take advantage of the capital and investment benefits used by many of the offshore private equity reinsurers.

While we have seen several companies explore this option, it does create an additional management responsibility for the company, in that they need to set up all the appropriate regulatory structures themselves, but it does provide an alternative outlet to partnering with outside investors and/or best-in-class investment managers.

Sidecar sponsors also receive a fee for management of the facility and policy administration. And while there are some advantages to this, there are also a significant number of challenges that would need to be navigated.

EMEA Reinsurance Market

Demand for reinsurance remained strong in the region during 2022 and the 2023 renewal, with a growing appetite to broaden reinsurance coverage. Some insurers extended the existing coverage (focused on mortality risk) to include disability risk, while others incorporated extreme mortality coverage to protect again future pandemics.

This demonstrates a more cautious approach as claim experience in the region during 2022 is not dissimilar to prior years in Europe, and the impact of COVID-19 on claims was mainly seen in countries such as South Africa.

This growth in demand was also observed in more capital-focused reinsurance solutions, which aim to help cedants manage economic volatility. These solutions help cedants reduce their exposures to a broad range of risks including market risk, lapse risk, longevity risk, or overall volatilities in the IFRS and Solvency II balance sheets, together—where appropriate—with ratings.

As cedants focus on enhancing the resilience of their solvency position, they are also more mindful of how capital is deployed, and some of them sought capital-lite options to fund new business growth leveraging reinsurers’ balance sheets.

Meanwhile, cedants were also exploring strategic options to dispose of legacy portfolios and refocus their priorities.

In 2022, a significant number of run-off portfolios were transferred to specialist reinsurers with asset management capabilities, with an appetite for the large volume of assets as well as the underlying insurance risks. These transactions ranged in size from EUR 2 to 20 billion.

Significant portfolio transfers closed in 2022

| Seller | Buyer | Details |

| Zurich | GamaLife | Italian life and pension back book (USD 9.5 billion of reserve) |

| Allianz France | CNP | More than 20,000 savings accounts (EUR 2.1 billion assets) |

| AXA Germany | Athora | German life and pension back book (EUR 16 billion of reserve) |

| AXA Belgium | Monument Re | Belgium run-off life portfolio (EUR 2.6 billion of reserve) |

| NN Belgium | Athora Belgium | Portfolio of closed individual life policies (EUR 3.3 billion of assets) |

Reinsurers have largely been able to digest these opportunities in the region, despite the challenging environment.

In EMEA, contrary to the hardening market conditions faced by the property and casualty industry, life, accident and health reinsurers adopted a relatively consistent appetite, capacity and pricing approach to prior years, although there were instances where the reinsurers increased pricing due to constraints on return on capital and pressure from inflation.

In these turbulent times, we keep on seeing a flight to quality in the L&H market when looking for long-term and sustainable reinsurance partners. We have seen relatively stable retention levels, capacity and prices on the traditional L&H business and placements.

Augusto Diaz-Leante, Head of Life & Health Continental Europe Managing Director at Swiss Re

On the other hand, rising interest rates and inflation, coupled with the likely effects on the policyholders’ behaviour of a potential economic recession, are increasing the cost of capital of our clients. This is leading to an increasing demand of capital management reinsurance solutions with limited existing capacity in the market, especially for big transactions.

ASIA-PACIFIC Reinsurance Market

In APAC, mounting pressure in the reinsurance market was felt though the 2023 renewal process, with a reduction in reinsurance capacity by ~20%-25%, while prices increased by ~0%-5%.

The impairment in reinsurance capacity is partly driven by experience. Reinsurers in the region have been decisive in exiting loss-making lines of business and most required a minimum margin of 5% to participate in quota share programmes.

Many reinsurers operating in the region suffered considerable losses during the COVID-19 pandemic due to exposures in the US and are therefore adopting a more conservative stance.

The uncertain economic and geopolitical environment also encourages reinsurers to operate with a more prudent risk appetite.

Many reinsurers refrain from taking long-term guarantees given the uncertain economic outlook, whilst others avoid participating in business in China and Taiwan due to the ongoing Russia-Ukraine war, strained US-China relationship, and the hardening stance taken by China on Taiwan.

The reduction in capacity is also partly due to the spill-over impact from the property and casualty lines of business, where losses in the region constrain the overall capacity of composite reinsurers.

In contrast to the challenging reinsurance renewal process, a key growth area during 2022 is the co-insurance/asset intensive reinsurance, with an increasing demand from cedants in Japan, Singapore, Hong Kong and Korea, as cedants seek to improve capital position on in-force portfolios, and improve the yield offered on new business.

LATIN AMERICA Reinsurance Market

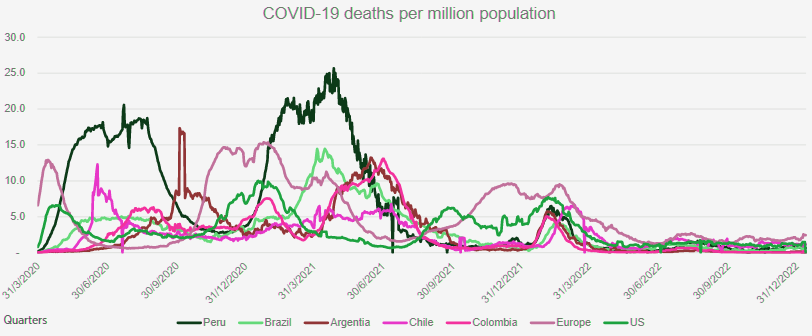

In Latin America, 2022 saw a slow-paced return to normality in terms of mortality experience, with claim rates dropping back to pre-pandemic levels in most countries, some of which have even seen an improvement compared to pre-pandemic levels.

Uncertainty remains, however, around the effect of COVID-19 and the fresh memory of it continues to drive the demand for reinsurance of pandemic and catastrophe events, forming an essential component of the risk assessment and management framework of cedants.

Reinsurers remain cautious, and in some markets, new pandemics were excluded from the cover on both treaty and facultative bases.

There was a reduction in reinsurance prices, in some markets down to pre-pandemic levels by the end of 2022, as new reinsurers with no or limited COVID-19 losses entered the market, particularly in the facultative business.

During the 2023 renewals, where the reinsurers seized the opportunity to adjust prices upwards, reflecting the higher target profit margin requirements, many cedants opted to increase the retention limits to maintain the overall spending within budget. The cautious attitude was also reflected in reinsurers’ reluctance in taking long tail risk amid the uncertainty on interest rates and inflation.

The hardening of reinsurance conditions manifested itself further in the health reinsurance industry, with upward pressure on pricing driven by inflation and increase in claim rates due to the backlog accumulated during the pandemic.

There is limited capacity for health reinsurance in the region, as most reinsurers resolved to offer non-proportional covers only.

During 2022, we have seen an emerging trend of cedants considering complex structured solutions such as longevity or asset intensive reinsurance, tailored to solve specific and complex risks faced by cedants, which were rarely seen in the region in prior years. This mirrors the cedants’ continuing efforts in innovation, both in terms of the underlying product design, and their risk management approach.

Accident & Health Reinsurance

The accident and health market proved challenging at 1 January 2023. The majority of discussion focused around war, the ongoing conflict in Ukraine, and the impact on T&Cs under personal accident treaties.

Exclusionary language for Russia, Ukraine & Belarus (RUB) was at the forefront of discussion, and there was a clear division in the market around the coverage reinsurers were willing to give in respect of war and RUB.

Most global reinsurance groups were comfortable with just a territorial exclusion for RUB, others were seeking more restrictive cover via the IUA 06-001 passive war endorsement. Overall, there was sufficient capacity across the market to get programmes home at preferred T&Cs for war and RUB, at the right price.

From a pricing perspective, the retrocession covers saw price increases in the region of +15%-20%.

The accident and health insurance market has not seen much in the way of large cat loss activity, and pricing uplift was predominantly being driven by loss activity in other lines of business and an uplift in cost of aggregate for key perils such as terror and nuclear, biological, chemical and radiological (NBCR).

The first-tier reinsurance market was less impacted due to the significant amount of capacity available in the market with clean programmes seeing a price increase of approximately +5%.

As we look forward into 2023, new COVID-19-related losses emanating from the Asia-Pacific region may put a strain on first-tier reinsurers. We expect that the majority of these losses will be contained locally, but the Lloyd’s market is likely to be impacted as well. These losses are likely going to be retained net following the outbreak of the COVID-19 pandemic, and the introduction of communicable disease exclusions which limited clients’ ability to aggregate claims.

We expect capacity for first-tier A&H reinsurance to remain stable into 2023 given its excellent long-term loss record and profitability.

…………………………

AUTHORS: Etienne Busson (EMEA), Jeffrey Seow (Asia-Pacific), Mike Kaster & Rob Fast (North America), Alnair Escalante (Latin America), Madeleine Larke (Accident & Health) – Gallagher Re’s Global Life, Accident & Health team

Fact checked by Oleg Parashchak